Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Most likely result: A further substantial stock market plunge.

In mid-January, I wrote "Collapse of corporate earnings portends imminent stock market plunge." At that time, the collapse of corporate earnings was only estimated.

Now the actual reports are out. Since January 1, reported earnings per share have gone from $48 per share to $27 per share. The bulk of that collapse occurred within the last two weeks.

This is an enormous collapse, and it's having a dramatic effect on price/earnings ratios (also called "valuations").

For simplicity, let's assume that the S&P 500 stock index has been at 760 since January 1.

Then, on January 1, the P/E ratio was 760/48 = 15.8.

On February 13, the P/E ratio was 760/27 = 28.1.

To see this graphically, take a look at the following chart. There's a price/earnings ratio chart at the bottom of this web site's home page, and it gets updated automatically every Friday. Here's last Friday's version of the chart:

|

If you look at the far right side of this chart, where the red circle is, you can see a huge spike in the last week, sending the P/E ratio up to 28.

As I've pointed out many times, P/E ratios held steady at around 18 for the entire years 2006-2007. This happened despite the fact that stock prices (shown on the bottom half of the chart) varied wildly.

The only way that this could have happened is if investors purposely held stock prices at the right levels, and that means that the buy/sell algorithms in their computers made decisions based on whether a stock's price was above or below 18 times earnings. There's no other reasonable explanation for how P/E could have held steady at 18 for over 2 years.

Now those same buy/sell algorithms have to deal with a collapse in reported corporate earnings, and the only way to do that is for the S&P index to fall to below 500 (and the Dow to fall below 5000).

I do not know any other way to interpret this collapse in reported earnings.

It's not surprising that the American economy shows the same signs of collapse that we've been seeing around the world.

Last week, the world's attention was drawn to an East European banking crisis, that threatened to create a domino effect that could bring down other European banks.

On Wednesday, that crisis took another step forward, when Ukraine’s national credit rating was cut two levels by Standard & Poor’s to the lowest in Europe, a day after Latvia was downgraded to junk, as eastern Europe’s most debt-laden economies lurch closer to default.

Worldwide trade and transportation have been grinding to a halt, with China's economy crashing much faster than expected.

|

In fresh news on Wednesday, Japan announced that its exports had fallen 46% in January. Demand for Japanese cars in particular fell by 69%. This is part of the general collapse of Asian trade.

As I warned web site readers last week, this continues to be a time of maximum danger. This rapid fall in reported corporate earnings could certainly trigger a larger panic. As I've discussed many times on this web site, generational theory predicts that there MUST be a generational stock market panic and crash, the first since 1929. It's impossible to predict the exact date, but with economies plunging around the world, the mood may be right for a major panic.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(26-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The government agrees to impose Sharia law in exchange for "peace"

|

A local local government official announced a "permanent ceasefire" with the Taliban militants on Friday. Pakistan has agreed to remove its army from the Swat Valley region, where it had been fighting the Taliban, and to implement Sharia, or strict Muslim law, in the entire region.

The capitulation comes after months of Taliban terror that included beheadings, kidnappings, and the destruction of girls' schools. Nearly half of the civilian population have been forced to flee their homes. The Taliban agreed to a ten-day ceasefire on Monday, and now the government seeks to extend it to a "permanent peace."

Even so, the Taliban have not accepted the deal, and they have not agreed to end terrorist activities.

A Taliban spokesman said, "[W]e will see what will be done by the government of launching Sharia law, then we will decide."

The Pakistan government has made several "peace agreements" in the past with the Taliban. Each of these peace agreements has failed. In each case, the Taliban continued with terrorist attacks, and used the time to regroup and rearm.

The terrorist attacks certainly didn't stop during last week's so-called "ceasefire." The Taliban are Sunni Islamists, and their terrorist attacks are generally directed against either westerners or Shia Muslims. On Thursday, a Shia official was gunned down in a city near the Swat valley, and on Friday, a suicide bomber blew up in the midst of the Shia funeral procession for the gunned-down official.

On Saturday, a senior government official in Swat Valley was kidnapped.

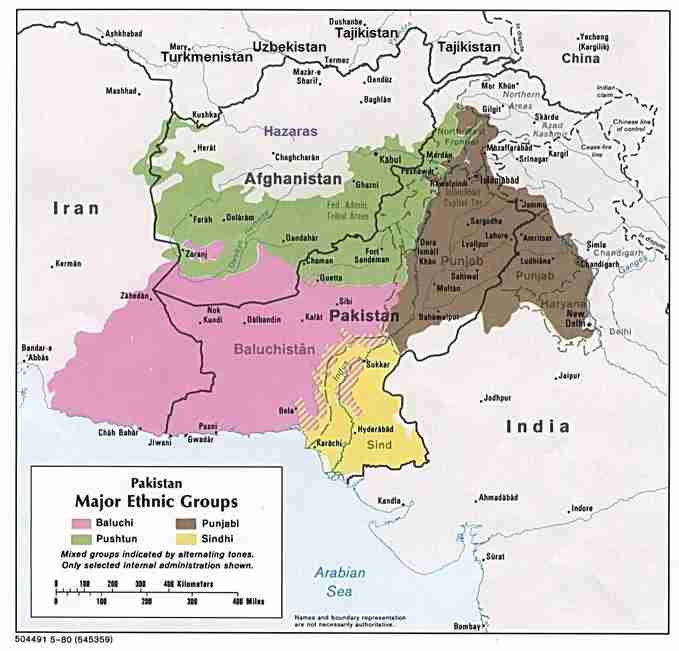

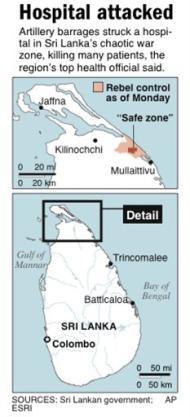

In an article last July, I explained the following map in detail:

|

Desperate Pakistan government capitulates to Taliban in Swat Valley:

The government agrees to impose Sharia law in exchange for "peace"...

(23-Feb-2009)

India's Prime Minister Singh formally accuses Pakistan re Mumbai terrorist attacks:

It's one thing when a low-level official makes an accusation,...

(7-Jan-2009)

After Mumbai's "26/11" nightmare finally ends, India - Pakistan relations face crisis:

Enraged Mumbaikers are demanding action and change today,...

(30-Nov-2008)

Pakistan-based Lashkar-e-Taiba suspected in terrorist attack on Mumbai (Bombay), India:

It's a "War on Mumbai" by an attack from the sea....

(27-Nov-2008)

Pakistan nears bankruptcy, as China refuses aid:

Pakistan will forced to seek unpleasant help from the IMF,...

(20-Oct-2008)

Islamabad Pakistan: Massive Taliban/al-Qaeda terrorist bombing:

"Pakistan's 9/11" has left the country in a state of shock,...

(22-Sep-2008)

Asif Ali Zardari, widower of Benazir Bhutto, wins Pakistan presidency:

The backdrop is Pakistan's fury over US armed forces assault into Pakistan's tribal areas...

(8-Sep-2008)

Pakistan's government coalition dissolves following dispute over Taliban:

As fighting rages in Pakistan's tribal areas,...

(26-Aug-2008)

Pakistan government crisis deepens, following Musharraf's resignation:

The government is completely rudderless as suicide bombers shock the country....

(23-Aug-2008)

Pakistan government combines chaos with paralysis as Musharraf is threatened with impeachment.:

The army may have to step in....

(8-Aug-2008)

Pakistan is paralyzed as Tehrik-e-Taliban advances in NorthWest:

Pakistan army abandons negotiations for war to prevent imminent takeover of Peshawar...

(29-Jun-2008)

Pakistan's tribal areas have become the world nerve center for al-Qaeda terrorism:

Al-Qaeda now has "free reign" and "safe haven" in this region....

(6-Apr-08)

Benazir Bhutto killed by suicide bomber after election rally in Rawalpindi:

Here's what to watch for in the next few hours and days....

(27-Dec-07)

Pakistan: Over 106 dead in spectacular assault on radical mosque in Islamabad:

Radical students hoped to spark an Islamic revolution against Musharraf....

(12-Jul-07)

Riots in Karachi, Pakistan, threaten Musharraf's presidency:

Thirty people were killed and hundreds were injured on Saturday...

(13-May-07)

Al-Qaeda resurging in Afghanistan and Pakistan:

Al-Qaeda's greatest threat is to Britain and Europe....

(19-Feb-07)

"Koran in toilet" rumor is uniting Muslims around the world:

From Gaza to Indonesia, Muslims are shouting "Death to America."...

(15-May-05)

Pakistan "Black Day" protests fail:

Continuing a worldwide trend of increased militarization and police power, President Pervez Musharraf...

(02-Jan-05)

| ||

Briefly, the Taliban are drawn from the Pashtun ethnic group (green on the map). The Afghanistan Pashtun were easily defeated by coalition forces in 2002 because they were in a generational Recovery era, having just fought a brutal civil war in the early 1990s.

However, the Pashtun of Pakistan are still in a generational Crisis era, and they're crossing the border into Afghanistan. They're being joined by Arab al-Qaeda terrorists and other Sunni Muslim extremists, who are being drawn to the region like bees to honey, thanks to the American involvement in Afghanistan.

It's quite possible that if the war in Afghanistan were simply against Afghan Pashtuns, then there wouldn't be a war. In a Recovery era, they have no desire or taste for war whatsoever, and any halfway reasonable approach would create a truce. For example, an approach similar to the "surge" in Iraq would probably bring the hostilities to an end, as they have in Iraq.

But the Afghan war is not simply against Afghan Pashtuns. It's against an increasingly large army of Taliban and al-Qaeda Islamists who are based in the Pakistan's FATA (Federally Administered Tribal Areas) and in Pakistan's Northwest Frontier Province (NWFP), where the Swat Valley is located.

The United States is being increasingly drawn into this escalating war. Within the last week, the Obama administration has increased the number of American troops in Afghanistan, and has expanded drone missile strikes within Pakistan.

In an article I wrote last July, during the middle of the election campaign, I quoted an interview given by Obama, and I concluded the following: "This portion of the interview makes it clear that Obama is just as strident about Afghanistan as Bush was (and is) about Iraq. Obama is just as "pro-war" as President Bush is, as vice-president Dick Cheney is, Donald Rumsfeld is, as the neo-cons are, etc., etc., except that he's "pro-war" about a different war, and a far more dangerous war, and a war far more likely to escalate."

Some people accused me of being "ideological" when I wrote things like this, but nothing I've written was or is ideological. We're now seeing the unfolding of exactly what I wrote, as the youthful Obama escalates the war in Afghanistan, in order to prove that he's not "weak" on terror.

The strategy of al-Qaeda and the network of Sunni Islamists is clear, as I've described many times: Emulate Iran's Islamic Revolution of 1979 by using terror to trigger a new Sunni revolution in some country. Once they have control of one country, use that as a base to launch attacks on other countries, establishing a new Muslim Caliphate. They failed in Iraq (in a generational Awakening era), and they will fail in Afghanistan (in a generational Recovery era), but they are succeeding in Pakistan (in a generational Crisis era).

The importance of the victory of the Taliban and al-Qaeda in Swat Valley cannot be underestimated. Sunni extremists need a secure region that they can use for training and coordination. Afghanistan used to be that place before 9/11, but the Afghan war destroyed the Taliban/al-Qaeda infrastructure in Afghanistan.

It's taken several years, but al-Qaeda and the Taliban have been slowly but surely restoring their infrastructure. They began in the tribal regions on the border between Pakistan and Afghanistan, and are now expanding into northwest Pakistan.

Taking control of Swat gives them control of a larger region, and a launching pad for strikes designed to bring down the Pakistan government in Islamabad.

Pakistan's president, Asif Ali Zardari, is a Shia Muslim, and his assasinated wife, Benazir Bhutto, was from Pakistan's leading Shia family since independence in 1947. You don't have to be an Islamist terrorist in Pakistan to wish to be rid of Zardari. It would be natural for Sunni Punjabis to make political alliances with Sunni Pashtuns (Taliban) to oppose Zardari on a variety of fronts. And the situation is made worse by the fact that the country Pakistan is close to bankruptcy.

From the point of view of Generational Dynamics, a re-fighting of the massively genocidal war following the 1947 Partition that created India and Pakistan is coming with absolute certainty. Both India and Pakistan are becoming increasingly polarized between moderate and extremist groups, and this polarization extends to Afghanistan, where American forces are slowly but surely being drawn deeper into the conflict.

(Comments: For reader comments, questions and discussion,

as well as more frequent updates on this subject, see the Afghanistan, Pakistan and India thread of the Generational

Dynamics forum.)

(23-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The Dow Industrials are 47% below their peak, in a new six-year low.

According to an article scheduled for Friday's Wall Street Journal:

|

The Dow Jones Industrial Average broke to a new six-year low Thursday, dashing hopes of a quick market recovery and reawakening fears that the stock declines aren't over.

The Dow industrials now have lost nearly half their value, or 47%, since their record close 16 months ago. They fell 89.68 points to 7465.95 on Thursday, dropping past the Nov. 20 low of 7552.29.

With other indexes down similarly large amounts, investors are wondering how much longer the pain will continue.

If past experience is any indication, it can continue for a while. Money managers and analysts who have studied past bear markets are warning clients that they aren't yet seeing the signals they would expect to see at a true market bottom.

The Dow's 47% decline in the current 16-month bear market already is one of the biggest in the index's 113-year history. The only time it fell significantly harder was 1929-32, when it lost almost 90% of its value, and almost no one believes a similar calamity awaits this time.

The classic sign of a bottom that many analysts and money managers are looking for is a period of frantic selling, followed by a sudden onset of heavy buying. They have seen the selling, but so far, they haven't seen the buying. The fear is that this means more selling is ahead."

The "frantic selling" followed by "heavy buying" is what I described last year in "The origins of the hare-brained "capitulation" fallacy."

The latest fall comes amidst sharply increasing concern about the viability of east European banks, so much so that Moody's Investors Service warned of a "rapidly deteriorating global macroeconomic environment."

According to Moody's, "East European countries -- the region includes Central and Eastern Europe (CEE), South-Eastern Europe (SEE) and the Commonwealth of Independent States (CIS) -- have now entered a deep and long economic downturn." In worst shape are the Baltic countries, Hungary, Croatia, Romania and Bulgaria, because of their high fiscal deficits. However, Ukraine, Kazakhstan and Russia are all under pressure as well.

That's not all though. These East European countries are deeply in debt -- and they're in debt to West European countries, especially Austria, Italy, France, Belgium, Germany and Sweden. Thus, if one of the East European countries goes into default, it would begin a chain reaction that would cause major banking crises in one of those six West European countries.

The result is that the interest rate spreads on credit default swaps (CDSs) for several European countries have widened considerably, indicating that investors are "betting on" a default in one of those countries.

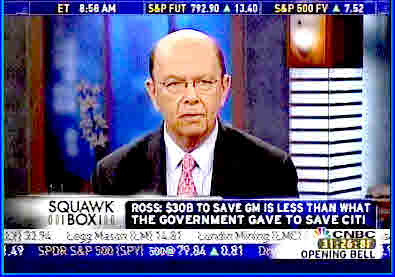

On Thursday morning on CNBC, billionaire investor Wilbur Ross made an interesting statement of a kind that I haven't heard before. The following is my transcript:

|

There's too much consumer debt out there, and you can argue that the anomaly was not so much the present recession. The anomaly may very well be the boom time that we had before.

One economist did a calculation - if you X'ed out the economy the home equity that was liberated through remortgaging, you know what you would have had in the six years from '00 to '06? Three down years, and three years of less than 1% growth. Total economy.

Basically, it all came from the consumer, and it wasn't the consumer income; it was consumer leveraging. Median income in this country actually went down in this country from 2000 to 2006, and so basically did net worth.

[CNBC anchor Joe Kernen: And you factor out the tech bubble, and it's positive effect in the late 90s, and you have that we haven't done anything for 15 years.]

That's right. We hid it pretty well, but in a sense that's a giant Ponzi scheme itself. It makes Madoff and everybody else look pretty small."

Regular readers of this web site will not be surprised at the characterization of the entire market the last few years as a "giant Ponzi scheme." I've been describing the global economy as a "pyramid scheme" and a "Ponzi scheme" since 2004.

What's remarkable is to hear such a remark on the normally Pollyannaish CNBC.

Even more remarkable is that CNBC anchor Joe Kernen, who has always been wildly optimistic, is actually making a connection between the 1990s dot-com bubble and the 2000s Ponzi scheme. Wow! Next thing you know, it'll occur to him that all this happened at exactly the time the Great Depression survivors all retired. Naaahhh. That's way too deep.

I'd like to warn web site readers that this may be a time of maximum danger, and that the current situation may indeed be a "crisis low," as the WSJ headline says. As you know, generational theory predicts that there MUST be a generational stock market panic and crash, the first since 1929. It's impossible to predict the exact date, but with the market now falling to a new six-year low, the mood may be right for a major panic.

If the market begins to recover again in a "bear market rally," then the immediate danger may be over. But if the market continues to fall, as the above Wall Street Journal article says that many analysts expect, a full-scale panic may occur right away, rather than later.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(20-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Thousands of left- and right-wing protestors clash in Dresden

As I explain frequently on this web site, Generational Dynamics doesn't use the strict legal definition of the word "genocide." In generational theory, "genocide" refers to any action that clearly gives little value to individual life. Generally this means that the society gives much higher political priority to scoring a victory in a battle than it gives to the goal of preserving individual lives, especially civilian lives.

For example, under the Generational Dynamics definition, the following would be considered genocidal actions by the United States in World War II:

Other examples of genocidal acts during World War II are the Holocaust (by the Germans) and the Bataan Death March (by the Japanese).

From the point of view of Generational Dynamics, these kinds of genocidal acts are what characterize a crisis war. Non-crisis wars do NOT have these genocidal acts, as can be seen, for example, of America's actions in the wars in Vietnam and Iraq, where internal political pressures force us to criminally prosecute soldiers who harm civilians.

I've said on occasions that no nation ever remembers the genocidal acts that they perpetrate against others, or ever forgets the genocidal acts that others perpetrate against them.

|

So it's not surprising that the Germans have not forgotten the firebombing of Dresden in February, 1945. In fact, this was the subject of one of the first articles that I posted on this web site, in February 2003.

The firebombing is one of the most controversial Allied military operations in World War II, with many historians criticizing it as unnecessarily brutal, when Germany was 12 weeks from capitulation. Some 1,300 British and U.S. bombers dropped more than 3,900 tons of high-explosive bombs and incendiary devices in four raids, from February 13-15, destroying 13 square miles of the city and igniting a horrific firestorm that wiped out mostly residential downtown Dresden.

The Germans have commemorated the anniversary of the Dresden bombing every year since then. In fact, this is the 50th anniversary of a special friendship agreement between Dresden in Germany and Coventry in England -- two cities that were destroyed by enemy bombing.

In recent years, the commemorations have been hijacked by neo-Nazis who claim that the firebombing of Dresden was a worse atrocity than the Holocaust.

Of course this claim is refuted by the numbers. Millions of Jews died in German concentration camps, with 1.3 million Jews were murdered at Auschwitz alone. A recent study commissioned by the city of Dresden concluded that some 25,000 civilians were killed in the firebombing.

On Saturday, some 6,000 neo-Nazis, mostly dressed in black, gathered in Dresden and staged a "mourning march" in commemoration of the 64th anniversary of the 1945 firebombing. This was the one of the largest far-right demonstrations in decades.

A counterdemonstration drew more than 10,000 participants, who marched against rising neo-Nazism in eastern Germany. Some 4,000 police had been dispatched to Dresden, to keep the peace. However, violence occurred on Saturday evening when a group of neo-Nazis attacked two buses full of left-wing activists.

From the point of view of Generational Dynamics, we're seeing the signs of the coming re-fighting of many of the battles of World War II.

Many people are surprised when I tell them to expect a new European war, but those people do not remember that such wars have been occurring regularly since the days of the Roman Empire. In recent centuries, the major west European crisis wars have included the Thirty Years War, the War of the Spanish Succession, the Napoleonic Wars, the Franco-Prussian wars and World War II. These wars have occurred almost as regularly as clockwork, and the time is fast approaching for the next one.

Was the firebombing of Dresden really genocidal?

In an article in Der Spiegel called "The Logic Behind the Destruction of Dresden," British historian Frederick Taylor explains the military rationale behind the attack:

The Dresden attack was directly linked to the conduct of the war elsewhere -- in this case on the Eastern Front. In Feb. 1945, Dresden was a major transport and communication hub less than 120 miles from the advancing Russians. The aim of the bombing was quite deliberately to destroy the center of the city, thereby making the movement of German soldiers and civilians impossible. ...

There were other targets too. Berlin was also seen as essential to continuing German resistance and was heavily bombed on Feb. 3. Raids on Dresden and Chemnitz were delayed by bad weather. And ultimately, only the Dresden raid was successful -- horribly so as the 25,000 or more casualties bear witness. This was, in fact, a clear-cut case where maximum destruction was the central aim of the attack. There can be no question that the presence of many refugees was factored into the Allies' calculations. A Feb. 1, 1945 memorandum specifically noted the huge tide of refugees passing through the eastern German cities as a "plus point," chillingly adding that attacking these cities would "result in establishing a state of chaos in some or all of these areas."

This is what happens to every country, and people of every nationality and ethnicity, in every crisis war.

At the beginning of the war, there's actually a feeling of celebration and euphoria, as the anxious population believes that now all their problems will be solved with a quick victory. When the first military disaster occurs, the public becomes anxious and panicky. As time goes on, and the population becomes increasingly desperate, they begin to panic and worry about the survival of their nation and their way of life. At that point, the value of any human life -- theirs or their enemy's -- becomes insignificant in comparison to the uncompromising need to win at any cost.

That's certainly what happened in the case of the firebombing of Dresden. By that time, the Allies were desperate. There's no doubt, as Frederick Taylor says, that the attack had clear and important military objectives that would shorten the war, but the shock and awe factor of attacking a city crowded with refugees was considered a "plus point." In a non-crisis war, it would be considered so much a "minus point," that it would be out of the question.

This is what's in store as we approach the Clash of Civilizations world war. It will probably start out small, as a regional war, but as populations become increasingly desperate, the value of human life will reduce to zero, and hundreds of millions, or even billions of people will be killed.

People who think that this could never happened should remember that in millennia of history it's never failed to happen. Genocidal war is as much a part of the human DNA as sex is. The human race would not have survived, if it weren't for both sex and genocidal war. And this is about to be proven again.

(Comments: For reader comments, questions and discussion,

see the Geopolitical topics thread of the Generational Dynamics

forum.)

(17-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Building a sand castle while the tide is coming in.

President Barack Obama claimed a major victory on Saturday, with the Congressional passage of the $787 fiscal stimulus package.

In Saturday's weekly address to the nation, he said:

Congress has passed my economic recovery plan – an ambitious plan at a time we badly need it. It will save or create more than 3.5 million jobs over the next two years, ignite spending by business and consumers alike, and lay a new foundation for our lasting economic growth and prosperity.

This is a major milestone on our road to recovery, and I want to thank the Members of Congress who came together in common purpose to make it happen. Because they did, I will sign this legislation into law shortly, and we’ll begin making the immediate investments necessary to put people back to work doing the work America needs done."

From the point of view of Generational Dynamics, Obama is quickly demonstrating that people in the "Nomad" generational archetype (like Generation-Xers) are pragmatic managers that lead the nation through the Crisis era.

(For information about generational eras and archetypes, see "Basics of Generational Dynamics.")

President Obama achieved this huge victory less than a month after taking office. Obama has translated his contempt for Boomer and Silent generation values and accomplishments into his own accomplishment, one of the most dramatic in American history -- a spending bill that dwarfs anything that could even be imagined a year ago.

The fiscal stimulus bill passage has given hope to many people that it will provide relief from the crashing economy, and the rapidly spreading unemployment that causing suffering among millions of people.

|

Unfortunately, those realities will be affected only marginally by the fiscal stimulus bill. Nothing has happened that will change anything that I described in "The outlook for 2009."

The euphoria over the passage of the fiscal stimulus bill contrasts sharply with the political disaster over the Troubled Asset Relief Program, or TARP. The TARP money is to be used to purchase "troubled assets" -- mortgage-backed securities (MBSs), collateralized debt obligations (CDOs), credit default swaps (CDSs) -- that have become near-worthless because of the collapse of the real estate and credit bubbles. Thus, it's the TARP that's most relevant to the realities of the economy for most people.

On Monday evening, President Obama gave a press conference to sell the fiscal stimulus package. He declined to discuss the TARP, saying that Treasury Secretary Timothy Geithner would provide all the details on Tuesday.

Well, Geithner gave a speech on Tuesday that provided almost no details at all. And there's a good reason why: Because there's no solution to the problem that the TARP is supposed to solve.

When the the Emergency Economic Stabilization Act became law in October of last year, I called it the "Bailout of the World" (BOTW), because it was huge -- a $700 billion bailout of the banks and other financial institutions. That $700 bailout was going to solve the economy's problems.

Then-Treasury Secretary Hank Paulsen spent half of that amount -- $350 billion -- on "saving the banks," and now the economy is worse than ever. People are wondering where the money went, and why bankers were continuing to give themselves fat bonuses.

This has made the political climate for the TARP much more toxic than it was in October.

The purpose of Geithner's speech, and subsequent testimony before Congress, was to justify spending the remaining $350 billion to "save the banks." He was supposed to explain in detail how he planned to spend that $350 billion, but instead he simply provided an outline that was no different than Secretary Paulsen might have provided.

There are good reasons why he couldn't have provided details: Because it's increasingly clear that the "troubled assets" have notional values in the trillions or even tens of trillions of dollars, far in excess of the $350 billion being discussed. And so, rather than provide details, he decided to bluff.

As I wrote last year in "One, Two, Three ... Infinity,") the amounts being demanded for bailouts keeps growing exponentially. A lot of people think that the $757 fiscal stimulus money is the same money as in the $700 BOTW, but it's not. These are two separate amounts, and there are demands for even more money.

A clear political statement criticizing the both the stimulus package and the TARP package for being too timid is given by Paul Krugman, last year's Nobel Prize winner in economics. This is my transacript of his interview on Wednesday, February 11, on BBC. The comments in brackets are from the interviewer, Matt Frei. The phrase "financial plan" refers to the TARP.

In the process of first a low initial bid by the White House and then it's been scaled down and somewhat degraded, it's not enough. It's enough to mitigate, but not enough to produce a full recovery. So it's disappointing. They'll have to come back for a second round.

As for the financial plan - if anyone can tell me what the financial plan is that would be a helpful sign. Everyone who sat down to look at it said, I don't get this - it's more of an outline, a plan for a plan, not a real plan.

It's not terrible, not a crazy outline, but it's not a real plan.

[They've had weeks to sort this out.]

It's very puzzling. We all have fears about what happened. But what's clear is that they have not actually bitten the bullet. They've not actually said, OK, here's what we really need to do.

For all of the talk, -- If you read the first few minutes of Secretary Geithner's speech, he was saying we need a dramatic plan, we need to act, we need to resolve this. And then he produced something that was more like a sketch of how we might possibly go about thinking about the thing.

[What is the bullet?]

The bullet is -- you need to go in to major financial institutions, take a serious look, and if they're not viable, you need to put them into government receivership. We've got to clean out those bad assets and the only way to do that is to take them under the government's wing, essentially, temporary nationalization is going to be. I predict that's what will happen in the end, but it depends on how long it takes.

[Why is it taking so long? Is it a philosophical question - this government just doesn't do nationalization? Is it the fact that in a broader spectrum we're stuck in an era where we think that tax cuts are the things that are finally going to get this economy going?]

Well, there's two things. First, on the stimulus -- these two things are really very different. One of the problems that Obama's having is that the public mushes these two things together. The stimulus by itself is probably very popular, but the bailout is deeply unpopular. But they get smushed together and you get something that isn't getting enough public support.

But there's a Republican party which is 87% committed to voodoo economics. That's the 36 out of 41 Republicans that voted for another round of Bush-style tax cuts. A large part of that party is just not ready to compromise, so Obama has to work on the narrow margin of basically three Republican senators you can talk to. That's a big problem.

Then, I think on the bank stuff, it's a failure of nerve. I have reason to believe that economists in the Obama administration actually have a model of what the problem is that's not very different from mine, but the political willingness to step out there and say that we hve to do something really, really radical is not yet there.

[What would you like to see in the stmulus package?]

First of all, it should be 50% bigger. It should be a $1.2 trillion, not an $800 billion package. And it should be more focused on spending. There should be more aid to states, not less, which was just negotiated. There should be more aid to education. There should be more health care - things that are both going to mitigate the pain of this recession and are also more bang for buck. Just, more stuff.

Right. You give somebody, particularly an affluent person a tax cut, then he or she may or may not spend it.

You repair leaks in the school roof, then you put somebody to work directly. That's more effective - you're just going to get more out of those things.

Now I understand there may be limits to that, but they clearly have not reached those limits."

The strong partisanship of this statement of both Krugman and the BBC interviewer (Matt Frei), calling the Republicans "committed to voodoo economics," destroys the credibility of the statement. (Krugman is still doing the job that the Nobel Prize committee appointed him last year to do: continue to bash George Bush and the Republicans.)

There's absolutely no reason why a tax cut to businesses, allowing them to avoid laying off workers, is "voodoo economics," while giving money to near-bankrupt state governments, allowing them to avoid laying off workers, is a brilliant plan.

The confusion becomes even greater when you look at another big bailout favored by Krugman and the Democrats -- the bailout of the big three Detroit auto makers. What is the brilliant economic reasoning that makes that bailout good, but a tax cut to other businesses bad?

The biggest problem that President Obama will have going forward is dealing with this kind of poisonous ideology. It's because of this kind of ideological attitude among Krugman and Democrats that the fiscal stimulus plan did not receive a single Republican vote in the House, and only three Republican votes in the Senate.

Even if the fiscal stimulus and TARP programs had a chance of succeeding, they're only US programs. However, as I've discussed frequently, countries around the world have collapsing economies as well, and many are much worse off than the US. However, none of these countries (with the possible exception of China) has any kind of fiscal stimulus program comparable to the US. In particular, the European Union is completely bound up in multi-country politicans, and is effectively paralyzed, even in an emergency.

In the past, I've criticized John Mauldin for doing some excellent analysis, but failing to draw the correct conclusions. Like Nouriel Roubini, Mauldin describes a rapidly deteriorating global financial system, but then misleads readers into believing that everything will be ok anyway. If Mauldin told the complete truth about what was coming, he'd lose much income from many of his wealthy clients.

(For earlier discussions of Mauldin's newsletters, see "There's never before been a day like this on Wall Street," and "Blogger watch: Mish Shedlock goes gloomy, while John Mauldin gets muddled.")

However, I wish to call your attention to Mauldin's latest newsletter, in which he appears to be realizing that the world financial system is collapsing. The newsletter is a quick "survey of the rest of the world."

He has charts and tables discussing the following:

His newsletter is well worth reading, but keep in mind that when he reaches his final conclusions -- that he has "exciting news" about some "cool opportunities with world-changing technologies" -- it's to keep his own investors interested, and protect his own income.

Ambrose Evans-Pritchard of the Telegraph is the only mainstream media reporter that I'm aware of who regularly reports what's going on in the global financial crisis. I've quoted him a number of times in the past, especially for his grasp of what's going on in Europe and Asia.

His latest column discusses the European banking situation:

The unfolding debt drama in Russia, Ukraine, and the EU states of Eastern Europe has reached acute danger point. If mishandled by the world policy establishment, this debacle is big enough to shatter the fragile banking systems of Western Europe and set off round two of our financial Götterdämmerung.

Austria's finance minister Josef Pröll made frantic efforts last week to put together a €150bn rescue for the ex-Soviet bloc. Well he might. His banks have lent €230bn to the region, equal to 70pc of Austria's GDP.

"A failure rate of 10pc would lead to the collapse of the Austrian financial sector," reported Der Standard in Vienna. Unfortunately, that is about to happen.

The European Bank for Reconstruction and Development (EBRD) says bad debts will top 10pc and may reach 20pc. The Vienna press said Bank Austria and its Italian owner Unicredit face a "monetary Stalingrad" in the East. ...

Not even Russia can easily cover the $500bn dollar debts of its oligarchs while oil remains near $33 a barrel. The budget is based on Urals crude at $95. Russia has bled 36pc of its foreign reserves since August defending the rouble. ...

Almost all East bloc debts are owed to West Europe, especially Austrian, Swedish, Greek, Italian, and Belgian banks. En plus, Europeans account for an astonishing 74pc of the entire $4.9 trillion portfolio of loans to emerging markets.

They are five times more exposed to this latest bust than American or Japanese banks, and they are 50pc more leveraged (IMF data). ...

Europe's governments are making matters worse. Some are pressuring their banks to pull back, undercutting subsidiaries in East Europe. Athens has ordered Greek banks to pull out of the Balkans. ...

The implications are obvious. Berlin is not going to rescue Ireland, Spain, Greece and Portugal as the collapse of their credit bubbles leads to rising defaults, or rescue Italy by accepting plans for EU "union bonds" should the debt markets take fright at the rocketing trajectory of Italy's public debt (hitting 112pc of GDP next year, just revised up from 101pc – big change), or rescue Austria from its Habsburg adventurism.

So we watch and wait as the lethal brush fires move closer.

If one spark jumps across the eurozone line, we will have global systemic crisis within days. Are the firemen ready?"

The crisis brewing in Europe is actually quite similar in nature to the one that's occupied the US for the last 18 months, but it's now reaching a crisis point, and Europe doesn't have anywhere near the infrastructure that the US has to handle this emergency.

In other words, Europe and Asia are having the same TARP disaster that we're having, with fewer tools available to handle it.

For those who wish to read more, a web site reader sent me a PDF file of a report written by Merrill Lynch analyst David A. Rosenberg, called "Some inconvenient truths." He says that we're in a new depression, and it's going to last 3 to 7 years.

What's new about this is that it's the first time that a major investment bank analyst is making such a prediction.

I put the PDF file on my web site for access to those who wish to read it.

While I'm mentioning other sources, you can check Nouriel Roubini's blog, Michael ("Mish") Shedlock's blog, the Calculated Risk blog (with Tanta), the Sudden Debt blog, the MinyanVille blog, Yves Smith's Naked Capitalism blog, and the Financial Times alphaville blog.

These bloggers are very useful at pulling facts together but, like Mauldin's newsletters, they fail to draw the right conclusions, for fear of getting people mad at them.

It depends on what you mean by "work."

As I've been saying on this web site for six years, we're headed for a new Great Depression, as can be seen simply by applying to the Law of Mean Reversion to the 'real value' of the stock market. This is not rocket science, and every prediction I've made based on this observation has turned out to be true, or is trending true. There is no web site in the world with anything approaching the predictive success of this web site.

Neither Congress nor President Obama have repealed the Law of Mean Reversion, so the stock market will still fall much farther, many more businesses will go bankrupt, and millions more people will be laid off, irrespective of the fiscal stimulus bill.

This is just as true today as it was when the credit crisis began in August, 2007. Each intervention, whether by the Fed, or by the Treasury Dept., or by Congress, was greeted with euphoria and relief, along with the belief that the the crisis was over. Each time, I explained that the credit crisis and real estate bubbles were so huge that no amount of money was available to blow them up again once they started leaking. There were hundreds of trillions of dollars in structured finance securities created, and many of those securities are now disappearing or becoming worthless. A couple of trillion dollars in a fiscal stimulus or TARP plan will not even make a dent.

This brings us back to the contrast between the fiscal stimulus victory and the TARP disaster that I referred to in the title of this article.

What the current Adminstration is doing is building a sand castle. The debate over the stimulus package is about how many rooms in the castle, and how many elegant turrets to add on. The failure of the TARP program is about the tide coming in to wash away the foundations of the castle, leading to its total collapse.

And this doesn't even take into account that countries around the world are going to collapse, some much faster and deeper than the US, and they're going to blame the US, because of the subprime mortgage debacle.

However, it's pretty clear that the fiscal stimulus package will "work" in the sense of helping some people, at least for a while.

What's going on today is a fiscal experiment with no parallel in history. It will definitely not save us from financial devastation or world war. And it's no help at all when Krugman and other Democrats call other people's ideas "voodoo economics," when they themselves have no idea what they're doing.

The question is whether it will make things better or worse, and I have no answer to that question. In that sense, it will "work," one way or another.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(16-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

It's obvious that Geithner has no idea what he's doing.

Tuesday was the day of the long-awaited details of the $800 billion spending plan that's supposed to save the world.

Treasury Secretary Timothy Geithner speech was slightly different in tone from Obama's press conference on Monday evening. Both of them started from the assumption that everything that the Bush administration did was wrong. Obama used his press conference to warn of worldwide disaster if Republicans didn't get on board with Geithner's coming proposal.

Geithner's speech on Tuesday was used to say what we'll do to avoid disaster. In commanding tones, he rattled off a list of things that his spending programs will accomplish.

He said that everything that the Bush administration had done was completely wrong and had failed, and that Obama wouldn't make the same mistakes. He said that President Roosevelt in the 1930s, and Japan in the 1990s, had done the right thing -- a big spending program -- but the reason that both of those spending programs failed is because they were launched too late, and they weren't big enough.

The question that was left unanswered by both Obama's and Geithner's speeches was this: If everything that the Bush administration failed, how can you possibly be certain that what you're doing won't fail?

In other words, if you're saying that Bush was full of crap, then how do we know that you aren't full of crap?

They only gave reasons why past attempts failed. Hoover didn't act in time. The Japanese in the 1990s didn't act in time. We're going to act in time, so this time it will work.

Well, why? You're doing fundamentally the same things they did. What makes you think that doing the same things they did, only faster, is really going to work?

That question was not answered.

The markets were flat before Geithner's speech, and immediately went down afterwards, ending the day down 4.5-5%.

According to Michael Feroli of J.P. Morgan Chase, the proposal was "A major disappointment. The new plan discussed some of the ideas that have been floated in the media over recent days, and delivered some cosmetic re-labelling of existing programs, but many of the fundamental questions that former Secretary Paulson encountered last Fall remain unanswered."

Goldman Sachs said, "The speech and accompanying fact sheet leave open many questions about the timing of these interventions and the terms of asset purchases and recapitalization. Much of the program clearly remains to be worked out over the coming weeks and months."

Analysts that I heard all said the same thing: Geithner didn't really say anything, didn't provide any details.

Geithner's speech confirmed what I said about Obama's speech on Monday: These two guys are just babbling. They have no idea what they're doing. They have no idea what they're saying. They just read from a script, and pray that something will work.

From the point of view of Generational Dynamics, nothing will work, as I've described many times, most recently in my "The outlook for 2009."

A web site reader has called my attention to some research by Ulrike M. Malmendier, Associate Professor of Economics at University of California.

In her August, 2007, paper, "Depression Babies: Do Macroeconomic Experiences Affect Risk-Taking?" (PDF) (with Stefan Nagel), she analyzes existing data about the investing habits of people born before, during and after the Great Depression of the 1930s.

Her conclusion? People who lived through the Great Depression are more risk-averse than people born afterwards.

Now, this is a perfectly obvious conclusion, and one that I've stated hundreds of time on this web site. But it's a conclusion that's completely foreign to mainstream economists.

Malmendier herself says the following:

Our paper connects to several strands of literature. While there is NO PRIOR LITERATURE, to the best of our knowledge, documenting empirically the effect of experienced macro-economic shocks such as the Great Depression, several papers in macroeconomics and public finance analyze the impact of age and demographic composition." (My emphasis)

Can you believe this? There hasn't been a single study on the risk-aversion of Great Depression survivors. The only thing that economists look at is the differences by age or race or income level.

Mainstream economists assume that a 50-year-old white male in the 1970s is the same as a 50-year-old white male in the 1990s, and they don't even consider the possibility that the fact that only one of them survived the Great Depression is an important factor.

That's why mainstream economics has been a total failure for the last ten years, and why mainstream economics did not see, and can't explain the current mess we're in. (See "System Dynamics and the Failure of Macroeconomics Theory," and "Brilliant Nobel Prize winners in Economics blame credit bubble on 'the news'."

A contribution to the Generational Dynamics forum called my attention to a CNBC video called "Predicting Crisis: Dr. Doom & the Black Swan, How to predict a financial crisis and the five signs of a bear, with Nouriel Roubini, RGE Monitor and Nassim Taleb, The Black Swan author."

I strongly urge all web site readers to take the time to watch that video, and see what horse's asses the CNBC anchors turn into when Roubini and Taleb try to tell them what's really going on. Just watch those bleating CNBC clowns for a few minutes, and you'll see for yourself what pathetic hands our country is in.

(Comments: For reader comments, questions and discussion,

see the President Barack's news conference 2/9/2009 thread of the

Generational Dynamics forum.)

(11-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

To me, he seemed anxious and desperate. We'll see what the polls say.

It was about ten minutes into the Monday evening press conference, as he was answering the first question, that I realized that President Obama was babbling, and really had no idea what to say. Here's the transcript:

THE PRESIDENT: No, no, no, no -- I think that what I've said is what other economists have said across the political spectrum, which is that if you delay acting on an economy of this severity, then you potentially create a negative spiral that becomes much more difficult for us to get out of. We saw this happen in Japan in the 1990s, where they did not act boldly and swiftly enough, and as a consequence they suffered what was called the "lost decade" where essentially for the entire '90s they did not see any significant economic growth.

So what I'm trying to underscore is what the people in Elkhart already understand: that this is not your ordinary run-of-the-mill recession. We are going through the worst economic crisis since the Great Depression. We've lost now 3.6 million jobs, but what's perhaps even more disturbing is that almost half of that job loss has taken place over the last three months, which means that the problems are accelerating instead of getting better.

Now, what I said in Elkhart today is what I repeat this evening, which is, I'm absolutely confident that we can solve this problem, but it's going to require us to take some significant, important steps.

Step number one: We have to pass an economic recovery and reinvestment plan. And we've made progress. There was a vote this evening that moved the process forward in the Senate. We already have a House bill that's passed. I'm hoping over the next several days that the House and the Senate can reconcile their differences and get that bill on my desk.

There have been criticisms from a bunch of different directions about this bill, so let me just address a few of them. Some of the criticisms really are with the basic idea that government should intervene at all in this moment of crisis. Now, you have some people, very sincere, who philosophically just think the government has no business interfering in the marketplace. And in fact there are several who've suggested that FDR was wrong to intervene back in the New Deal. They're fighting battles that I thought were resolved a pretty long time ago.

Most economists, almost unanimously, recognize that even if philosophically you're wary of government intervening in the economy, when you have the kind of problem we have right now -- what started on Wall Street goes to Main Street, suddenly businesses can't get credit, they start carrying back their investment, they start laying off workers, workers start pulling back in terms of spending -- when you have that situation, that government is an important element of introducing some additional demand into the economy. We stand to lose about $1 trillion worth of demand this year and another trillion next year. And what that means is you've got this gaping hole in the economy.

That's why the figure that we initially came up with of approximately $800 billion was put forward. That wasn't just some random number that I plucked out of a hat. That was Republican and Democratic, conservative and liberal economists that I spoke to who indicated that given the magnitude of the crisis and the fact that it's happening worldwide, it's important for us to have a bill of sufficient size and scope that we can save or create 4 million jobs. That still means that you're going to have some net job loss, but at least we can start slowing the trend and moving it in the right direction.

Now, the recovery and reinvestment package is not the only thing we have to do -- it's one leg of the stool. We are still going to have to make sure that we are attracting private capital, get the credit markets flowing again, because that's the lifeblood of the economy.

And so tomorrow my Treasury Secretary, Tim Geithner, will be announcing some very clear and specific plans for how we are going to start loosening up credit once again. And that means having some transparency and oversight in the system. It means that we correct some of the mistakes with TARP that were made earlier, the lack of consistency, the lack of clarity in terms of how the program was going to move forward. It means that we condition taxpayer dollars that are being provided to banks on them showing some restraint when it comes to executive compensation, not using the money to charter corporate jets when they're not necessary. It means that we focus on housing and how are we going to help homeowners that are suffering foreclosure or homeowners who are still making their mortgage payments, but are seeing their property values decline.

So there are going to be a whole range of approaches that we have to take for dealing with the economy. My bottom line is to make sure that we are saving or creating 4 million jobs, we are making sure that the financial system is working again, that homeowners are getting some relief. And I'm happy to get good ideas from across the political spectrum, from Democrats and Republicans. What I won't do is return to the failed theories of the last eight years that got us into this fix in the first place, because those theories have been tested and they have failed. And that's part of what the election in November was all about."

This is close to gibberish. It's a laundry list of problems and what he'd like to do, but nothing that explains how he'd like to do it. His tone of voice sounded desperate. I actually felt bad for him.

One thing that made me chuckle was, "That's why the figure that we initially came up with of approximately $800 billion was put forward. That wasn't just some random number that I plucked out of a hat."

Actually, he's right. It isn't a "random number." It was chosen because they want to spend as much money as they can get away with, but they don't want to go over $1 trillion, because too many people would object.

I watched the local news after the press conference. They interviewed a 41 year old man with two degrees from MIT, a wife who's a stay-at-home mom, and two children. He was shocked to lose his job at the end of December, and doesn't know where he'll find another job.

The wife commented on Obama's performance. She looked very worried, and said, "When he said that he has full confidence that he can turn things around, that he has a solution to the problem, then I believe that he has a solution to the problem."

Ah yes, it's nice to be young and full of faith.

The "common wisdom" today is that the financial crisis is caused by a "lack of confidence," a diagnosis completely without meaning. Thus, the wisdom goes, all Obama has to do is give a stirring speech that restores confidence, and the crisis will end. In his heart, even Obama knows that's bullshit, but he's gotta do what he's gotta do.

According to Matt1989, writing in the Generational Dynamics forum, said that "As for Millies [i.e., in the young Millennial generation], there's very little chance that this will have much of an effect. Obama's got at least 8-9 months (though I'd double it) worth of cushioning where he can do very little wrong in my generation's eyes. We'll see what direction the financial crisis takes us."

President Obama is still having a honeymoon. Politics continues to be kind to him, as do events. In my opinion, Obama did poorly on Monday evening. Let's see how he does when a full-scale crisis occurs.

(Comments: For reader comments, questions and discussion,

see the President Barack's news conference 2/9/2009 thread of the

Generational Dynamics forum.)

(10-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Israel's historic connection to Russia plays an increasing role in Tuesday's election.

|

It was over three years ago, in January, 2006, that Israeli Prime Minister Ariel Sharon suffered a massive stroke. He lies in a coma to this day, while his major and most controversial accomplishments -- the construction of the security wall surrounding Israel and the Israeli evacuation of Gaza in 2005, continue to loom as major issues, as Tuesday's election approaches.

The security wall keeps suicide bombers from entering Israel, but it doesn't prevent Hamas militants from shooting rockets over the wall into Israel.

And much of the world was shocked by the ferocity of Israel's attack on Gaza in December and January, with hundreds or perhaps thousands of bombs targeting Hamas leaders, suspected weapons depots, and underground tunnels, from one end of Gaza to the other. Much of the world has condemned Israel for this "overreaction" to the Hamas rockets.

This has caused Israelis themselves to become more convinced that a negotiated solution is impossible. They're not sure what the solution is, but few people believe that there are ever going to be "two states side-by-side" as proposed by President Bush in the Road Map to Peace in 2003.

They believe that a much tougher approach is required, but they're not sure what. They're grasping at solutions. The current Prime Minister, Ehud Olmert, is head of the centrist Kadima party, the party that Ariel Sharon formed several months before his stroke. But Olmert is thought to have bungled the 2006 war against Hizbollah in Lebanon, and his ratings have never recovered. The major left-wing party, Labor, is also suffering in the polls, as liberal policies toward the Palestinians fall into disfavor.

So the expected winner on Tuesday is Benjamin Netanyahu and his right-wing Likud party. Netanyahu has promised not to give in to the Palestinians -- by giving up land on the West Bank -- or the Syrians -- by giving up the Golan Heights.

But the real change in Israeli attitudes is shown by the increasing popularity of another candidate, Avigdor Lieberman, and his Yisrael Beiteinu ("Israel is our home") political party. Lieberman is called a "far-right racist" by those who don't like him, because of his anti-Arab rhetoric.

Lieberman questions the loyalty of Arab citizens of Israel, and has proposed deporting Arabs who cannot pass a loyalty test.

Lieberman has expressed the view that a much larger imposition of force must be used against the people of Gaza. "A real victory, can be achieved only by breaking the will and motivation of Hamas to fight us, as was done to the Japanese in the last days of world war two."

I assume that the last statement refers to the use of nuclear weapons against Hamas. From the point of view of Generational Dynamics, that kind of approach could only achieve the desired result when everyone is exhausted, at the climax of a genocidal crisis war that had already been going on for several years. In the present context, such an action would immediately trigger worldwide condemnation and major retaliation by most of the nations in the Mideast.

Perhaps his followers don't believe Lieberman really means it. Maybe they just like hearing him say it, and they believe that just by saying it, Lieberman can convince Hamas to stop sending rockets into Israel.

Lieberman was born in the Soviet Union in 1958, and emigrated to Israel in 1978. Overwhelmingly, his supporters have been among the large community of Russian-speaking voters, mostly Russian emigrés and their children.

When Lieberman makes statements related to things like nuking Hamas, it's thought that he's actually emulating Russian Prime Minister Vladimir Putin, who is very popular in Russia because of his own extremely confrontational statements.

It seems to be working for Lieberman, because not only has it made him popular with Russian-speaking Israelis, but his popularity is spreading to a wider audience of Israelis who are concerned about security.

Lieberman's success is causing other candidates' campaign to target the Russian-speaking voters as well.

Israeli Army Minister Ehud Barak, who is also running for Prime Minister, promised to try to "Putinize his image." It's thought that the entire election is undergoing a "Russification."

It's not surprising that Russia and Israel have a love-hate relationship (PDF).

On the one hand, Jews have often suffered enormous discrimination in Russia. As depicted in the Broadway play, "Fiddler on the Roof," many Russians emigrated to the Palestine area in the late 1800s, giving the initial impetus to a Jewish state.

On the other hand, Russians have a deep spiritual connection to Jerusalem.

When the Roman Empire fell 406, the Eastern Roman Empire, centered in Byzantium (Constantinople later, and Istanbul today), became the second Roman Empire. When Constantinople fell in 1453, Moscow assumed the mantle of the Third Roman Empire. In 1472, Ivan the Great married a Byzantine princess and assumed the title of Tsar, and thus became the first Tsar of the new Tsarist Russia. ("Tsar," or "Czar," was derived from the name of the Roman Emperor Caesar, as is the German word "Kaiser.") Thus, Ivan would be not only the head of Russia, he would also be head of the Orthodox Christian Church -- and never part of the Roman Catholic Church.

As guardians of the true, original, and "orthodox" Christian faith, the Russians considered themselves protectors of Jerusalem, the source of the Orthodox Christian faith.

Russia became an atheist state with the Bolshevik Revolution in 1917, and rejected all connections with the Russian Orthodox Church, including its protection of Jerusalem.

But by 1948, when Russia's Awakening era was in full swing, Russia became the first country to recognize the new state of Israel.

With the current revival of the Russian Orthodox Church in Russia, the spiritual connection to Jerusalem is returning as well.

At the same time, both Russia and Israel face the common enemy of Islamist terrorists -- from Chechnya for Russia, and from Gaza for Israel. The connection between Russia and Israel is expected to strengthen as the Clash of Civilizations world war approaches.

For those who, like me, need a scorecard to follow Tuesday's election in Israel, here's one from Haaretz:

Blocs based on latest Haaretz-Dialog poll:The right-wing bloc: - Likud (headed by Benjamin Netanyahu): 27 seats - Yisrael Beiteinu ("Israel is our home" - a far-right pro-transfer party headed by Avigdor Lieberman): 18 seats - Shas (Sephardi ultra-Orthodox party headed by Eli Yishai): 9 seats - National Union-Habayit Hayehudi (coalition between two right-wing parties, the long-standing National Union and fledgling Habayit Hayehudi [the Jewish home]): 6 seats

The left-wing bloc: - Kadima (centrist party established by Ariel Sharon and now headed by Tzipi Livni): 25 seats - Labor (headed by Ehud Barak and formerly Israel's dominant party): 14 seats - New Movement-Meretz (latest incarnation of the left-wing Meretz): 7 seats - Hadash (Jewish-Arab party formerly known as a communist party): 3 seats - United Arab List-Ta'al (a union of two predominantly Arab parties, the United Arab list and Ahmed Tibi's Ta'al): 3 seats - Balad (predominantly Arab party whose name is a Hebrew acronym for National Democratic Assembly): 2 seats

(Comments: For reader comments, questions and discussion,

see the Israeli Elections thread of the Generational Dynamics forum.)

(9-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Investors were cheering the state of confusion and panic in Washington, because the news was so bad that it meant that a fiscal stimulus package will pass and will save the world.

Friday morning's jobs report was an enormous shock to everyone - almost 600,000 jobs lost in January - the worst since 1974 and an increase in the unemployment rate to 7.6%.

In commenting on the jobs report, one young female economics expert exclaimed, "When you start to see numbers that take you way back to 1974 - that's the largest payroll drop that we've endured since then - we saw a loss of about 598,000, you get nervous -- cause that takes you back to when The Sting was the best picture for the Oscars, Roberta Flack's "Killing me softly" was the number one song -- we're going waaaaaaaaay far back."

Mohamed El-Erian of Pimco Inc. was a little more sober on CNBC:

So it's telling you in a very clear and loud manner that we are in the midst of something very different. It's more than just a severe and synchronized global recession.

It's more than just a banking system that's not functioning.

People are going into preservation mode, into precautionary mode. Even those who can spend are not spending, and that is a major concern as you look forward."

El-Erian said that there are four "balance sheets" that are contracting: the banking and finance balance sheet, the consumer balance sheet, the mortgage market, and the global balance sheet. He said that the rest of the world is looking to President Obama for leadership to solve this problem.

El-Erian's solution? The Obama fiscal stimulus plan has to exhibit "shock and awe," to restore confidence.

President Obama made a televised statement:

These Americans are counting on us, all of us in Washington. We have to remember that we're here to work for them. And if we drag our feet and fail to act, this crisis could turn into a catastrophe.

We'll continue to get devastating job reports like today's -- month after month, year after year. It's very important to understand that, although we had a terrible year with respect to jobs last year, the problem is accelerating, not decelerating. It's getting worse, not getting better. Almost half of the jobs that were lost have been lost just in the last couple of months."

(Incidentally, if you want to find the above transcript, you can't go to the White House web site and search for press releases. Apparently, press releases are Boomer crap. Instead, if you're lucky, you can find it on the White House Blog, subtitled "beyond the echo chamber." Also, you can no longer find President Bush's old speeches on the White House web site; apparently President Bush has become an unperson.)

Washington is still heavily bogged down in a state of near paralysis, as it has been for years. However, the jobs report was so disastrous, that it actually motivated the Congress to move ahead on the fiscal stimulus bill, which otherwise might have died.

And that's why investors are celebrating. The disastrous jobs report was GOOD NEWS. It means that the fiscal stimulus package will pass, and that's why the stock market surged 3%.

You know, Dear Reader, there was a time when I used to mock investors for their "bad news is good news" attitude, but now it just makes me numb, and makes me want to throw up. So, you'll have to provide your own mocking.

It was just a month ago that the world was expecting everything to get all better on January 21, the day after President Obama's inauguration. Obama himself had expected the fiscal stimulus package to pass in Congress on that day, so that he could sign it immediately. He expected to get 80 votes in the Senate, including all Democrats and many Republicans. He expected it to restore confidence immediately, as he believed President Roosevelt had done when he took office in 1933.

What is absolutely clear is that no one in Washington has any idea what's going to happen. The development of this fiscal stimulus bill is a circus, with little kids competing with one another for goodies. It's an embarassment to the nation.

At the beginning of 2009, I wrote "The outlook for 2009," telling what was REALLY going to happen, and none of that has changed.

First, it's way too early in the deflationary spiral for anything to work. There is not enough money in the world to stop it. To the contrary, we're seeing one economic indicator after another that's turning negative and accelerating in the negative direction. The world is falling faster and faster into a black hole, and nothing can stop it.

Long-time readers of this web site know that the last paragraph is not some fanciful whimsy, and that it's based on hard analysis that I've been posting for years. (See "How to compute the 'real value' of the stock market.")

Second, we're still headed for a generational panic and crash, and I've described it this way several times in the past:

You'll have millions or even tens of millions of Boomers and Generation-Xers in countries around the world, never having seen anything like this before, not even believing it was possible, and in a state of total mass panic, trying to sell all at once. Computer systems will crash or will be clogged for hours, or perhaps even for a day or two. People who had hoped to get out just as the collapse is occurring will be totally screwed, and will lose everything. Brokers and other institutions will go bankrupt."

This might happen tomorrow, next week, next month or thereafter. We can't predict when it will happen, but it's coming soon with absolute certainty.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(7-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

A new study shows 8% unemployment, with 20 million migrants unemployed. This news is much worse than expected, and represents a threat to social stability, according to Chinese officials.

|

This comes at the same time that other economic statistics continue to indicate a huge shakeout in China's economy is occurring.

In particular, corporate profit in China appears to be rapidly crashing. Profits of industrial companies plunged 27% in the three months to November, according to official figures. Industries related to exports are particularly hard hit.

In another dramatic development, Chinese citizens seem increasingly turning away from investment in China, and using what money they have to invest in (of all places) America - American products and securities. Total outflows in the fourth quarter were as much as $240 billion.

The sharp increase in unemployment estimates for migrant workers was revealed at a press conference held by Chen Xiwen of China's Central Finance and Economic Leading Group. Here's a translation of what he said, from Victor Shih of RGE Monitor:

Shih analyzes this further by adding 15 million or so in the registered urban unemployed (not migrant workers, but residents in major cities), and reaches a total of 37 million unemployed, or over 8% of the total work force of 430 million.

This is extremely high for China, higher than at any time since the end of China's crisis civil war, the Communist Revolution that climaxed in 1949. China depends on low unemployment to maintain social stability.

As I wrote in 2005, from the point of view of Generational Dynamics, China is approaching a major civil war. This conclusion was based on a variety of factors, including the increasing number of mass riots, a huge migrant worker population, big income disparities, and an unraveling of the social structure.

The Chinese authorities themselves are well aware of this. As I've said many times, the Beijing government is among the most paranoid in the world, afraid of their own population.

China has tens of thousands of "mass incidents" each year. In a typical incident, someone accidentally bumps into somebody on the street in a shopping area. Or, even worse, somebody bumps into somebody's wife. An argument ensues, and other people join the fray and take sides, especially if the one of the people is a peasant and the other is a member of China's élite, a member of the Chinese Communist Party (CCP). Soon, people start using their cell phones to call other people, and the altercation may grow into a riot with thousands of people, or more.

If even one incident like this happened in the US, it would be worldwide news. But in China, there are hundreds of "mass incidents" in the country EVERY DAY. Some are small, involving only a few people, while others are major riots.

The growing global financial crisis is causing the worst possible scenario for the Beijing government. China's crisis wars have always been major rebellions -- the White Lotus rebellion (1795-1805), the Taiping Rebellion (1852-1871), and Mao Zedong's Communist Revolution (1934-1949). Chinese authorities are well aware that a similar rebellion could flare up at any time.

"Without doubt, we are entering a peak period for mass incidents. In 2009, Chinese society may face even more conflicts and clashes that will test even more the governing abilities of all levels of the party and government," Huang Huo, a reporter for the state-run New China News Agency, warned this month. The Chinese have special security forces trained to handle these "mass incidents," as long as they're relatively small. But the greatest concern, in the current financial climate, is that the small incidents could coalesce into a "national-level event" that would bring about civil war.

I've written about this many, many times, and as far as I know, this web site is the only one that's predicting a China civil war with absolute certainty. Indeed, the only way to make such a prediction is by means of generational analysis.

So I was really startled to read Yves Smith's blog Naked Capitalism and see the following indignant statement:

It is a demonstration of a tendency I find troubling: engaging in black and white thinking. This is not an either/or."

As I said, I've never seen any blog or web site, other than this one, making such a prediction. This web site is so different from the Naked Capitalism blog that it's hard to believe that anyone could confuse them, but it appears that's what happened.

It's worth quoting some more of Smith's indignant statement, because it provides insight into how people think about this issue:

Anyone familiar with generational theory would know that this comparison makes absolutely no sense whatsoever. During the 1960s, America was in a generational Awakening era, a time when massive protests and demonstrations are common, but a crisis civil war is impossible. This is how I knew, for example, that the Iraq "civil war" that everyone was talking about would have to fizzle out, and it did, because Iraq is today in a generational Awakening era.

(See "Iraq Today vs 1960s America," and "Basics of Generational Dynamics.")

But China is in a generational Crisis era, meaning that the country is "attracted toward" war, so the current situation is not at all incomparable to America in the 1960s. A more valid comparison would be to America's civil war in the 1860s.

This is completely untrue. There is a huge anti-government movement, the Falun Gong movement, which China has outlawed. Furthermore, the reason that China spends such huge sums of money censoring the Internet is because of fears of a "nationwide event," set up by internet communications.

(See "List of major Generational Dynamics predictions" for more information about Generational Dynamics predictions.)

From the point of view of Generational Dynamics, China is headed for a civil war with absolute certainty, but that's not all.

One of the most important stories of the decade, in my opinion, was the anti-Japan rioting in China in 2005. The authorities diverted anti-party sentiment at the time, and changed it to anti-Japan sentiment. So a civil war in China would almost certainly lead quickly to a world war. And with China's economy crashing rapidly, the time may not be too far off.

(Comments: For reader comments, questions and discussion,

see the China thread of the Generational Dynamics forum.)

(4-Feb-2009)

Permanent Link

Receive daily World View columns by e-mail