Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

In an emergency move, Iceland's central bank raised interest rates to 15%.

Iceland's central bank raised interest rates by 1.25% this week to a record 15%, in an effort to support the country's crashing currency.

The statistics are grim. The króna ("krona" or "crown") currency has fallen in value over 30% since January 1 against the euro, over 3% on Friday alone. And inflation has jumped sharply in March to 8.7% from February's 6.8%.

How will raising the interest rate to 15% help the situation? That's because, in the words of Iceland's critics, for the past few years, Iceland has been acting like a hedge fund, instead of a country.

I actually wrote about this early in 2006, with an article entitled "Sudden collapse of Iceland krona portends bursting of 'carry trade' bubble."

At that time, there was some fear that the international "carry trade" was going to crash. After writing that article, I learned that those in the international carry trade are ALWAYS in fear that it's about to crash, so I dropped the subject.

However, this time the fear isn't over the international carry trade, but over possible failure of Iceland's banks.

It used to be that Iceland made most of its income from fishing. But in the last decade, Iceland got into the carry trade business. Iceland's central bank sent interest rates so high -- over 10% -- in order to encourage foreign investors to borrow money from Japan (where the interest rate is close to 0%), and then invest it in Iceland.

In any other country, setting interest rates so high would cause a deep recession, because businesses would not be able to borrow money at those high rates. But Iceland got away with it, because foreign investors would invest in Iceland to take advantage of the high rates.

In other words, it was just another way to abuse credit and make money in the credit bubble. On this web site we've discussed all kinds of abuses -- collateralized debt obligations (CDOs) and lately auction-rate securities (ARSs).

Now we have this additional scheme to make money in the credit bubble -- turning the country into a hedge fund and take advantage of the carry trade.

Now that the credit bubble is deflating, there's a credit crunch, where everyone is hoarding cash.

And so, Iceland's scheme is falling prey to the credit crunch for exactly the same reasons that CDOs and ARSs are failing -- because "cash" means "dollars" or "euros" or "yen," but does not mean Icelandic króna. Many investors now consider the króna to be as risky as subprime mortgage loans. Money is pouring out of Iceland, and the value of the currency is falling rapidly.

|

And so the Iceland central bank has raised the interest rate to 15% in a desperate move to attract investors back.

Will it work? Lots of people don't think so. The interest spread on credit default swaps (contracts that "bet" that a company or, in this case, a country, will default) has been been surging so high that it means that investors are essentially betting that Iceland's banks WILL default.

Well, the Fed saved Bear Stearns from default and bankruptcy. Maybe

the Fed (or the European Central Bank) will save Iceland from default

and bankruptcy. We should soon know.

(31-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

From individual investors to tech firms, people are losing their money.

Last month, investors were told that they couldn't get their money out of funds that they'd invested in -- funds backed by auction-rate securities (ARSs) that they'd been told were as "good as cash," but which paid slightly higher interest rates than standard money market funds.

Now, UBS AG is telling investors that it's marking down the values of those investments. On Friday, according to an article in the Wall Street Journal, UBS began notifying investors that it will begin marking down the values of the securities in investors' accounts.

The markdowns will range from about 5% to more than 20% of the principal, depending on the securities.

Oh wait, there's good news: "The losses won't be realized immediately, as investors are currently unable to sell the securities for lack of a market," according to the article.

So, your investments have been marked down, but that's OK because you still can't get your money out anyway.

In related news, high tech firms such as hand-held-device maker Palm Inc., internet-service provider EarthLink Inc. and internet job-search company Monster Worldwide Inc. are being forced to acknowledge substantial asset writedowns.

High-tech firms are particularly vulnerable, because they often keep a lot of cash on hand to make deals with. Auction-rate securities have been an attractive investment vehicle because they pay better interest rates than cash and because they're "as liquid as cash," a claim that's now turning out to be false. Starting next month, the list of companies disclosing large ARS holdings "is going to grow pretty quickly," according to an analyst, and many of these firms are going to be forced to write down significant portions of their assets.

If this prediction is true, then we'll see a huge ominous new twist in the credit crisis. For months we've been seeing large asset writedowns by numerous financial institutions. A spate of writedowns from high-tech firms would show that the "subprime virus" is now spreading rapidly outside of the financial community into the larger corporate arena, as well as to individual investors. From the point of view of Generational Dynamics, this change must come sooner or later anyway, but it will be a shock to the public when it happens.

Interestingly, these assets being written down are not always CDOs or other mortgage-backed securities. More and more, the problems are with auction-rate securities (ARSs), which are "a whole nother thing."

Generally speaking, when you make a long-term investment, you can expect a higher yield (interest rate) than with a short-term investment, since a long-term investment carries a higher risk of default.

In the 1980s, investment brokers started using a trick. A municipality or a corporation would issue long-term bonds, and normally would have to pay high interest rates to investors in the bonds. But investment brokers converted the long-term bond into a series of short-term securities. Thus, a 10-year bond might be split up into 120 one-month securities. Since one-month securities normally pay much lower yields than 10-year bonds, the municipality or corporation would have much lower interest rates.

The only problem is that while a 10-year bond has to be sold only once, the one-month securities have to be sold over and over again, each month. So the investment brokers would hold monthly auctions, allowing investors to bid on the short-term securities. (In actual practice, these auctions might be held every 7 days, every 28 days, or every 35 days.) Since the yield (interest rate) on these short-term securities can change every time there's an auction, they're called "auction rate securities," or ARSs.

You know, I heard of this scheme some years ago, but I never paid much attention to it because it's so hare-brained that I thought it was a scam. It wouldn't be so bad if it were used sparingly, but like every other conceivable form of credit, it was abused during the credit bubble. It now turns out that hundreds of billions and perhaps trillions of dollars have been invested in ARSs. This hare-brained scheme has become the norm, much to my surprise.

I will say this for ARSs: They aren't based on massive fraud and corruption, the way that CDOs and mortgage-based securities are. The auction-rate securities are based on sheer, utter stupidity, the stupidity of people in the Boomer generation and Generation-X who think that if something makes money today, then it will make money forever. The stupidity is monumental, but it's just stupidity, not fraud. (However, it IS fraud if the broker tells the investor that they're "as good as cash.")

As long as the credit bubble was expanding, and there was plenty of money around, the investment banks were willing to guarantee the weekly or monthly auctions, in the sense that if there were no bidders for the ARSs, then banks would purchase them. But now with the deflating credit bubble and the credit crunch, investment banks are hoarding money and are unwilling to guarantee ARSs when the auctions fail. With most of these auctions failing nowadays, the ARSs can't be sold for cash, and so investors in ARS-backed funds can't get their money out.

This is affecting a LOT of people. If you'd like to get a feel for it, take a look at this February 27 BloggingStocks blog entry. It had over 800 comments, mostly from people telling their sad stories. Here's the first of the comments, from someone named Mike Rubin:

Mike Rubin was lucky -- at least at that time (Feb. 28) -- because he hadn't really lost anything -- yet. But I'll bet that he's in a lot worse trouble today, unless he's been able to sell his ARSs in the meantime to some "greater fool."

This auction-rate security crisis is just the latest manifestation of the growing deflationary spiral. The credit bubble, which created hundreds of trillions of dollars in new "money" (mostly in the form of credit derivatives), is now deflating. Consumer and commercial credit is disappearing, as the deflationary spiral accelerates, and the credit crunch worsens.

Banks are hoarding cash, because they're hiding the fact that more asset writedowns are coming, and they'll need that cash when the writedowns actually occur. In a scenario laid out by Oppenheimer analyst Meredith Whitney, this could trigger a forced selling panic, as the market is flooded with near worthless CDOs and other mortgage-backed securities. And now we have to add ARSs to that mix of worthless securities.

The Fed can see this coming as well, and has been launching one new program after another to inject liquidity into the places in the system where it's needed most.

The Fed has provided some $260 billion in short-term loans to banks through a series of auctions beginning in December, and will hold two more auctions in April, offering another $100 billion. These measures, along with its hand in saving Bear Stearns from bankruptcy, have been getting increasingly desperate. Each new intervention requires more ammunition than the last one, and each has a diminishing salutary effect.

The climax of my "bloated mansion" analogy appears to be getting closer and closer each day. Here's how I described it in November:

The Fed and other central banks have been running around the mansion with hammers and glue and nails, patching things up as fast as they can, trying to keep ahead of termites. They've been pretty successful with their hammers and glue and nails in postponing the inevitable, even bloating the mansion up a little more, but they can't keep up with the termites.

[What's happening] is that the hammers and glue and nails aren't working, and it won't be long now before the entire mansion collapses into the ravine."

As each week goes by, you can just feel that Fed chairman Ben Bernanke is running around the mansion faster and faster, using up his supply of nails and glue, in the hope that that internal rot can be "contained," but it never can because the credit bubble engulfed the entire world when it was growing.

The credit bubble created hundreds of trillions of dollars in new money, mostly in the form of credit derivatives, in a huge Ponzi scheme or pyramid scheme. Now that the bubble is deflating, all that money is unwinding, and there's less money in the world each month than there was the month before.

The Fed has a few hundred billion dollars at its disposal. It does not have anything close to the hundreds of trillions of dollars that would be required to reflate the credit bubble, or avoid a huge financial crisis.

All in all, the Fed has been using its available assets very cleverly. It's managed to keep the mansion together with nails and glue at the the most critical structures, but it's a losing battle. I'm amazed that the Fed has been so successful thus far.

As regular readers know, we've been keeping a running track of the analysts' estimates of corporate earnings. For the fourth quarter, analysts estimated 11.5% growth at the beginning of the quarter, but that became a -25.2% (i.e., a 25.2% fall) when actual earnings were announced.

Now we're seeing the same thing in the first quarter. Here's the latest summary from CNBC Earnings Central:

23 companies in the S&P 500 have reported earnings for Q1, 73.91% have beaten estimates, 13.04% were in-line, and 13.04% have missed. (Data provided by Reuters Estimates)

The blended earnings growth rate for the S&P 500 in first-quarter 2008, combining actual numbers for companies that have reported, and estimates for companies yet to report, fell to -9.3% from -7.9%, mostly due to downwared revisions in the Financials sector.

On January 1st, the estimated growth rate for Q1 was 5.7%. (Data provided by Thomson Financial)"

So we can update our tracking table as follows:

Date 1Q Earnings estimate as of that date ------- ------------------------------------ Oct 23: +10.0% Jan 1: +5.7% Feb 6: +2.6% Feb 29: -1.1% Mar 7: -4.3% Mar 14: -7.8% Mar 21: -7.9% Mar 28: -9.3%

And we can expect further reductions when the first quarter ends next week.

I'm hearing all kinds of ridiculous things these days.

Long time readers may recall that in 2006, former Fed chairman Alan Greenspan blamed the housing bubble on the fall of the Berlin Wall.

Greenspan, who is trying to save his own legacy, has just written a commentary in Financial Times blaming the credit crisis on "animal spirits."

He says that existing macroeconomic models are simply failing -- which is exactly what I've been saying for years. But instead of trying to work "animal spirits" into the macroeconomics models, it would work better if they worked System Dynamics into the models, as I described in "System Dynamics and the Failure of Macroeconomics Theory."

If you're looking around for more silliness beyond "animal spirits," it's hard to beat the two "investment advisors" that I quoted in January as saying that people with brain disorders make better investors.

Here's some more silliness in the public mood:

On Friday morning, I was listening to a BBC financial report on how there are far fewer mergers and acquisitions this year than in previous years, and I was startled to hear the following statement:

This is an incredible statement. Mergers and acquisitions don't actually PRODUCE anything. They're simply financial transactions that generate enormous fees for investment brokers. Since most of these deals were leveraged, they were a big part of the "creation" of money during the credit bubble.

We've actually gotten to the point where financial reporters are putting forth the view that financial transactions are the "fuel of the financial markets."

Hey, folks, the fuel of the financial markets are businesses that produce things. JP Morgan doesn't produce things, but General Motors does.

This once again shows how different generational attitudes are. The generations of people who lived through the Great Depression would not have thought that financial paperwork was the fuel of the financial markets. People born after WW II have little understanding of the connection between production and income.

What's funny is that all of this will be "obvious" once the financial crisis begins. "Of COURSE companies like General Motors, not mergers and acquisitions, are the fuel of the financial markets. Of COURSE auction-rate securities violate the rules of the universe, and can't work forever. Of COURSE there was a huge stock market bubble based on credit. It's so OBVIOUS, why on earth didn't we see all this before???"

You'll be hearing that a lot.

You'll also be hearing this a lot: "Why oh why didn't I just save a few hundred dollars instead of spending everything. If I had, then I'd be OK now."

I've estimated that the probability of a major financial crisis (generational stock market panic and

crash) in any given week from now on is about 3%. The probability of

a crisis some time in the next 52 weeks is 75%, according to this

estimate.

(29-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The Oppenheimer analyst says to expect reduced earnings expectations next week.

|

Meredith Whitney is executive director of equity research at Oppenheimer and Co. She's also a Cassandra, predicting very troubled times ahead, but unlike most Cassandras, she's actually believed by some people.

I last quoted Whitney in an article last month, an article that's worth reading just for the pictures - she's a real babe.

But she's also just about the only analyst who ever appears on CNBC who tells exactly what's going on, which makes her very unusual. She made some calls last year about Citibank that got her a great deal of verbal abuse -- until they came true. So she's respected by a lot of people, albeit reluctantly.

Appearing again on CNBC on Thursday, she was interviewed by anchor Maria Bartiromo. In her interview, she essentially accused many banks of (a) fraud and (b) unmitigated stupidity -- although those words weren't used.

She also provides an explanation for why estimated earnings keep falling. I recently posted this table:

Date 1Q Earnings estimate as of that date ------- ------------------------------------ Oct 23: +10.0% Jan 1: +5.7% Feb 6: +2.6% Feb 29: -1.1% Mar 7: -4.3% Mar 14: -7.8% Mar 21: -7.9%

And earlier I posted a similar table for the fourth quarter. In both cases, the corporate earnings estimates kept falling, week after week. As we'll see below, Whitney expects a big drop in earnings estimates next week.

Bartiromo began by asking her about a report that she published on November 11, 2007, on the ratings agencies:

|

What I basically said was, after $100 billion in securities had been downgraded in the month of October, that would impact what the regulators would require the banks to maintain on their balance sheets, with respect to those downgraded securities.

So that the capital ratios would look far worse than anyone had imagined, worse expectations than anyone had. And as a result, there would be more of a broad-based round of capital raised, and that's in fact what's happened. ...

The point of my note today was that in the month of February, 3½ times, or $370 billion in securities were downgraded in the month of February. So first quarter earnings are going to put even more pressure on capital ratios, beyond all these charges that I expect."

So here's what's going on. Regular readers of this web site know that banks and financial institutions have been forced to write down billions of dollars in assets that they have in their portfolios. These are CDOs and other mortgage-backed securities that are nominally worth one value, but may be almost worthless on the open market.

So that's bad enough, but it causes another big problem for the banks: Regulators require banks to keep certain amounts of cash (or cash-equivalent securities) on hand to handle emergencies. These amounts of cash are called "capital ratios." What Whitney is saying is that once these writedowns occurred, they no longer had enough cash on hand, and had to go out and raise capital, thus affecting their earnings significantly.

She concludes by pointing out that the size of the writedowns was 3½ times as large in February as it was in October, so banks are in an even worse situation today.

Whitney goes on to explain what banks are doing wrong:

Well the problem is that each month that they wait, the asset values go lower, and then when the ratings agencies downgrade these assets, they're required to carry even more capital against those assets.

And capital clearly in short supply in the financials right now. ...

There are a couple of things that go on. So you have people that refuse to sell assets.... So if banks don't want to sell these assets, the longer they wait to sell these assets, the values decline.

But then when, all of a sudden, banks decide TO sell all these assets, there'll be a supply jam on the market driving prices down even lower, so there'll be more write downs. And ultimately, I think these financials will sell assets at well below today's market prices. ...

So I am playing catch-up with the banks that are playing catch-up with the credit markets, and I think if everyone just took their poison -- or their medicine, so to speak -- it would be easier on all of us analysts."

|

This is actually very explosive stuff -- although neither of the women indicated that it was.

What Whitney is saying is that banks are trying to avoid having to write down their assets for as long as they can avoid it. But the longer they wait, the worse it is, because the mortgage-backed assets keep falling as time goes on.

But Whitney goes much farther -- she's predicting a full-scale panic when banks finally are forced to mark these assets down. Because the market will be loaded down with these securities from all sorts of financial institutions, they really will be almost worthless.

Just to provide context, as I've said before, the stock market panic of 1929 was caused when investors, who had purchased stocks on credit (margin), were forced to sell their good stocks to meet margin calls on their bad stocks. That forced selling caused share prices to fall even further, resulting in more margin calls to investors, resulting in more forced selling, until there was a full-scale panic.

Bartiromo has no clue about this, of course, but it's disturbing that Whitney doesn't seem to realize the full impact of what she's saying either.

She says that the banks should just "take their medicine," to which my response is, be careful what you wish for.

By the way, when she says that banks are stalling, she's essentially accusing them of defrauding the public, by pretending that their assets are worth more than they really are.

Bartiromo asks Whitney whether earnings estimates will come down next week:

In February I cut [my earnings estimates] aggressively because I thought that the loss expectations for on-balance-sheet loans would be far higher than anyone expected. And at that time, I was 30% below the street. Going into yesterday, I was the HIGH on the street.

So these earnings estimates are being revised down dramatically on a consistent basis. So I don't think we're anywhere close."

This reflects the "earnings estimates" tables that I keep posting. She points out that earnings estimates have been falling steadily, and they'll fall even more next week.

Bartiromo asks whether the stock market will decline further:

And what I had said at the time, what I had believed is -- this is an agony of incrementalism, where we have all these write downs are ultimately going to be, so we'll have a protracted environment where you have to continue to bolster up reserves."

Here's where Whitney is wrong. She thinks that all these writedowns will occur over a period of months, everyone will "take their medicine," and then things will be back to "normal." What she doesn't understand is that she's laid out a very explosive panicked selling scenario.

Finally, Bartiromo asks Whitney whether she'd buy financial stocks (like banks) right now:

So the net of all this is that next week is going to be a very rocky week, after the first quarter ends, and actual earnings start pouring in.

Whether this results in panic selling at some point, as Whitney indicates it will, remains to be seen.

I've estimated that the probability of a major financial crisis (generational stock market panic and

crash) in any given week from now on is about 3%. The probability of

a crisis some time in the next 52 weeks is 75%, according to this

estimate.

(28-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The reasoning is incredibly shallow.

On Tuesday morning, one of Wall Street's top financial analysts said that he's changed his "bearish" opinion, and now believes that the worst of the subprime crisis is over for the stock market.

|

Bob Doll, global CIO of equities at investment management firm BlackRock Inc., appeared on CNBC and explained the reasoning. Other pundits said that they agreed with his reasoning, one saying that "there's an 80%-90% chance that stocks have bottomed out, and will start to go up."

Another pundit said, "This is the greatest buying opportunity for stocks we've seen in a long time."

This is like saying, "We've had a week of sunny weather, and so it will be sunny for the next few months." Or, it's like saying, "I've been winning at the roulette wheel for a while, and that means that I'll keep on winning."

I was amazed by how shallow the reasoning was. This is a guy who's known as "the trillion dollar man," and yet he was completely ignorant of the simplest fundamentals. It makes you wonder whether he's simply an out and out liar, saying whatever he has to, so that he won't lose his clients.

CNBC anchor Becky Quick asked him how he felt about stocks now:

Here's the list. Last week, failure of Bear Stearns, opening up of the borrowing window of the Fed to non-bank institutions, Fed cut 75 basis points, easing of capital restrictions for Fannie and Freddie [quasi-governmental mortgage lenders], Bush administration willing to talk about housing relief, largest daily gain of stocks in 5 years, sharp correction in commodity prices, and it was only a four day week."

Doll is echoing something that I've heard frequently in the last few days: "The federal government is fully on board in doing everything possible to fix this problem. They're throwing everything but the kitchen sink at the problem, and will keep on doing so until it gets solved."

This is the principle reason for optimism, but it's based only on things that have happened in the last week! This is the reasoning of people who believe that "history always begins this morning."

Bob Doll continued as follows:

Now here's where Doll is probably lying. By "valuation levels," he's referring to the price/earnings ratio, and he's saying (by inference) that valuation levels are low, and that therefore investors will be motivated to buy stocks at these prices.

Either this "trillion dollar man" is lying, or else he doesn't know what he's talking about.

There's a price/earnings ratio chart at the bottom of this web site's home page, and it gets updated automatically every Friday. Here's the March 20 version of the chart:

|

As you can see from this chart, "valuation levels" have been fairly constant, around 18, since early in 2006. This can't be a coincidence, and it means that most investors are following the same formula, and keeping the price/earnings ratio constant. Surely Doll must know this, so when he implies that valuations are lower, he must be lying.

Why, you may ask (especially if you're new to this web site), are valuation levels constant, if stock prices have been falling so sharply during the last few months? If prices have been falling, then shouldn't price/earnings ratios also be falling?

The answer is that they would, except that corporate earnings have also been falling sharply.

Regular readers of this web site saw what happened with estimates of fourth quarter earnings. On October 1, at the beginning of the quarter, the official estimates were that 4Q earnings would GROW 11.5%. These estimates kept falling, week after week, as shown in the following table:

Date 4Q Earnings estimate as of that date ------- ------------------------------------ Oct 1: +11.5% Dec 7: -1.3% Dec 14: -3.8% Dec 31: -6.1% Jan 4: -9.5% Jan 11: -11.3% Jan 18: -19.0% Jan 25: -20.5% Feb 1: -20.7% Feb 8: -20.2% Feb 15: -21.1% Feb 22: -21.0% Feb 29: -25.2%

By the end of February, when almost all ACTUAL 4Q earnings had been reported, earnings had FALLEN 25.2%.

Now we're playing the same game with first quarter earnings.

Here's the summary from Friday from CNBC Earnings Central:

14 companies in the S&P 500 have reported earnings for Q1, 85.71% have beaten estimates, 7.14% were in-line, and 7.14% have missed. (Data provided by Reuters Estimates)

The blended earnings growth rate for the S&P 500 in first-quarter 2008, combining actual numbers for companies that have reported, and estimates for companies yet to report, stands at -7.9%.

On January 1st, the estimated growth rate for Q1 was 5.7%. (Data provided by Thomson Financial)"

So now we can update our table of first quarter earnings estimates:

Date 1Q Earnings estimate as of that date ------- ------------------------------------ Oct 23: +10.0% Jan 1: +5.7% Feb 6: +2.6% Feb 29: -1.1% Mar 7: -4.3% Mar 14: -7.8% Mar 21: -7.9%

March 21 in this table corresponds (roughly) to December 21 in the previous quarter, and so we're on pretty much the same path in the first quarter as we were in the fourth quarter.

Apparently investors are very well aware of this, because they've been keeping price/earnings ratios steady at 18. How could Doll possibly not know this?

Next, Doll addressed the question of asset writedowns. Regular readers know that Citibank, Merrill Lynch, and many other banks have lost tens of billions of dollars, after being forced to "write down" the value of CDOs and other mortgage-backed assets in their portfolios.

There's a light at the end of the tunnel, meaning that we're beginning to get our arms around the magnitude of the problem. Six months ago, three months ago, it was a big black hole. No one had any clue how big the writeoffs were going to be. Now we're beginning to get some handle, but ... a lot of it is still to be written off."

So there you have it. Based on the events of the last week, ignoring all the trends that have been established since August and earlier, all problems are solved, and now the bubble can start growing again. It is truly astonishing to me.

For six years, I've been saying, based on fundamentals, that the stock market is overpriced by a factor of almost 250%, and that we're entering a new 1930s style Great Depression. Those fundamentals have not changed in the last week, or in the last six years.

To repeat what I've said before, if you go back through history, there are many small or regional recessions. But since the 1600s there have been only five major international financial crises: the 1637 Tulipomania bubble, the South Sea bubble of the 1710s-20s, the bankruptcy of the French monarchy in the 1789, the Panic of 1857, and the 1929 Wall Street crash.

These are called "generational crashes" because they occur every 70-80 years, just as the generation of people who lived through the last one have all disappeared, and the younger generations have resumed the same dangerous credit securitization practices that led to the previous generational crash. After each of these generational crashes, the survivors impose new rules or laws to make sure that it never happens again. As soon as those survivors are dead, the new generations ignore the rules, thinking that they're just for "old people," and a new generational crash occurs.

We're now overdue for the next generational crash, and it might occur tomorrow, next week, next month, or next year.

In case you've forgotten, here's the historical graph of price/earnings ratios:

|

Once again, this is NOT rocket science. You can just look at this graph and see that we're close to the edge of a huge cliff that will bring P/E ratios down to the 5-7 range over a three year period, which will bring the stock market down to the Dow 4000 range or below.

I've estimated that the probability of a major financial crisis (generational stock market panic and

crash) in any given week from now on is about 3%. The probability of

a crisis some time in the next 52 weeks is 75%, according to this

estimate.

(25-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Socialists gain power across France, leaving economic reforms in doubt.

Last May, after French president Nicolas Sarkozy's euphoric victory over Socialist candidate Ségolène Royal, I posted a list of the campaign promises that he made:

Sarkozy government becomes paralyzed after defeat in municipal elections:

Socialists gain power across France, leaving economic reforms in doubt....

(24-Mar-08)

British Prime Minister Gordon Brown loves America too.:

We now have two European leaders competing for our affections....

(13-Nov-07)

Nicolas Sarkozy gives stirring speech to joint session of Congress:

Years of French/American hostility seemed to melt away on Wednesday,...

(8-Nov-07)

Sarkozy begins term as activist President of France:

The pundits' comparison of Sarkozy to Margaret Thatcher is a dangerous one....

(19-May-07)

Euphoric Nicolas Sarkozy supporters celebrate victory over Ségolène Royal:

First 100 days: Put France back to work, stop illegal immigration, and make France a great nation again....

(8-May-07)

NY Times columnist Thomas Friedman shows ignorance and evasiveness about al-Qaeda in Iraq:

In an interview that appeared on CNN on Sunday,...

(24-Apr-07)

France heads for chaos in Sunday's first round election for President:

Nicolas Sarkozy is leading in the polls, and he may even not hate America. Mon dieu!...

(22-Apr-07)

Paris riots continue for seventh night:

Historically, Paris is well known for its riots and rebellions....

(3-Nov-05)

France's Nicolas Sarkozy says "Let them eat cake!":

There's been violent racial rioting in Paris's Muslim ghetto suburbs every night since Thursday,...

(2-Nov-05)

| ||

I joked that, after that, he would turn water into wine for the nationwide party. ` Now, ten months later, Sarkozy has accomplished almost nothing -- a minor change to overtime laws, and little else. Sarkozy's approval rating, which was at 65% last July, is now at 38%.

Last week, the leftists won a major victory against Sarkozy's center-right coalition by taking more than 30 cities and large towns, including a landslide victory in Paris. Under France's legislative system, this defeat severely limits Sarkozy's ability to implement reforms.

France's government is quickly sinking into the paralysis quagmire that's affecting all countries that fought in WW II as a crisis war:

The reason for this paralysis is that the generations that survived WW II are gone now. Those people did some great things -- they created the United Nations, World Bank, Green Revolution, World Health Organization, International Monetary Fund, and so forth. They created these organizations and managed them for decades with one purpose in mind: That their children and grandchildren would never have to go through anything so horrible as World War II. Now all those people are gone, and the people left behind have no idea what's going on or what to do. They're unable to lead or govern. All they know how to do is whine and complain, and wait until the next disaster, the next world war, forces them to do great things as well.

However, Sarkozy's image problems go beyond paralysis.

Many French people are now tut-tutting disapprovingly over Sarko's whirlwind romance and sudden marriage to singer and supermodel Carla Bruni.

For a long time, the two were inseparable, almost joined at the hip, as they traveled from country to country so that Sarkozy could fulfill his duties as President of France. It seemed sexy and romantic at first, but as it went on for months, the French people finally decided that it was just tacky, and they've given Sarkozy the name President Bling-bling.

Sarkozy is now taking steps to 'sober up' after the elections, in an effort to regain Presidential stature and the confidence of French citizens.

If you'd like to see "more" of Carla Bruni, you'll find plenty of opportunities to do so on the Internet.

For this article, we've selected a very pretty song that she sings in English. The title is, "Nobody Knows You when You're Down and Out," and the words reflect very real feelings of a great many people today:

(24-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

A Khalil Shikaki poll shows increasing acceptance of violence against Israel in the Palestinian territories. The poll was conducted by Shikaki's Palestinian Center for Policy and Survey Research.

Shikaki told the NY Times that he was shocked because the survey showed greater support for violence than ever before, and that, for the first time, a majority favored an end to negotiations and the shooting of rockets at Israel. According to Shikaki,

Gaza war heads toward cease-fire, while violence surges in Sri Lanka:

Thousands of civilians' lives are at risk by army attacking terrorists responsible for suicide bombings....

(19-Jan-2009)

In Gaza and Sri Lanka, war slides into genocide.:

Both wars are getting increasingly meaner and nastier....

(6-Jan-2009)

Israel begins ground invasion into Gaza:

The region appears to be teetering on the edge of wider war...

(3-Jan-2009)

Israel declares "war to the bitter end" and "all-out war" against Hamas in Gaza:

The rhetoric indicates an extremely dangerous situation....

(30-Dec-2008)

Israel's rocket attack on Gaza opens continues a week of sharp escalation:

Hundreds of Palestinians were killed or injured Saturday,...

(27-Dec-2008)

Palestinian opinion shifts toward greater confrontation with Israel:

A Khalil Shikaki poll shows increasing acceptance of violence against Israel...

(24-Mar-08)

Violence in Gaza escalates significantly as Israel contemplates an invasion:

American warships are off the Lebanon coast to promote "regional stability."...

(1-Mar-08)

Suicide bombing in Israel blamed on the Gaza border opening:

Although Egypt finally closed the border on Sunday,...

(5-Feb-08)

Egypt's failure to close the Gaza border further destabilizes the region.:

Changing events brings Israelis, Palestinians and Egyptians into further confrontation and conflict....

(26-Jan-08)

In dramatic scene, 60,000 Gazans pour into Egypt through holes blasted through border wall:

Euphoric Gazans go shopping, bring back food, fuel and fertilizer....

(24-Jan-08)

Israeli blockade of Gaza triggers protests against Egypt:

Angry Gazans stormed the Rafah crossing into Egypt on Tuesday,...

(22-Jan-08)

Violence continues in Gaza as Israel kills 18 to stop rocket attacks:

President Bush's new Mideast peace initiative has a zero chance of success....

(17-Jan-08)

Tony Blair compares the Mideast peace process to the Northern Ireland peace process:

Generational Dynamics illuminates when such historical comparisons are valid and when they are not....

(30-Nov-07)

Mideast summit in Annapolis has feel of act of desperation:

No one appears to have any expectations whatsoever -- talking just to talk....

(27-Nov-07)

Hamas fires on civilian Palestinian crowd commemorating Yasser Arafat:

Eight people were killed when Hamas gunmen fired into the crowd....

(13-Nov-07)

Pressure is building in Israel for a new invasion of Gaza:

Surprisingly, many Palestinians are allying with Israel against Hamas....

(12-Sep-07)

Hamas' stunning Gaza victory shocks entire Mideast:

A major realignment of unknown proportions is occurring throughout the Mideast....

(22-Jun-07)

Abbas dissolves the Palestinian Authority as Hamas overpowers Fatah in Gaza:

There are now effectively two Palestinian Authorities,...

(15-Jun-07)

Hamas presses for control in Gaza, Fatah gets revenge in West Bank:

The U.N. is considering deployment of a multinational force in Gaza,...

(14-Jun-07)

Palestinian road to civil war escalates another step:

Gunfights escalated to larger military actions in northern Gaza...

(13-Jun-07)

Jordan's King Abdullah renews stark warnings about Palestinian problem:

Both Israelis and Palestinians are becoming increasingly furious at each other,...

(22-May-07)

Gaza close to state of emergency as Israel tries to avoid getting pulled in:

The streets of Gaza are clear except for gunmen today,...

(16-May-07)

Palestinian Interior Minister resigns as escalated Gaza violence threatens civil war:

Six people were killed and dozens wounded over the weekend...

(15-May-07)

Palestinian "unity government" leading soon to new crisis with Israel:

As the young generation of Palestinians become increasingly "lost and desperate,"...

(14-Mar-07)

Jordan's King Abdullah tells Congress that Palestinian issue is the core issue:

Unfortunately few in Congress know what he's talking about....

(8-Mar-07)

"Palestinians don't deserve a state":

Even the most optimistic Palestinians are despairing that their dream is slipping away....

(4-Feb-07)

Fatah storms Hamas stronghold in Gaza:

Palestinian President Mahmoud Abbas appears to be carrying out his ultimatum to Hamas,...

(1-Feb-07)

Palestinian civil war between Hamas and Fatah now seems inevitable:

Peace talks and ceasefires seem close to being over for good....

(29-Jan-07)

Palestinians' Fatah/Hamas crisis increases as Israeli government is close to anarchy:

The possibility of a Hamas vs Fatah civil war in the Palestinian territories appears to be increasing by the day....

(7-Jan-07)

In desperation gamble, Mahmoud Abbas calls for new Palestinian elections:

Hoping to end political deadlock and head off a Palestinian civil war,...

(16-Dec-06)

Will Mohammed Dahlan trigger a Palestinian civil war?:

Hamas blames the young Fatah terrorist for the near-assassination of Prime Minister Haniyeh....

(16-Dec-06)

Interviews with young Gazans spotlight road to war:

For these young fighters, attacking Israel is an end, rather than a means to a political end....

(10-Dec-06)

Can we "Flip Syria" and solve all the Mideast problems?:

Even by Washington standards, Wednesday was possibly the most bizarre day on record....

(7-Dec-06)

Jordan's King Abdullah warns of explosions in Palestine and Lebanon:

Abdullah repeatedly chided the ABC News interviewer Stephanopolous, who remained completely oblivious...

(26-Nov-06)

Level of loathing between Israelis and Palestinians increases:

According to an online correspondent with contacts in the Israeli government,...

(27-Sep-06)

Tony Blair commits the rest of his term to solving the Mideast problem:

Meanwhile, the Palestinians announce a unity government -- with a condition....

(12-Sep-06)

Israel re-occupies Gaza and abandons West Bank "convergence":

Lawlessness has gotten so bad in Gaza that even Hamas apologized...

(8-Sep-06)

Aftermath of Lebanese war: The winners and losers:

Everyone seemed to follow his generational archetype, as if hypnotized to do so....

(6-Sep-06)

Some random notes on the Mideast crisis:

First off, dislodging Hizbollah from the Israeli border is almost impossible....

(21-Jul-06)

Mideast war now centers around Hizbollah's Hassan Nasrallah:

Nasrallah splits the Arab world and draws international support for Israel...

(17-Jul-06)

The European Union is "extremely concerned" about Mideast tensions:

But guess what the EU politicians express "particular concern" about!...

(3-Jul-06)

Israeli armed forces mass on Gaza border after soldier's kidnapping:

Egyptian mediators are attempting to head off a "large scale military offensive"...

(26-Jun-06)

Tensions reaching the boiling point among Palestinians and Israelis:

So-called "pinpoint" Israeli missile strikes have killed several civilians, including children...

(21-Jun-06)

Ex-CIA chief James Woolsey says Gaza pullout was "Worst result possible":

Five bystanders, including a pregnant woman, were killed by Palestinian gunmen...

(5-Jun-06)

Hamas and Fatah armies gearing up for major confrontation in Gaza Strip:

Egypt and Lebanon are also being increasingly threatened by the escalating violence....

(23-May-06)

Palestinian Authority and Hamas deploy rival armies in Gaza:

In open defiance of PA president Mahmoud Abbas, Hamas mounted an illegal 3,000 man militia force...

(17-May-06)

Saudi and other Mideast stock markets appear to be crashing:

While Wall Street is rocketing toward a historic new high,...

(7-May-06)

International game of "chicken" leading to disaster in Gaza:

Mideast envoy James Wolfensohn quits in disgust with all participants in the so-called "peace process."...

(5-May-06)

Crunch time for Hamas, as American and European aid is cut off to Palestinians.:

Will they "cry uncle" and recognize Israel in exchange for financial aid?...

(10-Apr-06)

International political chaos grips Israel, Palestine, and everyone else, as Hamas takes over on Saturday:

No one, not even Hamas itself, has any idea what to do next, except to let events play out as they will....

(18-Feb-06)

Hamas victory and cartoon controversy significantly affect chances of Mideast war:

It's time to change to the world conflict risk graphic....

(10-Feb-06)

Hamas victory throws Mideast 'peace process' into disarray and turmoil:

What struck me most, seeing the cheering Hamas supporters on TV yesterday,...

(27-Jan-06)

Sudden generational shift puts Palestinian "Young Guard" threatening "Old Guard":

Younger generations in control in Palestine and Israel bring war closer....

(16-Dec-05)

Gaza violence spiking up as Israel launches "crushing response" to rocket attacks:

Hamas promised to stop attacking Israel from Gaza, to prevent spiraling out of control....

(26-Sep-05)

Gaza strip descending into further chaos and lawlessness following Israeli withdrawal:

Black market prices for weapons have been falling sharply in Gaza,...

(14-Sep-05)

With Israelis almost gone, Gaza is becoming increasingly violent and unstable:

Especially ominous is the planned intervention by Egypt as border guards....

(8-Sep-05)

Israel withdraws from Gaza amid hopes for peace and fears of instability:

Here's what you should watch for in the weeks ahead....

(16-Aug-05)

Ariel Sharon and Mahmoud Abbas meet as Mideast cease-fire unravels:

Like Britain vs France, Israel vs Palestinian Authority meetings are becoming increasingly confrontational....

(22-Jun-05)

Abbas is increasingly losing control of Gaza and the West Bank:

Palestinian militants are infuriated by Abbas' unilateral cancellation of parliamentary elections....

(6-Jun-05)

Some notes on current news in Darfur, Palestine and Ukraine:

It appears that the genocidal crisis war in Darfur, Sudan, may be ending....

(24-Jan-05)

NY Post: "Arafat Dead - And he won't be missed.":

I look at Arafat's life very, very differently....

(14-Nov-04)

Top Israeli aide says that Israel has abandoned the American-sponsored 'Road Map to Peace':

The plan to create a Palestinian state has effectively been scuttled...

(7-Oct-04)

Israel makes it official: The American-backed "road map to peace" is dead.:

In fact, Israel itself is in enormous turmoil today because of Ariel Sharon's disengagement plan....

(16-Sep-04)

A dramatic shift in Palestinian opinion, as Arafat retains control:

Major violence has not yet spread from Gaza to West Bank, but the question of whether things will "spiral out of control"...

(1-Aug-04)

Beheadings part of increasing conflict level throughout Mideast:

The level of conflict is increasing throughout the Mideast, from Gaza to Pakistan, from Saudi Arabia to Uzbekistan.

(23-Jun-2004)

"Mideast Roadmap" - Will it bring peace?: Generational Dynamics predicts something quite different for the Mideast. (01-May-03) | ||

Here's are the main findings from the poll:

As regular readers of this web site know, this is the kind of attitude change that I've been watching for, for several years.

In 2003, when I wrote "Mideast Roadmap - Will it bring peace?" I said that the Roadmap would fail, and that the death of Yasser Arafat, when it occurs, would be part of a major generational change that would lead to a new genocidal war between Jews and Arabs, re-fighting the war between Jews and Arabs that followed the partitioning of Palestine and the creation of the state of Israel in the late 1940s.

Arafat died in November, 2004, and Israeli Prime Minister Ariel Sharon went into a coma in January, 2006. These two men cooperated (consciously or unconsciously) in prevent a new genocidal war between Jews and Arabs, but now, with both of them gone, generational forces are taking over, and there is no way to prevent a new war.

Still, I've never yet seen the requisite fury and hatred from the Palestinians toward the Jews that would signal that such a war is getting close. (Nor have I seen it on the Jewish side, either.)

This is only one poll, of course. It indicates not a massive change

in attitude, but an incremental change in attitude. But it's a

significant change and, even more important, it represents a trend

that may well be unstoppable.

(24-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

In a major change of political direction, Taiwan's voters elected Ma Ying-jeou by the largest margin of victory in the history of Taiwan's presidential races.

Ma's Nationalist Party (or Kuomintang party or KMT) candidacy defeated Frank Hsieh of the Democratic Progressive Party (DPP), the party of outgoing president Chen Shui-bian.

Voters shrugged off concerns about China's violent crackdown in Tibet, and the fear that China would crack down similarly on Taiwan, focusing instead on Taiwan's economic troubles, and the economic advantages of greater trade opportunities with the mainland.

Voters also rejected referendums that would have called on the government to try to gain Taiwan's admission to the United Nations separate from China. (The two countries' officials names are "Republic of China" or ROC, and "People's Republic of China" or PRC, respectively.)

The Central Election Commission also said two referendums calling on the government to work for the island's entry into the United Nations failed. China had warned that the referendums threatened stability in the region.

Ma's victory, and his desire for closer relations with China, closes a circle that's almost a century old. After the (Awakening era) Chinese Revolution of 1911, the political chaos led, in the 1920s, to the Nationalist government led by Chiang Kai-shek. Challenging Chiang was the Communist faction, based on Russia's recent Bolshevik revolution, and led by Mao Zedong. Mao's "Long March" in 1934 launched the civil war between the two factions. The civil war ended in 1949, with Chiang's Nationalists fleeing to the offshore island of Formosa which, together with some other islands, form the province or nation (depending on your point of view) of Taiwan.

Communist China and Communist Russia (in the form of the Soviet Union) never got along very well, and never really had much in common, except for each having slaughtered tens of millions of people, and in the 1960s there was international concern that they two countries were close to nuclear war with each other. (Such a war, if it had occurred, would have been a non-crisis war for both nations, and most likely have ended quickly, with no use of nuclear weapons, following great political opposition to the war in both countries.)

Nonetheless, as the two major "Communist" countries of the world, China and the Soviet Union felt a kind of kinship that was completely shattered by the momentous events of 1989 and after:

Things came to a head when Taiwan's DPP won the Presidency in March, 2000. A shocked CCP clamped down on the Falun Gong in April, 2000, brutally repressing it. Falun Gong advocates claim that thousands of Chinese have been jail or executed, simply for practicing meditation exercises.

The CCP are the most paranoid people on earth today -- afraid of the Tibetans, the Falun Gong followers, and the people of Taiwan -- and even afraid of their own people, who have tens of thousands of anti-CPP demonstrations every year.

Beijing has never ceased to express its continuing contempt for the DPP, and has openly stated that it favored the victory of KMT candidate Ma Ying-jeou.

That's why Ma's victory brings a circle to a close. The Nationalists and the Communists were allies in the 1920s. Then they split apart and fought a war, and became each other's hated enemy. But now they're back together again, promoting peace and harmony and cooperative economic development.

Ma Ying-jeou was born in Hong Kong in 1950 -- his parents were in the midst of fleeing to Taiwan, but had to pause in Hong Kong to give birth. Ma is Harvard educated, and speaks English well.

The irony aside, the question arises whether this means a détente in Taiwan / China relations. Ma is certainly not going to make it easy for Beijing. His "pro-China" campaign stressed closer business ties with China, but no peace treaty with China until Beijing dismantles its arsenal of missiles aimed at targets in Taiwan.

One of the interesting things about Ma is that when you read the recent news profiles about him, some of them describe him as "charismatic," and others describe him as definitely "not charismatic." I guess it depends on chemistry and politics.

But his promises of change do seem to have gotten him elected on a wave of euphoria similar to the euphoria that's been surrounding Barack Obama in America. Such waves of euphoria always quickly dissolve within a few weeks or months, as the promised changes don't materialize, leaving an electorate that feels angry and betrayed, and looking for someone to blame.

One of the most bizarre signs of that euphoria was contained in a BBC pre-election report on Friday, describing a ferry service running across the Straits of Taiwan between the Chinese town of Xiamin, and the Taiwan island of Jinmen. Here's the final portion of the report (my transcription):

And those in the know say that China decided some years back that it would not be taking military action over Taiwan, no matter what.

Chong-pin Lin, Foundation on Cross-Strait Studies: "Beijing made the decision in summer of 2002 thinking that the economic development of China is more important then unification of the so-called 'motherland.'"

No one's actually announced that, but well there are regular direct ferries between Jinmen and Xiamin in what was once a flash point for global conflict.

Humphrey Hawksley, BBC News on the outlying Taiwanese island of Jinmen.

Now, I'm used to hearing bizarre things on the BBC, but this really tops the list. "People in the know"???? Who are they? Is Lin Chong-pin one of those people? It turns out that he's a supporter of the hated (by China) DPP party, so how would he ever get to be "in the know?"

This is exactly the kind of airhead expectation that's been occurring in places around the world, as the world enters a generation crisis era, 62 years after the end of World War II.

The Chinese have repeatedly threatened the United States with war over Taiwan, and have repeatedly threatened to invade Taiwan itself, and that's not going to change. China continues to accelerate its massive military buildup, preparing for war against Taiwan and the United States, and that's not going to change either.

Meanwhile, here are two "reality checks":

Here's President Bush's statement on the election results:

Taiwan is a beacon of democracy to Asia and the world. I am confident that the election and the democratic process it represents will advance Taiwan as a prosperous, secure, and well-governed society.

It falls to Taiwan and Beijing to build the essential foundations for peace and stability by pursuing dialogue through all available means and refraining from unilateral steps that would alter the cross-Strait situation. I believe the election provides a fresh opportunity for both sides to reach out and engage one another in peacefully resolving their differences.

The maintenance of peace and stability in the Taiwan Strait and the welfare of the people on Taiwan remain of profound importance to the United States. We will continue to maintain close unofficial ties with the people on Taiwan through the American Institute in Taiwan in accordance with our long standing one China policy, our three Joint Communiqués with the People's Republic of China, and the Taiwan Relations Act."

What many people don't understand, except for the readers of this web

site, is that a war over Taiwan could begin as early as tomorrow, if

just one of these three parties miscalculates, panics and overreacts

to something. Generational Dynamics predicts that there will be such a

war next week, next month, next year, or thereafter, but it is coming

with absolute certainty.

(23-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Ugly memories of the 1989 Tiananmen Square massacre are being revived.

In generational theory, China's 1989 Tiananmen Square massacre is an example of an "Awakening climax" -- an event so profound that it resolutely settles the "generation gap" political battles of the recent or ongoing Awakening era in favor of either the old generation of crisis war survivors, or the young generation of rebels.

In America's Awakening era, it was the resignation of Richard Nixon that signaled a victory of the Boomer generation over the WW II GI generation.

In China, the Tiananmen Square massacre firmly established Mao Zedong's generation as the political victors over the young generation, and today the Chinese Communist Party (CCP) is mostly led by Maoists in their 70s.

The people of Taiwan, watching the Tiananmen Square massacre from across the Taiwan Straits in 1989, were absolutely horrified.

Up to that time, the unchallenged assumption was that Taiwan would eventually reunite with China (the so-called "One China policy"). There was essentially only one political party, the Kuomintang Party (KMT).

But the Tiananmen Square massacre gave rise in Taiwan to a student movement called the "Wild Lily rebellion," formed to demand political reform in Taiwan, and to develop a unique Taiwanese identity different from that of China.

This rebellion evolved rather quickly into the new Democratic Progressive Party (DPP). DPP chairman Chen Shui-bian became Taiwan's president in 2000, and was reelected in 2004 in a wild election battle.

Beijing's CCP has never tired of expressing contempt and hatred for Chen Shui-bian and his DPP party, but they've lived with it by issuing one threat of war after another if the Taiwan government makes any moves at all towards an independent Taiwan.

One of the moves that most infuriated the Taiwanese was China's "Anti-Secession" law, which commits China to forcibly repatriating Taiwan to China.

In August 2006, Sha Zukang, the Chinese ambassador to the U.N., furiously and harshly threatened the U.S. over Taiwan. He was literally screaming in an interview with a BBC reporter:

It's not a matter of how big Taiwan is, but for China, one INCH of the territory is more valuable than the LIVES of our people."

[With regard to the U.S.'s constant criticism of China's rapid militarization:] It's better for the U.S. to shut up, keep quiet. That's much, much better. China's population is 6 times or 5 times the United States. Why blame China? No. forget it. It's high time to shut up. It's a nation's sovereign right to do what is good for them. But don't tell us what's good for China. Thank you very much."

And so it was with a measure of some relief to Beijing to see that Ma Ying-jeou, the KMT Presidential candidate, had a substantial double-digit lead over Frank Hsieh, the DPP candidate, according to polls in advance of the planned election on Saturday, March 22.

But now Ma's lead as fallen sharply, as Hsieh has been using the Tibet violence to bring back memories of Tiananmen Square.

According to the NY Times:

Beijing authorities have been wary of the party’s candidate, Frank Hsieh, even though Mr. Hsieh has repeatedly voiced much more willingness than President Chen to allow more Taiwanese investment on the mainland and more cross-straits transportation links.

Mr. Hsieh and his party, with help from President Chen’s ministers, have moved swiftly to turn Tibet into a central issue in the campaign. They contend that Tibet’s fate is an example of Taiwan’s future if it does not stand up to Beijing.

“What has happened in Tibet in the past three decades, and what is going on now, is a warning to us,” said Shieh Jhy-wey, the minister of information and a Democratic Progressive Party hard-liner toward Beijing. “We don’t want to have the same fate as Tibet.”

Mr. Hsieh abruptly turned a campaign rally in Taipei on Wednesday night into a candlelight vigil for Tibetans who have been killed, injured or detained during the Chinese crackdown. Party activists unfurled a huge Tibetan flag and Tibetan students sang a Tibetan anthem."

Ma has been resorting to damage control. A recent statement by Prime Minister Wen Jiabao of China suggesting that Taiwan's future is with China, Ma condemned what he described as a, “ruthless, irrational, arrogant, foolish and self-righteous comment.”

The extremely paranoid Beijing CCP officials have their backs to the wall right now. They will not tolerate any sign of secession, from either Tibet or Taiwan, and there are signs that they're already overreacting in Tibet. This is only increasing secessionist desires in both places.

But as much as Beijing would like to clamp down even harder, they're restricted from doing so for fear of an international boycott of the summer Olympics. This would be an enormous humiliation.

From the point of view of Generational Dynamics, the US and China are headed for war over Taiwan. The only question is timing.

A victory by Ma on Saturday would do a lot to reduce tensions for a while. A victory by Hsieh would substantially increase tensions.

The worst case scenario for Beijing on Saturday would be a victory for Hsieh, accompanied by a "YES" vote on a referendum that calls on Taiwan to join the United Nations as a member separate from China. Even worse, the Tibet situation could become even more violent.

In this worst case scenario, Beijing may well take some kind of action once the Olympics games end.

From the point of view of Generational Dynamics, what's fascinating

about this situation is how the 1989 Tiananmen Square massacre is

reverberating forward through history, bouncing like a ball from

Beijing to Taiwan to Tibet to Washington and back again. China has

been trying to erase memories of the massacre ever since it occurred,

and now it's up in their face at precisely the time they want it

least -- the 2008 Beijing Summer Olympics.

(21-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Remember ages ago (i.e., last week) when things looked "normal"?

The stock market has exhibited extreme volatility and wild swings during the last few days, amid unprecedented events -- several hedge fund failures, a major investment bank failure and historic Fed interventions.

Commodities investors have begun to express caution as prices suddenly collapsed on Wednesday, breaking a very long period of bubble-like increases:

Soybean futures for May delivery fell 50 cents, or 3.6 percent, to $12.57 a bushel in Chicago. The exchange's limit for gains or losses in soybeans is 50 cents. The price has fallen 21 percent since reaching a record $15.8625 on March 3. Still, most-active futures have risen 66 percent in the past year after U.S. farmers planted the fewest acres in 12 years.

Gold futures in New York plunged $59, or 5.9 percent, to $945.30 an ounce, the most since June 2006, after the Federal Reserve cut U.S. borrowing costs less than investors expected yesterday. Gold reached a record $1,033.90 on March 17. Crude oil fell as much as 4.5 percent to $104.48 a barrel in New York. The most-active contract reached a record $111.80 on March 17."

There have been "waves of selling," according to the article, as hedge funds that have used leverage to purchase large commodities positions are now deleveraging, in advance of a possible bubble collapse.

Many investors are pulling out the market into the safety of Treasury bills, causing the yield on 3-month Treasuries to fall to 0.47% from 0.79% a day earlier, and 6-month Treasuries to fall to 1.1% from 1.24% a day earlier.

Pundits on CNBC were saying that they've never before seen anything like what's going on now -- especially the wild swings in all markets.

A web site reader wrote to me that she's lost a fair amount of money on her futures contracts in the last two days because of "Bernanke's clever fixes."

I admire people with such strong stomachs that they're even ABLE to deal with these kinds situations. This is not for the faint of heart.

I continue to strongly advise against getting into the short or futures markets.

Keep in mind that there may be a major financial crisis at any time, causing a domino effect of bankruptcies. In that case, investors could lose their escrow accounts or be unable to collect from counterparties.

Right now, about the only thing that makes sense is cash.

There is a little bit of good news in this: With commodity prices

falling, the cost of wheat, corn and soybeans is falling, which may

mean that a few million more people in the world may be able to

afford to eat, at least for a while.

(20-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

After the Fed's Tuesday action, lowering the Fed Funds rate by ¾% to 2¼%, the yield on 3-month Treasury bills is now 0.79%, and on 6-month T-bills it's now 1.24%.

I've suggested short-term T-bills in the past as a perfectly safe investment vehicle for those who feel that they MUST be earning interest, and so would like to avoid just keeping cash.

But with T-bill interest rates so low, it may not be worth the trouble. It's even worse if you purchase T-bills through a broker who charges a fee. However, if you still wish to consider T-bills, you can get them online with no fee from http://treasurydirect.gov .

The other alternative you can consider is getting a bank CD

(Certificate of Deposit). Many banks are now providing above-market

yields, because they're anxious to get customers. As usual, though,

make sure that the bank is FDIC insured, and that you carefully

follow all the rules, especially if you're depositing more than

$100,000.

(19-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

I was bombed with thousands of spam messages on Tuesday, and so my e-mail service was effectively shut down for a while. If you sent me a comment on Tuesday, I may or may not have gotten it, so you may wish to resend it.

This is a good time to remind you that you can write to me with comments and questions.

The web site traffic has been growing substantially, but fortunately for me, the rate of messages has been growing more slowly. And so, it may take a few days to get back to you, but so far I've been doing OK keeping up with the e-mail messages. Use either an e-mail message, or the "Comment" link at the top of this page.

If you want to have a more open debate, you can do so in the "Objections to Generational Dynamics" thread of the Fourth Turning forum.

Thanks to all my web site readers for coming back every day.

I know that a lot of people are in a great deal of pain these days, because things are happening that mainstream politicians, analysts and journalists have been oblivious to. This is the only web site in the world that's been telling you what's coming, and it's the only web site in the world that's been right every time. I'm glad that I've been able to help so many people prepare for the future.

Once again, if I can respond to any questions or comments, please

feel free to direct them to me.

(19-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

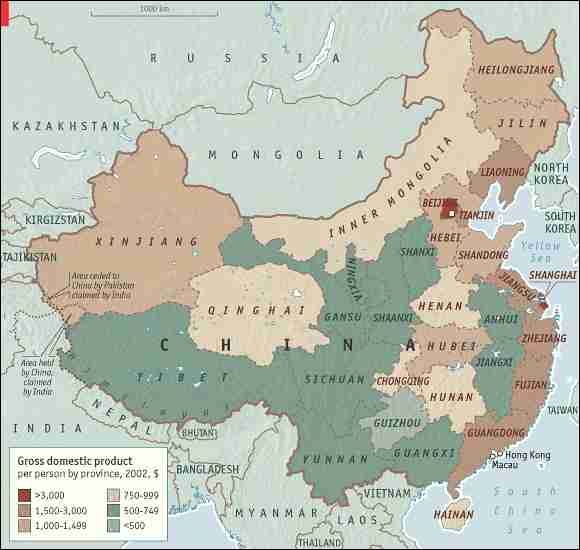

Violence has spread well beyond the borders of Tibet itself.

|

After a week of rioting, Chinese security forces have clamped down and restored calm to Lhasa, the capital of what China calls the Tibet Autonomous Region (TAR). Officials have demanded that all rioters turn themselves in to the police, and have warned that any further rioting will have severe consequences.

However, China's troubles are far from over. Rioting is increasing in historic ethnic provinces -- Qinghai, Sichuan and Yunnan. Rioting is increasing in Dharamsala, India, where the Dalai Lama and exiled Tibetans have been living since the 1959 Chinese clampdown. There's also rioting among Tibetans in Kathmandu, Nepal.

Although the violence in Tibet has not spiraled out of control, it's clear that the ethnic fault line between the Tibetans and Chinese is overwhelmingly hate-filled, especially on the Tibetan side. Tibetans in Lhasa have targeted Chinese businesses and committed abominations on Chinese people.

For decades, the Chinese authorities have done one thing after another to infuriate the Tibetans.

In response, the current Dalai Lama has announced his intention to appoint his own successor, without waiting for his own death,

It doesn't take a rocket scientist to see that this is going to end badly. The only question is the time frame.

The Tibetans believe that this time is their best chance. With the Beijing Olympics only a few months away, Tibetans see this as the best time to reach their goal of a separate nation of Tibet.

The Chinese would never consider that, of course, since that would imply that Taiwan could also secede. So you can see that the Tibetan and Chinese positions can never be reconciled without a war.

The situation is of theoretical interest to Generational Dynamics because of the differing generational timelines. The Tibetans' last crisis war climaxed in 1959, while the Chinese' last crisis war climaxed in 1949. It's possible for an identity group to have a crisis war a few years "early," especially if they're attacked by another identity group already in a crisis era. This doesn't seem likely in the TAR itself, but something like it is quite possible in the areas Qinghai, Sichuan and Yunnan where the Tibetans and the Chinese Han intermingle and compete for resources. This is something to watch for and evaluate.

The greatest chance for violence is Chinese overreaction. The Chinese Communist Party (CCP) are probably the most paranoid group of people on earth these days, and they see the Tibetan rioting as a Great Tibetan Conspiracy to humiliate the Chinese in the Olympics. There's some truth to that claim, of course, but not to the massive extent that the CCP fears. If the CCP would only "cool it," then the riots would mostly fizzle, and prove only a minor embarrassment in the summer. Instead, the CCP is making the situation much worse than necessary.

Even worse for the Chinese is that countries around the world are linking the Tibet situation to the Olympics and calling for Chinese restraint. The Chinese are especially being warned not to repeat the 1989 Tiananmen Square massacre.

The paranoid CCP officials are facing potential humiliation on several fronts. The Tibet situation will undoubtedly continue; the Darfur human rights criticisms will continue, especially since Steven Spielberg resigned; and Taiwan is holding Presidential elections on March 22, including a referendum on Taiwan joining the United Nations separately from China. The temptation for the Chinese to overreact must be great.

And once the Olympics games have ended, then the CCP will have no

further motivation to hold back. Beijing is probably already

preparing action plans, possibly with military components, to be put

into effect as soon as the games end.

(18-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

According to Suze Orman, most people are too scared to do anything.

Appearing on CNBC late Monday afternoon, well-known financial advisor Suze Orman (who, incidentally, sounds exactly the same as her Saturday Night Live parody) answers the question of what "every day investors" are doing and should be doing:

|

Nobody's been telling them the truth. They hear someone go on television last week and say, ohhh, Bear Stearns is fine, and then all of a sudden they've seen millions of dollars go down the tube.

But what's happening, Dylan, in my estimation, with really the people out there, the every day people, which are MY people that I'm talking to, they are so afraid, they are really taking their head and sticking it in the sand. They're not opening up their statements, they're not looking at what they have, they don't want to pay attention now because they don't know what to do, and things like today only make it worse for the common person on the street. ...

And where do they own [their] stock? Most people own stock in a 401K or a retirement plan. Normal, every day people don't even think really that they open up an account at a brokerage firm and besides their retirement account, they don't know that you buy stock outside a retirement account. Most people think that the only place and the only way that they invest is with their retirement accounts, so in their retirement accounts, are they looking at their 401K statements? No. Are they looking at the IRA statements, Roth IRA statements, SEP IRA ra statements? No. So they're just keeping plodding along or, worse, they've just stopped doing anything."

Orman then went on to recommend that "every day investors" should open their IRA statements and make sure they understand what's in their accounts. And then they should invest ONLY in good, solid stocks.

People who followed her advice at any time since October 2006 would be underwater today, since the Dow Industrials are now at their lowest since October, 2006.

Orman is an investment counselor. If she ever told people to sell all their stocks, then she would lose all her clients, and she would never be invited to speak on television. All of these people have a built-in conflict of interest -- their income depends on lying, if necessary, to say that stocks will continue to go up.

One reason that I've been right about everything for six years is that I have no such conflict of interest. I neither make nor lose money if the markets don't do as I predict, so I have nothing to lose by telling the truth. I have nothing at stake except my own credibility.

The collapse of Bear Stearns is very ominous, and portends bad times ahead. We're in a deflationary spiral that's accelerating, and can't be stopped by the Fed or any politicians. If you've put off selling your stocks, then you've already lost a lot of money, and unless you do so now, you're going to lose a lot more.

I've written several articles suggesting plans. One of the most recent, from last month, is "Readers comment: Gold prices and where you should put your money."

Now is the time to take action, before things get a lot worse.

(18-Mar-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

After Bear Stearns collapses in three days, who will be next?

A year ago, in January, 2007, Bear Stearns shares were selling for $171. At the beginning of 2008, they were selling for $85. A week ago it ws $30/share. On Sunday, Bear signed a deal to be acquired by JP Morgan Chase at $2.00 per share.

The Fed and the financial community were putting enormous pressure on both companies to avoid a Bear bankruptcy. The reason is not the obvious one (that investors would lose money). The reason is that many hundreds of small investment firms use Bear as a bank to clear their transactions, and those hundreds of banks would be unable to do business if Bear went bankrupt.

The analog to this is if, hypothetically, a large internet firm like Comcast went bankrupt. It's true that, in such a case, the investors would lose a lot of money, of course. But the worst effect to the public would be that all its customers would instantly lose their internet service.

So it's not that Bear was "too big to be allowed to fail," so much as a need to keep it providing services to its customers.

The problem is that Bear has a huge portfolio of CDOs with high notional values, but completely unknown "mark to market" values, since there IS no market for these CDOs.