Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

An assessment of where we are and where we're going.

What was really remarkable about the past week was that "Ben Bernanke's Great Historic Experiment" has been put into full operation.

It's hard to overstate the importance of what's going on. We are now at the focal point of decades of macroeconomic theory that says that the Great Depression need not have happened, and could have been prevented by means of a minor change in Fed policy.

The next few weeks will either prove that Ben Bernanke and the macroeconomic theory that he's implementing are correct or disastrously wrong. Either way, it's truly a historic moment and will be recognized as such for decades to come.

Recall the main points of the experiment, which we'll summarize briefly:

|

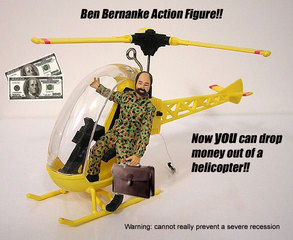

The adjoining graphic is a cartoon that's been circulating around the internet showing Bernanke dropping money out of a helicopter. This cartoon alludes to a 2002 speech by Bernanke, where he presumably said that dropping money out of a helicopter would solve any Great Depression by defeating deflation.

Actually, he said something very different in that speech, and I'll come back to that speech in a moment, because it tells us a great deal about where the Fed is going in the next few weeks and months.

But first I want to provide a context by reviewing the extremely remarkable events of the last week.

As we've previously discussed, the Fed reduced the "discount rate" from 6.25% to 5.75% on Friday, August 17. This was done after a week of enormous volatility in the stock market, and signs of greatly increase "risk aversion" among investors and financial managers.

Lowering the discount rate means that banks can borrow money from the Fed's "discount window" at the new lower rate. Thus, the Fed "provides money to the economy" as summarized above.

What has become apparent in the meantime is that nobody wanted to borrow from the discount window, even at the lower rate. There are good reasons for this. Banks rarely use the discount window anyway, because they can borrow money from each other at a lower rate, the "Fed funds rate," which is currently set at 5.25%.

It's true that there were some well-publicized discount window withdrawals by several German banks on Monday.

However, the purpose of Bernanke's great experiment would be thwarted unless it resulted in a lot more money being injected into the economy.

Several hours after the rate cut was announced on Friday (Aug 17) morning, it was becoming clear that the new discount rate was not working as hoped, and on Friday afternoon, the New York Fed (which actually administers the discount window) spoke to the four largest US banks (Citigroup Inc., Bank of America Corp., JPMorgan Chase & Co. and Wachovia Corp.) in a conference call and essentially ordered them to borrow money from the discount window. All four did so, each borrowing the minimum amount possible ($500 million).

The Fed did a few other extraordinary things to encourage use of the discount window:

All of these steps were enough to provide a real shot in the arm to investors, changing their moods from panicky back to giddy, as the Dow went up 1% on Wednesday, and again on Friday.

So now the first week of Bernanke's new policy has come to an end, with results that many pundits are claiming were highly successful. Volatility has come down about halfway to previous "normal" levels, and investor "risk aversion" seems to have been quenched.

I'm being unfair to pundits if I leave it at that, however. A number of pundits have been warning that the worst is yet to come. They point to continuing and increasing problems with mortgage-based securities, as the subprime "teaser rates" continue to be reset in the millions, and they also point out that last week's market was not representative because everyone was on vacation and volume was extremely low. One worried pundit pointed out: "When the market fell, it was on very high volume; when the market recovered, it was on very low volume. This means that investors are really not yet convinced that the Fed moves are working."

(Boomer trivia: The title of this section refers to an early 1960s TV show that ran opposite Twilight Zone.)

In a speech given on November 21, 2002, Bernanke laid out a number of Fed interventions that might take place if the economy became increasingly distressed.

I will now analyze that speech, but I must begin by saying that his reasoning is extraordinarily shallow. He says things that simply don't make sense, and which time has now shown to be completely wrong.

Still, it's a very important speech there's every reason to believe that Bernanke STILL believes almost everything he says there, and because the Fed interventions that he describes are probably going to take place in the next few months. So the speech is important because it provides something of an additional roadmap to the near future.

Let's do this in two phases.

We'll start by making a simple list of the tools that he believes that the Fed can use to inject money into the economy. Then, in the next section, we'll discuss his reasoning.

Here is a list of the tools that the Fed has:

However, it's not an automatic thing. Banks are free to charge each other any interest rate they like. However, if a bank has money to lend, and it can lend the money to another bank at interest rate A, or lend it to the government (the Fed) at interest rate B, then the bank will lend it at whichever rate is higher. That's just common sense. And so, the Fed can control A by controlling B. This is done by "open market operations."

To control B, you have to get banks to lend money to the government, and the way you do that is by selling short-term (overnight) Treasury bills, and let banks bid on them, applying the law of supply and demand. If a lot of bids come in, so demand is very high, then the prices of the bills go up, pushing yields down below 5.25%, so the Fed increases supply and auctions more off; if only a few bids come in, so demand is very low, then the prices of the bills go down, pushing yields above 5.25%, then the fed decreases supply, and stops auctioning. (29-Aug correction)

So the Fed auctions off exactly enough each day to keep the interest rate on the bills it sells at exactly 5.25%, or as close as possible. That's how B is controlled. Once B is set to 5.25%, then A will also return to 5.25%, to compete with the government, and so banks will loan money to each other at that rate.

This is the particular option that Bernanke exercised in the last week, with some variation: it's a 5.75% interest loan (not zero interest), and it's a 30-day loan. It takes as collateral some of the questionable commercial paper that's being backed by subprime mortgage loans, as described previously.

At this point, it's worthwhile to note that Bernanke is pursuing this policy for a different reason than the reason he discussed in 2002. At that time, he was concerned about deflation (as occurred in the early 1930s, and in Japan in the 1990s), and was describing asset-backed loans at zero interest rates for the purpose of combating deflation. This whole idea was based on concepts of deflation that were completely wrong, and have been proven wrong in the intervening time.

Today, Bernanke isn't concerned about defeating DEFLATION; he's concerned about increasing money liquidity in the markets, but without increasing INFLATION. There's an inherent contradiction in such policies, since increasing money liquidity should naturally increase inflation (or decrease deflation, which was his point in 2002). So he's offering discount window loans at 5.75% -- a high interest rate -- to avoid stirring inflation.

Well, if the interest rate is so high, then why lower the discount rate at all? The answer appears to be that it's all psychological. Lowering interest rates to increase liqudity and to defeat deflation makes sense; lowering them to increase liquidity but not to increase inflation really doesn't make sense.

And this is a point that we'll return to: Bernanke's 2002 speech was about avoiding a new Great Depression by controlling deflation. That's not the situation today.

So this is one of many serious problems with Bernanke's strategy.

In fact, the reason that he even lists other tools in his strategy is because he believes they'll be needed when the Discount Rate and Funds Rate go down to zero, and therefore cannot go any lower. (You know, I don't really believe this, but that's a topic for another day.)

I'll now go on and list the remaining tools that he described, because it's of interest to get the whole list down. But remember that they're all geared towards injecting liquidity by controlling deflation.

This is where he made his famous statement:

This is the one part of the speech that everyone seems to remember, but Bernanke wasn't recommending it; he was simply repeating a suggestion by Milton Friedman.

Now that we've listed the main tools described by Bernanke in the speech, let's move on to his assumptions and conclusions.

As I've said many times on this web site, mainstream macroeconomics has been wrong about everything since at least 1995. The mainstream models, which were devised in the 1970s and 1980s, did not predict or explain the dot-com bubble, and could not explain why the bubble occurred in the late 90s instead of the 1980s or 2000s, and could not explain almost anything that's happened since 2000.

It's certainly unequivocally true that no mainstream economist predicted anything that's going on today. This is all a complete shock to mainstream macroeconomics.

Bernanke's 2002 speech illuminates some of the main assumptions that mainstream macroeconomics makes, and it's easy to see from his speech that not only does Bernanke not know what he's talking about, but even HE thinks he doesn't know what he's talking about.

His discussion of deflation shows this quite forcefully, in which he says that deflation is "not a mystery":

Deflation is defined as a general decline in prices, with emphasis on the word "general." At any given time, especially in a low-inflation economy like that of our recent experience, prices of some goods and services will be falling. Price declines in a specific sector may occur because productivity is rising and costs are falling more quickly in that sector than elsewhere or because the demand for the output of that sector is weak relative to the demand for other goods and services. Sector-specific price declines, uncomfortable as they may be for producers in that sector, are generally not a problem for the economy as a whole and do not constitute deflation. Deflation per se occurs only when price declines are so widespread that broad-based indexes of prices, such as the consumer price index, register ongoing declines.

The sources of deflation are not a mystery. Deflation is in almost all cases a side effect of a collapse of aggregate demand--a drop in spending so severe that producers must cut prices on an ongoing basis in order to find buyers. Likewise, the economic effects of a deflationary episode, for the most part, are similar to those of any other sharp decline in aggregate spending--namely, recession, rising unemployment, and financial stress."

Now, you have to laugh at this. It's so ridiculously shallow that you'd think he'd be embarrassed to utter it.

He says that deflation is defined as a general decline in prices. Fine.

What are the causes? It's "a side effect of a collapse of aggregate demand -- a drop in spending so severe that producers must cut prices on an ongoing basis in order to find buyers."

In other words, deflation occurs when producers cut prices, and producers cut prices when demand for the producers' products collapses.

I think I learned that in 10th grade social studies class. Do we really need a Princeton professor of economics to recite it?

What causes the collapse of aggregate demand?? Why do people suddenly stop wanting producers' products? He doesn't answer that. Obviously he no idea whatsoever. He has absolutely no idea why deflation occurs. The above explanation is simply babbling.

In the above, he mentions "recession, rising unemployment, and financial stress" as being related, but he doesn't name them of the CAUSE of deflation. Good thing, too. He's well aware that during the Great Inflation of the 1970s, there was high inflation, recession, rising unemployment, and a great deal of financial stress.

I don't know what I find more astonishing -- the fact that Bernanke says these incredibly vacuous things, or the fact that I'm the only person who points them out. It's like that fairy tale about the King who wore no clothes, and everyone was too embarrassed to say so.

Bernanke and other economists have an extremely simplistic view of inflation and deflation. If you lower interest rates, then more money enters the economy and inflation increases; if you raise interest rates, then less money enters the economy, and inflation decreases or turns into deflation.

From the point of view of Generational Dynamics, the situation is a lot more complicated.

Economists assume that new businesses are born each decade, and die each decade, and each decade is pretty much the same as each other decade. All of their models depend on that assumption.

But that assumption is obviously wrong, as anyone can easily see. Most major businesses today were either born or completely renewed during the Great Depression. They invested heavily in research and development in the 40s and 50s, and reached their zenith in innovation and product excellence by the 60s and 70s. That's why demand was so high for American products, and why high inflation occurred: We just couldn't manufacture products fast enough to satisfy demand.

Since the 1980s, these companies have gotten older. Bureaucracy has increased, and product innovation has taken second place to protecting existing jobs and income streams. The main objective is to protect one's ass. That's why demand for American products has gotten so low, and why prices and inflation are falling.

Even though this is completely obvious, mainstream economists have no concept of it. Their flat view of time, where every decade is like every other decade, is obviously wrong, but it's the underlying assumption of every economic model, and it's why Bernanke is babbling completely nonsense.

Since 2002, the Fed funds rate has been near-zero, and by the standards of their 1970s models, inflation should have been enormous. Instead, inflation remained tame. But Americans rejected American products, and when to China for manufactured goods and to India for services.

Here's what Bernanke said in his speech:

The phrase "use monetary and fiscal policy as needed to support aggregate spending" is what the previously described tools are all about -- inject money into the economy, to increase spending, so that people will buy American products, so that demand will go up, prices will go up, and inflation will go up. Simple huh?

He added the following:

Well, that's what the Fed did in 2002 and 2003 -- moved "premptively and aggressively" to head off deflation, and that's what's brought us to our current state today.

As I said, from the point of view of Generational Dynamics, this is all wrong.

I knew all this in 2002 and 2003, because I had already developed the first two of major measures for valuating the stock market, as described in my recent essay, "How to compute the 'real value' of the stock market." And I wrote about it in my 2003 book, Generational Dynamics, where I referred to the "crusty old bureaucracy" that formed the leadership of most American companies. I knew at that time that we were headed for a new 1930s style Great Depression, but I was wrong about one major thing: I thought that the market would continue to decline from that point on.

In fact, here's what I wrote and posted on January 3, 2003, in my "Stock market forecast for 2003." This was one of my first predictions on this web site, and it contained a number of errors. However, this was also several months before I developed the Generational Dynamics forecasting methodology, and I don't claim to have started getting everything right until then.

Still, it's interesting to see what I wrote on January 3, 2003:

If technological and economic forecasting means anything at all (and it does), then the first of these forecasts doesn't have a chance of happening.

The second forecast may come true, in the sense that the forecasted crash to below 6000 may wait a year or two.

My guess: Something will go wrong in the war against Iraq or the war against terror, something that will expose a new vulnerability. That will have two effects: The DJIA will fall, and public resolve to pursue the war against terror will increase. Even if the war goes well in 2003, the stock market will continue to fall.

My guess is that the DJIA will be in the low 7000s or lower at the end of 2003."

At least I had the good sense to call these "guesses." Since that time, I've learned to say that "Generational Dynamics tells you were you're going, but not the path you'll take to get there," and "a stock market panic and crash might occur next week, next month or next year, but it's coming with 100% certainty, and probably sooner rather than later." In other words, the prediction a stock market crash and a new 1930s style Great Depression was correct, but I was wrong in "guessing" what the DJIA would be.

What I mainly didn't foresee was the "preemptive and aggressive" policy of the Fed, described above, to move against deflation before it got started. As a result, the DJIA did NOT fall -- but not for the reason that Greenspan and Bernanke intended.

The predicted reason that the market would go up is because the low interest rates would create more aggregate demand for American products, thus pushing up prices. That may have happened marginally, but I don't know anyone who could claim that it's happened in any serious way in the intervening five years.

Instead, all that money that poured into the economy was channeled into the huge Ponzi scheme that we're living with today, creating the stock market bubble, the housing bubble and the credit bubble.

The point I want to make here is that Bernanke's speech was completely wrong in explaining what was going on and predicting what was going to happen. Greenspan and Bernanke went ahead with a policy that they didn't understand, and didn't even really claim to understand, but which they thought might work if you have sufficiently simplistic economic beliefs.

If Bernanke's discussion of deflation is shallow, his discussion of Japan is mind-bogglingly bizarre.

I actually wrote a sparse analysis of Japan in March 2003, but wasn't able to complete the picture until February of this year, when I was finally able to obtain historical data on the Tokyo Stock Exchange dating back to 1914, and wrote "Japan's real estate crash may finally end after 16 years."

In brief, Japan had a major generational stock market panic and crash in 1990, just like America in 1929. But Japan's previous major stock market crash was in 1919. So you have: Wall Street: Crash in 1929, new bubble in 1995, 66 years later; Tokyo Stock Exchange: Crash in 1919, new bubble in 1984, 65 years later.

Japan's 1980s real estate and stock market bubble was HUGE. When the market crashed in 1990, prices in Japan fell for 15 years, and only in the last year have begun to rise again.

And yet, Bernanke doesn't believe that deflation is (or should be) possible. He believes that the long deflationary collapse was based on errors by the Bank of Japan (i.e., Japan's "Fed"), and on political confusion. He doesn't EVEN MENTION the 1980s bubble.

You know, Dear Reader, you must think that I enjoy writing insulting remarks about today's political and financial leaders, but really I don't. I hate what's happening, and I hate the utter stupidity of these people in positions of leadership.

But for heaven's sake, this guy was a Professor of Economics at Princeton. How could be possibly be this stupid?

But I digress. Let's quote directly from his speech:

First, here are his reasons for saying that deflation shouldn't occur:

What has this got to do with monetary policy? Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation."

OK, so he tells his little "parable" to say that deflation never occurs as long as you can pump as much money into the economy as you want.

Well, didn't Japan try that, and didn't it fail? Here goes:

The claim that deflation can be ended by sufficiently strong action has no doubt led you to wonder, if that is the case, why has Japan not ended its deflation? The Japanese situation is a complex one that I cannot fully discuss today. I will just make two brief, general points.

First, as you know, Japan's economy faces some significant barriers to growth besides deflation, including massive financial problems in the banking and corporate sectors and a large overhang of government debt. Plausibly, private-sector financial problems have muted the effects of the monetary policies that have been tried in Japan, even as the heavy overhang of government debt has made Japanese policymakers more reluctant to use aggressive fiscal policies. Fortunately, the U.S. economy does not share these problems, at least not to anything like the same degree, suggesting that anti-deflationary monetary and fiscal policies would be more potent here than they have been in Japan."

Well, let's all stop and have a moment of silence. Bernanke in 2002 says that Japan had "massive financial problems in the banking and corporate sectors and a large overhang of government debt." He adds that "the U.S. economy does not share these problems."

Maybe the US economy didn't in November 2002, but it sure does today.

Next:

In short, Japan's deflation problem is real and serious; but, in my view, political constraints, rather than a lack of policy instruments, explain why its deflation has persisted for as long as it has. Thus, I do not view the Japanese experience as evidence against the general conclusion that U.S. policymakers have the tools they need to prevent, and, if necessary, to cure a deflationary recession in the United States."

And so, he doesn't believe in bubbles, even though Japan had a huge bubble in the 1980s. He believes that deflation can be prevented, even though Japan couldn't prevent in the 1990s.

I often talk of the incredible arrogance and narcissim of people in the Baby Boomer generation, and how each one is in the center of the universe, and his words are the Golden Words of Truth, even when they change their minds or ignore any facts.

Here you see arrogance and narcissism at its height. Ben Bernanke, sitting on his grandmother's knee in the 1960s and listening to the "shoe factory" story reached some conclusions about how he was so much smarter than anyone who came before him, and even facts staring him in the face are to be ignored.

How does he explain his views in the face of clear, obvious contradictions in Japan? How does he justify his policies?

Why, it's simple. Japan's deflation was caused by politics. The people at the BOJ and the Japanese Diet were just plain stupid. They didn't know what they were doing, and they argued with each other so much that they never got things done.

And so, like any other Boomer, Bernanke has no concept of what's going on in the world. In the end, he's just like all the other Boomer politicians I talk about on this web site -- he knows how to argue and blame everyone else, be has little ability to actually get things done.

According to a recent article, recently published Fed minutes from 2001 reveal a policy of "calculated ambiguity":

This 2001 policy gives some insight into Ben Bernanke's policy today.

Bernanke has received a fair amount of pundit criticism in the last week, for not going far enough. Pundits have complained that the ½% reduction in the Discount Rate is too small a policy change to have any real effect, and that the Fed should be much more aggressive -- by lowering the Funds Rate ½ point or a full point.

In fact, as we described above, Greenspan followed a "preemptive and aggressive" policy in 2002 to head off deflation.

So we have two conflicting policies here: a "preemptive and aggressive" policy to head off problems before they start, and a "calculated ambiguity" policy that calls for a slower approach so that there's an excuse if the policy doesn't work.

My guess is that Bernanke is following a "calculated ambiguity" policy right now, and will become more aggressive only if it becomes necessary.

But here's the interesting question: As the economic situation becomes increasingly severe, how far will Bernanke go in using the tools described?

Will he go so far as to use all the tools available to him to flood the markets with money, and print so much money that inflation runs away and the dollar essentially becomes worthless?

|

I've been predicting since 2003 that we're in a long-term deflationary trend (like Japan in the 1990s). This is based on the adjoining graph that shows that long-term inflation is running above the exponential growth trend line and so, by the Law of Trend Reversion, must fall below the trend line for a long period of time. This means that the Consumer Price Index (CPI) has to fall 30% or more, which would indicate a great deal of deflation.

However, I've always had in the back of my mind that Greenspan, and now Bernanke, might defeat this trend by making the dollar worthless.

I actually don't believe that will happen. A policy of that type would have to be sustained for several years to have such a deleterious effect, and within a few months it would be seen to be failing.

But up to that point, we can expect to see Bernanke's Great Historic

Experiment proceed with an increasingly aggressive policy of

injecting money into the economy, until it becomes clear that such a

policy is a total failure.

(27-Aug-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004