Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

The housing news continues to get worse and worse.

I don't report on the latest housing news the way I used to because it's always the same -- prices fall, sales fall, inventories grow, foreclosures are surging. You don't need me to tell you what's going on -- it's in the news practically every day.

People who first said that there wasn't a housing bubble, then said that housing prices wouldn't fall, then said that they wouldn't fall far, then said that the fall in prices was over, then said that the fall in prices was over, then said that the fall in prices was over, etc., etc. -- all of those people were wrong, time after time.

On Tuesday morning, the new Case-Shiller home price indexes were released, showing declines in all 20 cities in the survey. Prices have fallen 12.7% in the last year.

The reason I wanted to cover this is because the Calculated Risk blog posted a very revealing graph of the situation:

|

There are several interesting things about this graph. (And by "interesting," I mean "depressing.")

First, you can see by the shapes of the curves that prices are in free fall, and there's no sign whatsoever of leveling off.

Furthermore, even in the best case scenario that you could hope for -- that next month the curves start leveling off (go through a point of inflection), forming a new "U", they would still continue falling for several months until the bottom of the "U" was reached. And that's the most optimistic scenario. The more likely scenario is that prices will keep falling for at least a couple of years.

Last, there was never much of a bubble in Denver and Cleveland, as you can see from the graph, but prices are still falling sharply, as if there HAD been a bubble. This shows that price plunges are going to far overshoot the long term trend line, and end up much lower than if a bubble had never occurred. (This result would be predicted anyway by the Law of Mean Reversion that I talk about all the time.)

I've estimated that the probability of a major financial crisis (generational stock market panic and

crash) in any given week from now on is about 3%. The probability of

a crisis some time in the next 52 weeks is 75%, according to this

estimate.

(30-Apr-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Is Al Gore planning a new movie, perhaps "An Inconvenient Famine"?

We're now into the second week of major mainstream media news coverage of the food crisis. After eight years of steadily rising food prices, it's about time.

Here's how one news story described the situation in Haiti:

For many Haitians, the mud biscuits are their only food. They taste of fat, suck the moisture out of the mouth and leave behind an aftertaste of dirt. They often cause diarrhea, but they help to numb the pangs of hunger. "I'm hoping one day I'll have enough food to eat, so I can stop eating these," Marie Noël, who survives with her seven children on the dirt cakes, told the Associated Press.

The clay to make 100 of the biscuits costs $5 (€3.15) and has risen by $1.50 (€0.95), or about 40 percent, within one year. The same is true of staple foods. Nevertheless, the same amount of money buys more of the mud cakes than bread or corn tortillas. A daily bowl of rice is almost unaffordable.

The shortages triggered revolts in Haiti last week. A crowd of hungry citizens marched through Port-au-Prince, throwing stones and bottles and chanting, "We are hungry!" in front of the presidential palace. Tires were burned, and people died. It was yet another of the rebellions that are beginning to occur with increasing frequency worldwide, but which are still only a harbinger of what is yet to come."

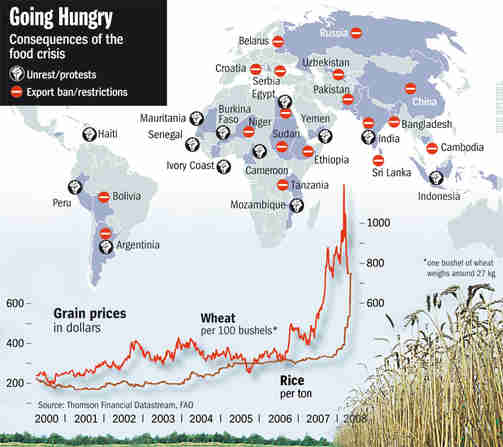

Unrest is increasingly breaking out around the world, as illustrated in this map from Der Spiegel:

|

The above map shows the increasing number of countries that are limiting food exports, and the increasing number of places where food riots and other unrest are taking place.

For some time now, I've been making fun of the global warming "crisis" as big farce, whose major purpose was to give organizers the chance to take jet planes to vacation spots like Bali and run air conditioners all day, while they sit around and whine about not having the chance to get rich over "carbon credits." The whole thing is a joke.

Unlike global warming, the food crisis is an actual, real worldwide crisis.

The United Nations held a food crisis conference on Monday and Tuesday, but they didn't hold it in Bali. They held it at the United Nations offices in Bern, Switzerland.

Secretary-General Ban Ki-Moon said the following:

|

We have agreed on a series of concrete measures that need to be taken in the short, medium and long terms. The first and immediate priority issue that we all agreed was that we must feed the hungry. The CEB calls upon the international community, and in particular developed countries, to urgently and fully fund the emergency requirement of $755 million for the World Food Programme, and honour outstanding pledges.

Without full funding of these emergency requirements, we risk again the spectre of widespread hunger, malnutrition, and social unrest on an unprecedented scale. We anticipate that additional funding will be required."

Here we see the first problem. Ban and the U.N. don't have a snowflake's chance in hell of getting that money. As Ban suggests, a number of countries (not the U.S.) have even not honored their outstanding pledges, and it's highly doubtful that they'll honor them AND pledge even more money.

Ban used the word "unprecedented" twice in the above quote. He said it was "an unprecedented challenge of global proportions," and that "we risk again the spectre of widespread hunger, malnutrition, and social unrest on an unprecedented scale."

Wrong, wrong, wrong. There is nothing unprecedented about this. This happened before WW II and before WW I. It happens before and during almost every major war, and is part of the complex of factors that lead to war. Fat and happy people don't need to go to war; starving people have no choice. This problem is VERY precedented.

As an example, read the account of the 1943 famine in India, in my November article, "UN expert calls biofuels a 'crime against humanity.'"

It always surprises me how many people still vastly underestimate the seriousness of this problem. Several web site readers over the years have suggested that new food technologies like hydroponics will solve any food shortage problem. Maybe they will ... some day, but there's no technology that will help in the short to medium term.

Other people believe that the food crisis is simply a bubble, and that the bubble will burst by natural means before long.

In support of this, a web site reader on Tuesday referred me to an article by John P. Hussman, president of Hussman Investment Trust:

In effect, we are observing a version of tulip-mania with foodstuffs. I would expect that prices will reach a speculative peak, probably within a few months, and then most probably plummet with very little in the way of relief rallies. That is a fairly predictable dynamic once commodity price movements reach the parabolic stage that they have entered lately. Still, it's not clear how high that parabola will ascend, because as the slope goes vertical, small differences in the exact point of the bust will lead to substantial differences in the price at the high. But the world has more arable land and more capacity to bring it into use within months and years than should cause near-term concern about a Malthusian breakpoint."

There are several problems with this analysis. For one thing, food prices have been increasing faster than inflation since 2000, and have really skyrocketed since 2004 -- but any evidence of speculators or hoarding has only surfaced within the last year. Furthermore, food stocks and inventories have been going down every year.

But a more important flaw is the reasoning that there's plenty of "arable land" that can be brought into use. There's much more to the problem than the single dimension of arable land.

We'll come back to this, but first, some people are calling for a new "Green Revolution" to repeat the success of the Green Revolution that was launced by the Rockefeller Foundation in 1948, and which revolutioned agriculture in India and other countries in the 1960s.

Just reading the above paragraph, you can see what an unrealistic idea that was. It took 20 years to implement that last Green Revolution. The current emergency may cause an explosion in less than 20 weeks.

The new Green Revolution is supposed to target Africa. At the UN conference, World Bank president Robert Zoellick responded to the calls for a new Green Revolution:

|

Now we can get back to Hussman's argument about "arable land." That's only a small part of the problem. Zoellick has listed a number of problems that have to be solved before the food crisis can be resolved in Africa.

Solving all of these problems would require the coordination of many countries and agencies, in a world where governments of one country after another are becoming increasingly paralyzed.

Once again, there isn't a snowflake's chance in hell that this new "Green Revolution" program will be put into effect.

I have mixed emotions about Hussman's argument that food prices are going to fall when the commodities bubble bursts, because it belongs in the "be careful what you wish for" category.

|

The prices of wheat, rice, and other staples WILL fall from their high bubble prices -- but only as part of the general deflationary spiral that the world will be facing.

At that point, however, many people in the world will starve, because food distribution systems will collapse in many parts of the world.

The picture above shows a shanty town in Mumbai (Bombay) India. There

are probably thousands of these around the world today, many of them

packed into cities of millions of people, with no local farmland. The

collapse of the commodities bubble will mean that food prices will

collapse, but the deflationary spiral will mean that food

distribution systems that normally deliver food to shanty towns like

this one will not be in operation.

(30-Apr-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

In an interview replayed on CNN on Sunday, originally broadcast on May 12, 2002, the late Palestinian leader Yasser Arafat expressed great affection for the Jews:

|

Western governments considered Yasser Arafat to be a terrorist.

Was Arafat playing to the cameras? Probably.

But were Arafat's emotions genuine? I believe so.

Arafat was born in 1930, so when he talks about playing with Jews as a small boy, he's talking about something like 1935. That was long before WW II, and long before the partitioning of Palestine.

In fact, Jews and Arabs did get along for centuries. Things began to change because of anti-Semitism in Russia and Europe that caused Jewish migration to the Palestine area. The migration turned into a flood in the 1930s, when Hitler came to power.

The violence began with rock-throwing, and only became full-scale genocidal warfare between Arabs and Jews when Palestine was partitioned and the state of Israel was created in 1948.

Arafat lived survived that horrible war and, like almost all survivors of generational Crisis wars, vowed that he would do anything possible to make sure that nothing like that ever happens again. The same was true of Ariel Sharon, Israel's Prime Minister and Arafat's counterpart.

A year after the interview, on May 1, 2003, the Mideast Roadmap to Peace was announced by the Bush administration and other Western governments. It called for side-by-side Jewish and Palestinian states by 2005. Obviously that never happened.

When the plan was announced, I wrote the following:

These two men hate each other, but they're the ones cooperating with each other (consciously or not) to prevent a major Mideast conflagration. Both of them remember the wars of the 1940s, and neither of them wants to see anything like that happen again. And it won't happen again, as long as both of these men are in charge.

The disappearance of these two men will be part of an overall generational change in the Mideast that will lead to a major conflagration within a few years. It's possible that the disappearance of Arafat alone will trigger a war, just as the election of Lincoln ignited the American Civil War. (It's currently American policy to get rid of Arafat. My response is this: Be careful what you wish for.)"

Seeing this old Arafat interview again brings back memories of what was happening in 2003. The West was furious at Arafat, blaming him for preventing blocking any peace plan from being implemented. In those days, the common wisdom was that when Arafat was gone from the scene, then a peace plan would go forward.

From the point of view of Generational Dynamics, that's total nonsense. Arafat wasn't blocking a peace plan. Arafat was keeping the younger Palestinian generations from exploding. Yes, Arafat was a terrorist, but from his point of view, an occasional terrorist act was the lesser evil, compared to a full-scale genocidal war, refighting the war of the late 1940s.

|

Arafat died in November, 2004, and the West rejoiced, believing that the Roadmap to Peace could finally be implemented. Instead, things have gone from bad to worse in the Palestinian territories, especially Gaza. Violent deaths are a daily occurrence, as are missiles launched from Gaza into Israeli towns.

Few people today would doubt that the Mideast is sliding toward a

major war. The death of Yasser Arafat, the man who called Jews his

"cousins," had exactly the opposite effect that Western governments

expected. That's why I wrote in my May 1, 2003, article quoted above:

"Be careful what you wish for."

(29-Apr-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Meanwhile, the deflationary spiral is in progress, but hyperinflation is not.

On Friday morning, I listened on CNBC to a discussion with two Nobel Prize winners in Economics give their explanations of what went wrong with financial instruments that led to the credit bubble that's now bursting.

|

The two were Robert Engle, 2003 Nobel Prize Winner in Economics, and Joseph Stiglitz, 2001 Nobel Prize Winner in Economics.

According to the program discussion, it was Engle who developed the mathematical models that were used by the financial engineers to develop the CDOs and related instruments that created the credit bubble.

The credit bubble created tens of trillions of dollars of securities (CDOs or collateralized debt obligations), backed by mortgage-based securities, on the assumption that the housing bubble would continue forever. The math behind these CDOs was based on numerous false assumptions, as I explained in "A primer on financial engineering and structured finance." (In addition, the same mindset that created the fraudulent CDOs also invented the hare-brained auction rate securities scheme, which has created in more trillions of dollars in worthless securities.)

And so, the issue under discussion was whether it was Engle's model that's to blame for the credit bubble and the current financial crisis.

This question was addressed to Stiglitz: "Is it a case of financial innovation gone awry? Is it a matter that regulators couldn't keep up with it fast enough? Was the model a force for good, and just misused?" Stiglitz' reply:

One of the things that's really quite striking is that they believed that they were creating new financial instruments, these new financial instruments were going to change the world, and yet, in estimating the risk, they had to use previous data, data from the world before they changed it.

So there was inherently a logical inconsistency in what they were doing."

This is a point that I've made numerous times, and discussed at length two years ago in "System Dynamics and the Failure of Macroeconomics Theory."

Stiglitz is saying that in this one case, economists tried to apply old financial models to new financial instruments, and the assumptions in the old models failed.

When I discuss this concept, however, I state it differently: In EVERY case, economists' macroeconomics models are always wrong, because they're ALWAYS based on old data, and the models don't take into account generational changes. By modifying the models to incorporate System Dynamics as applied to generational flow, the models would be much more accurate.

Stiglitz went on to discuss the issue of "correlative risk." This is also an issue that I touched on in "A primer on financial engineering and structured finance." The problem, in a nutshell, is that if everyone is using exactly the same model, doing exactly the same things, then one person making a mistake means that EVERYONE is making the same mistakes. In that case, mistakes correlate with one another, rather than occurring randomly:

So for example, big events like housing prices going down -- they felt you had to diversify, because you only own -- you had a portfolio of 1000 houses. How could 1000 houses all have problems?

Well, the answer is, if the housing market collapsed, if unemployment increases, if interest rates rise, a very large fraction of all of these are going to have problems.

They simply didn't take into account these kinds of correlative risk, and the extent to which these correlations might actually be increased by the fact that they were all using similar models."

Now what does this guy think -- that we're all idiots - which is what we'd have to be to believe this drivel.

He's saying that these brilliant Gen-X financial engineers all went to business school, all learned these complex mathematical models, then went into the financial industry and applied these models, creating CDOs and other complex financial instruments.

But ohhhhh, they forgot that unemployment might increase!! Duh!!

And ohhhhh, they forgot that interest rates might rise!! Duh!!

And ohhhhh, they forgot that the housing bubble might burst!! Duh!!

Does Nobel Prize winner Stiglitz really believe this? Does he really think the rest of us believe it?

At that point, the following question was posed to Professor Engle: "If everyone is using the same model, does that make it a less effective model? What do you think to that?" Here's his response:

Ohhh, now I get it. It's "the news" that's the problem. These financial geniuses created these CDOs and other financial instruments.

But ohhhhh, they forgot that the economy might slow down!! Duh!!

This is the kind of airheaded discussion that's become the norm among today's economists, even Nobel Prize winning economics. It's total gibberish, but that's OK by today's standards.

It's easy to see why Stiglitz and Engle are puzzled. It's the unspoken question in all of these discussions: How could massive, pervasive credit fraud have occurred throughout the entire financial and real estate industry? How could EVERYBODY in these industries, from top to bottom, all be so willing to practice such corruption and fraud, screwing investors and the general public for their own gain?

This is the question that they don't even try to answer.

Just as they never try to answer why the dot-com bubble occurred in the late 1990s. Why did the dot-com bubble occur at all, and why did it begin in 1995 rather than some other year, say 1985 or 2005? They don't try to answer that, even though the answer is completely obvious: 1995 was the time when all the survivors of the Great Depression were replaced, in senior management positions, with people who were born after the Great Depression. It's as simple as that, but none of the great geniuses even think of it.

And now, what about the credit bubble? Stiglitz and Engle are trying to figure out how the corruption and fraud could have been so pervasive, and why no regulators stopped it. So they had to grasp at something that affects everything, and they picked interest rates and unemployment. Well then, why didn't the same thing happen the last time interest rates rose and unemployment rose?

It makes no sense at all, but they never consider the obvious solution: There is one thing that's changed for every company of every type to people at every level, and that's generational changes. That's the one and only explanation that even makes sense, and yet it's never even suggested or discussed. Apparently it's too abstract for even Nobel Prize winners to grasp.

Also on Friday, CNBC economist Steve Lieseman presented some data about the surging default rate for CDOs. In addition to be very significant by itself, this data refutes the claims of Stiglitz and Engle.

If you've been following the financial news or this web site for the last year, then you know that many financial institutions -- Merrill Lynch, Citibank, Bear Stearns, etc. -- have been "writing down" assets in their portfolio. This means that these securities were on the books at an inflated estimated nominal value computed by a computer model. It had to be done this way because there was no market in which to buy and sell these assets. As the housing bubble began to burst, financial institutions -- completely against their will -- were forced to re-value or "write down" these securities more realistically.

The original inflated values were set by computer models that assumed that the CDOs were AAA rated, meaning that the probability of default is much higher than assumed. As the probability of default rose, the CDOs become worth less.

However, the writedowns were made without the CDOs actually defaulting. The re-valuing was done based on new assumptions that the CDOs had a much greater chance of defaulting than previously assumed.

Well now the CDOs are starting to default -- in high volume.

According to the data presented by Lieseman:

Lieseman somehow concluded that this was "good news" (everything is always "good news" on CNBC), but in fact these figures not only show that Stiglitz and Engle are wrong, they also show that the most cynical explanation is the correct one.

The innocence explanation that banks are giving for creating worthless CDOs and selling them to people is that they didn't understand that they were going to be worthless. Stiglitz and Engle supported this innocence explanation by saying that these poor financial engineers couldn't possibly have foreseen such things as the bursting of the housing bubble or a rise in interest rates.

But by 2007, it was perfectly clear that the housing bubble had burst, and that interest rates were rising. So by Stiglitz' and Engle's reasoning, the financial engineers should immediately have realized that their models were wrong, and the banks should have immediately stopped creating and selling CDOs.

But that's not what happened. What happened, as I've said before and has been confirmed by these new figures, is that the banks continued to create these faulty CDOs and sell them to investors.

In other words, putting Stiglitz' and Engle's reasoning together with Lieseman's figures, the only possible explanation is massive fraud by the banks.

And that doesn't surprise me at all, and shouldn't surprise any regular reader of this web site.

Recently, in the article "FBI joins SEC into wide-ranging investigation into mortgage-lending industry." we provided a lengthy list of all the actors in the housing and credit bubbles, and the kinds of fraud they perpetrated at all levels. It ran from homeowners who lied on their applications to brokers who lied about home values to lenders who adopted "predatory" lending practices to investment banks that created fraudulent CDOs and other mortgage-backed securities to ratings agencies that gave them AAA ratings in return for fat fees to "monoline" bond insurers that insured them for fat fees. The list is almost endless.

What Lieseman's figures show is that all these forms of fraud actually INCREASED as time went on. I've said this before, but Lieseman's figures prove it.

Economists like Stiglitz and Engle look at this massive, pervasive fraud, and have NO IDEA what's going on. How could so many people been involved? They have no explanation, and they grasp at straws.

I've given a complete explanation of the credit bubble in generational terms, showing how the Boomers first caused the dot-com bubble, and then how the Boomer/Gen-X interaction caused the credit bubble and the massive fraud. That's the only explanation that actually makes sense, unlike the ones given by Stiglitz and Engle.

And what I've also said before is that the stench is sickening. We're talking about huge numbers of people who defrauded poor people, investors and the general public for their own personal gain. We're talking about a financial industry culture, led by Boomers who were willing to overlook fraud for personal gain, and perpetrated by nihilistic, destructive, and self-destructive Generation-Xers who were willing to perpetrate any fraud, screw any person or group of people, for their own personal gain.

It's no wonder that Stiglitz and Engle and other mainstream economists are spouting nonsense to explain what happened. Even if they know what happened, they can't admit it because they'd be admitting their own complicity.

The current financial crisis has gone through several stages. First it was the finance and real estate industries defrauding investors and the public, with analysts and journalists saying that we're in a new modern world where prosperity would last forever.

Then, when the credit crisis began in August, there was a swing to risk aversion, as asset writedowns showed that financial institutions had been consistently lying to investors and the public.

Since then, we've had commercial banks, investment banks, ratings agencies, "monoline" insurers, analysts, journalists and government officials and regulators lying about what was coming.

The cycle has repeated over and over: Someone would say that everything was all right, and then the next day some earnings figures or other data would prove they'd been lying. Then they'd say that everything was all right, and the data would get even worse. And the cycle would repeat.

What's happened in the last couple of months is really ugly: The lying gets worse each time the news gets worse. Even worse than that is that investors are adopting the attitude that the news is so bad that it can't get any worse, and so it has to get better.

These people should have no credibility left at all, after everything they've said has turned out to be wrong, time after time. And yet, they seem to believe and support one another until the data proves them wrong. It's a variation of "honor among thieves."

An obvious example is the table of corporate earnings estimates that I've been posting, based on figures from CNBC Earnings Central supplied by Thomson Reuters. Here's the latest version:

Date 1Q Earnings estimate as of that date ------- ------------------------------------ Oct 23: +10.0% Jan 1: +5.7% Feb 6: +2.6% Feb 29: -1.1% Mar 7: -4.3% Mar 14: -7.8% Mar 21: -7.9% Mar 28: -9.3% Apr 4: -12.2% Apr 11: -14.1% Apr 18: -14.6% Apr 25: -14.1%

On January 1, the beginning of the first quarter, analysts estimate earnings growth of 5.7%. Those estimates have fallen almost every week since then, apparently leveling off around -14-15%. Don't be surprised if this estimate falls even further.

How can anyone possibly believe anything that analysts at Thomson Reuters, or ANY analysts, say at this point? And yet, investors appear to be mesmerized by estimates that earnings will grow 25-50% in the third and fourth quarters. How dumb do they have to be to believe that?

The situation that we have today is that the same financial managers, financial engineers, analysts, regulators and journalists who created and supported the housing and credit bubbles, through either their own stupidity or their own dishonesty or their own corruption or their own criminality are now continuing with exactly the same stupidity, dishonesty, corruption and criminality, because to do otherwise would be to admit to their own part in the growing financial crisis.

Amid all this stench of corruption, these people should have no credibility left whatsoever. Instead, they cling to credibility by supporting one another's corruption, watching as the news gets worse and worse, hoping for the day when they'll find someone besides themselves to take all the blame.

Are asset writedowns almost at an end? The banks, analysts and journalists are saying that they are, but they haven't gotten this right since the beginning, so we have to assume that they're being stupid, dishonest or corrupt, as they have been all along.

In fact, some figures published this week indicate that there's still a long way to go.

Let's begin with a table of all the asset writedowns so far (as of April 1) -- and keep in mind that in each case, the institution had said just a few days earlier that everything was perfectly fine:

Firm Writedown Credit Loss Total

----------------------- --------- ----------- -----

UBS 38 38

Merrill Lynch 25.1 25.1

Citigroup 21.4 2.5 23.9

HSBC 3 9.4 12.4

Morgan Stanley 11.7 11.7

IKB Deutsche 9 9

Bank of America 7.3 0.9 8.2

Deutsche Bank 7.4 7.4

Credit Agricole 6.5 6.5

Credit Suisse 6.3 6.3

Washington Mutual 0.3 5.5 5.8

JPMorgan Chase 2.9 2.1 5

Wachovia 2.9 2 4.9

Canadian Imperial (CIBC) 4 4

Societe Generale 3.8 3.8

Mizuho Financial Group 3.4 3.4

Lehman Brothers 3.3 3.3

Barclays 3.2 3.2

Royal Bank of Scotland 3.1 3.1

Goldman Sachs 3 3

Dresdner 2.7 2.7

Bear Stearns 2.6 2.6

ABN Amro 2.4 2.4

Fortis 2.3 2.3

Natixis 1.9 1.9

HSH Nordbank 1.7 1.7

Wells Fargo 0.3 1.4 1.7

BNP Paribas 1.3 0.3 1.6

DZ Bank 1.5 1.5

National City 0.4 1 1.4

Bank of China 1.3 1.3

Bayerische Landesbank 1.3 1.3

Caisse d'Epargne 1.3 1.3

LB Baden-Wuerttemberg 1.3 1.3

Nomura Holdings 1 1

Sumitomo Mitsui 1 1

Gulf International 1 1

European banks not 8.4 8.4

listed above

Asian banks not 4 0.7 4.7

listed above

Canadian banks 2.4 0.1 2.5

excluding CIBC

----------------------- --------- ----------- -----

TOTALS 206 25.8 231.8

And so, that's a total of $232 billion in asset writedowns, as of April 1.

What should we make of this list? Is this the end of the writedowns? Are institutions finally being honest, and confessing to everything, as investors seem to believe?

Actually, there's every reason to believe the opposite:

And so there's no motivation whatsoever to hurry up and write down assets, and there are HUGE motivations NOT to do so unless absolutely forced to. So there's ABSOLUTELY NO REASON to believe that the asset writedowns are anywhere close to completion.

Also, notice the following peculiarity: Recall from the figures above the Steve Lieseman provided that $179 billion in CDOs have ALREADY DEFAULTED. As Lieseman discussed when he presented these figures on CNBC, there's absolutely no way to correlate the defaulted CDOs with the writedowns in the list above. The banks are simply keeping all that information top secret. If $179 billion have already defaulted, you can be sure that there will be a lot more than $232 billion in writedowns to come.

One question that we might ask ourselves is this: How much are the assets in institution portfolios that MIGHT have to be written down in the future? It turns out that we know at least some of the answer to that question, thanks to new data that was posted last week.

But first we have to review some definitions. Last October, I described a new accounting rule, FASB Statement 157. This rule describes three categories of assets that an institution might have in its portfolios, and three different methods for determining their market values. Here are the three categories:

Valuations are based on "quoted prices in active markets for identical assets or liabilities." Prices appear on computer screens.

Assets in this category: Publicly traded stocks, listed futures and options, government and agency bonds, and mutual funds.

Valuations are based on "observable market data" for similar or comparable assets, such as dealer-pricing services based on surveys or other market bids and offers. Fewer screen prices.

Assets in this category: Emerging-market government bonds, some infrequently traded corporate and municipal bonds, structured notes, some mortgage and asset-backed securities, and some derivatives that don't trade publicly.

Valuations are based on management's best judgment, and involve management's "own assumptions about the assumptions market participants would use in pricing the asset." The process can employ pricing models based on estimates of future cash flows or other formulas.

Assets in this category: Some real-estate and private-equity investments, certain loan commitments, some long-term options, and less easily tradable asset-backed bonds.

Most CDOs and asset-backed securities are in the Level-2 category, and some are Level-3.

What's been happening since August is that as Level-2 assets either default or get written down, a chain reaction is created. These writedowns and defaults become "observable market data," and so by the "mark-to-matrix" rules, similar securities held by the same institution or other institutions must be written to comparable prices.

The new FASB Statement 157 accounting rules became effective on November 15, and now, five months later, the size of the assets in these categories has become public for some major institutions.

Bennet Sedacca on the Minyanville web site posted the following table of Level-2 and Level-3 assets for the eight largest holders in the U.S.:

Institution Level 2 Level 3

and ticker Assets Assets

------------------------- -------------- ------------

1) JP Morgan (JPM) 1,093,059,020 71,290,000

2) Citibank (C) 933,639,030 133,435,000

3) Bank of America (BAC) 781,805,030 31,470,000

4) Merrill Lynch (MER) 768,073,010 41,449,000

5) Goldman Sachs (GS) 620,985,970 96,386,000

6) Bear Stearns (BSC) 332,979,010 37,350,000

7) Morgan Stanley (MS) 304,052,010 78,168,000

8) Lehman Brothers (LEH) 199,830,990 42,508,000

------------------------- -------------- ------------

Totals 5,034,424,070 460,766,000

Putting all this together, here's what we know:

You can make your own judgment, but my judgment is that hundreds of billions of dollars or trillions of dollars of additional writedowns are being hidden by financial institutions, either inadvertently, or purposely, in order to mislead investors and the public.

And judging from the reactions of investors and the financial press, who are saying that the worst is over, the financial institutions' mendacity is being rewarded.

Little is known by anybody about the real structure of all of the the $700 trillion worth of credit derivatives in financial portfolios of institutions around the world, since they're totally unregulated.

One segment of those credit derivatives, the credit default swaps (CDSs) segment, totalling $45 trillion, is becoming better understood.

In particular, it's becoming clearer that the marketplace is creating long "chains" of CDSs that pose serious systemic risk to the global economy.

In general terms, here's how these chains are created:

Now you're happy because you've made a dandy little $10,000, and you sold all the risk the someone else. And B is happy, because he's made $90,000, and he knows that my CDOs are as "good as gold."

And so now B has netted $5,000, and he has no risk, because now C has all the risk.

Now you may think that the above example is fanciful, but as I understand what's going on, it is not fanciful. In fact, it's become standard practice among investment banks and hedge funds to offload risk in exactly this way. Hedge funds in particular have created tens of trillions of dollars of CDSs in order to offload risk with one another. The "monoline" bond insurers have acted as counterparties to many of these CDSs, in return for fat fees.

Now you can see the meaning of the phrase "counterparty risk." I've signed a CDS with you, and if my CDOs default, I'll expect you to pay me $1 million.

You think you're OK, even if you don't have $1 million to spare, because you've signed a CDS with another counterparty, B, who'll have to pay you the $1 million that you have to pay me. The counterparty chain goes through C, D, E, and so forth and, like any chain, it's only as strong as its weakest link.

With tens of trillions of dollars CDSs intertwined through investment funds and hedge funds, there is a great deal of fear that any large bankruptcy will cause a chain reaction that will cause multiple bankruptcies.

It was exactly this kind of CDS counterparty chain reaction risk that Fed Chairman Ben Bernanke was talking about when he testified before Congress to explain why the Fed saved Bear Steans from bankruptcy in March. Bear Stearns was going to go bankrupt within 24 hours, which would have caused a systemic calamity to the global economy.

At the end of the most interesting part of the testimony, Senator Bunning asked, "What's going to happen if a Merrill or a Lehman or someone like that is next?" He never got an answer to that question, but there's no doubt that the correct answer is a financial calamity.

I'm getting one or two questions each week from web site readers either asking about or disagreeing with my discussion of deflation and the deflationary spiral we're headed for.

Here's a recent message from a web site reader:

Now... I think that you are of the opinion that a deflationary cycle is coming. The article above suggests that inflation will happen becasue currencies are no longer tied to gold and so governments can just print more and more money.

There certainly seems to be two camps of thought on this issue, both camps having there fair share of people without vested or biased interests. I'm confused as to how these two camps could have such different views."

The spectre of deflation forces a historic change in economic theory:

Economists are shocked that the fight against inflation is over....

(8-Nov-2008)

What's coming next: Understanding the deflationary spiral:

Why are the dollar and the yen getting stronger, while the euro is getting weaker?...

(27-Oct-2008)

Roubini: The situation is "sheer panic," as hundreds of hedge funds are going bust:

Policy makers may need to close markets for one or two weeks....

(24-Oct-2008)

There's never before been a day like this on Wall Street.:

Possible exception: One of the days just before or after the 1929 crash....

(11-Oct-2008)

Ben Bernanke's Great Historic Experiment is at the brink:

Desperation sets in as credit markets continue to seize up....

(25-Sep-2008)

Government promises to buy bad debt to end the credit crisis:

Stock markets stage huge comeback as giddy investors pile in....

(19-Sep-2008)

Another stunning and historic bailout: Fannie Mae and Freddie Mac:

Giddy investors are popping the champagne corks....

(9-Sep-2008)

Long-term negative market trends asserting themselves strongly:

Stock and commodities prices plummet as worldwide foreclosures and recessions worsen....

(5-Sep-2008)

Money supply contracts dramatically, as credit markets continue to seize up.:

Former IMF chief: Worst of global financial crisis is yet to come....

(24-Aug-2008)

As commodities plummet worldwide, the meaning is unclear.:

We speculate on some possibilities....

(11-Aug-2008)

Alan Greenspan calls this a "once in a century" liquidity crisis.:

Says that the "big surprise" is the "impressive" American economy...

(3-Aug-2008)

More questions from readers on finance and investing:

Anxious readers wonder what's going on, what to do next....

(18-Jul-2008)

Pundits and analysts are baffled by the market's performance:

They have some interesting fantasies, as well....

(10-Jul-2008)

Questions from readers on finance and investing:

On fraud, the FDIC, China, and other subjects....

(23-Jun-2008)

Royal Bank of Scotland issues global stock crash alert:

"A very nasty period is soon to be upon us - be prepared,"...

(18-Jun-2008)

A clearer explanation of credit default swaps.:

How credit default swaps (CDSs) present a systemic risk to the global financial system...

(4-Jun-2008)

WSJ's page one story on Bernanke's Princeton "Bubble Laboratory" is almost incoherent:

So is Thursday's speech on bubbles by Fed Governor Frederic S. Mishkin....

(18-May-2008)

Brilliant Nobel Prize winners in Economics blame credit bubble on "the news":

Meanwhile, the deflationary spiral is in progress, but hyperinflation is not....

(27-Apr-08)

Investment bank UBS is now "writing down" clients' auction rate securities:

From individual investors to tech firms, people are losing their money....

(29-Mar-08)

Both consumer and commercial credit is disappearing as deflationary spiral accelerates:

Wall Street markets plummet 3% on Tuesday, as service sector contracts sharply....

(6-Feb-08)

Will hyper-inflation make the dollar worthless (like the Weimar republic)?:

I've gotten this question several times this week from web site readers,...

(21-Dec-07)

Questions and answers about the "credit crunch":

What's going on, and what you can do about it....

(6-Dec-07)

Understanding deflation: Why there's less money in the world today than a month ago.:

As the markets continue to fall, the Fed is increasingly in a big bind....

(10-Sep-07)

Bernanke's historic experiment takes center stage:

An assessment of where we are and where we're going....

(27-Aug-07)

Ben Bernanke's Great Historic Experiment:

Bernanke doesn't believe that bubbles exist. His Fed policy will now test his core beliefs....

(18-Aug-07)

Japan's real estate crash may finally end after 16 years:

To see where America is going, look what happened in Japan....

(20-Feb-07)

This week's financial data points to trend back toward deflation.:

Several inflationary indicators are down for June...

(17-Jul-04)

| ||

So I'll summarize the discussion again here, and leave anyone wanting more to read the "related articles" in the sidebar. Also, although mainstream economists talk about nothing but inflation, I would point out that I've been right a lot more often than mainstream economists in the last six years.

First, let's discuss the "gold standard" which, until 1971, pegged the value of gold at $35 per ounce. The argument being made by some (but not by Bernanke and other policy makers) is that the government could not "print money" in the 1930s because the dollar was pegged to gold, but could "print money" as much as it wanted today, making the dollar worthless, and pushing the economy into hyperinflation. Supporters of this view also use the term "fiat currency" to describe the dollar today, not pegged to gold, as opposed to the dollar before 1971.

This argument about the gold standard is completely irrelevant to the discussion in just about every possible way:

With regard to gold, I'm going to repeat a warning that I've posted several times before: The price of gold has been in the $300-500 per ounce range since the 1970s, except for the bubble in the early 1980s and the bubble going on today. The price of gold will almost certainly fall to the $300-500 range again, once the bubble bursts, even if it spikes briefly upward again. Gold is way overpriced today, and represents a very poor investment for most people.

As for the potential of hyperinflation, just consider the figures that have been given in this article: Hundreds of trillions of dollars in credit derivatives in institutional portfolios around the world; tens of trillions in credit default swaps (CDSs); over $5 trillion in CDOs and other "Level-2/3" assets. Add in at least $5 trillion as the size of the housing bubble, and additional trillions of dollars for bubbles in consumer debt.

All of that money is disappearing, as the credit bubble implodes. Are CDSs "real" money? Yes they are, in a very real sense. It's true that you can't go into the grocery story and purchase a quart of milk with a CDS, but you CAN (or at least COULD until last August) use those CDSs to purchase stock shares or other marketable securities.

When the Fed saved Bear Stearns from bankruptcy, it was not by "printing money." In fact, all the various actions taken by the Fed in recent weeks have been to permit commercial and investment banks to exchange their worthless CDOs for Treasury bills.

When a bank thus gets rid of its CDOs, it no longer has to write them down according to mark-to-market rules. Those worthless CDOs are then in the Fed's portfolio, where they will sit until either the bank has to take them back, or until the Fed can find another way to get rid of them.

So the real danger is not hyperinflation. The real danger is that the Fed itself will go bankrupt, when it becomes evident that those CDOs really are near-worthless.

And that's certain to happen, according to an analysis by Oppenheimer analyst Meredith Whitney. Here's what she said, describing the actions of commercial banks:

Well the problem is that each month that they wait, the asset values go lower, and then when the ratings agencies downgrade these assets, they're required to carry even more capital against those assets. ...

There are a couple of things that go on. So you have people that refuse to sell assets.... So if banks don't want to sell these assets, the longer they wait to sell these assets, the values decline.

But then when, all of a sudden, banks decide TO sell all these assets, there'll be a supply jam on the market driving prices down even lower, so there'll be more write downs. And ultimately, I think these financials will sell assets at well below today's market prices."

Whitney said that a month ago, and we can see that her predictions about falling asset prices have been coming true. This is indicated by the surging defaults in CDOs that we discussed earlier.

But now many of those near-worthless assets are in the Fed's portfolio, rather than in the banks' portfolios. So the real danger is not some kind of hyperinflation. The real danger is the total collapse and bankruptcy of the Federal Reserve, as the value of its assets become worthless. This will create a massive chain reaction, resulting in the collapse of tens of trillions of dollars worth of CDOs, CDSs, auction rate securities, and other near-worthless securities, the detritus of the burst credit bubble.

As I've been saying for years, the credit bubble has to burst. It's already leaking, and it's leaking faster and faster. At some point, the chain reaction just described will begin. This won't cause hyperinflation, because the Fed has only a tiny amount of money available to it, compared to the massive money losses that will occur. Those massive losses will create the deflationary spiral that I've described.

I've estimated that the probability of a major financial crisis (generational stock market panic and

crash) in any given week from now on is about 3%. The probability of

a crisis some time in the next 52 weeks is 75%, according to this

estimate.

(27-Apr-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Appearing on PBS on "Bill Moyers' Journal," Reverend Jeremiah A. Wright Jr. was given a full hour to explain his numerous well-publicized anti-American remarks, including his accusations that America is rooted in terrorism, that the 9/11 attacks were "the chickens coming home to roost" for America's crimes, and that the US government created the Aids/Hiv virus as a weapon to exterminate blacks.

The one-hour interview appeared on PBS's Bill Moyers' Journal on Friday evening, and is being repeated during the next few days.

Listening to Wright, I was reminded how easy it is for hate-filled racist bigots to have no trouble cherry-picking "facts" to justify their prejudices. Hitler never had any trouble justifying his hatred of Jews, the Ku Klux Klan never had any trouble justifying their hatred of blacks, and Wright had no trouble justifying his hatred of America. These people are all of the same cloth.

Whenever I hear Reverend Wright screaming "God damn America! God damn America! God damn America!", I feel the need to take a shower. However, that option isn't always available.

So for those of you who feel the same way, I offer you the following video of Canadian singer Celine Dion to serve as a very effective antidote:

(27-Apr-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web.com (Interland) is bouncing e-mail messages again.

If you've sent me an email message in the last week, then it's possible that I haven't received it.

Right at this moment (Friday morning) all e-mail messages to generationaldynamics.com are being bounced, because of problems on their systems. This apparently has happened off and on for the last week.

If you send me an e-mail message, please copy it to the following gmail account that I've set up: jxenakis123@gmail.com . That way, I'll get it one way or the other.

Also, you can use one of the "Comment" forms, such as the one on the right.

(25-Apr-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

After years of price rises, mainstream media is finally recognizing there's a problem.

Food rationing comes to the United States:

After years of price rises, mainstream media is finally recognizing there's a problem....

(24-Apr-08)

Food panics and riots spread around the world:

The unending sharp price wheat, corn and rice prices are destabilizing nations....

(9-Apr-08)

UN World Food Program to institute food rationing:

Surging food prices are causing food riots around the world....

(26-Feb-08)

Wheat price rises blocked by commodities market price increase limits:

American wheat stockpiles are lowest since just after World War II....

(9-Feb-08)

Wheat prices surge above $10 per bushel, sparking little concern:

World food stocks dwindling rapidly, according to the UN....

(23-Dec-07)

UN expert calls biofuels a "crime against humanity":

Separately, Oxfam says that biofuels won't work, and they "trample" poor people....

(7-Nov-07)

United Nations warns of social unrest as food prices continue meteoric climb:

With world wheat prices now up 60% since January, countries are panicking...

(08-Sep-07)

World wheat prices up 30% since May on panic buying:

Wheat prices hit an all-time record high, as stocks are low, and poor weather...

(25-Aug-07)

The global warming fad is becoming the enemy of food production.:

Food prices are continuing to increase sharply around the world....

(16-Jul-07)

Price of food is skyrocketing in India and China:

In fact, crop prices are increasing around the world,...

(11-Apr-07)

In Mexico, violent crime from drug cartels increases with tortilla prices:

After Acapulco incident, Canada may advise citizens not to travel to Mexico....

(8-Feb-07)

UN World Food Program will cut Darfur humanitarian rations in half:

This continuing genocide is a very sad situation, but it can't be stopped....

(29-Apr-06)

In a new bizarre move, North Korea demands an end to U.N. food aid:

The famine-stricken country officially told the UN World Food Program...

(26-Sep-05)

Food prices continue to increase dramatically around the world:

Hunger, poverty and starvation are spreading to increasing masses of people around the world,...

(10-Aug-05)

China appears to be approaching a major civil war :

Unrest is spreading, and economic disparities make China a textbook case for a massive civil war in the making

(16-Jan-2005)

Green Revolution vs Malthus Effect: Despite the "Green Revolution," world population continues to grow faster than food production. This is one of the fundamental reasons why wars occur. (28-Jun-2004) | ||

It has been a mystery to me for years how the world could possibly be so oblivious to the growing problem of food scarcity and higher food prices. I first wrote about this in 2004 in "Green revolution vs the Malthus effect," and the mystery has been growing since then as the problem has gotten worse every year. Food prices have been growing faster than inflation since 2000, and started spiking rapidly by 2007.

The "Malthus Effect" is a term that I coined for the phenomenon that population grows faster than the food supply, resulting in genocidal wars. Thomas Roberts Malthus first wrote about this in 1798, but he made a mistake in concluding that food scarcity and rising food prices would cause famine. What I call the "Malthus effect" corrects this error by concluding that food scarcity and rising food prices would cause genocidal war, as populations compete for scarce resources.

It's somewhat of a cultural breakthrough that this past week, BBC, CNN, CNBC and other major media channels finally devoted a great deal of air time to the worldwide food crisis.

What really has caught everyone's attention is that major warehouse clubs Sam's Club and Costco are in the process of limiting sales of rice, and considering the same for flour and for some oils.

The motivation for rationing is that large purchasers, especially restaurant chains, are hoarding large quantities of rice because the price keeps on increasing. The world price of rice has more than doubled in the last year, and increased 47% just this year. Prices are expected to continue increasing at least until 2009. And so large purchasers are hoarding to save money, resulting in rationing.

In fact, food scarcity and food prices are creating destabilization all of the world. Haiti's government fell last week because of rising food prices, and rice-producing countries, including China, India, Vietnam and Egypt, have been limiting or forbidding exports.

The world's largest rice exporter, Thailand, is also considering export bans to prevent internal shortages. The World bank is warning that if Thailand reduces exports, then panic buying may be triggered throughout Asia.

World Vision International, which provides food relief in 35 countries, said it can no longer provide rations to 1.5 million of the poor people it fed last year because of soaring costs.

This is affecting everyone in the world, creating pools of hunger and starvation in many different places.

If the situation is so bad that the United States, the best-fed country in the world, is forced to resort to food rationing, then you can just imagine what must be happening in the developing world.

It's only a matter of time before one of those pools of people turns into a hungry mob, and then an angry mob.

Reggae isn't my favorite kind of music, but this video of Bob Marley's "Them Belly Full" is really great, and carries an important message:

Them belly full but we hungry

A hungry mob is an angry mob

A rain a fall but the dirt it tough

A yot a yook but the yood no 'nough

You're gonna dance to Jah music, dance

We're gonna dance to Jah music, dance

Forget your troubles and dance

Forget your sorrows and dance

Forget your sickness and dance

Forget your weakness and dance

Cost of living get so high

Rich and poor they start to cry

Now the weak must get strong

They say, oh what a tribulation

Them belly full but we hungry

A hungry mob is an angry mob

A rain a fall but the dirt it tough

A pot a yook but the yood no 'nough

We're gonna chuck to Jah music, chuckin'

We're gonna chuck to Jah music, chuckin'

Chuckin', chuckin', chuckin', chuckin'

Belly full but them hungry

A hungry mob is an angry mob

A rain a fall but the dirt it tough

A pot a cook but the food no 'nough

A hungry man is an angry man

A rain a fall but the dirt it tough

A pot a yook but the yood no 'nough

A rain a fall but the dirt it tough

A pot a cook but the yood no 'nough

(24-Apr-08)

Permanent Link

He denies the 'erotic fantasy' reports of an affair with Alina Kabaeva

|

The Moscow newspaper Moskovski Korrespondent was forced to shut down, and its editor, Grigori Nekhoroshev, was forced to resign, in retaliation for printing rumors that Putin had divorced his wife, and was going to marry rhythmical gymnast Alina Kabaeva, a superstar and gold medal winner at the 2004 Olympics in Athens. (See my article, "Vladimir Putin finds a way to retain power in Russia" for more details about the rumors.)

"Our director came to the newsroom and told us we were being shut down," said the shaken editor Nekhoroshev. "As far as the story is concerned I’ve full faith in my correspondents."

Several hours earlier, at a press conference in Sardinia with the Italian Prime Minister Silvio Berlusconi, Russian journalist Natalia Melikova asked Putin about the rumors.

Berlusconi immediately gestured at Melikova, pretending to be shooting her with a gun.

There's little doubt that Berlusconi was joking, but the joke isn't so funny when you consider that other Russian journalists who displeased the Kremlin ended up with bullets in them.

At the press conference, Putin derided the “snotty noses and erotic fantasies” of the journalists reporting the rumors, which he denied, saying: "There is not a word of truth in this story. Politicians live in glass houses, everyone wants to know how they live, but there are limits and there is a private life and these limits should be respected. ... Other publications of a similar nature have in the past mentioned similar stories about me and women entertainers and attractive young girls and it will come as no surprise to you that I don't like them."

Melikova reportedly was reduced to tears by the incident at the press conference, but later said, "I saw Berlusconi's gesture and I know he has a reputation as being a joker. I hope there are no consequences." I suspect that Melikova has learned her lesson.

But there were consequences for Moskovski Korrespondent, and its

editor, as the paper was shut down just a few hours after the press

conference.

(23-Apr-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

None of Obama, Clinton or McCain have any idea of this.

Last month, in my article on Ma Ying-jeou's presidential victory in Taiwan, I quoted a BBC report by BBC correspondent Humphrey Hawksley claiming that China has decided that economic development with Taiwan is so important that "unification" of Taiwan with China has become irrelevant.

I was very critical of this view, and so I was extremely flattered last week to receive an e-mail message from Mr. Hawksley himself pointing out an IHT.com article in which he expands his thoughts in much greater detail:

High-level conferences did not bring peace. Nor has one side battered the other into submission. Time, pragmatism and compromise produced a win-win formula that could serve as an example elsewhere - the Middle East, the Balkans, Tibet. It's already being replicated between the U.S. and China.

China and Taiwan have each become so irreplaceable to the global supply chain that the benefits of the status quo, coupled with increased living standards, far outweigh those of causing trouble.

The information-technology sector alone gives an idea of how easily a China-Taiwan conflict could paralyze world consumer markets. Between them, China and Taiwan control much of the computer Internet market.

On a wider scale, economic links between China and Taiwan continue to grow. More than 50,000 Taiwanese companies operate in China. Taiwanese overall investment there is at least $150 billion, with more from Taiwanese-owned offshore companies. China-Taiwan annual trade is more than $100 billion, and products of this alliance involve supply chains from dozens of other countries.

Add China's reliance on exports to the United States and its billions of dollars of U.S. debt, and the scenario of all this suddenly unraveling becomes unthinkable, conjuring up a Cold War comparison of a "mutually assured destruction" through economic instead of nuclear strikes. The difference is that bankers and economists, not generals, call the shots.

In recent years this economic reality has increasingly loomed over Chinese and American policymaking, paving the way for a permanent peace. "Beijing made a decision in the summer of 2002 that the economic development of China was more important than the unification of the motherland," explained Chong-pin Lin, president of the Foundation for International and Cross-Strait Studies. "And that was inter-related to another principle of placing cooperation with Washington higher than conflict with Washington." ...

For its part, the United States since 2003 has taken the side of China whenever Taiwan makes rumbling noises on the issue of independence. This inconsistency between America's claim to a global democratic mission and its warning to Taiwanese voters not to upset the Chinese apple cart is another example of the changing paradigm. "America is praising the people of Iraq for going to the polls yet at the same time condemning us for having a vote to express our desire to be part of the international community," notes Bi-khim Hsiao, international affairs spokesman for Taiwan's defeated Democratic Progressive Party. ...

The United States could eliminate this inconsistency by using the very model that it fostered - "China-Taiwan supply-chain diplomacy" - to motivate other conflict zones towards peace.

One crucial marker is the link between economic performance and political maturity. According to the Taiwan Institute of Economic Research, it was only possible to begin dismantling Taiwan's dictatorship in the mid-1980s when the per capita GDP had reached $5,000. David S. Hong, the president of the institute, suggests that China will not be ready for such a transformation until per capita GDP reaches $15,000, perhaps more than a generation from now. At present the GDP is about $2,000, against Taiwan's $17,000.

Both the Chinese government and Tibetan activists could learn from the Taiwan example. At present, decades of Chinese investment and economic growth in Tibet have had scant effect on Tibetans who cling to their culture and religion even if that means less material improvement. China, too, remains determined to preserve its control over Tibet no matter what the economic cost may be. It's a lose-lose situation. ...

Humphrey Hawksley is a BBC correspondent. His latest book "Security Breach," is due out in August. Reprinted with permission from YaleGlobal."

At its heart, this is the "war is bad for business" argument, which can be used to prove that no major war can ever occur -- until it does.

Practically every major war in history was conducted by belligerents that were doing business with each other.

For example, England and France have had robust commercial ties, ever since the French Normans and William the Conqueror conquered England in 1066. And yet, those commercial ties meant nothing in one major war after another.

The problem is that these major wars ("generational Crisis wars," as I refer to them) almost never make sense in retrospect. How could Japan have POSSIBLY decided to bomb Pearl Harbor, when the US was many times larger than Japan, and clearly would win the subsequent war? In the American civil war, how could the South POSSIBLY have decided to initiate war, when the North was three times larger than the South? It was easy to prove that neither of these wars could ever possibly occur -- until they did.

So the "war is bad for business" argument may challenge the motivation of SOME wars, but it clearly is completely irrelevant for many of the major wars of history.

I refer to this distinction frequently on this web site, but the current debate over China and Taiwan makes it appropriate to look at it a little differently.

These are two completely different war paradigms, reflecting two completely different ways that wars can begin. Few people grasp this distinction, even though it's crucial to understanding where the world is going today.

We've actually had two recent wars that illustrate this clear distinction:

Many of these arguments turned out to be wrong later, but that's not my point. My point is that this war was pursued in a methodical, rational manner, following months of debate. Even today, pursuit of war is still being debated -- in Congress, in the media, in the United Nations. This was illustrated by the "surge" scenario, which was pursued in conjunction with methodical, rational worldwide debate.

There was no lengthy international debate prior to the beginning of this war. To the contrary, this war was unthinkable before it happened. Prior to summer 2006, almost nobody even contemplated the possibility that Hizbollah would be showering Israel with missiles, and Israel would be bombing and destroying Lebanon's infrastructure. To say that such a war was "bad for business" is a vast understatement.

Once again, contrast this with the Iraq war just described, where it was debated endlessly before it happened, and various endgame scenarios were laid out by different parties supporting or opposing the war. There were no endgame scenarios laid out for the Israel-Lebanon war, because almost no one thought that such a war was even conceivable.

And yet, Israel panicked, miscalculated, and attacked Hizbollah and Lebanon within four hours after the kidnapping of two soldiers -- with no plan, no clear objectives. Once the war began, Israel blundered from one objective to another, one plan to another. The entire war was pursued through improvisation.

First, Israel would just pursue the war through air power. Then they'd need just a few ground forces. Then they'd need a few more ground forces. Finally there was a large Israeli army in Lebanon. If you'd like to refresh your memory about what happened, read "How Israel panicked in pursuing the summer Lebanon war with Hizbollah" and "Israeli governnment in crisis after report on war with Hizbollah."

What about international debate? There was indeed a great deal of international debate in the United Nations Security Council and in the world media -- but it only began well after the war started. And then what all the debate was about was how to create an international force that would sit "between" the Israeli and Hizbollah forces, so that the war could stop. Once again this contrasts with the Iraq war -- there was never any discussion of an international force to go between the American and Iraqi armed forces.

The fact is that when those two Israeli soldiers were kidnapped, nothing else mattered. NOTHING. Israel's prime minister Ehud Olmert didn't ask, "How will this military action affect sales of Israeli bagels to Lebanese grocery stores?" All such reasons instantly dissolved into irrelevance. "War is bad for business" was not even a momentary consideration. Even though the Lebanon war was impossible before it happened, it happened anyway. And now, two years later, the two Israeli soldiers are still being held hostage by Hizbollah.

That's the flaw in the "war is bad for business" argument about China and Taiwan.

You have to understand this distinction if you want to understand where the world is going today. People don't think in terms of the "crisis war paradigm," because they've rarely seen anything like it since World War II ended, and when it occurs, it's considered an aberration.

The 1994 Rwanda genocide is an excellent example of a Crisis war, and the international community is still totally baffled as to what happened and why. They have NO IDEA what caused that genocide to occur.

And now we have the Darfur genocide. When it received worldwide attention in 2004, I predicted that the UN would not stop the genocide, because it was a Crisis war, and crisis wars have to run their course. That's exactly what happened, and now, four years later, the Darfur war appears to be no closer to a conclusion than it did in 2004.

That's why I say that politicians, journalists, analysts and historians have no idea about these two different war paradigms, even when they're perfectly obvious. The wars in Rwanda, Darfur, and Lebanon were launched as Crisis wars, and it never occurs to anyone that exactly the same thing could happen with China and Taiwan.

Furthermore, the generational aspect of this is all-important. These Crisis wars can only be launched during generational Crisis eras -- those periods of time beginning 55-60 years after the end of the last Crisis war, when all the survivors are disappearing (retiring or dying), all at once. As long as the survivors of the previous Crisis war are alive and in charge, they make it their life's goal to prevent anything to so horrible from happening again. When the survivors die off, the younger post-war generations have NO IDEA what's coming.

It's worth emphasizing this point more. People who lived during World War II, even as children, saw this kind of irrational, panicky warfare over and over. WW II was not just one war -- it was many wars being fought simultaneously, and each one of these component wars was shocking in its own way. People who lived through that recognize those kinds of panicky emotions, and they spend their lives preventing that kind of war from happening again.

The housing bubble began in 1995.:

This means that the housing crisis will last for almost another decade....

(8-Sep-2009)

Laughable SEC report on Madoff absolves SEC management of blame:

"Confusion" and "inexperience" of young SEC staff members are blamed....

(6-Sep-2009)

Stories of massive generational fraud and corruption continue to pour out:

Long-time readers of this web site know how much my life...

(14-Apr-2009)

The economy, the stimulus plan and the budget plan all continue to unravel:

Markets keep falling as world economic trends continue to plunge....

(2-Mar-2009)

Neil Howe calls Early Gen-Xers the "dumbest generation":

I disagree - Boomers are the dumbest generation....

(10-Dec-2008)

'Liberation Hero' Robert Mugabe now destroys Zimbabwe with cholera:

Adding to his record of mass torture, slaughter and economic destruction,...

(8-Dec-2008)

A generational view of China's growing melamine food disaster:

On Thursday, the FDA issued a nationwide alert, banning Chinese dairy products...

(17-Nov-2008)

How Boomers and Generation-Xers brought about the dumbing down of Information Technology (IT) :

Software development has adopted a Java cookbook approach that leads to project failures. Also: How Digimarc Corp. self-destructed with management's cookbook programming mentality.

(1-Jul-2008)

Questions for readers: Managing Boomers vs Generation-X in the workplace.:

Also an ethics question: When do you tell the boss that the project is crashing and burning?...

(5-Jun-2008)

Teen "emo subculture" creating violent fault line in Mexico City:

The depressive 'emotive' music style is also being blamed for suicides in Europe....

(25-May-2008)

Software development projects for Moody's, Digimarc, Y2K, DEC further illuminate Gen-X nihilism:

As Boomers and Gen-Xers have taken charge, software development standards have suffered....

(23-May-2008)

China and Taiwan: Understanding two different war paradigms:

None of Obama, Clinton or McCain have any idea of this....

(23-Apr-08)

NY Governor Elliot Spitzer: A Generation-Xer gets his comeuppance:

Rarely has someone's fall from grace been met with so much glee....

(12-Mar-08)

Reader comments on the Nihilism of Generation-X:

Who's more at fault for our problems - Gen-Xers or Boomers?...

(29-Jan-08)

The nihilism and self-destructiveness of Generation X:

Who's more to blame for our troubles: The Boomer generation or Generation X?...

(21-Jan-08)

Markets fall as investors are increasingly unsettled by bad economic news:

Hopes for quick return to "normal" bubble growth are fading....

(21-Nov-07)

| ||

The survivor generations are so successful in preventing that kind of panicky war that the younger generations are completely unprepared for it. The US has had several non-crisis wars -- the Korean War, the Vietnam War, the 1991 Gulf War -- all fought in the "non-crisis war paradigm." Today's Boomers and Gen-Xers have never experienced anything remotely like a Crisis war.

And when they occur in other nations, they're considered aberrations. According to this reasoning, the Rwanda and Darfur wars are caused by tribal juices, and the Iran/Iraq war are caused by Arab war proclivities. This is nonsense. Crisis wars happen in all nations, though on different timelines.

That's exactly how these crisis wars begin, and how war with China will begin. Perhaps it will begin with an incident in Taiwan. Or perhaps it will begin with an incident with Japan over the Senkaku / Diaoyu Islands. Or, perhaps it will begin within China itself. One web site reader recently wrote to me that it's most likely to begin within central Asia. The scenario can't be predicted, but the final result is certain.

In discussing the Iraq and Lebanon wars above, I glossed over a couple of important points that I'd like to mention now:

For those students of generational theory who wish to understand what happens in a Crisis war, I cannot emphasize too strongly how valuable it is to study the 2006 Israel/Lebanon war.

When I wrote about the winners and losers of the Lebanon war, I contrasted the war styles of the two parties. Both sides followed their generational scripts almost to the letter.

Israel fought in a typical crisis era panicky "hot" war style, furiously bombing infrastructure, calling up new reserves every day, confronting Hizbollah terrorists on their own soil, and feeling very anxious about the U.N. peace deal after the war. In fact, the "58 year hypothesis" also applies to the Israeli situation -- it occurred 58 years after the 1948 partitioning of Palestine and creation of the state of Israel.

If Hizbollah had fought in a "hot" style, they would have crossed the border into Israel and killed Israelis in their own homes.

Instead, Hizbollah fought the war in a "cool," methodical non-crisis war style. They launched missiles from their home soil, retreating to their homes or to bunkers as needed. They methodically goaded Israeli into supplanting their air-only war with a ground war, requiring thousands of Israeli soldiers to fight on Lebanese soil. The goaded the Israelis into destroying Lebanese infrastructure, and killing Lebanese civilians, including women and children.

The contrast could not have been sharper, and clearly illuminates some of the major differences between crisis and non-crisis wars.

In the case of China and the United States today, the "war is bad for business" argument would have applied ten years ago, when there were plenty of survivors around from the two Crisis wars -- World War II for America, and Mao's Communist Revolution for China.

The level of anxiety and paranoia between China and the West is growing daily, as I wrote last week, in conjunction with Tibet and the Olympics torch protests. The West is becoming increasingly suspicious about China, and China is becoming increasingly furious with the West. As I wrote, there's plenty of anti-Chinese bigotry in the West, and the Chinese have good reason to be angry about it, but the problem is that the Chinese are increasingly crossing the line into paranoia, claiming that Western governments and media are purposely campaigning against China. This is exactly the kind of atmosphere that can lead to panic and a military intervention that spirals out of control into a full-fledged Crisis war.

In addition, the 58-year hypothesis fully applies to this situation, since Mao's Communist Revolution ended 59 years ago, in 1949, in the massive bloodbath that led millions of Chinese to flee to the island of Formosa (Taiwan).

Applying the 58 year hypothesis to China today is speculation, and so let's speculate. The Chinese Communist Party (CCP) Central Committee is made up of people in exactly the age group we're talking about -- roughly 63 years old and older, who remember that final bloodbath from their childhood. When these men and women talk to one another, they have a visceral connection with one another, not wanting that bloodbath to be repeated; when they talk to younger people, the younger people can barely figure out what they're talking about. That's the muscle behind the 58-year hypothesis.

In other words, the people in the CCP Central Committee may decide that time is not on their side. They may reach the conclusion that if they don't recover Taiwan quickly, then there'll be a negative outcome. What negative outcome? Here are some possibilities: