Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Yes, this story DOES have a generational angle.

|

Sales have been plunging at Victoria's Secret stores, and CEO Sharen Turney said that a change is coming:

"We've so much gotten off our heritage ... too

sexy, and we use the word sexy a lot and really have forgotten the

ultra feminine. ... I feel so strongly about us getting back to

our heritage and really thinking in terms of ultra feminine and

not just the word sexy and becoming much more relevant to our

customer. ... We will also reinvent the sleepwear business and

focus on product quality. Our assortment will return to an ultra

feminine lingerie brand to meet her needs and expectation."

From the point of view of Generational Dynamics, this is just one more indication of the sharp change in gender attitudes and roles that the country is experiencing as it enters a generational Crisis era. The 1990s was a generational Unraveling era, and during such eras, "anything goes." Individual rights are paramount, and any political speech or sexuality or lifestyle is considered acceptable. While open sexuality is considered radical and progressive during an Awakening era (like America in 1960-70s), it's considered the norm in an Unraveling era, and generates a backlash during a Crisis era.

|

Feminist alert: Millionaires' mistresses and wives are biggest victims of financial crisis:

Abusive, controlling husbands are forcing wives to do their own cooking and cleaning....

(5-Jul-2009)

A generational explanation of Iran's political crisis:

What happens when an irresistible force meets an immovable object?...

(23-Jun-2009)

Victoria's Secret changes from "too sexy" to "ultra-feminine":

Yes, this story DOES have a generational angle....

(29-Feb-08)

ABC's Cokie Roberts conveys the frustration of feminists over Barack Obama:

Obama himself is an empty vessel waiting to be filled....

(25-Feb-08)

Subprime mortgage executive kills wife and jumps off bridge to his death:

There's a lot more to this story than the papers are telling....

(21-Jan-08)

Iran's President Ahmadinejad facing a growing "generation gap":

Gas rationing and restrictions on women are infuriating the college-age generation....

(2-Jul-07)

Book review review: Christopher Hitchens: "God Is Not Great: How Religion Poisons Everything" (I):

Part I: Is religion really the root of all evil?...

(3-Jun-07)

Iranian police swoop down on women with loose headscarves:

Sorry, I just can't stop laughing at this one....

(25-Apr-07)

Collapse of Duke rape case represents cultural change:

False accusations against men are likely to occur less often now....

(22-Apr-07)

Activists accuse Fox's '24' of promoting torture.:

In the end, it's just another way to bash our troops....

(18-Mar-07)

Researchers say that today's college students are excessively "narcissistic" and money-oriented:

I hope taxpayers didn't pay for this nonsense....

(2-Mar-07)

Boys, boys, boys! China is running out of girls.:

A look inside a Chinese maternity ward...

(1-Feb-07)

Feminism flourishes in Iran, as the international crisis on nuclear weapons intensifies:

Iran's new president, Mahmoud Ahmadinejad, named a hardline Islamist cabinet on Sunday,...

(15-Aug-05)

"It's going to be the 1950s all over again":

Young women in droves are staying home to take care of the kids,...

(11-Oct-04)

Gender gap replaced by a marriage gap or mother gap:

The new phrase replacing "soccer moms" is "security moms," worried about their family's safety from terrorism....

(28-Sep-04)

CBS fined $550,000 because Janet Jackson bared her breast on MTV show:

Women love "manly men"; the gender gap is narrowing. The sex revolution is over....

(24-Sep-04)

Vatican criticizes the "lethal effects" of feminism:

This is one more indication, following the backlash against Janet Jackson's bared breast at the Super Bowl, that the sexual revolution is over....

(1-Aug-04)

China is getting more girls:

With a huge surplus of boys, ultrasound exams are illegal in China,...

(15-Jul-04)

The race and gender wars are abating:

The amount of public polarization along issues of race, gender and crime has plummeted in recent years,...

(30-Jun-04)

The New Sexual Revolution:

The pendulum is swinging back.

(27-Feb-04)

Schwarzenegger's victory could spell trouble for Bush: It also signals the end of the societal culture / gender wars. (8-Oct-03) | ||

I've described all this many times on this web site. In "Iran's President Ahmadinejad facing a growing 'generation gap,'" I described how Iran, which is currently in a generational Awakening era, is experiencing the same kind of gender conflict that America experienced in the 1960s.

In America in recent years, there have been many, many signs of women returning to stereotypical female gender roles, which some feminists are viewing with horror, saying "'It's going to be the 1950s all over again.'"

I remember being really startled, just after 9/11, when newspaper articles said that women were being attracted to "manly men" again, and when firemen and policemen were being praised as heroes for their willingness to run back into burning buildings to save people. When I was growing up in the 1950s, if you had asked a boy what he wanted to be when he grew up, it's quite likely that he would have said "fireman" or "policeman" -- and a girl would have anwered "a mother." Those sentiments disappeared pretty much completely in the 1960s, but suddenly were returning after 9/11.

The same story is occurring all the time. Whether it's CBS being fined $550,000 because Janet Jackson had bared her breast on MTV's SuperBowl halftime show on CBS, or educated women choosing to stay home with the kids, or Cokie Roberts complaining that Hillary Clinton has been pushed out of the way by a "cute young man [who] comes in and says a bunch of sweet nothings," the story is the same: men and women are returning to their stereotypical gender roles.

This isn't the first time this has happened. America's previous generational Unraveling era was the 1920s "flapper" era, when female sexuality was as open and accepted as in the 1990s. It began to change as America entered a generational Crisis era in the 1930s, when open sexuality began to be criticized and questioned.

A sign of that transition is Cole Porter's title song from the 1934 show Anything Goes! Some excerpts from the song's lyrics are as follows:

The last verse is a reference to a "shocking" publicity campaign by Simmons Bedding Company featuring Eleanor Roosevelt, just before her husband, Franklin Roosevelt, became President.

And here's a video from a 2007 production of Anything Goes! with absolutely fantastically mind-blowing choreography:

The 1934 song "Anything Goes!" represents a transitional time in American attitudes towards sex. If, up to that point, good authors who "once knew better words now only use four-letter words" is true, then things had already changed dramatically by 1939 when Clark Gable's "I don't give a damn!" in the 1939 movie Gone with the Wind caused a scandal.

America is in a similar transitional time now, and Victoria's Secret's own transition is a microcosm. The "in your face" sexuality of the store is hurting sales because a new generation of young women is rebelling against the sexual attitudes of their older sisters and mothers. While young women of the 1960s complained about having to wear their mothers' girdles, young women of today don't want to see their mothers' negligées, at least not in public. Instead of "very sexy," Victoria's Secret is now talking about being "ultra-feminine."

My expectation is that the Victoria's Secret transition is far from

complete. My expectation is that young women will see even the

"ultra-feminine" message as being unacceptable, unless it's

accompanied by a great deal more modesty. I'm not saying that women

are going back to sleeping in ankle-length breeches, but I am saying

that a retrenchment in open sexuality is in progress, and will

continue for many years.

(29-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Condoleezza Rice promises to take action, but exactly what is she threatening?

Kenya's political coalition may collapse and lead to tribal warfare:

Kenya is still reeling from the waves of gruesome ethnic violence...

(18-Feb-2010)

In Kenya, Kofi Annan's mediation talks collapse:

Condoleezza Rice promises to take action, but exactly what is she threatening?...

(27-Feb-08)

Kenya settles into low-level violence on the way to Rwanda:

So far, it's "ethnic cleansing," but not genocide,...

(1-Feb-08)

Kenya is almost -- but not quite -- on the brink of genocidal ethnic war:

There are hundreds of thousands of refugees displaced from their homes,...

(8-Jan-08)

Post-election massacre in Kenya raises concerns of tribal war:

Hundreds of people have been killed in ethnic violence since Monday,...

(2-Jan-08)

Dept. of Treasury proposes national mortgage bailout as losses become more widespread:

Florida state and local governments are in financial crisis this weekend,...

(1-Dec-07)

Sunday news shows: What would we do if we captured Osama bin Laden?:

And the Democrats refuse to commit to end Iraq war even by 2013....

(30-Sep-07)

Ethiopians crush Islamists in Somalia, forcing retreat to Kenya:

The problem is that Somalia may still not have a stable government....

(2-Jan-07)

Somalia and Ethiopia close to full-scale war, according to leaked UN report:

Thousands of refugees are fleeing Ethiopia into Kenya to escape war...

(28-Oct-06)

Storks fall out of the sky in Lebanon:

500 million birds are migrating from Asia to Africa this week and next,...

(28-Oct-05)

| ||

As I described when the violence first broke out, Kenya's last generational Crisis war was the Mau-Mau rebellion that ended in 1956.

Today, 52 years later, there are still a number of "elder" leaders around, aged 57 and above, who still remember the utter horror of the Mau-Mau rebellion, and will do anything possible to keep anything similar from happening again. Their children and grandchildren, however, don't feel so strongly.

Former UN Secretary-General Kofi Annan has been meeting with the "elders," and they're willing to look for a compromise, but they'll be killed by their younger supporters if the compromise goes too far.

Annan's effort never had a chance, as we've said. Kenya is UNLIKELY to spiral into a full-fledged ethnic civil war at this time, but in the next 5-6 years, when these aforementioned "elders" all disappear, a full-fledged ethnic war is a certainty.

So now Kofi Annan's mediation talks have collapsed.

Kofi Annan, you'll recall, considers the US to be the fount of most of the evil in the world. He condemned the US for intervening in Iraq, and condemns the US even more for NOT interfering in Darfur.

And now, Annan has one more failure to add to his resumé. He was mired in the mud of Saddam Hussein's money-for-oil scandal, and he whined for years about the Darfur civil war while it only got worse. Has he really ever accomplished anything except to pontificate?

Well, what's really shocking is the statement by US Secretary of State Condoleezza Rice. It goes through several paragraphs of diplomatic boilerplate, and then concludes:

What "necessary steps" are we going to take? Omigod, we're not going to send in American troops, are we? I know that President Bush has been making some vague statements expressing sorrow that we didn't send troops into Darfur. He isn't looking to salve his guilty conscience in Kenya, is he?

From the point of view of Generational Dynamics, what's going to happen in Kenya is perfectly clear. There's a major fault line between ethnic groups -- The Kikuyus and their allies versus the Luos and their allies. The low-level violence we've been seeing will continue for weeks or months or years until something triggers the new genocidal crisis war that we've been referencing. Then there'll be massive slaughter between these ethnic groups. Probably one side will win, and the other side will come close to being exterminated. That's absolutely certain; only the exact dates are in doubt, although it's pretty certain within 5-10 years.

But all this is going to happen with or without Kofi Annan, with or without American troops. It's already "in the cards," as they say.

In that time frame, the "clash of civilizations" world war will be in

full swing. We'll be dealing with our own wars of extermination.

Let's hope that we don't get mired in a Kenya quagmire before then.

(27-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Surging food prices are causing food riots around the world.

Food rationing comes to the United States:

After years of price rises, mainstream media is finally recognizing there's a problem....

(24-Apr-08)

Food panics and riots spread around the world:

The unending sharp price wheat, corn and rice prices are destabilizing nations....

(9-Apr-08)

UN World Food Program to institute food rationing:

Surging food prices are causing food riots around the world....

(26-Feb-08)

Wheat price rises blocked by commodities market price increase limits:

American wheat stockpiles are lowest since just after World War II....

(9-Feb-08)

Wheat prices surge above $10 per bushel, sparking little concern:

World food stocks dwindling rapidly, according to the UN....

(23-Dec-07)

UN expert calls biofuels a "crime against humanity":

Separately, Oxfam says that biofuels won't work, and they "trample" poor people....

(7-Nov-07)

United Nations warns of social unrest as food prices continue meteoric climb:

With world wheat prices now up 60% since January, countries are panicking...

(08-Sep-07)

World wheat prices up 30% since May on panic buying:

Wheat prices hit an all-time record high, as stocks are low, and poor weather...

(25-Aug-07)

The global warming fad is becoming the enemy of food production.:

Food prices are continuing to increase sharply around the world....

(16-Jul-07)

Price of food is skyrocketing in India and China:

In fact, crop prices are increasing around the world,...

(11-Apr-07)

In Mexico, violent crime from drug cartels increases with tortilla prices:

After Acapulco incident, Canada may advise citizens not to travel to Mexico....

(8-Feb-07)

UN World Food Program will cut Darfur humanitarian rations in half:

This continuing genocide is a very sad situation, but it can't be stopped....

(29-Apr-06)

In a new bizarre move, North Korea demands an end to U.N. food aid:

The famine-stricken country officially told the UN World Food Program...

(26-Sep-05)

Food prices continue to increase dramatically around the world:

Hunger, poverty and starvation are spreading to increasing masses of people around the world,...

(10-Aug-05)

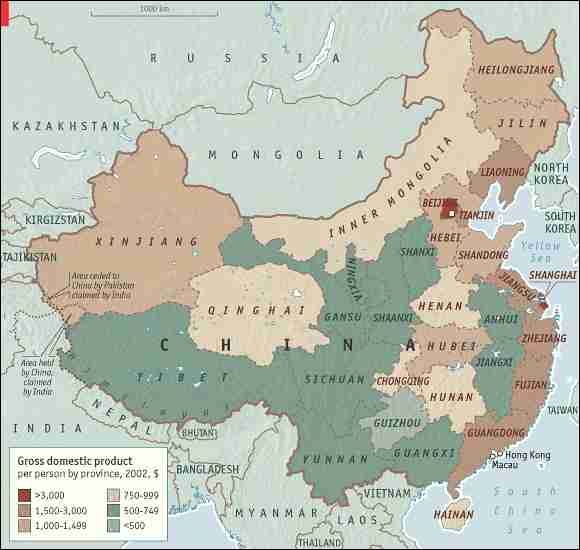

China appears to be approaching a major civil war :

Unrest is spreading, and economic disparities make China a textbook case for a massive civil war in the making

(16-Jan-2005)

Green Revolution vs Malthus Effect: Despite the "Green Revolution," world population continues to grow faster than food production. This is one of the fundamental reasons why wars occur. (28-Jun-2004) | ||

It will be no surprise to the regular readers of this web site that there's a real emergency going on in the world, and I'm not referring to the fad "emergencies" like climate change.

Food prices around the world continue to surge uncontrollably. Overall, prices of food are up 40% in the last year. This may not mean much to most Americans, since food is a relatively small part of the American budget. But in places where average earnings are less than a dollar a day, this throws more people into starvation.

UPDATE: After this article was posted, wheat prices have hit fresh highs. Wheat on the Chicago Board of Trade (CBOT) rose the maximum 90 cents allowed to $11.99 a bushel. (The 30 cent limit that I mentioned recently has been increased to 90 cents.) And Financial Times reports that prices of top-quality wheat jumped 25 per cent on Monday in Kazakhstan, a central Asian country that's one of the world's largest exporters of wheat. (This paragraph added on Feb 26.)

The United Nations World Food Program (WFP) is responsible for distributing food to world regions hit by war, natural disaster, or poverty.

However, food prices have been rising so rapidly, that the WFP's budget requirements have been rising by tens of millions of dollars PER WEEK.

According to the WFP's Josette Sheeran, we're "seeing a new face of hunger in which people are being priced out of the food market" with hunger now "affecting a wide range of countries", pointing to Indonesia, Yemen and Mexico in particular.

According to news reports, food riots have broken out in Morocco, Yemen, Mexico, Guinea, Mauritania, Senegal and Uzbekistan. Pakistan has reintroduced rationing for the first time in two decades. Russia has frozen the price of milk, bread, eggs and cooking oil for six months. Thailand is also planning a freeze on food staples. After protests around Indonesia, Jakarta has increased public food subsidies. India has banned the export of rice except the high-quality basmati variety.

There's little doubt that this can go on much longer. One of the features of the modern world is the success of modern medicine, and the reduction of the infant mortality rate, from 40-50% in the early 1800s to 1-2% today. This has created huge masses of young people around the world, often packed into huge "megacities," each containing tens of millions of people with no access to farmland. Families in poverty in those cities often survive by foraging in large garbage dumps for scraps of food left over by people who can afford to buy food. With the worldwide price of wheat doubling in the last year, and other food prices increasing as well, there are probably tens of millions more people in the world each month who have to forage through garbage dumps. Each month, more and more men are unable to feed themselves and their families, and their only choice for survival will be either mass rebellion or to join the army and go to war.

What never ceases to amaze me is how little attention this problem gets. We've just spent the weekend listening to the most bilious nonsense about whether it's plagiarism to quote someone who quoted the words, "We hold these truths to be self-evident." Can you think of a more moronic and fatuous debate?

But not a word about what is undoubtedly the greatest emergency in the world today -- the increasing starvation of millions of people, and the resulting instability.

From the point of view of Generational Dynamics, the world is headed

for a "clash of civilizations" world war, with absolutely certainty,

and it's just possible that it will be launched somewhere because a

"tipping point" was passed in the growing price of food.

(26-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

You could've knocked me over with a feather.

|

Boomers reading this web site may recall hearing the following on television many times during their youth: "You unlock this door with the key of imagination. Beyond it is another dimension. A dimension of sound. A dimension of sight. A dimension of mind. You're moving into a land of both shadow and substance of things and ideas. You've just crossed over into the Twilight Zone."

On Monday, S&P Ratings re-affirmed the AAA rating of "monoline" bond insurers MBIA Inc and Ambac Financial Group. Investors became so euphoric that they pushed the stock market up 189 points in the Dow Industrials.

I went to the S&P web site, and found the statement explaining their reasoning. It contains this text on MBIA:

However, the reversion back to a negative outlook is warranted in light of the absolute size of stress scenario losses relative to the adjusted capital cushion, as well as the uncertainty surrounding a possible reconfiguration of the company. In our view, several factors--the viability of the resulting corporate structure, investor acceptance, the effect on the company's franchise value, and the potential for disadvantaging any group of policyholders with regard to the availability of claims-paying resources--will require further assessment."

This is a pretty mealy-mouthed statement. They're saying (my paraphrase):

We have to look at motivations here. S&P, along with other bond ratings agencies, took fat fees from bond issuers in return for giving AAA ratings on the CDOs, and did so long after it was clear that these CDOs were seriously flawed. They essentially lied for months. There's no reason to assume that they wouldn't lie now, if they felt that lying would be to their advantage.

MBIA, along with other bond insurers, took fat fees from bond issuers in return for insuring CDOs in order to give them AAA ratings, and did so long after it was clear that these CDOs were seriously flawed. They essentially lied for months. There's no reason to assume that they wouldn't lie now, if they felt that lying would be to their advantage.

(For those interested in the math behind the creation of CDOs from mortgage-backed securities, and how they get AAA ratings from "monoline" bond insurers, see "A primer on financial engineering and structured finance.")

We're now in the middle of a huge political battle, headed by New York Insurance Superintendent Eric Dinallo, to arrange a bailout of the bond insurers. This bailout involves money from the banks whose CDOs are in danger of losing their insurance and a signoff from the ratings agencies that they won't downgrade the insurers' AAA ratings.

If the bailout doesn't work, then it's widely believed that the stock markets will fall sharply, and whoever didn't cooperate in Dinallo's scheme would receive all the blame.

So the banks are willing to spend a few billion on financing MBIA and the others, because they're going to lose at least that much anyway, writing down CDOs in their portfolios. And the ratings agencies are willing to sign on, because otherwise they'll be blamed.

Everyone has major conflicts of interest, and no one has any credibility.

But let's look at this in another way.

Suppose that you own a house, and you have a homeowner's insurance policy that protects you against things like fires and robberies and other stuff that homeowner's policies are supposed to cover.

And suppose that your house is worth $200,000. (Let's assume these are normal times, and there's no deflating housing bubble, so the $200,000 is a real number.)

OK. One day you read in the newspaper that your insurance company is in some financial trouble, and they've lost their AAA rating.

So now your house is worth only $50,000.

Huh??? Is your house worth $200K or $50K? Why should your insurance company's problem mean that your home's value has fallen by 75%? That makes no sense at all.

But that's what we're talking about with these bond insurers. This is all part of the magic and alchemy that was dreamed up by the Generation-X genius "financial engineers" who set all this stuff up.

Let's use round numbers. There are, say, $60 billion of at-risk CDOs in the portfolios of various banks. They're all AAA rated, because a bond insurer has insured them against default.

Suddenly the bond insurer's rating goes down. The CDOs are now worth only $15 billion.

Huh??? Are these CDOs worth $60 billion or $15 billion? How can they fall in value by 75% just because the bond insurer loses its rating?

So now, someone gives the bond insurer $3 billion in credit. By magic, the CDOs go from $15 billion in value back to $60 billion in value.

|

Let's look at one more aspect of this, by going back to the $200,000 house that's worth only $50,000 when the insurance company gets into financial trouble. How could that ever be possible? (This and subsequent paragraphs were added on Feb 26.)

There's only one way it could be possible: The only reason your house was ever worth $200K is that you expect it to burn down, so that you can collect the insurance. Your house is worth four times as much if it burns down than if it stays up.

Translate that reasoning into the CDO case, and you see what's going on. You have $60 billion in CDOs, but they're worth only $15 billion when your bond insurance company gets into trouble. How could that ever be possible?

There's only one way it could be possible: The only reason that the CDOs were ever worth $60 billion is because you expect them to default, and the owners can collect the insurance.

Taking that reasoning a step further, if the industry is expecting $500 billion in additional CDO writedowns that can be avoided only if the bond insurers retain their AAA ratings, that can only mean one thing: That the $500 billion is going to come from payouts by the bond insurers. There's no other possibility.

When S&P reaffirmed MBIA's rating on Monday, they didn't follow that reasoning. Instead, they assumed that only a small fraction of the CDOs would default. That's why S&P's action is essentially fraudulent. But these financial institutions have been committing fraud with CDOs for a long time now, and so this is nothing new. The only really new thing is that the government, in the form of New York Insurance Superintendent Eric Dinallo, is fully involved in the fraud.

I've quoted the passage below before, but it's worth doing again. This is from John Kenneth Galbraith in his 1954 book, The Great Crash - 1929:

Galbraith's paragraph describe's precisely what's going on now with Dinallo's working sessions, and in meeting rooms in banks around the world.

I've estimated that the probability of a major financial crisis (generational stock market panic and

crash) in any given week from now on is about 3%. The probability of

a crisis some time in the next 52 weeks is 75%, according to this

estimate.

(26-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The "subprime virus" is spreading rapidly through Europe now.

These days, when pundits refer to a bank as "going to the confessional," they mean that the bank is making its latest announcement of how many billions of dollars it's losing because it has to write down worthless or near-worthless CDOs in its asset portfolio. Some banks and financial institutions have been to the confessional several times.

But in fact very few banks been to the confessional. Most have been sitting on their assets, waiting until either the problem goes away, or until someone sticks a gun to their backs.

|

That's what's happening to many of Germany's state-owned banks right now. The result is that these banks are turning to Angela Merkel's German federal government for bailouts.

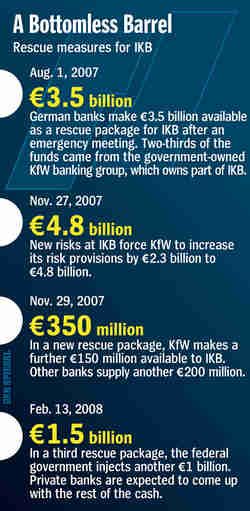

The most dramatic situation is at Düsseldorf-based IKB Deutsche Industriebank AG. It began requiring bailouts with the international "credit crunch" financial crisis that began last August, and has has required one additional bailout after another, with a €1.5 billion ($2.2 billion) approved just last week. And there's no guarantee that further bailouts won't be required.

Another state-owned bank, WestLB, has received a €5 billion ($7.4 billion) rescue package. Sachsen LB has received €2.73 billion in loan guarantees from the states, as well as €14 billion from other state-owned banks. Nordbank needs €1 billion, while BayernLB just reported a €1.9 billion writedown, as a result of infection by the subprime virus.

Where did these German banks obtain all these CDO securities that were supposed to make them rich? Why, they obtained them from Swiss banking giant UBS AG, which itself has been to the confessional several times, has had to take a whopping $18.4 billion in writedowns.

Germany's Nordbank, for example, purchased some $15.6 billion worth of CDOs from UBS six years ago, as a low-risk high-yield investment. On Saturday, Nordbank announced that it was suing UBS, claiming that the investment had a much higher risk than UBS let on.

So let me get this straight. The guys at Nordbank (which, incidentally, is worth about €207 billion in assets), were so dumb that they let those sharp cookies at UBS snooker them into buying $15.6 billion of CDOs that are now turning out to be near-worthless. It's nice to know that, as we head for a time when great masses of people are going to be unemployed, bankrupt and homeless, that Nordbank's lawyers and UBS's lawyers are going to have plenty of money to spend on their yachts and mistresses.

Unfortunately, German bankers are still fooling themselves, if we're to believe the words of Rainer Skierka at Bank Sarasin. He referred to a recent announcement by Credit Suisse of massive further writedowns and said, "Credit Suisse was seen as transparent and more credible than other (banks). This has now all disappeared and it has lost substantial credibility over recent days."

But then he says that for other banks, there's only one problem left: "The only problem is the monoline insurers and what implications (weakness in that sector) might have for banks," he said.

This is a common fantasy that we've mentioned before. The "monoline" bond insurers are part of the alchemy that gave near-worthless CDOs their AAA ratings.

(For those interested in the math behind the creation of CDOs from mortgage-backed securities, and how they get AAA ratings from "monoline" bond insurers, see "A primer on financial engineering and structured finance.")

So the fantasy is that all these bailouts of all these banks can be avoided, if only the bond insurers are bailed out first. Then the bond insurers can work their magic again, and near-worthless CDOs in everyone's portfolios would suddenly get back their old bubble value, and the bubble can start growing again.

Incidentally, there's presumably been a high-profile working session going on all weekend, headed by New York Insurance Superintendent Eric Dinallo, who's trying to get everyone to agree to a bailout of the bond insurers. There are all sorts of screwy ideas on the table, but since the intention is to find a way to get the bubble to start growing again, they're all mathematically impossible.

As of this writing on Sunday evening, the Wall Street Journal is reporting that Ambac, the second-largest of the bond insurers, has obtained $3 billion in financing, allowing it to continue in business at least on the municipal bond side of its business, with the CDO side of its business still in doubt.

However, that's far from enough to reflate the credit bubble that's now leaking like mad.

So that leaves the German public banks left in their state of crisis. According to Der Spiegel:

It is a nightmare scenario that the government financial supervisory authority now believes is increasingly likely. Germany's public-sector banks speculated far more heavily than private banks in American subprime mortgage securities. Now these banks' beleaguered executives are calling on the government to bail them out from a disaster of their own making. ...

In other words, [the argument went,] WestLB failure would deeply jeopardize Köln-Bonner Sparkasse, as well as at least three other savings banks in North Rhine-Westphalia.

If that happened, the corporate customers of the affected banks could end up without access to their money for weeks, possibly even months. Despite the fact that the customers' deposits are in fact guaranteed, any bank insolvency is preceded by a moratorium on all bank transactions. This ... would only lead to further bankruptcies, especially since the remaining savings banks in North Rhine-Westphalia, as their association presidents conceded, would have trouble satisfying the regional economy's liquidity requirements, because they already have a total of €43 billion in WestLB loans on their books. Furthermore, many of these banks also invested in American subprime mortgage securities, which they too would have to write off. The Westphalia-Lippe savings bank association, for instance, invested €100 million in the securities that triggered the worldwide financial crisis.

The officials involved painted grim scenarios. What would happen if customers were to withdraw their deposits from the savings banks en masse? And what if the insolvency of WestLB led to difficulties at two other state-owned banks, HSH Nordbank and BayernLB? How would that affect Bavaria and Hamburg, where the banks are headquartered? Would the public-sector banking system even be capable of surviving the failure of three state-owned banks? Could this in fact lead to the collapse of the entire economy, which would affect growth rates, unemployment and, ultimately, the well-being of society for many years to come? In the end, the participants were so drained that they agreed to a compromise.

Six months ago, BaFin president Jochen Sanio was heavily criticized when he warned of the "worst financial crisis since 1931." But now many politicians are convinced that the situation is far more serious than they had assumed until now."

The date 1931 is as symbolic to German financiers as 1929 is to Americans, as described in "The bubble that broke the world."

On May 11, 1931, the Credit-Anstalt bank of Austria failed. This triggered mass panic and bank failures throughout Central Europe, and generated a worldwide banking crisis. On July 13, the German Danatbank failed. Foreign investors in Germany quickly withdrew their capital from Germany, heightening the crisis, leading to the complete collapse of the German economy. By the end of the year, there were over 6 million unemployed, and the resulting social tension gave rise to Communism and Naziism.

And so, there are many justified fears about what's going on in Germany today. The German public banks are heavily interlocked with one another, and are required to support each other when one is in trouble. I don't know the history of German banking, but I'd be willing to bet that this interlocking scheme was put into place in order to avoid another disaster like the one in 1931.

If a bank is in trouble, its peer banks are supposed to help out, rather than allow a bank to fail, with the resulting public panic. But how is that supposed to work when all (or most) of the public banks are failing? What if they all got infected by the "subprime virus," because they all invested heavily in AAA rated high-yield CDO securities? How can they bail each other out, when they ALL need bailing out?

That's the situation facing Germany today; that's why the federal

government is being forced to provide bailout money to the banks; and

that's why everybody in Germany's financial community is scared to

death.

(25-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Obama himself is an empty vessel waiting to be filled.

|

I always say on this web site that Generational Dynamics is concerned with the attitudes and behaviors of large masses of people, entire generations of people. The attitudes and behaviors of politicians are irrelevant, except insofar as they reflect the attitudes of the great masses of people.

The rise of Barack Obama surely fits this category. There's been a huge surge in support for Obama among Democrats, and even among some Republicans. This support has translated into historically high campaign contributions from tens of millions of people. That a major change is going on is without question.

And it's pretty clearly a generational change. As I wrote a year ago in "Barack Obama to Boomers: Drop dead!" Obama has captured the enthusiasm of Generation-Xers by capturing and expressing their hatred for the Boomer generation. According to Obama:

In the back and forth between Clinton and Gingrich, and in the elections of 2000 and 2004. I sometimes felt as if I were watching the psychodrama of the baby boom generation — a tale rooted in old grudges and revenge plots hatched on a handful of college campuses long ago — played out on the national stage."

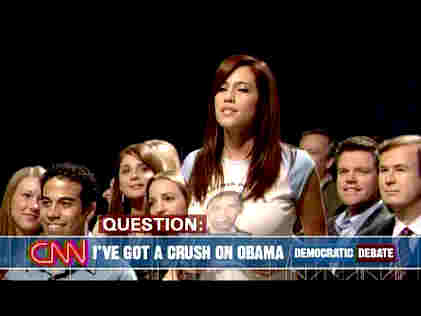

On ABC's news interview show, This Week With George Stephanopoulos, on Sunday morning, Boomer feminist commentator Cokie Roberts expressed her frustration with Obama's success:

I had the opportunity to interview Billie Jean King this week, and she said, "You know, I feel that everything I've worked for all of my life is going out the window."

|

And there is that sense. I mean, here is this woman, she's worked hard, she's done it all the way you're supposed to do it, and then this cute young man comes in and says a bunch of sweet nothings, and pushes you out of the way. And a lot of women are looking at that and saying, "There goes my life."

Well, that's the way life is. Roberts' characterization of the battle between an older woman and a "cute young man" misses the mark, insofar as she believes that this is a man versus woman issue. It's not a gender issue. It's not a feminist issue. Gender and feminism are irrelevant. It's a generational issue.

For decades, Gen-Xers have been living in the shadows of the Boomer generation, and have developed enormous fury at and hatred for the Boomers. Now it's the Xers' turn, and they'll brush the Boomers aside. A collection of frustrated feminist politicians will have nothing to say about it.

There's a piece missing from the Obama campaign and Obama himself: A political philosophy, especially a foreign policy philosophy.

On this web site, I've frequently expressed contempt for Washington politicians on the left and right for not knowing basic facts about what's going on in the world.

This is certainly true of Obama. His remarks about unilateral withdrawal from Iraq are irresponsible, and his remarks about pre-emptive American attacks on Pakistan soil are extremely dangerous. These remarks show that he has no "antiwar" philosophy, and in fact no philosophy at all.

President George Bush has admitted many times that he had no real political philosophy until 9/11, after which he devoted his Administration to the war against terror.

Assuming that Obama becomes President, what political philosophy will he adopt? He doesn't know -- right now he's an empty vessel. And his enthusiastic, euphoric supporters don't know either -- except that they believe that he's going to "bring change," although they don't really know whether the change will be good or bad.

The "change" that feminists are seeing is particularly ironic. I've never really understood what even feminists believed that they wanted for women in the workplace, since in my decades in the computer industry I've never, except for once or twice, seen any woman who was willing to put in the long hours in the workplace that many men put in as a matter of course. As I wrote in "'It's going to be the 1950s all over again,'" young women themselves, even well-to-do well-educated young college women, are choosing more and more to stay at home with the kids, much to the horror of Boomer feminists.

So it's been clear now for some years that Gen-X women have little use for Boomer feminism, just as Gen-X financial engineers have little use for credit restraint that was practiced by Boomers' predecessors.

What will happen now if a Gen-Xer becomes President? In what ways will his contempt for Boomers be expressed? Will his naïveté lead us to war more quickly, or will his youthful earnestness calm international fears for a while? And when the "clash of civilizations" world war comes, as it must, will he panic and lead the nation initially to disaster -- as Franklin Roosevelt and Abraham Lincoln did initially in WW II and the Civil War, respectively -- or will his responses be more measured?

If and when Obama takes office, what we're most likely to see is a repeat of the public manic-depressive behavior that followed the Democratic Congressional election victory in 2006. That election was to "bring change" as well. A couple of weeks later, Donald Rumsfeld resigned, and the journalist David Gergen described in giddy terms, "This is the best moment we've had in over three years." The giddiness didn't last though, as could be seen when the new Congress came to town, and it was apparent that "change" wasn't going to happen. NBC newsman Chris Matthews spoke for the left when he launched an ignorant and vitriolic screaming rant against President Bush.

After the 2006 elections, the desire to effect change, no matter what change, no matter how irresponsible, was blocked by President Bush. If Obama takes office with the Democratic party in control of Congress, then public demands for "change" may cause a young President, anxious to prove his toughness, to panic and do something dangerous. That's what happened with President Kennedy and the Bay of Pigs disaster, for example.

The desire for change, led by Gen-Xers, that's now sweeping the nation will affect the character of our response to the massive world war that coming, but we have no way of knowing what form that response will take.

My death waits like an old rouée

So confident I'll go her way

Harvesting the passing time

My death waits like a princess

At the funeral of my youth

Crying for the passing time

My death waits like a wicked witch

At the torching of our wedding

Laughing at the passing time

But whatever lies behind the door

And what's waiting for me there,

Angel or devil, I don't care,

For in front of that door, there is you.

-- From Jacques Brel, La Mort

Whoever is our next President, whether Barack Obama or someone else,

we won't know what's behind the door until he (or she) opens it.

(25-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Russia hints at using force on the side of Serbia.

A couple of days ago, I commented on the secession of Kosovo from Serbia as something that would certainly not bring peace to the region.

Now violence has been breaking out in Serbia, demonstrating against Kosovo's independence. The American embassy in Belgrade, the capital of Serbia, was attacked and burned by a mob on Thursday, in protest of the US recognition of Kosovo's independence.

There have been massive demonstrations in the city of Mitrovica, a city that's now in Kosovo, but has a very large Serbian population.

Analysts have expressed concern that the violence will spiral out of control spontaneously into a new Balkans war. This is, of course, completely impossible: This region just had a crisis war in the 1990s, and is now in a generational Recovery era (also called a High or Austerity era). So a major war of this type is completely impossible.

But it's well to review some of the thoughts that are going through people's minds.

It was June 28, 1914, that terrorists from Belgrade assassinated Austrian Archduke Francis Ferdinand, triggering the Great War and the massive slaughter of tens of millions of people. Germany got pulled into the war against its will, because of mutual defense treaty with Austria; it fought half-heartedly, and was forced to capitulate mainly because of political protests in Berlin. France got pulled in because it was allied with Russia and was attacked by Germany. America got pulled in because of an alliance with the UK. This was a non-crisis war for all of these countries.

This was a real crisis war for Russia and Turkey (the Ottoman Empire), the two main representatives of the Orthodox and Muslim civilizations at the time, and was the continuation of their long-held mutual genocidal hatred. The war led to the destruction of both countries, as Russia's Bolshevik Revolution ended six centuries of Tsarist rule, and the destruction of the Ottoman Empire ended six centuries of Muslim unity and a caliphate in Istanbul.

Now let's move back to today. The Balkan states have already had their next crisis war, in the 1990s, about 70 years after the end of World I. Russia and Turkey have not. They are both deep in a generational Crisis era. They are both increasingly xenophobic. Old religious practices are reasserting themselves, as the Kremlin is getting closer to the Russian Orthodox Church, and Islamists have replaced secular politicians in the Turkish government.

New violence in the Balkans is bound to fizzle out if it's allowed to. That's most definitely not the biggest danger now.

The biggest danger now is that Russia (which identifies with Orthodox Serbia) or Turkey (which identifies with Muslim Kosovo) may decide to intervene. A confrontation between Russia and Turkey in the Balkans could quickly spread into a confrontation surrounding the Black Sea.

The following map highlights the Black Sea region, and the three traditional battle regions -- the Balkans, the Crimea and the Caucasus -- where the Orthodox and the Muslims have had their crisis wars:

|

That's why the most ominous portion of the Serb / Kosovo story is the following:

"If the EU works out a single position or if NATO steps beyond its mandate in Kosovo, these organizations will be in conflict with the U.N., and then I think we will also begin operating under the assumption that in order to be respected, one needs to use force," Moscow's ambassador to NATO Dmitry Rogozin said, in comments carried by Russia's Interfax news agency."

Exactly what kind of force was not specified, but that's the real

danger in what's going on today in Serbia and the newly independent

Kosovo.

(23-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Steven Spielberg's resignation earlier this week as artistic adviser to the 2008 Olympics scheduled this summer in Beijing has clearly shocked Chinese officials. Spielberg's reason for resigning is that China is not doing enough to resolve the genocidal situation in Darfur. A particular issue is China's sales of weapons to the Sudan government, considered the aggressor in the war of genocide.

Darfur war takes a major turn, as Sudan expels aid groups.:

Oxfam, CARE, Save the Children, and numerous other aid groups...

(11-Mar-2009)

Chad and Sudan may be close to a declaration of war:

The peace agreement signed in March seems to be falling apart....

(18-Jun-2008)

Sudan's Darfur war expands as Khartoum comes under attack by rebels:

What were they thinking? everyone's asking. But it DOES make sense....

(14-May-2008)

Ban Ki Moon blames Darfur genocide on global warming:

Damn! He's blaming the Darfur crisis civil war on America!!...

(19-Jun-07)

Senator Joe Biden wants to move troops from Iraq to Darfur civil war:

Saying on Meet the Press that we should remove troops from Iraqi "civil war,"...

(29-Apr-07)

President Bush gives Sudan "one last chance" to end Darfur genocide:

But is Steven Spielberg aiding the genocide?...

(19-Apr-07)

Women's groups protest rape as a weapon of war in Darfur:

As the civil war in Darfur continues to grow more violent,...

(11-Dec-06)

UN: Darfur became much worse "while we were watching Lebanon and Israel":

Amnesty International reports that Sudan's new military buildup is precursor to a "catastrophe"...

(29-Aug-06)

UN declares that Darfur war was "not genocide," in the most sickeningly cynical story of the year:

If mass murders and rapes and forced relocation of millions of people isn't genocide, then what is?...

(01-Feb-05)

Today's slow-motion genocide in Darfur recalls the lightning quick genocide in Rwanda in 1994:

Why do these things always seem to happen in Africa? Understanding Africa's geography explains why.

(22-Aug-2004)

Jesse Jackson calls for sending American troops to Darfur:

You see how it works? Everyone has a war they like....

(27-Jul-04)

Darfur saga like depraved game of musical chairs:

As I've said before, I've gotten good at turning off my own feelings of horror...

(19-Jul-04)

Darfur genocide: The UN is completely irrelevant:

It was just three months ago that Kofi Annan said "never again," referring to the 1994 Rwanda genocide....

(28-Jun-04)

| ||

I've previously said that the Olympics event has become as important to Beijing as a sweet 16 coming-out party for a teenage girl, and everything that happens seems to confirm that view. According to various news reports in recent months, China has:

There have been numerous international complaints directed at Beijing over its failure to help with Darfur. I admit to enjoy a fair amount of Schadenfreude over this, because China has always been a cheerleader for international protests against America, and now they're getting a taste of what they put out.

|

Spielberg's resignation has been such a shock that they've actually let Liu Guijin, China's special envoy to Darfur, give a press conference in London, explaining how much China has done to resolve the Darfur issue.

Normally the Chinese don't allow their diplomatic representatives to speak publicly, for fear that they'll say something "wrong," as in 2006, when Sha Zukang, the Chinese ambassador to the U.N., started screaming anti-US threats about Taiwan to a BBC reporter.

So Liu Guijin's press conference, and his subsequent interview with the BBC is a very big deal. Here's what he said to the BBC (my transcription):

We have never threatened the government of Sudan with anything. We have never imposed anything. We have never forced them to do anything. We give them advice. We engage them. We try to persuade them."

This is an amusing illustration of China's diplomatic problems. He might have said, "We give them advice. We engage them. We try to persuade them. We supply them with weapons." But he left that last part out.

In fact the whole concept is hilarious. There are millions of people fighting each other to the death in Darfur. Is Liu really saying that sending a few people in for a friendly chat is going to change anything? As I've said many times, nothing can stop the genocide in Darfur, until it's run its course.

Just as equal partners, as friends, we give them advice for the better, for the good of the sovereign government. ...

The non-interference in the internal affairs of a sovereign country is the cornerstone abd basis of the Chinese diplomatic policy.

And the Chinese government's active engagement with regard to the Darfur issue does not mean that we have changed this policy, or that we are going to change this policy.

Because China, as a responsible member and one of the five permanent members of the Security Council, we have been asked, and we feel, that it is necessary for us to show more responsibility to play a more active role in finding settlements of international crises."

China's walking a tightrope here. China knows that if they criticize human rights in Darfur or anywhere else, then the international community will point out massive human rights violations in China (like being thrown in jail for years and tortured for uttering the words "falun gong").

Something's really building to a crescendo in Beijing. Almost every

resource in China is focused on the summer Olympics. Once the

Olympics games are over, China is going to have a letdown. We'll

have to see how that letdown affects policy.

(23-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Which do they want - intervention or non-intervention?

In reporting on President Bush's trip to Liberia, the last stop on his 5-nation tour of Africa, reporter Laura Trevelyan said this:

By going to Rwanda, George Bush was able to underscore what the US is doing in Darfur, a conflict that HE calls a genocide. America's been criticized for wringing its hands over the killings in the west of Sudan, while being unwilling to send in troops."

In these two sentences, one spoken right after the other, Trevelyan manages to zing the US twice, and in completely contradictory ways, without feeling any embarrassment about it.

I guess that this is what we have to expect, being Policemen of the

World and all, but it would be nice if the BBC could tone down its

hatred for America, especially its President.

(23-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Iraq is unfazed, and al-Sadr extends his cease-fire for six months.

Reportedly 10,000 Turkish troops crossed into Iraq on Thursday to destroy rebel Kurdish (PKK) bases in the extremely rugged mountainous region of northern Iraq.

The Turks say that it's a "limited operation," and that the troops will return to Turkey in the "shortest time possible."

According to security sources in Turkey:

TV channels and news agencies reported 10,000 troops were taking part in the cross-border offensive and the Turkish troops entered 10 km inside the Iraqi border. But CNN Turk reported 3,000 troops from special forces take part in the operation, citing security sources. Reports say the operation focused on the Hakurk region of northern Iraq.

The operation is expected to last 15 days, CNN Turk reported, citing security sources. ...

[In related news], Turkish President Abdullah Gul called Iraqi President Jalal Talabani on the phone on Thursday and informed him about the cross-border ground operation launched by Turkish Armed Forces (TSK) against terrorist organization (in the north of Iraq). Presidency press center stated on Friday that Gul briefed Talabani about the target of ground operation which TSK initiated on Thursday."

As usual, when analyzing a situation like this, it's necessary to sort out the individual generational timelines of each of the countries involved.

Turkey is well into a generational Crisis era, and so this situation could be dangerous if Turkey's military involvement spirals out of control.

However, Iraq is in a generational Awakening era, as we've said a zillion times on this web site to explain why a civil war in Iraq was and is impossible. Thus, Iraq is UNLIKELY to mount a military response to Turkey's invasion, which means that the situation as a whole is unlikely to spiral out of control.

The most likely outcome from this incursion is that, at some point, Turkey will complete its operations in the northern Iraq mountains, and then withdraw, succumbing to mounting international pressure. This scenario could be thwarted if the effort to clear out the PKK terrorists ends up in a "Vietnam-like quagmire," but even then a spiraling war seems unlikely.

As if to emphasize the fact that Iraq is in a generational Awakening era, the Shi'ite cleric Moqtada al-Sadr has extended his Mahdi militia's ceasefire for another six months. His previous ceasefire was set to expire, but in a statement Friday addressed to his own Mahdi army militia fighters, he says the following:

Whoever applies this is truly in the (Mahdi) Army and is among those who will bring victory for the Imam (Mahdi) after his appearance, God willing. So I will give you another opportunity to gain wholeness, just as I have given it to myself before you. So I extend the freezing of the Mahdi Army until the 15th of Shaaban (mid-August.) You have my thanks and appreciation for your understanding and your patience, as well as your holy struggle and your continuing to rebel against infidels and your love of faith, the believers, Islam, Muslims, Iraqis and Iraq.

In conclusion, I say: God ... make the members of the Mahdi Army the best followers of the prophets ... make them satisfactory to you ... make them the best of believers."

I discussed the coming of the Mahdi two years ago in "Iran and Ahmadinejad are waiting for the Mahdi," something that's roughly equivalent to waiting for the second coming of Christ in the Christian religion.

Al-Sadr is thus tying belief in the Mahdi to his statement to his militia to extend the ceasefire in the war against the infidels (the Sunnis and the Americans).

This hints at the kind of "generation gap" that he's dealing with:

His young warriors want to fight the infidels, but the warriors'

parents, who survived the bloody and genocidal Iran/Iraq war of the

1980s, don't want any part of a new war.

(23-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

According to a statement read on CNBC on Friday morning, Merrill Lynch is downgrading mortgage-finance firms Fannie Mae and Freddie Mac, because "The weakening macro trends add legitimacy to fears that these two companies are going to witness additional financial stress because they're highly leveraged."

What's interesting about this is that the the WSJ report simply says that Merrill Lynch "is taking a bearish view," without mentioning the 25% figure. I guess they didn't want to frighten people.

So I slogged through the Merrill Lynch site to find the actual report. It compares the current housing downturn to the 1991 housing downturn. Here's what it says (HPD = housing price declines, CME = Chicago Mercantile Exchange):

"The ML Economics team forecasts that home prices will decline roughly 25% through 2009 nationally, above the current market expectations of about 20%. To put this in perspective, the peak-to-trough HPD in the Case-Shiller Composite Index was -8.3% in the early 1990’s. A handful of large markets experienced double digit declines during this period, including Los Angeles (-27%), San Diego (-17%), Boston (-17%), New York (-15%) and San Francisco (-12%), which we think could be bested as prices revert to historical support levels on HH income. Thus, the de-leveraging process could lead to a more protracted downturn for housing beyond current expectations.

The housing market remains oversupplied, with 9.6 months supply of new homes, the highest level since January 1991 and 9.6 months of existing homes, only slightly below the record high of 10.7 months established in October 2007. We think the combination of sharp price declines and a contraction in supply will be necessary to correct the supply-demand imbalance. CME composite real estate futures contracts currently reflect assumptions of a peak-to-trough decline of about 19%, with the trough expected in late 2008, suggesting significant additional downside from current expectations.

Accelerating HPD and tighter guidelines will likely intensify the deterioration in credit trends, with delinquencies and foreclosures, already at high levels, rising significantly for the foreseeable future, in our view. Reduced borrower equity from continued weakness in the housing market and stricter credit standards will inhibit the ability of marginal borrowers to escape from their onerous mortgage debt."

This really is devastating news to those who have been praying for a quick recovery, and it means that the "subprime virus" is going to continue spreading and affecting everything. It's also totally consistent with the recent recent remarks of Meredith Whitney, and with other analysts who have been predicting a mere 20% housing price decline.

One financial type came onto CNBC a few minutes later, and said, almost hysterically, "That's not going to happen."

Why? he was asked.

"Because that would mean that the total value of housing in the US would go from $20 trillion to $15 trillion, and nobody's going to let that happen." Perhaps he thinks that the Hand of God will reach down and reflate the bubble.

From the point of view of Generational Dynamics, the housing price

decline should be quite a bit larger than 25%, as we enter a new

1930s style Great Depression.

(22-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Investors are increasingly aware that they have no idea what's going to hit them.

As you may recall, Fitch Ratings is one of the bond rating companies (along with Standard & Poor's and Moody's Investors Service) that are being blamed for being at the hard of the current credit crisis, because they took fat fees from mortgage-backed CDO issuers in return for giving the CDOs an AAA rating. Now, to save face, they're re-rating many of these mortgage-backed investments, and the results are increasingly gloomy.

On Thursday, Fitch released a statement on life insurance companies.

Now, perhaps you hadn't thought of this before, but when you buy life insurance, you send money each month to the insurance company, and the insurance company invests that money, so that it can pay out when you kick the bucket. And, like any other investor, life insurance companies have been looking for ways to get higher returns for their investments, and up till the middle of last year, that meant investing in mortgage-backed CDOs.

Well, now Fitch is taking a look at the investments of life insurance companies, and they've been found to be "problematic," although Fitch doesn't want to panic anyone, so they're calling the problems "manageable."

Here's what the statement says:

Fitch estimates unrealized mark-to-market losses on subprime and Alt-A related investments held by U.S. life insurers to be in the $7 billion to $8 billion range, which equates to approximately 13% of exposure and 3% of aggregate industry statutory capital. Further, Fitch expects the industry to report realized losses of between $2 billion and $3 billion (GAAP) in the fourth quarter of 2007.

While Fitch expects further deterioration in the performance of subprime residential mortgages, particularly for 2006 and 2007 vintage years, our analysis suggests that the industry is well positioned to withstand current market volatility given its focus on high investment grade securities, relatively stable liability profile and positive cash flow. Despite the significant deterioration of subprime mortgage markets and increased credit risk in other fixed income markets, Fitch views the U.S. life insurance industry as well capitalized. ...

Several companies are being more closely monitored due to either significant CDO exposure or more significant investment in subprime RMBS with 2006 and 2007 vintages or exposures outside the insurance group."

There are several things to take away from Fitch's statement:

In fact, almost no corporation today is above suspicion.

This is the conclusion from a Wall Street Journal article to appear on Friday. It says that investors are increasingly concerned that many more corporations are going to default on their bond obligations.

How do we know that? Because the costs of "credit default swaps" (CDSs), the insurance you buy when you want to be sure that bond obligations WON'T default, is skyrocketing.

According to the article,

Bonds issued by major corporations have been a rare bright spot in the battered credit markets -- few investors believe these companies will go bust even if there is a serious recession.

In recent days, investors in credit-default swaps, which act as insurance policies against defaults, have grown increasingly gloomy because of worries about the global economy and the possibility of problems in the market.

The losses are tracked by several indexes, which track the cost of buying insurance on bonds issued by 125 big companies. Two of the indexes are at records and have doubled since the start of the year, meaning investors who sold this insurance suffered losses. The worry is that the indexes' moves could prove to be self-fulfilling prophecies, causing heavy losses for investors and making it even harder for people and companies to borrow money. Adding to the anxiety: Analysts can only guess at the volume of investments tied to the indexes, who is holding them and what it would take to trigger a full-scale sell-off.

"You don't know when it is going to happen; you don't know how much it is going to be," said Michael Hampden-Turner, a credit strategist at Citigroup Inc. in London. That "makes everybody really nervous."

The article adds that the cost of insuring $10 million in bonds has risen to $152,000, up from $80,970 at the beginning of the year.

"It is a kind of vicious circle," said Demetrio Salorio, deputy head of debt capital markets for Société Générale in London."

This kind of interlocking collapse is exactly the kind of thing that I've been talking about. It was the cause of the initial 1929 panic collapse, and it's expected to happen again.

I've estimated that the probability of a major financial crisis (generational stock market panic and crash) in any given week from now on is about 3%. The probability of a crisis some time in the next 52 weeks is 75%, according to this estimate.

The heart of the ongoing discussion is the fate of the bond insurers (MBIA, Ambec, FGIC, ACA -- also called "monolines") that I've discussed at length.

|

Meredith Whitney, an analyst at Oppenheimer, occupies a very special place in investors' hearts these days. She published a research note in October predicting that Citibank (actually, Citigroup) would not be able to pay a dividend to investors.

Now, you'll recall that the stock markets peaked on October 9, 2007, and have been generally falling ever since. Well, Whitney's being blamed for that, for costing the world $369 billion in lost stock market values. I can just imagine, based on my own experiences, how much abuse and anger have been directed at her.

Well, she appears to be like me in the sense that she keeps on making predictions that are certain to come true, but upset people. It's an obsession with me - maybe it is with her too.

|

Anyway, she's now predicting that Citibank, along with Merrill Lynch and UBS, will be among the hardest hit banks in the world when the bond insurers lose their AAA ratings.

In an interview on Thursday afternoon on CNBC, she detailed the reasons as follows (my transcription):

|

There was an interesting exchange during this interview, in which Whitney essentially ridiculed a bank president who was saying that the worst might soon be over.

The interviewer, Maria Bartiromo, replayed a byte from an interview a couple of days earlier, who commented on whether the stock market might start going up again:

Whitney's response was to make the point that, essentially, nobody knows what's going on, and nobody knows how long the housing collapse will last -- something that many people (including me) believe will take years. And if nobody knows then, in particular, the ratings agencies don't know how much the bond insurers (monolines) will have to write down their own CDO assets. If they write down their own assets, then they won't have money to pay off insurance policies (just like the life insurance policies we discussed earlier):

There's no way they could do it, and for Bob Diamond to have such confidence, you know that's terrific for him, but he's a very small minority who speak with such confidence, because even when the most seasoned veteran lenders, guys like Jamie Dimon [James "Jamie" L. Dimon - CEO of JPMorgan Chase & Co.], guys like Al Kelly at American Express, guys like Ken Lewis [Kenneth D. Lewis , CEO and President of Bank of America], have been so shocked and so uprooted by the sudden and dramatic rise in loss rates -- even from the 3rd quarter to December -- even from November to December -- that their guidance is basically thrown out the window. And this is a micromanager like Jamie Dimon - so if he doesn't have control over things, it's amazing that anyone would. So hat's off to [Bob] Diamond -- I'm impressed that he has such boldness, because the people that I've talked to have never seen it this bad."

Note that these other financiers "have been so shocked and so uprooted by the sudden and dramatic rise in loss rates ... even from November to December -- that their guidance is basically thrown out the window."

This is a really critical point. People who have been listening to the various bank CEOs and Presidents who have been predicting that things would soon be all right are now, according to Whitney, in a state of shock.

Recall the table of the changes in fourth-quarter earnings estimates that people have been making, starting from the beginning of the fourth quarter:

Date 4Q Earnings estimate as of that date ------- ------------------------------------ Oct 1: +11.5% Dec 7: -1.3% Dec 14: -3.8% Dec 31: -6.1% Jan 4: -9.5% Jan 11: -11.3% Jan 18: -19.0% Jan 25: -20.5% Feb 1: -20.7% Feb 8: -20.2% Feb 15: -21.1%

This is an incredible table, because it indicates that these banks were expecting earnings to GROW by 11.5% at the beginning of the quarter, and yet they ended up FALLING by 21.1%. Whitney's point is that all previous guidance estimates have been thrown out the window, and that Bob Diamond it talking complete nonsense, something that should be no surprise at all to regular readers of this web site.

|

As a side point to this interview, it's worth noting that Maria Bartiromo herself seemed to be somewhat shell-shocked. As I've pointed out several times, Bartiromo likes to be happy and perky and jolly and Pollyannaish, and doesn't like people who break her mood.

But she seemed really disturbed by this interview, and asked Whitney whether the market would sell off further. Whitney's response:

So Whitney is not pulling any punches, and I'll bet that a lot of people are really pissed off at her (again) today.

But it's not Whitney's fault that the "subprime virus" is quickly

spreading into everything. As they like to say in those 1950s horror

movies, "Eeeeeeeeeeeeeeek!! No one is safe!!!" And, indeed, no one

is. The subprime flu is going to get you unless you protect yourself

as quickly as possible.

(22-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Closed end funds seem to be like a roach motel: You can check in, but you can't check out

I've been mentioning these arcane, obscure "auction rate securities" for a few days now -- in "Pundits are now referring to a spreading 'subprime virus'" and "'Credit crunch' domino effect is now affecting student loans."

The situation appears to be worsening significantly, according to a report by Steve Lieseman on CNBC on Wednesday morning.

As you read this, just get a sense of it, and don't worry about the technical details of what the different kinds of funds and securities are. Just remember that we're talking about the "safest" AAA rated securities -- supposedly as safe as cash -- securities that your pension fund, your college's endowment, your mom's money market fund or your employer might have invested in, because they're so "safe."

Here's my transcription of the report:

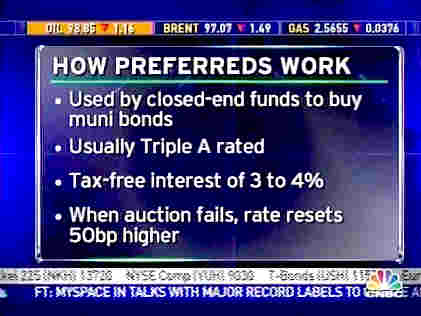

|

Major investment banks telling some of their richest investors that so-called "auction-rate preferred securities" -- they can't have their money back, and that the investors can't even sell the securities at a loss because there's no secondary market. They're in the financial equivalent of limbo here.

|

|

CNBC spoke with one investor in Miami Beach who has $2 million of these securities with closed end funds run by Blackrock, Gabelli, Calamos and Pimco. She says she can't withdraw her money to purchase a house she's contracted to buy, and she risks losing her $190,000 deposit if she walks away. She's told she can't have her money back. Other investors can't withdraw to make hefty tax payments that are coming due. These securities are sold at auctions in $25,000 units to wealthy investors and institutions. They expire every 7 to 28 days, at which point a new auction is held, but lately, the auctions are failing as part of the broader credit crunch. Not enough buyers are showing up, but more importantly, because the big investment banks -- they act as lead managers on these deals -- they're refusing to perform the role they've played for 25 years, and provide liquidity to the markets when they're out of balance.

|

|

The funds from these auctions are used by closed-end funds. They lever up and they buy muni bonds. The auction rate preferreds are usually triple A rated -- a lot of good that's doing people now. They pay a tax-free interest rate of 3 and 4%. When the auction fails, they only reset a little bit higher.

I talked to Mario Gabelli [chairman of Gabelli Funds] by phone. He would not comment on the record but he asked me to give the broker of the investor we talked to his number. He called the broker, hoping that something could be worked out, without offering anything specific.

A Blackrock executive says, "These are unprecedented times in the industry." He held out little hope for investors.

The closed end funds are in a bind. Wall Street is getting a black eye from some of its best customers. But if they pay off the preferred holders, they risk hurting the holders of the common shares in the closed funds.

Here is a note: These are not regulated money market funds. They [who?] cannot buy these securities. ...

Before I came on air, about 15 minutes ago, Mario Gabelli calls me back again from the gym. He says that on our behest Gabelli has issued a statement. And the statement says that "the board of directors on this Gabelli equity trust has authorized the fund and advisors to explore alternatives, including the repurchase of these preferred in a secondary market. But since there are so many legal loopholes to navigate, it's going to take time."

Becky: The people in these funds are people who tend to be very conservative investors. These are people who are not looking for anything but to be in the safest securities, and the question is, were they marketed to these people as that.

Lieseman: I've spent 2½ days trying to understand these securities. They are the most messed up securities. There is no contingency plan for the failure of the auction. If the auction fails they simply hold your money, try to redo the auction again."

Here's part of the text of Gabelli's statement (PDF), as it currently appears on their web site:

The Board of Directors of the Equity Trust has authorized the Fund and its Adviser to examine and explore all alternatives including the possibility of repurchasing a portion of these preferreds if a secondary market develops.

Since there are many legal hoops and regulatory hurdles to navigate in order to provide liquidity, and since a secondary market for ARPs may be in the process of being developed, we are only able to move as quickly as legal counsel provides the necessary guideposts, the Board approves the appropriate measures, and the market opportunities develop."

Those who would like to understand more of the nitty-gritty details can find more information at these locations:

The point is that these were AAA rated securities, meaning that any investor or corporation or investment fund could feel completely safe in purchasing them. They were as good as cash. Of course US Treasuries are the safest of all, but the AAA rated securities are also as safe -- because they're AAA rated, right? -- and often pay a good, solid ½-1% more interest than Treasuries. That makes them worthwhile, doesn't it?

As usual, pundits and analysts, who believe that "history always begins this morning," have no idea what's going on. "What's wrong with these investors," they seem to be saying. "Why won't they attend these auctions and bid on the auction-rate securities? Why don't they know that they're still safe?"

A big part of the reason, as I've previously said, is that investors don't believe these pundits and analysts any more, because the pundits have always said that it was safe to ignore any bad news that comes along. As I wrote recently, the moral to the Aesop's Fable "The boy who cried wolf" is that "Nobody believes a liar, even when he's telling the truth."

However, there is a big picture here, as I've been saying for several years: There's been a mammoth worldwide liquidity and credit bubble, and now it's deflating, leaving less money in the world each day, as we head for a new 1930s style Great Depression. I didn't know several years ago that one part of the scenario would be that "auction rate securities" would be frozen -- hell, I never even heard of them until a couple of weeks ago. But I knew that the bubble would deflate, and that little chunks of the world economy would collapse, one after the other, until the whole thing collapses in a generational panic and stock market crash, the first since 1929.

When I first pointed this out to people in 2002, I was treated like an idiot, even though it's easy to prove, then and now, that the stock market is way overpriced. But nobody's calling me that now. Everything that I predicted is coming true, for the reasons that I predicted.

Another thing going on is the soap-opera drama of the "bailout" of the bond insurers (MBIA, Ambac, FGIC, ACA) that I recently discussed at length. It has been the Sisyphean task of New York Insurance Superintendent Eric Dinallo to arrange this bailout, but every time he proposes something new, it collapses and he has to start over again. (King Sisyphus of Greek mythology was sent to Hades and condemned forever to roll a huge boulder up a hill, only to have it roll down again on nearing the top.)