Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Generational Dynamics illuminates when such historical comparisons are valid and when they are not.

People are always quoting the famous phrase by George Santayana, "Those who cannot remember the past are condemned to repeat it." Politicians and historians are always trying to discover ways to apply the lessons of the past to the present.

Unfortunately what is true in one place or time may or may not be true in another place or time. For example, there was an international oil embargo against South Africa in the late 1980s because of Apartheid, and it was one of the factors that successfully ended Apartheid.

On the other hand, there was an oil embargo against Japan in 1941, and it led to Pearl Harbor and international war.

So, what do we learn from history? Do we learn that oil embargoes work, or do we learn that oil embargoes don't work?

Generational Dynamics gives us at least a partial answer. The oil embargo against South Africa worked because it occurred at the time of the climax of an Awakening era. Politics and morality play a big role in societies in late Awakening and Unraveling eras, and so a political act, like an embargo, can have a big effect.

The oil embargo failed against Japan because Japan was in a generational Crisis era. During a Crisis era, morality issues are far less potent, and something like an embargo can easily be considered to be an act of war.

Thus, when you're trying to learn lessons from history, you have to make sure that the generational eras correspond.

Another example is the civil war in Darfur versus the so-called "civil war" in Iraq.

I've said for years that a civil war in Iraq is impossible, because Iraq is in a generational Awakening era, and any incipient civil war fizzles quickly. That's exactly what happened in Iraq.

Contrast that to the real civil war in Darfur. Politicians around the world have been whining because no one has "stopped" the Darfur civil war. I wrote from the beginning that the Darfur is in a generational crisis era, and a crisis civil war CANNOT be stopped, just as a tsunami cannot be stopped. And indeed, the UN and the international community have failed completely and repeatedly to stop it.

That's the difference between a generational Awakening era, as in Iraq, and a generational Crisis era, as in Darfur.

If people in the State Department or the United Nations understood generational theory, they wouldn't make so many mistakes. Generational theory, properly applied, could give any country a substantial advantage in international relations. Unfortunately, no one even wants to consider it.

This finally brings us to the main topic today, Tony Blair's comparison of the Mideast "peace process," going on today, versus the Northern Ireland peace process.

The "Troubles" of Northern Ireland peaked in 1972 with "Bloody Sunday," in which the British army fired on a large mass of civil rights protestors, killing 26. (A roughly similar event occurred in the US in 1971, when the Ohio National Guard fired on Kent State students, killing four.)

These are Awakening era events -- violent to be sure, but still Awakening era events. Violent Awakening Era events are never crisis civil wars, but the issues surrounding them either grow and fester, leading to civil war in the next Crisis era, or else they die out, usually in the next Unraveling era. The latter is what happened in the Troubles of Northern Ireland. Bloody Sunday ostensibly pitted the Protestants against the Catholics, but there has been no recent history of a major war fault line between Protestants and Catholics. The amount of violence has substantially disappeared since 1972.

But no such reasoning applies to the Mideast. There IS a major fault like between Arabs and Jews in the Mideast, and they fought an extremely bloody and genocidal war in the late 1940s when Palestine was partitioned and the state of Israel was created. Israel was created on May 15, 1948, and the Palestinians today still commemorate May 15 every year as "Al Naqba - Catastrophe Day."

|

And so, from the point of view of Generational Dynamics, the Northern Ireland Troubles would have led to peace with or without the help of politicians, while the Mideast troubles must lead to war with or without the help of politicians. Politicians make ABSOLUTELY no difference to either situation.

That doesn't stop them from taking the credit, though. (As the old joke goes, it's like the rooster taking credit for the sunrise.)

And that's exactly what Tony Blair did on Thursday, when interviewed by reporter Hala Gorani on CNN International.

The context of the interview was the Mideast summit in Annapolis that ended on the same day. The "accomplishment" was that everyone agreed to talk some more. It's really kind of pathetic, but it's what politicians do.

Here's how Blair began:

|

You know I like Tony Blair, because he always has a friendly, positive demeanor, even when he's blowing hot air.

The "peace process" has repeatedly failed to accomplish anything for decades, and Blair is saying that EVERYTHING will now be accomplished within a year. Why? Because of a "very strong statement and commitment" by both sides. What was that commitment? To talk more.

Gorani asked Blair about the Jerusalem issue, which she indicated was one of many issues on which neither side is willing to compromise. here's Blair's response:

Now this is simply wrong. Here's where Blair is comparing an Awakening era political dispute to a Crisis era fault line dispute. The first is resolvable, and the second is not. Having "some hope and credibility" has nothing to do with it. There is simply no comparison.

Gorani picks up on the comparison by comparing the northern Ireland terrorist group, the Irish Republican Army (IRA), with the Palestinian terrorist organization, Hamas:

Blair: "The difference is very simple. When we actually got the Sinn Féin political party associated with the IRA into the peace process, we did so on the basis that certain principles were accepted. And let me make it very clear, it's not that people are saying, we will never contemplate dealing with Hamas. Hamas can be dealt with provided that they except the two principles of the gateway into the process. Number one, there should be two states, so Israel's got a right to exist."

Comparing the IRA to Hamas really illuminates the lash of generational theory, and why it means that the two situations are completely different.

The survivors of the Arab-Israeli war in the late 1940s, including Israelis like Ariel Sharon and Palestinians like Yasser Arafat and Mahmoud Abbas, were determined to spend their lives making sure that no such war would ever happen again. And they succeeded so far, and Mahmoud Abbas is still determined to succeed.

But Hamas was formed by people in younger generations who do not fear another war with Israel, and are far more motivated by the injustices they fell from Israeli occupation and control. This younger generation is growing, and the older generations are dying off, and so when Tony Blair says that the Mideast problem can be solved by having "some hope and credibility," the whole idea is absurd. Hope and credibility are completely irrelevant to these kids, who see only despair and depression.

|

Here's a diagram that I worked up several years ago to illustrate what goes on, and how generation gap lines are distinguished from fault lines. When I have some time, perhaps I'll turn it into an animated GIF where the horizontal generation gap line moves up and down automatically.

But here's the idea: In the years immediately following a crisis war, the horizontal generation gap line is near the bottom of the diagram, and there's a large older generation of war survivors who have vowed to spend their lives preventing any such war from ever occurring again. That's why the portion of the vertical fault line that's above the horizontal line is shown as a dotted line; violence across the fault line is muted because neither side wants another war.

As time goes on, the horizontal line moves up; the older generation disappears, and the younger generation grows larger. The portion of the vertical fault line that's BELOW the horizontal line is shown as a solid line, because it's a real fault line, and the level of violence and hostility grows.

It's a shame that people in our State Dept. or the United Nations

don't have a clue about any of this stuff. At the very least, it

would allow them to concentrate their resources where they might

actually do some good.

(30-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

It was the biggest two-day Dow Industrials increase in five years, and everyone wore a smile a mile wide on CNBC on Wednesday.

On Tuesday, investors had gotten all excited when the nice oil sheiks in Abu Dhabi agreed to bail out Citibank.

On Wednesday, a Fed Governor gave a speech and supposedly hinted that the Fed would cut interest rates again, when the FOMC (Federal Open Market Committee) meets next on December 11.

That's all it took to push the Dow Industrials up 311 points on Tuesday.

Here's how a Financial Times article explained what happened:

Mr Kohn, the number-two official at the central bank, said the Fed would be "flexible and pragmatic" in responding to new risks to growth arising from the relapse in financial markets."

Now, I read through Kohn's complete speech, and you can do the same, but I don't see any "clear hint" at all. The 2000 word speech discusses the Fed balancing act -- promoting financial stability while avoiding moral hazard -- and concludes with the following:

So yes, the phrase "flexible and pragmatic policymaking" does appear in the next-to-last sentence of the speech, but it refers to the balancing act of financial stability versus moral hazard. It's a thin reed on which to base a stock-buying orgy. Nonetheless, investors have succumbed to full-scale bipolar disease for several weeks now, and after a long depressive period, it was probably time for a manic episode.

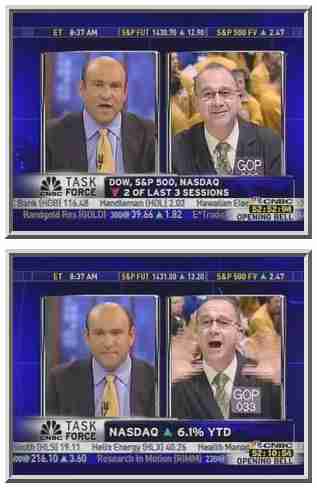

|

I did make note of some particularly amusing statements made on CNBC on Wednesday, so that I could share them with you, Dear Reader.

Here's one from Phil Roth, chief technical market analyst at trading firm Miller Tabak:

This is exactly the kind of "bad news is good news" statement that I keep talking about. So if you've recently become unemployed, and you can't find another job, you should be aware that it's good news, and that a you're very lucky person. Even more important, you're helping the wealthy Wall Street investors make more money, and that's what counts in life.

|

And now, here's the funniest statement of all on CNBC on Wednesday:

This brief statement is so wrong on so many levels that it's hard to know where to begin. It's typical of what we hear on CNBC, and I wish the quote had come from a male, so that I can't be accused of picking on a girl, especially a blonde. But male or female, blonde, brunette or redhead, this kind of blithering stupidity is the norm.

She says that "we've got a 14 multiple on the market." What does that mean? It means that the price/earnings ratio index is 14. But readers may have noted that there's a price/earnings ratio chart at the bottom of this web site's home page, and it gets updated automatically every Friday. Here's the November 23 version of the chart:

|

As you can see from the above graph, the P/E ratio is not 14. It's actually around 17-18. The question is: Where did Van Cleave get the figure 14 from?

The answer is that she's using the wrong value for earnings. The P/E ratio should be computed by dividing the stock price by the company's earnings per share for the last year. But Van Cleave isn't doing that, because that would give an embarrassing result.

Van Cleave is using so-called "forward earnings," the bloated estimates for earnings in 2008. By using a bloated value for earnings, the P/E ratio becomes smaller. What Van Cleave computed is total gibberish.

And this is a woman who probably makes over a million dollars per year investing other people's money in the stock market.

What you should understand, Dear Reader, is that YOUR pension fund, your 401k, your stock market or hedge fund broker -- the people managing YOUR hard-earned money are, like Van Cleave, too stupid to know how to compute a price/earnings ratio.

Computing the price/earnings ratio isn't exactly rocket science. Someone would have to be unbelievably stupid to be unable to learn it. And yet, Van Cleave and other people who manage YOUR money are just that stupid.

It doesn't stop there.

She says, "which is very low in any of the last 10 years." But look at this graph of P/E ratios for the last century that I've posted several times:

|

Now as you can see, the P/E ratio index was ENORMOUSLY above average for the last ten years, by historical standards, and so to compare today's value to the last 10 years is moronic.

I don't expect the "man on the street" to necessarily understand these things. But I DO expect someone who earns millions of dollars managing other people's money to understand them.

And yet, Van Cleave is not only TOO STUPID to even know how to compute a price/earnings ratio, she's also TOO STUPID to know what the historical average is. And remember, this idiot or someone like her is managing your pension fund.

Let's go on to the third common error, though not one used by Van Cleave on this day.

Very often you hear some so-called expert on CNBC use the phrase "reversion to the mean," or "is reverting to the mean," to indicate that some long-term index is getting closer to its long-time historic average or mean value.

For example, some so-called genius might say, "the P/E ratio is getting close to 14, so it's reverting to the mean, so stocks are cheap again."

This is total nonsense. The Principle of Mean Reversion is not "reversion TO the mean"; it's "reversion OF the mean."

It's not the current P/E ratio that has to revert to 14; it's the mean or average that has to revert to 14. And the only way that can happen is for the current P/E ratio to go much lower -- around 5 or 6, as has happened several times in the last century, most recently in 1982 -- and stay very low for many years, so that the AVERAGE will get back down to 14.

I realize that to understand this concept requires several advanced degrees in higher mathematics, and so we can't expect Van Cleave and other financial experts to understand it when they're too stupid even to know how to compute the P/E ratio in the first place.

I just can't get over the sheer day by day stupidity of these people. It never ceases to astound me and infuriate me.

The only thing I can't figure out is whether they're being incredibly stupid or incredibly dishonest. It's quite possible that Van Cleave and others like her are very well aware that they're lying, and therefore they're committing fraud on their clients. If you're a client of one of these people, I definitely think you should start preparing your lawsuit for fraud and make these people pay dearly for their dishonesty and lack of ethics. They deserve the worst punishment they can get.

Now still you may be thinking, "Gee, who cares? The markets went up 2˝% to 3% on Wednesday, so everything is going great!!"

Well just take a look at my Dow Jones historical page, and check out what happened on Monday, October 7, 1929 (1929-10-07) -- notice that the market went up 6.32% on that one day alone. You can just imagine the smiles and laughter of investors on that day. And look at how much the stock market continued to gain throughout the entire week. Then, check out what happened just two weeks later.

That doesn't mean that we're going to have a stock market crash in two weeks, though we might. What it means is that Wednesday's 3% gain is not a sign of market strength; it's a sign of a drunken orgy at a time of great investor desperation.

From the point of view of Generational Dynamics, we're overdue for a

stock market panic and crash. It might come next week, next month or

next year, but it's coming with absolute certainty, and probably

sooner rather than later.

(29-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Markets soar after Abu Dhabi oil sheiks give Citibank $7.6 billion, in return for a stake in the company.

I've been wondering the last few days whether the Fed or the Dept. of Treasury would come up with some spectacular move to attempt to resolve the revived credit crunch crisis, and return the investment community back to a state of euphoria.

Well, it was neither the Fed, nor the Treasury Dept.

It was the Abu Dhabi Investment Authority (AIDA), the secretive association that invests the enormous oil profits of Abu Dhabi in the United Arab Emirates (UAE).

Actually, I should have thought of something like that. When I wrote the article, "The bubble that broke the world," I suggested that China might try to save the American economy, for its own well-being, in the same way that the US tried to save the German economy in 1931. Then and now it should have occurred to me that the Gulf oil sheiks might try to do exactly the same thing.

AIDA will invest $7.5 billion in Citibank (actually, Citigroup) in return for a stake in the company.

Rumors have been spreading for several days that Citibank was planning thousands of layoffs, and some people were speculating that Citibank would become insolvent. The rumors spread because Citibank has had to take $16.9 billion in writedowns in recent weeks. These writedowns have become common among many financial institutions recently. They come about because financial institutions create credit derivatives and CDOs, backed by subprime mortgage loans, priced according to computerized models that compute notional values far above what anyone would really be willing to pay for them. One firm after another has been forced to go through the "mark to market" process recently, revealing the true market value of these securities. Quite a few, nominally worth billions of dollars, have turned out to be almost worthless.

Citibank has been hit so hard by these writedowns that the future existence of the institution was in doubt. The injection of funds from Abu Dhabi gives new life to Citibank, at a time when it was most desperate to receive it.

However, Citibank, which has 320,000 employees globally, is still expected to lay off tens of thousands of employees.

It'll be interesting to see what kind of political backlash, if any, this provokes. In the past, Washington has gotten all bent out of shape after Arabs or Chinese or Japanese have made large investments in the U.S. This time, however, the Citibank situation is so desperate that it's not likely that we'll hear more than a few peeps.

Investors were thrilled, and quickly became drunk with euphoria. The Dow Industrials quickly rose over 100 points on Tuesday morning, and closed 215 points up.

The "bad news is good news" mentality returned to investors throughout the day. The reasoning was as follows: The market has fallen 10% from its high -- an amount that would qualify as a market "correction." Since the market has now had its "correction," according to this reasoning, it's time for the market to go up again.

Here's how CNBC anchor Joe Kernen put it on Tuesday morning:

Market hits a 10% correction. All these things that have gone too far -- where we may have quasi- or pseudo-bubbles -- they start to reverse. The markets finish - got the 10% out of the way -- oil starts reversing. The dollar starts reversing. Interest rates stop dropping. All these things start happening, and we all live happily ever after."

It's a nice fairy tale, and maybe some day it'll make a great movie.

But unfortunately the latest news doesn't justify this kind of euphoria. Housing prices have fallen 1.7% in the last three months alone -- the largest tumble in the 21 year history of the Home Price Index. And the US Consumer Confidence Survey index fell much more sharply than expected, indicating that consumer spending will be reduced.

Several paragraphs ago I mentioned the article, "The bubble that broke the world." If you haven't read that, then now would be a good time to do so. It uses a book written in 1931 to inform us of what's happening today -- how one desperate measure after another is being used to avoid the inevitable result.

From the point of view of Generational Dynamics, the stock market is

overpriced by a large factor,

currently almost 250%, same as in 1929. A full-scale generational

panic and crash must come before too much longer.

(28-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

No one appears to have any expectations whatsoever -- talking just to talk.

The last major Mideast peace initiative of the Bush administration begins on Tuesday in Annapolis, as leaders of Israel, the Palestinian Authority, Saudi Arabia and even Syria sit down to talk.

If there's anybody anywhere who believes that this summit meeting will actually accomplish anything, I haven't seen it or read about it.

Instead, those who favor the initiative are saying it's the beginning of a process, consisting of additional meetings in the future, to eventually come to a Mideast peace solution -- two states, one Israeli and one Palestinian, living side by side in joy and peace and harmony.

However, this "process" has begun a number of times in the past. Major examples include the Oslo accordings in 1994, President Clinton's 14-day Camp David summit get-together in 2000, and the Mideast Roadmap to Peace in 2003.

These and other initiatives have all failed completely -- even when an agreement was reached, things only got worse afterwards.

In fact, on May 1, 2003, when the Mideast Roadmap to Peace was announced, I predicted that the Roadmap would fail, the Mideast would becoming increasingly chaotic, leading to a major genocidal war between Arabs and Jews that would re-fight the genocidal war of 1948-49, following the partitioning of Palestine and the creation of the state of Israel.

Since 2003, and especially since the death of Yasser Arafat, it's hard to find a single day when the situation was not measurably worse than it was the previous day.

In fact, things have been getting worse and worse pretty steadily since the first Intifada in the late 1980s. President Clinton held several summit meetings with Mideast leaders during his Presidency, and things only got worse, especially after the disastrous Camp David meeting in 2000. President Bush has held no summit meetings until now, and things have only gotten worse. It doesn't take a rocket scientist to see that it doesn't make any difference whether you hold summit meetings or not -- things will get worse either way.

Indeed, each day that passes makes any kind of agreement less likely. Why? Because the people who most want an agreement are the generations that survived the 1949 war, and who see an agreement as the best way to prevent any such disaster from occurring again, and every day, more and more of those survivors die. Left behind are younger generations, most of whom are convinced that the only way to resolve the issue is to have victory over the other side.

Here are some of the current roadblocks to a peace agreement:

It's worth pointing out that the trends on all of the above issues is that they've gotten worse and more intractable; there is no indication of an improvement in any area that I'm aware of.

In fact, as I've pointed out many times, the governments of countries that fought in World War II as a crisis war are all becoming increasingly paralyzed. This is true of the United States, France, Japan, and other countries. The reason is that the the post-war generations, like America's Boomer generation, don't have any skills for leading and governing. This also applies to the Israelis and Palestinians. So even an agreement like the Oslo accords could not be repeated now.

From the point of view of Generational Dynamics, the Mideast is going

in one and only one direction: Toward a major new war between Arabs

and Jews, refighting the genocidal war of the late 1940s. And the

new war will pull in the United States and numerous other countries

that will be forced to choose sides between the two warring enemies.

(27-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Markets in Europe, America and Asia have fallen sharply on Monday and Tuesday, as the evidence builds that a major new international "credit crunch" crisis is about to begin.

Banks are hoarding cash, refusing to lend money to other banks. The interest rates tell the story:

Maturity Yield Yesterday Last Week Last Month -------- ----- --------- --------- ---------- 3 Month 2.99 3.10 3.23 3.80 6 Month 3.14 3.23 3.33 3.87 2 Year 2.88 3.07 3.16 3.76 3 Year 2.81 3.01 3.06 3.77 5 Year 3.20 3.41 3.55 4.05 10 Year 3.83 4.00 4.07 4.40 30 Year 4.29 4.42 4.48 4.70

In the above table, the "Yield" is the interest rate. Remember that the yield on Treasury bills goes down as the price goes up, and vice versa. The above table shows that yields are falling sharply, which means that prices are increasing sharply, which (by the law of supply and demand) means that demand is increasing sharply.

If demand for Treasury bills is increasing sharply, it means that banks are purchasing them in higher than expected volume. (This is what the phrase "hoarding cash" means. If a bank has cash and wants to keep cash, it still invests it in Treasury bills, since even a 2.99% interest rate is better than 0%.)

This is a very exceptional situation. Recall that the Fed Funds Rate is now at 4.75%, which is the interest rate set by the Fed for overnight loans. The 3-month interest rate would be fairly close to 4.75% in normal times. At 2.99%, it's very unusual.

This is exactly what happened in July and August, when the "credit crunch" almost shut down the entire banking system.

This time, however, the Fed and other central banks are trying to stay ahead of it. The Fed is pumping $8 billion into the economy, to head of a new credit crunch. The European Central Bank (ECB) announced a similar policy last week.

However, it's not clear that the central banks can do much more than they have, and what they've done isn't very much.

According to a JPMorgan economist, the markets went into "virtual panic mode" last week. "Pressure is building for central banks to become a lot more active and vocal [this] week if they want to avert a collapse in credit markets."

Whether the central banks and the Treasury Dept. can pull of some spectacular policy change to postpone the inevitable remains to be seen.

From the point of view of Generational Dynamics, there's no question

about what's going to happen. As I've been saying since 2002, the

stock market is overpriced by a large factor, currently almost 250%, same as in 1929. A full-scale

generational panic and crash must come before too much longer.

(27-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Hizbollah is threatening to cripple Lebanon's government indefinitely, now that Émile Lahoud's term as President ended on Friday, and the Parliament has been unable to select a successor.

|

Lebanon is politically split between pro-Syrian and anti-Syrian politicians. Lahoud was a pro-Syrian politician. That's why Hizbollah was supporting him, and don't want him replaced with an anti-Syrian person. The Lebanese Parliament is supposed to select a new President, but it currently has anti-Syrian majority. Terrorists, most likely hired and funded by Syria, have been killing one anti-Syrian politician after another, beginning in 2005 with the massive Beirut explosion that killed Rafiq Hariri. There have been more of these killings, and the seventh killing occurred with a Beirut bomb blast in June. This has whittled the anti-Syrian majority in the Parliament down to just one or two votes. That's presumably the reason why Hizbollah is threatening to prevent a vote indefinitely. They can do this by having their members boycott Parliament meetings, so there won't be a necessary quorum. Presumably that kind of stalling will give Syria the time necessary to kill off one or two more anti-Syrian members. There has been renewed fear of civil war in Lebanon, like the horrible civil war that occurred in the 1980s. Ever since last summer's Israeli war with Hizbollah in Lebanon, pundits have been almost unanimous in predicting a new civil war in Lebanon, especially since Hizbollah (supported by Iran and Syria) has been trying to trigger one. Apparently the pundits' reasoning is that if they had a horrible civil war 20 years ago, then they're ready, willing and able to have another. I've said repeatedly that a civil war in Lebanon is absolutely impossible, since only one generation has passed since the genocidal Lebanese civil war of the 1980s. Lebanon is in a generational Awakening era, and so a civil war is impossible. The Lebanese are terrified of another civil war. This is true of every country in a generational Awakening era. In this case, the survivors who lived through the 1980s are still, to this day, completely traumatized and horrified because of the barbarity of what ordinary Lebanese people did to each other. This was especially true in the explosive climax in 1982 when Christian Arab forces massacred and butchered hundreds or perhaps thousands of Palestinian refugees in camps in Sabra and Shatila. It's this horror and fear of repeating the atrocities of the last crisis war that prevent the survivors from ever taking part in a new crisis war. That's the essence of a generational Awakening era. So, as bad as the political turmoil becomes in Lebanon, there won't be another civil war, no matter how much the pundits talk about it. To get a feel for how the current situation is affecting the Lebanese, think of the American election in the year 2000, when there wasn't a clear winner chosen on election night. It's extremely dangerous for a country to be without a leader, since decisions can't be properly made. It was certainly one of the principal motivations of the US Supreme Court at that time to make sure that the indecisive state didn't continue for long. And there are many bitter feelings still continuing to this day over the way it turned out. That's the situation in Lebanon right now. The country will continue on with only a partial government until some compromise can be found to select a new President. But there won't be a civil war. | |||

Once upon a time, long, long ago, there was a British Empire.

Today, there's no longer a British Empire. In its place is the British Commonwealth of Nations, a group whose members are 53 nations consisting mostly of former British colonies.

Reference list of members: Antigua and Barbuda, Australia, Bangladesh, Barbados, Belize, Botswana, Brunei Darussalam, Cameroon, Canada, Cyprus, Dominica, Fiji Islands [suspended], Ghana, Grenada, Guyana, India, Jamaica, Kenya, Kiribati, Lesotho, Malawi, Malaysia, Maldives, Malta, Mauritius, Mozambique, Namibia, Nauru [special member], New Zealand, Nigeria, Pakistan [now suspended], Papua New Guinea, Samoa, Seychelles, Sierra Leone, Singapore, Solomon Islands, South Africa, Sri Lanka, St Kitts and Nevis, St Lucia, St Vincent and the Grenadines, Swaziland, The Bahamas, The Gambia, Tonga, Trinidad and Tobago, Tuvalu, Uganda, United Kingdom, United Republic of Tanzania, Vanuatu, Zambia.

Although the Commonwealth has officially existed since the mid 1800s, it became particularly important with the breakup of the British Empire after World War II. Still with the Queen as its head, the nations of the Commonwealth provide technical and administrative assistance to one another.

Interestingly, there is a competing organization: Organisation internationale de la Francophonie, the alliance of French-speaking nations. Coincidentally, la Francophonie also has 53 member nations. Just as Britain and France are in competition over everything else, there's also a competition between the Commonwealth and la Francophonie.

In fact, there's currently a kerfuffle over the bid by Francophone nation Rwanda to join the Commonwealth. Rwanda's aspiration to join the Commonwealth is not intended to shut out Francophone practices and the French language, according to the Rwandan government. "We are not going to the Commonwealth to speak better English, but to get economical, social and community benefits."

And so, although the Commonwealth and la Francophonie organizations are almost totally unknown in the United States, membership in these organizations is a very big deal among many nations internationally.

Which is why Thursday's suspension of Pakistan from the Commonwealth is also a very big deal.

Every two years, there's a Commonwealth Heads of Government Meeting (CHOGM), a get-together of the leaders of all the member nations. By coincidence, the CHOGM 2007 meeting is being held this very weekend in Kampala, Uganda.

On the eve of the meeting, on Thursday evening, the Commonwealth Ministers Action Group (CMAG) reached the decision to suspend Pakistan from the Commonwealth, because "it failed to fulfil. its obligations in accordance with Commonwealth principles." CMAG particularly objected to the fact that President Musharraf is both a civilian and military leader, both Head of State and Chief of Army Staff.

Saying that the decision was taken "taken in sorrow not in anger," CMAG demanded implementation of the following measures before Pakistan could be restored to full membership in the Commonwealth:

This is actually the second time that the Commonwealth has suspended Pakistan's membership. Pakistan was suspended in 1999, when General Pervez Musharraf seized power through a coup. The suspension was lifted in 2004.

An angry Pakistan government spokesman rejected CMAG’s decision and said it was "based on lack of realism and absence of understanding" of the situation in the country, and that they would not tolerate outside interference in Pakistan's affairs.

Pakistan's Ministry of Foreign Affairs issued the following statement on Friday:

The Government of Pakistan is committed to restore full democracy in the country. Emergency was a necessary measure to avert a serious internal crisis which is being addressed and the situation is now returning towards normalcy.

A neutral caretaker government is in place to hold free, fair and impartial elections. The Election Commission of Pakistan has already announced that elections to the National and Provincial Assemblies would be held on 8 th January, 2008 . Foreign election observers are welcome. Except for a few, all detainees held as a measure of precaution have been released. The print media was never under any restriction, while the large majority of television channels have resumed their transmission. Following the judgment of the Supreme Court on the validity of Presidential election, President Musharraf is expected to take the oath of the office as a civilian President.

The pace of progress towards normalcy will be determined by ground realities and legal requirements in Pakistan rather then unrealistic demands from outside.

In order to prevent any precipitate decision by CMAG, both the Prime Minister and the Foreign Minister had contacted the leaders of CMAG on telephone and through letters communicating the ground realities in Pakistan and underlining the significant political progress made since the imposition of Emergency. The CMAG countries were asked to take this progress into account in their deliberations and to postpone any consideration of suspension until a CMAG delegation could visit Pakistan to see for itself the existing circumstances and the steps taken by the Government to place Pakistan firmly on the path of democracy.

Therefore, the CMAG decision is unreasonable and unjustified. Pakistan will review its association and further cooperation with the organization."

As indicated by this statement, Musharraf appears to be moving in the direction of complying with Commonwealth demands. However, he has not yet named a date for removing the state of emergency.

On Friday, Pakistan's election commission confirmed that Musharraf won the October 6 presidential election, giving him another five years in office as Head of State.

This frees Musharraf, according to previous promises he's made. to resign as head of the military, and he's renewed his promise to do this within a week. Parliamentary elections are scheduled for January 8.

|

From the point of view of Generational Dynamics, Pakistan and India are headed for a new crisis war, re-fighting the genocide that followed the 1947 Partition of the subcontinent into (Muslim) Pakistan and (Hindu and Sikh) India.

Thus, there are many things happening that will complicate the path to the January 8 elections and the removal of the state of emergency:

Unlike Benazir Bhutto, a formerly exiled former Prime Minister, who is secular and ethnically Sindhi, Sharif is a conservative Muslim and is ethnically Punjabi, the most powerful ethnic group in Pakistan. Thus, in the Parliamentary elections, Sharif would split the formerly strong Punjabi support for Musharraf's candidates.

However, Musharraf was reportedly pressured to allow Sharif to return by Saudi King Abdullah, so that Sharif would provide a conservative Muslim counterweight to Benazir Bhutto, a relatively secular and liberal woman.

Reading through the above list, it's clear how rapidly Pakistan's domestic situation is changing.

Thus, although the Commonwealth's suspension of Pakistan is humiliating, it's far down the list of major factors that will influence Musharraf's actions.

And there's little doubt that there will be further rapid and

unexpected changes in the weeks to come.

(24-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

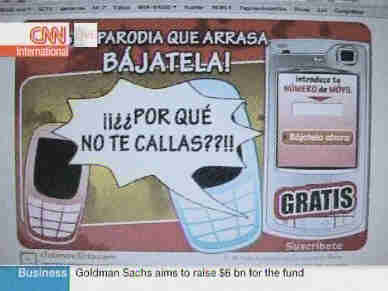

The King of Spain's memorable putdown of Venezuelan President Hugo Chávez has become the most popular ringtone in Spanish history.

|

Venezuelan President Hugo Chávez has increasingly become the biggest and most obnoxious loudmouth among international leaders, often even eclipsing his pal, Iranian President Mahmoud Ahmadinejad. (His other pal, Cuba's Fidel Castro, has been too sick to matter for a while now.)

So at a meeting in Chile two weeks ago, when Chávez kept interrupting Spanish Prime Minister José Luis Rodriguez Zapatero in order to call Spain's former Prime Minister José María Aznar a fascist,

Spain's King Juan Carlos spoke up and said to Chávez "żPor qué no te callas?" which means, "Why don't you shut up?"

The King's remark has been made available as a mobile phone ringtone by several by several phone companies, and about half a million people have downloaded it to their mobile phones. In addition, the phrase has appeared on T-shirts and mugs.

Here's an English-language translation of the exchange that occurred in Chile on November 11:

Chávez: Tell him to respect.

Zapatero: I demand you......., one moment….

Chávez: Tell him the same.

Zapatero: I demand that respect for one reason, moreover…..

Chávez: Tell him the same, president.

Zapatero: Of course.

Chávez: Tell him the same....

Spain’s King: Why don’t you shut up?

Bachelet: Please, don’t make a conversation, you have already had time to express your points of view, president, you have to finish,

Chávez: President Aznar may be Spanish but he is a fascist and a……

Zapatero: President Hugo Chávez, I think an essence exists, and it is that in order to respect and to be respected, we must try not to discredit. You can have different ideas, condemn conducts, but without discrediting. What I want to express is that a good way to work is to understand each other in favour of our countries, we must respect each other, and I ask – president Bachelet- that must be a rule of conduct in a summit which represents citizens, we must respect our leaders, every presidents and former presidents of all the countries that form this community.

I think it is a good principle and I strongly wish that should be a rule of conduct, because conduct gives essence to things, and you can disagree with everything respecting the rules, that is the principle in order to be respected.

I’m sure that all this committee and all Latin Americans want every democratic leaders (…) to be respected, today and tomorrow, although we have different beliefs.

(applause)

Chávez: Venezuela’s Government reserves the right to answer any attack anywhere, and in any tone.

Chávez is not used to having anyone talk back to him. He's demanded that the King Carlos apologize to him, and has made implied threats to nationalize Spanish investments in Venezuela if no apology is forthcoming.

So this amusing little spat is probably not yet over.

(23-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

In a discussion on Friday morning on CNBC, CNBC's chief macroeconomics commentator compared what's happening now to the worldwide credit crisis that occurred in August. That crisis, you'll recall, was resolved by unexpectedly large interest rate cuts by the Fed. Lieseman described what he's been hearing people say lately:

|

"I want to give you the flavor of what I'm hearing

from people in the credit markets. And the story I'm hearing is

that it's worse now than it was back in August. I'm hearing worse

comments, like Armageddon out there in some of these credit

markets.

It's an easier story to tell than it was back in August, because you're seeing it reflected in equity markets. I want to run through a couple of screens here. Take a look at the ABX. This is a market for insuring mortgage bonds or mortgage derivatives, and that's down - this is the close of business on Wednesday. That's not good -- it's below the August level by quite a bit. Then take a look at a wider market, which is the swaps market, and this is a swaps to treasury spread -- and you can see that it's actually higher now than it was back in August. And what you see there -- this is just a measure of risk aversion. The higher that number is, basically, the more risk averse people are. ... Bottom line is that relative to August -- and equities have caught on to this it seems -- credit markets are doing worse. We're awaiting a fix. There is increasing talk about a government fix here -- not letting the market sort this out on its own."

|

|

Before continuing with this, I'd like to remind the reader of an article that I wrote in December of last year, entitled "Financial analysts gush at stock market's meteoric rise." In that article, I quoted what Jack Bouroudijian of the Brewer Investment Group said on on CNBC:

"This has been a wonderful six months for the

market. And the worst thing about it is that we underperformed

the rest of the world. So it's really of question of whether we're

at the beginning of a multi-year run in equities. I guess that's

the big debate. When you've got these superstar fund managers

like the Bill Millers of the world, that are underperforming that

are still unbelievers out there, that makes me even more bullish

than I am. And we see all this data coming out and this is

absolutely everything that you want."

Bouroudijian's extremely gushy remarks were contrasted to the more sober remarks of others.

In particular, in that same article, I also quoted Randall Dodd, director of The Financial Policy Forum, who gave a warning about the coming crisis in credit derivatives:

"I don't want to be alarming, I'm just trying to

raise people awareness about these issues. I would look at the

credit derivatives market. We've had some problems in clearing

and settlement of those contracts. We've had problems with people

trading more credit derivatives than there is underlying debt.

And right now there's one big issue we have to look at -- it's

that a lot of our major banks and broker dealers are moving their

credit risk off their books and into hedge funds. So you have

financial institutions with capital requirements reducing the

amount of capital they use by moving that credit risk into hedge

funds which have no capital requirements and often use very high

leverage to manage their credit risk of selling credit protection

through this credit derivatives market."

Now that these warnings about credit derivatives are coming true, it's interesting to look at how attitudes have changed in the past year. Randall Dodd's warning is no long considered "alarming"; it's part of the general discourse today, and now for the first time there's even talk of "Armageddon."

|

Bouroudijian appears on the CNBC panels pretty often, and he's consistently gushy. To him, the market can go in only one direction -- up, then up some more. He uses words like "unbelievers out there" to indicate that it's all a matter of faith.

Well, now the question is this: Has Bouroudijian changed at all recently, now that the market has been falling fairly steadily since the October 9 high?

Here's how he responded on Friday morning to a question about what would be necessary for a year-end rally to occur:

One of the things that I like is that there is so much negative press out there. If you read the NY Times today, then there's an article about the Japanese basically calling it quits in America. Remember that this is the same group that bought the top.

|

And as far as Steve is concerned, Steve, you're talking to people who were looking at NO PROBLEM WHATSOEVER early in the summer. And now they're looking at Armageddon, now that all the news is out. Well that tells me that we're very close to a bottom. I love that kind of press."

Well, Bouroudijian is always good for a chuckle. But there are some very interesting things about what he said:

Lieseman responded to Bouroudijian as follows:

You need a sense that you're not going to come in in the morning and get whacked from the side that you've never heard of before, which keeps happening. Almost every day we hear a new thing coming out. That's one.

And two, you need a sense that either the government or the markets or some combination of the markets and the government have their hands around how to put a fix into the system. I don't think we're anywhere near the bottom on either one of those two stories yet."

There was some further arguing between the two over whether it's appropriate for the government to intervene in the market system, with Bouroudijian firmly opposed to any such intervention.

What's interesting about that discussion is the unstated assumption that there IS a government fix that would work. Is there really a government fix for everything? What if there ISN'T any government fix? No one considered that possibility. After all, the government has been so successful at fixing everything else, so naturally they have a fix for the credit crunch crisis as well, don't they.

Let's take a look at one more indicator:

|

I've referenced the MarketPsych investor fear index several times in the past, most recently on November 3, when I wrote that it was forecasting sharply increased market turbulence. The graphic above presents the index as of Friday morning.

Notice that there's a sharp upward spike on the right-hand side. That spike may or may not hold. In watching this index, I've noticed that spikes often disappear within a day or two, as more data comes in. So that spike may or may not disappear.

What IS significant, however, is the permanently elevated level of the index for over a full month. This is at the same level as the one-day spike in February over the Shanghai stock market panic, and it's almost as high as the August level. This index was at a low on January 19, and has been trending upward ever since, indicating an increasing level of investor anxiety throughout the year.

And this is the main point that I want to emphasize today.

When I wrote my August 17 article entitled "The nightmare is finally beginning," I wasn't referring to what was happening to the stock market indexes; I was referring to what I perceived as a sharply increased level of investor anxiety.

Because really, nothing special has happened to the stock market indexes in the last few months, or even this year. You could take this year's stock market performance and drop it into almost any year in the past six decades, and it wouldn't be considered particularly exceptional or noteworthy.

From the point of view of Generational Dynamics, what's important are the changes in attitudes and behaviors of masses of investors, entire generations of investors. The ups and downs of the stock market are irrelevant, except insofar as they reflect the changes in attitudes and behaviors of the masses of investors.

What's different now is that something big has changed since July 19, when the market reached the historic high of Dow 14000.

The triggering event appears to have been the July 18 Bear Stearns announcement that its hedge funds were almost worthless, thanks to writedowns of CDOs. By August 17, when I wrote the "nightmare" article, it was very clear that things had changed dramatically.

What we're seeing now is a huge change since July 19. Attitudes and behaviors have changed enormously. And the market itself is reflecting these changes, through its steady downward drift since it reached its new history high of Dow 14164 on October 9.

As I've been saying since 2002, Generational Dynamics predicts that

we're overdue for a generational stock market panic and crash, as happened in 1929. This is based

on the simple fact that price/earnings ratios have been astronomically

high by historic standards, and that the stock market is overpriced

today by a factor of about 250%, same as in 1929.

(23-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The number of regular readers to this web site has been growing steadily over the past year, and I thank all of you who keep coming back.

I particularly want to thank the four people who donated a total of $441. This was extremely generous and unexpected.

I often receive e-mail messages from people who call me insane or psychopathic. I chuckle at these, and I note that as the world situation deteriorates I'm getting far fewer of them.

More important, I also get e-mail messages from people who thank me profusely for "saving" them and their families, by allowing them to prepare for what's coming. I'm very thankful for these messages. These messages are very special to me, and they make all the work that I put into this web site worthwhile.

I'm very proud of the work that I've done in the development of Generational Dynamics, because I've accomplished so much, as I've shown on this web site. The amount of resistance to accepting anything this new, especially from Boomer academics, is enormous, and quite honestly I don't expect to survive long enough to see generational theory as an established academic pursuit. Nonetheless, with more and more people reading this web site, I hope that I've created a nucleus of interest that will grow as this extremely important analytical and forecasting methodology becomes better recognized.

I want to thank Bill Strauss and Neil Howe, the founding fathers of generational theory, as described in their 1995 book, The Fourth Turning. Generational Dynamics builds on top of their theory, and without their work it would not have happened. I've just learned recently that Bill is seriously ill with cancer. I wish him well.

I'm still managing to keep up with all e-mail questions sent to me, though it sometimes takes a few days (or longer) for me to get back with a response, depending on volume of e-mail. So if you have a question, by all means send me an e-mail message, or use the "Comment" link at the top of this page.

If you want to have a more open debate, you can do so in the "Objections to Generational Dynamics" thread of the Fourth Turning forum.

A web site reader recently wrote to me to wonder if there was any "redemption" for people like me. I wrote back to her that if there is any redemption, it comes about from people who read this web site and who take action in their own lives.

As I've said many times: No one can stop what's coming, any more than anyone can stop a tsunami. You can't stop what's coming, but you can prepare for it. Treasure the time you have left, and use the time to prepare yourself, your family, your community and your nation.

If you haven't heeded that advice yet, then now is the time to do it.

(22-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Hopes for quick return to "normal" bubble growth are fading.

A strong signal that investors and pundits are becoming increasingly pessimistic is what might be called the "time horizon" effect -- when do pundits think that things will return to "normal"? Usually the pundits give a time horizon of a day or, at most, a week.

But listening to the pundits on CNBC on Tuesday and Wednesday gave a very different picture. I heard one and only one pundit say that he expects a "year-end rally." The rest were unanimous: People are not going to be buying stocks for the rest of year -- and that includes large institutional investors, as well as small investors with 401K's -- because they want to wait until things have "settled down" again.

One pundit said that he's hearing that investors won't buy again until the Dow Industrials index is below 12,000 -- 1,000 points below where it is now. He also said that it might happen within the next week.

Asian stocks fell sharply on Tuesday night / Wednesday:

Australia All Ordinaries 6450.20 - 0.62%

Bombay Sensex 18602.62 - 3.52%

Hong Kong Hang Seng 26618.19 - 4.15%

Japan Nikkei 14837.66 - 2.46%

Shanghai Composite 5214.22 - 1.50%

Singapore STI 3347.20 - 2.65%

South Korea Composite 1806.99 - 3.49%

Taiwan Weighted 8484.11 - 2.27%

According to the Wall Street Journal, Asian investors were concerned that the U.S. economy, the most important export market for many of the region's companies, would continue to weaken. It said that "the region took its cue from unsettled trading" on Wall Street on Tuesday, when the market closed slightly higher, but only after turbulent 250 point swings. The article quotes a Tokyo trader as asking, "What the heck were the wild ups and downs in New York?" saying that the trading pattern reflected the unsettled prospects for the market.

European stocks on Wednesday similarly fell sharply.

As I've said many times before, from the point of view of Generational Dynamics, what's important is changes in behaviors and attitudes of large masses of investors, entire generations of people. The ups and downs of the markets are not per se of concern, except insofar as the indicate changes in behaviors and attitudes.

What we're seeing now is what I had been expecting to see when I wrote my August 17 article entitled "The nightmare is finally beginning." I indicated that we were now on the road to a stock market crash in the near future. The exact timing couldn't be predicted, but the speculation was that it would happen by the end of September. However, unexpectedly aggressive Fed interest rate cuts caused a period of drunken euphoria among investors, and postponed the inevitable results.

The markets in the last few days have been following the 1929-like pattern that I was expecting in September, before it was redirected by the Fed interest rate cuts. The one major thing that we haven't seen yet is a large "crash upward" such the 6.9% Dow increase that occurred on October 7, 1929, two weeks before the crash. (See Dow Jones historical page.) At any rate, extreme caution is called for.

Something else that's becoming increasingly clear is that faith in the Fed is collapsing. In fact, faith in any "easy solutions" is collapsing. On October 15, the mind-boggling "M-LEC" announcement, which was supposed to calm jitters, only increased them. The October 31 Fed interest rate cut only caused investors to become more sober, instead of returning to drunken euphoria.

On October 24, I quoted a pundit as saying, "Investors believe that everything is going to be OK because the Fed will cut interest rates. Everyone knows that the Fed is on their side."

No one says anything like that any more. The discussion about the Fed on CNBC on Wednesday morning was extremely negative. CNBC anchor Steve Lieseman expressed great concern that the Fed was contradicting itself on inflation, sometimes indicating that there's no problem, other times expressing concern. Another pundit described as "scary" the impression that the Fed was no longer setting policy, but was simply reacting to day by day events.

So, within the last 4-8 weeks, there has been enormous loss of hope in every direction. I can't recall hearing anyone describe any scenario that's going to make things better, except "waiting."

Before going on, I want to take a quick digression about the inflation rate, because I get a lot of questions about this.

There's a lot of obsessive fixation on the inflation rate because it's thought by many to be the key to the future. If the inflation rate is low, then the Fed can lower interest rates and "save the world" again; if the inflation rate is high, then the Fed can't risk lowering interest rates because that would raise inflation even more.

It's important to remember that there are two separate measures of inflation. They usually track each other closely, but they've been diverging in recent years.

I've been saying for several years that the CPI is on a long-term deflationary trend, and I expect the CPI to fall 30% or so by 2010. That's still my expectation. That means that your dollars will be increasingly valuable in the next few years. People who say "Get rid of all your dollars because they'll be worthless" are talking nonsense. Remember, you're still going to have to purchase groceries and stuff, so you're going to need cash.

(I apologize for being so America-centric in the above paragraph. However, the internal inflation rate will trend down just as sharply in most other countries, and for similar reasons. So the same remarks apply in other countries.)

I've made no predictions about the external value of the dollar, or on the claim that the dollar will become "worthless" in international markets, since it depends at least partially on political factors, in America and in other countries.

However, writing about "The bubble that broke the world" has led me more and more to believe that even if the dollar weakens further, it will remain strong during the crisis. One web site reader pointed out to me that it took 50 years for the British pound to lose 80% of its value and status as the world's reserve currency.

The problem that the Fed has these days is because the dollar is internally deflationary, but is externally inflationary. That's why nobody understands the Fed's message on inflation. For those of you who are concerned about the value of the dollar, it's worthwhile keeping these considerations in mind.

That ends the inflation digression.

The 1929 stock market crash was not a one-day event. The stock market kept falling, month after month after month, for three years, until 1932, when it had fallen 90% of its peak value. (Paragraph corrected - 7-Apr-09)

One question that I've wondered about is the "mood" of investors during those years. During the last few years, we've seen the "euphoric" mood of bubblehead investors for whom every bit of bad news was good news, and every bit of good news was cause for chirps of joy.

Well, what was it like during the downturn years?

It may be what we're seeing now -- an increasing expectation of more and more bad news, a lengthening time horizon before the masses of investors expect good news to start again.

This is certainly something that pundits and investors and journalists are completelly oblivious to. The whole concept of investor mood is foreign to them, especially when it's related to generational concepts.

And yet, it's the key to understanding what's going on and what's coming.

In order to advance this a little farther, here's a graph of the Dow Industrials since 1950:

|

In the above graph, the red line is the Dow Industrials. The blue line is the exponential growth trend, computed since 1896, and represents the "real value" of the stock market. This provides a reference to whether the market is overpriced or underpriced at any given time.

What I would like to do is speculate on how investor "moods" change as generational changes occur.

What I especially want to focus on is the two "inflection points" on the DJIA graph. At each of these two points, the graph turns a sharp corner to the left, forming the letter "V". Mathematically, these are the points in 1995 and 2003 where the second derivative is discontinuous (or infinite, depending on how you look at it).

Things in nature tend to be continuous, unless affected violently by some external force. A rolling ball may slow down or speed up, but the change in speed will be continuous unless the ball hits a rock or a tree.

Similarly, we would expect the DJIA curve to continue in the same direction, perhaps gradually rising or lowering, but a sharp "V" cannot occur unless affected violently by some external force. And the most obvious choice of an external force is a generational change.

Thus, we provide theoretically the following generational investor "moods" from 1950 to the present:

The Depression era survivors exerted leadership in global financial institutions. These leaders included those in the Silent Generation, the "depression babies" and "war babies" who grew up during the horrors of the Great Depression and World War II. They were in charge until the early 1990s, when they all disappeared (retired or died), all at once, leaving behind a new generation of younger leaders with little or no fear of credit.

The phrase that I'm going to apply to Boomers is: "passively destructive."

As I've described many times on this web site, Boomers have no ability to govern or lead. Their parents had been taking care of them their whole lives. All that the Boomers ever did was argue with and humiliate their parents, as happened in the 1960s with the "generation gap."

This is the explanation for the dot-com bubble in the 1990s. Boomers didn't actively create the bubble; they passively let it happen by removing decades-old restrictions, imposed by their parents, on the types of investments that they'd allow themselves to make. There was no destructive intent to harm other people. The destruction was passive.

There's really little difference between euphoria and panic, since both are totally emotional. They correspond respectively to the manic and depressive phases of bipolar disease. The symptoms may be different, but it's the same disease.

There's little doubt that it was in 2002 that the real abuse of credit began. There had been things like credit derivatives around before, but it was in 2002 that the really explosive use of "structured credit" began.

The Boomers were still nominally the leaders, but, as before, they didn't want to lead. The Gen-Xers stepped up and took charge.

Here's what PIMCO's Bill Gross said recently in his monthly column:

A web site reader put it a little differently. "Only Gen-Xers would have the technical sophistication to devise these complex, opaque and (consciously or not) dangerously deceptive models that the CDOs use. Few Boomer men can even type, let alone write software."

If the Boomers were "passively destructive," the Xers have been "actively destructive," creating these complex financial structures.

Much of what the Xers did was fraudulent, illegal, and contemptuous of the entire global financial system. I've pointed out several examples of fraud on this web site, especially fraudulent methods used to avoid having to apply "mark to market" to overpriced CDOs.

In fact, the number of legal actions is increasing. As time goes on, we're going to see more and more criminal prosecutions against everyone from individual homeowners who lied on their applications to mortgage brokers to major financial institutions.

Generation-Xers are the name for the generation born roughly between the early 1960s and the early 1980s. In generational theory, they belong to the Nomad archetype, the generation of people born during a generational Awakening era. Bill Strauss and Neil Howe, the founding fathers of generational theory, found that those in Nomad generations become disaffected and angry, growing up in the shadow of the favored Prophet generation (like America's Boomers).

In 2002, the first wave of Gen-Xers reached the age of 40, and were in sufficiently high leadership positions that they could influence and often control the financial decisions of many organizations, especially since their Boomer bosses just let them do what they want anyway.

I've spent a lot of time since the beginning of this year trying to figure out what's been going on. Once you really begin to understand what's going on with securitization of credit, credit derivatives and CDOs, you realize what a totally debauched, depraved and abusive design they are. This is no simple passive mistake -- that's what the dot-com bubble was. This was a massively destructive and self-destructive financial architecture, devised by nihilistic financial engineers on the edges of the Generation-X generation. This was active destruction at its most debauched and depraved, condoned by passively destructive Boomers. We're now about to pay a very, very expensive price.

Don't think that I'm saying that Boomers are good and Xers are bad. Both are pathetically bad, but it's their interaction, the way they complement each other, that results in the destruction we're headed for.

The above is a first pass at a generational explanation of what's going on. As time goes on, and as more information and more criminal prosecutions become known, I'll try to expand and refine it.

Finally, a web site reader has sent me, "for my reading pleasure," the address of a web page containing statements of journalists, pundits, financiers and politicians from the years 1927 to 1933.

Here's the list -- and remember that the crash began on October 24, 1929, and continued for three years, until mid-1932:

It was only in mid-1932 that the stock market began to gain again,

having fallen 90% from its 1929 peak.

(21-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The Pakistan army is massing for an assault against Taliban in Northwest Frontier Province (NWFP), as Taliban militants have taken control of the Swat valley.

|

Pakistan army helicopters and artillery are pounding militant positions in the Swat Valley, in anticipation for a ground assault in the next few days.

According to a rare media briefing by the army, a senior commander said the army had assembled about 15,000 troops in the Swat Valley's main town, and would launch its main offensive within days because militants from Afghanistan as well as the lawless Pakistani border regions of Waziristan and Bajaur had reinforced the followers of rebel cleric Maulana Fazlullah in Swat.

The plan was to push the militants back into the rugged Piochar side valley where they had established bases. "We will bottle up as many of them as possible and then eliminate them," said General Ahmed Shuja Pasha. "This is our killing ground," he added.

For some time, al-Qaeda and Taliban militants, including Osama bin Laden himself, have had control of the lawless FATA (Federally Administered Tribal Areas) -- not officially part of Pakistan, but administed by the Pakistan government.

In recent days, Taliban cleric Maulana Fazlullah has led his army of Taliban militants from the tribal areas into the settled areas of Pakistan's Northwest Frontier Province (NWFP), and have gained control of the Swat Valley.

This was one of the reasons given by President Pervez Musharraf to explain the imposed state of emergency.

In a related matter, dozens are dead in a clash between Sunnis and Shia in the tribal areas near Balochistan.

In an interview broadcast on CNN on Sunday, opposition leader Benazir Bhutto blamed the increasing violence on Musharraf. The following is my transcription of her remarks:

And we need to support our military by also co-opting the local population. I know the local population would have defended their town if we had given them the arms and the guns. They turned to me and asked me to get them some help, and I spoke about this at a diplomatic reception to caution the government that the militants were coming.

But unfortunately, the people aren't given the support they need to fight and face the militants themselves, and in the meantime, the militants spread. So I think that what General Musharraf has done may have been a little bit, but it hasn't stopped the spread of militancy and extremism in Pakistan.

... The issue for me is to have fair elections, and to have the people of Pakistan to express their view. I believe that the attempts to block my leadership and to block democracy are actually paving the way for the extremists to spread their influence, and I feel that the focus ought to be really on the extremists, not diverting the attention away from the real battle in Pakistan.

In my view it's the threat by the extremists that threatens today to disintegrate Pakistan. They're already into the Valley of Swat, and soon they'll be spreading outwards, toward our capital city of Islamabad. I may have my critics, but I leave the decision of Pakistan's destiny to the people of Pakistan. And the people of Pakistan have stood by me. Three million of them turned up at Karachi airport to receive me. 18,000 were imprisoned in the witchhunt launched to stop our "long march" to apply pressure for the restoration of democracy. The people want a democracy. They're marching with their feet so that their voices can be heard, so that their march can be heard.

And I would make a plea for fair elections. My concern is that if the elections are rigged, and I think they're heading towards rigged elections, well General Musharraf's team might end up giving more control to the religious parties under whose influence these extremists have spread, and then we would really be in the soup."

One thing that I'm understanding more and more about Benazir Bhutto is that she's an extremely careful politician who weighs every word she says for its political import. Many of remarks about democracy and popularity should be viewed through that filter.

There is one particular portion of her comments that I'd like to focus on:

Bhutto is suggesting that Musharraf execute a military strategy similar to the "surge" strategy devised by General Petraeus in Iraq. The end result of that strategy is that the Sunni insurgents turned against al-Qaeda in Iraq, and ended up fighting on the side of the Americans.

It's important to understand that this strategy cannot possibly work in Pakistan.

From the point of view of Generational Dynamics, Iraq is in a generational Awakening era, just one generation past the end of the last crisis war, the genocidal Iran/Iraq war of the 1980s. That means that the Iraqi people are "attracted away" from war, and will do everything possible to keep another genocidal war from occurring. That's why the Iraqi war was never a crisis civil war, and could never have been a crisis civil war. Any attempt to ignite a civil war, which is what al-Qaeda in Iraq tried, was doomed to failure, and any such war would fizzle out quickly. That's exactly what happened.

But Pakistan is in a generational Crisis era, three generations past the end of the last crisis war, the genocidal war that followed Partition in 1947. That means that the Pakistani people are "attracted towards" war.

Thus, Bhutto's suggestion to provide arms and weapons to the people of Swat Valley and expect them to eject the Taliban militia is far more likely to spiral out of control into full-scale warfare.

Iraq today and Pakistan today are in totally different generational eras. There is NO COMPARISON between the two. Anyone who tries to apply lessons learned in one country to the other country is on a fool's errand. If there is any "rule" to be learned, it's that Pakistan will most likely do exactly the opposite of what Iraq does in a like situation.

Possibly the thing that struck me the most when I did my in-depth analysis of Pakistan last week is that Musharraf and Bhutto are themselves split along the major internal Pakistan fault line -- Urdu-speaking Mohajirs (migrants from India) versus Sindhi-speaking Sindhis. This means that there never was a snowflake's chance in hell that Musharraf and Bhutto could have governed together in some power-sharing agreement, even though encouraging such an arrangement was (and perhaps still is) official US and British policy.

A web site reader has pointed out a related fact that's perhaps even more crucial.

I've said many times that I have great admiration for both Pakistan's President Pervez Musharraf and his Indian counterpart, India's Prime Minister Manmohan Singh, because these two leaders have engineered a remarkable détente that has prevented a conflict, indeed a nuclear conflict, between the nations, and they've pulled back from the continuing seething dispute over Kashmir and Jammu.

What my web site reader has pointed out is that both Musharraf and Singh share the same ethnic group -- Punjabi -- though of course they have different religions (Muslim and Sikh, respectively). Singh was born in 1932 in what is now Pakistan's Punjab province, and Musharraf was born in 1943 in Delhi, adjacent to what is now India's Punjab province.

That means that once Partition took place in 1947, Singh's family was in the forced relocation of western Hindus and Sikhs to India, while Musharraf's family was in the relocation of eastern Muslims to Pakistan.

That's very significant, and explains a great deal about why Musharraf and Singh have developed such a close relationship, and why they've been able to forge the remarkable détente that I've discussed.

It also means that any similar arrangement between Bhutto and Singh would be very unlikely.

From the point of view of Generational Dynamics, the genocidal

bloodbath war that followed Partition in 1947 will be re-fought with

100% certainty. There are two major scenarios. The first scenario

is a regional war in Kashmir spreading throughout the region; and the

second scenario is an ethnic or sectarian war starting somewhere and

spreading through the region. Either way, a major nuclear between

Pakistan and India cannot be avoided.

(19-Nov-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

This was the only mildly amusing thing on the Sunday news talk shows.

|

In his weekly commentary on "Face the Nation" on Sunday, CBS news man Bob Schieffer said that Congress could only accomplish one thing, namely, doing nothing:

Well, that's just the half of it.

With the help of the Democratic majority, they have managed to keep much of anything from happening, good or bad.

Who says there's nothing that two sides can't accomplish together? Of course there is - doing nothing.

Congress ran to the airport Friday for yet another break - they're taking two weeks this year for Thanksgiving. I wouldn't ask how many days you're taking because that would be a digression.

But my question is this: What do the following have in common?

Legislation to provide health insurance for children, education legislation, energy legislation, the farm bill, funding the Iraq war, and legislation funding all federal agencies except the Pentagon next year.

CBS's Bob Schieffer comments on the "Do Nothing" Congress:

This was the only mildly amusing thing on the Sunday news talk shows....

(18-Nov-07)

Japan: Prime Minister Shinzo Abe suffers major election defeat on Sunday:

Abe appears unable to govern, like Boomer politicians in America....

(30-Jul-07)

Congress fails to pass "no confidence vote" against Attorney General Alberto Gonzales.:

After failing to pass any kind of immigration bill...

(12-Jun-07)

Euphoric Nicolas Sarkozy supporters celebrate victory over Ségolčne Royal:

First 100 days: Put France back to work, stop illegal immigration, and make France a great nation again....

(8-May-07)

The Democrats are just as incompetent as the Republicans.:

And now, "The New Republic" magazine says that they're stupid on purpose....

(2-May-07)

Today's Schadenfreude: The Congressional pay raise is blocked.:

Congress is so paralyzed, they can't even raise their own salaries!...

(31-Jan-07)

Israeli army chief of staff resignation threatens entire government:

Israel is still reeling from the disastrous performance in the summer Lebanon war...

(18-Jan-07)

Likely result of the midterm elections: War in Iraq may escalate with "troop surge":

Is this what you expected or voted for?...

(17-Dec-06)