Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Enraged Mumbaikers are demanding action and change today, after 150 people were killed and hundreds more wounded in the horrendous three day, 60-hour assault on the business and technology center of India.

|

Relieved that the worst is over, Mumbaikers are proud of their city: "Mumbai stands tall" after the ordeal. There's particular pride that the grand Taj Mahal Palace Hotel, a major landmark for all of India, still stands.

True, many windows are broken and some floors are gutted. The terrorists tossed grenades into room after room, hoping to burn the entire structure down, and gain the notoriety of the terrorists who brought about the collapse of the World Trade Center towers in New York City on 9/11.

But the 26/11 attacks failed to do that. And that's what they're calling it, incidentally: 26/11 for November 26. It's Mumbai's 9/11.

They're also proud of their fallen police heroes, those who had died in the course of duty, saving the lives of hundreds of others. "They died so that Mumbai might live."

Here's an al-Jazeera video of some of the scenes of battle:

|

There were 126 people killed, and 327 people injured. Although the terrorists were supposedly targeting foreigners (Americans, British, Israelis), the vast majority of casualties were Indians, inflicted at the CST Railway Station, where one of the terrorists sprayed the crowd with bullets, killing as many people as possible.

As relieved as Mumbaikers are the ordeal is ending, their pride in their police heroes does not extend to their police leadership. It resembles the criticism of FEMA after hurricane Katrina in 2005. The criticism is that the police were totally unprepared -- had the wrong equipment, and were caught completely by surprise.

Here is a typical commentary by B. Raman, a former government official:

The Government of Prime Minister Dr.Manmohan Singh and his Congress (I) are back to their denial and cover-up mode. ...

I watched with shock and disbelief on TV, visuals of Hemant Karkare trying different helmets and bullet-proof vests before choosing one which suited his build. Here was the most threatened officer of the Mumbai Police and the Government had not even given him a protective gear tailor-made for him. This is a telling instance of the casual way we handle counter-terrorism and we look after our brave officers fighting terrorism."

Even worse, it turns out that the CIA had warned India's intelligence services in September of a planned Lashkar-e-Taiba (LeT) sea-borne attack on Mumbai, and other sources had confirmed that intelligence. People are furious that absolutely nothing was done to stop the terrorist attack, when this level of detail was previously known.

But mostly, Indian fury is growing towards Pakistan. The Pakistan government is not being blamed for perpetrating the attack, but they are being blamed for "coddling" LeT, doing nothing to arrest its leaders and close down its training camps.

Pakistan's response is that India is jumping to conclusions, and that India has plenty of its own home-grown terrorism. Here is one commentary, by a Pakistani defense analyst:

It is interesting that Indian security agencies failed to detect such a massive operation during its planning stage, but wasted little time in fixing the blame on some Pakistani group. If they knew who was responsible, why could they not pre-empt it?"

Despite the logic of that opinion, logic has little relevance to anything going on today, anywhere.

An alarmed Pakistan President Asif Ali Zardari gave an interview to the Indian television station CNN-IBN. Recall that Zardari has good reason to decry terrorism -- his own wife, Benazir Bhutto, was killed by Sunni Islamist terrorists:

|

As the President of Pakistan, let me assure you that if any evidence points towards any individual or group in my part of the country, I will take the strictest of action in the light of the evidence and in front of the world. ...

Sir I'll deliver because I stand by my people. I am delivering for Pakistan, I am delivering for the existence of Pakistan. I have a personal threat, I have a threat from the same forces. They may not be the same individuals but they are definitely the same forces and the same mindset, so I am not standing to appease any other people. I am trying to save my own nation. My country and the future of my children, so therefore I am as committed as can be."

|

The next step will be that India will provide Pakistan with specific evidence of the names and locations of LeT leaders and camps, and they will be asked to conduct raids and arrests, and turn the perpetrators over to India. Pakistan President Asif Ali Zardari has promised to cooperate fully with India in arresting the perpetrators, but how far this will go when words turn to action remains to be seen.

Still, if it turns out that Pakistan's ISI (intelligence services) had knowledge of a planned attack, and if Pakistan could have taken action to stop the attack, then there could be a major crisis between India and Pakistan.

One possible scenario is that the Indians could unilaterally attack LeT camps on Pakistani soil, provoking a response from Pakistan's army.

As things stand now, Pakistan is threatening to pull troops from Pakistan's western border, the one with Afghanistan, and shift them to its eastern border, the one with India, if tensions escalate on the border with India.

This is bringing full strength American diplomacy into the picture, as Secretary of State Condoleeza Rice apparently spent Saturday calling both sides to reduce tensions.

There have been dozens of terrorist attacks by Islamist extremists throughout the world, but if I had to name the top ones in terms of international significance, they would include the following:

It's too early to be sure, but to these I would now add the "26/11" Mumbai attack to this list. This was a new direction for these kinds of attacks. It was a "low-tech" attack in that it didn't require sophisticated bombs. But it was a highly sophisticated attack because of the complex logistics. Furthermore, by targeting Americans, British and Israeli guests, it was guaranteed international news coverage for many days.

In other words, it has to be considered a highly successful attack.

Al-Qaeda linked terrorist groups, including Lashkar-e-Taiba (LeT), embark on these attacks because their goal is to provoke a war -- a war between Pakistan and India, a war between Muslims and infidels. With billions of Muslims in the world, they believe that war is the only way to create Muslim nations.

Their model is the 1979 Islamic Revolution in Iran, where a major war defeated the existing US-backed Iranian government, and installed hardline Muslim fundamentalists. They believe that they can repeat that "success" in India, Pakistan, and other nations.

Thus, the main thing to watch for in the next few weeks is whether tensions between India and Pakistan escalate critically, possibly leading to armed skirmishes on their mutual border, or whether tensions subside after a while.

Most interesting will be to watch the effect of the Mumbai bombings on the elections taking place in India in the next few months, at the state and national level. There has been an upsurge of 'Hindutva' Hindu terrorist violence, and this Muslim terrorism may spark an upsurge in the Hindutva philosophy, and a gain to the Hindu nationalist Bharatiya Janata Party (BJP).

Pakistan and India had a massively genocidal war between Muslims and Hindus when Partition occurred in 1947, creating the two nations. From the point of view of Generational Dynamics, a re-fighting of the massively genocidal war following the 1947 Partition is coming with absolute certainty. This war will involve numerous ethnic groups, but underlying it will be Sunni Muslims versus Hindus + Shia Muslims.

(Comments: For reader comments, questions and discussion, see the Mumbai Shootings thread of the Generational Dynamics forum.

Other topics being discussed in the forum include the following:

A new World Bank report shows rapid deterioration.

Everyone was shocked on Wednesday when the China's central bank lowered interest rates by more than 1% -- the largest decrease since 1977, and the fourth interest rate decrease in just two months.

This comes just two weeks after China announced a gargantuan stimulus package, as unemployment soars and social unrest grows.

China is following a similar path to the U.S., where each failing bailout attempt is followed shortly after by a newer, larger bailout attempt, with absolutely no limit in sight.

The huge, worldwide credit bubble boosted China's economy, just as it boosted America's economy, and now that the credit bubble is leaking, it's pushing China into the same "Great Depression" as the U.S.

A new World Bank report on China's economy shows clearly how much the economy has deteriorated. This deterioration has become extremely rapid in the last few months, as the construction spree leading up the summer Olympics games in Beijing has been winding down.

I've gone through the report and extracted some of the graphics, which I'll discuss below.

|

Figure 1 shows how economic growth has been slowing. (SOEs are state-owned enterprises.) According to the report,

Note particularly that the fall in growth accelerated in October. What we're seeing is an accelerating collapse of China's economy, with no reason to believe that the collapse is going to reverse or even level off.

Figure 2 makes the point that China's economy depends on exports, exports have been decreasing. According to the report,

A major theme of the report is the collapse of a Chinese real estate bubble (although the report doesn't use the word "bubble").

A real estate bubble seems to be a part of the lead-up to every major financial crash. When you have a credit bubble going on, creating a lot of new money, then a lot of people believe that they can invest in real estate as a safe investment. After all, "they're not making any more real estate," and "the value of real estate never goes down." Unfortunately, those old sayings are not true in a major credit bubble crash, as the world has recently been discovering.

The most dramatic recent example of this was Japan's real estate bubble of the 1980s. It's incredible, but at its peak, the value of all real estate in Tokyo was greater than the value of all real estate in the United States. That's how huge the bubble was. After the 1990 crash, it was only after 16 years, that real estate prices finally bottomed out.

Now we see that China was also in a real estate bubble, especially in the large eastern industrial cities, and that bubble is starting to leak:

|

|

According to the report:

Weakness in real estate construction has contributed to a sharp slowdown in several “upstream” industries. The slowdown in steel and cement gathered pace in October in part in response to large inventory build ups (Figure 8). With these heavy industries decelerating faster than other sectors, “physical indicators” such as of freight volumes and electricity production have slowed significantly more than overall economic activity."

The details of the collapse of the China's real estate bubble are different from those for America's real estate bubble, but the results are the same.

A lot of people make the point that China is a creditor nation and America is a debtor nation, but during times of systemic financial crisis, it really may not make much difference.

America was a creditor nation in the 1920s, but it made little difference in the 1930s. This was described in "The bubble that broke the world." Just because some Brazilian bank owes you some money doesn't mean that you don't have stand in a soup line to eat.

Americans wasted their money by buying, among other things, Chinese manufactured goods. The Chinese wasted their money by investing in, among other things, a bubble stock market and American Treasuries.

One of these is called "consumption," and the other is called "investment." But in the end, there's no difference. Your money is gone. I'll leave it as an exercise to the reader to decide whether people are "happier" if they waste their money on consumption or on worthless investments.

Once the financial crisis is in full force, it makes no difference whether you owe money or you're owed money; either way, you have no money, and no credit is available.

The only thing that matters to an individual, creditor or debtor, is whether he has a job or some form of steady income. In a deflationary environment, even a very small income is enough to survive. The ones who don't survive are the ones who have NO income at all.

China is headed in that direction very quickly. The unemployment situation is 'grim' and getting grimmer. Millions of young migrant workers, who came from rural areas to the big cities to make money to send back to their families, are now out of a job, with no hope of employment. They're headed back to their rural area towns.

For Chinese leaders, already worried about social unrest, this is very significant. China's two previous massive crisis wars -- the Taiping Rebellion of the 1850s-60s, and the Communist Revolution of the 1930s-40s -- were both based on massive rebellions from rural areas.

In 2005, I wrote "China approaches Civil War," saying that a civil war is coming with absolute certainty, when economic conditions are right. Those conditions seem to be occurring right now.

(Comments: For reader comments, questions and discussion, see the China thread of the Generational Dynamics forum.)

Note: Much to my enormous shock and surprise, Paul Krugman's Friday column actually makes sense. It's the first column of his that I've read that isn't loaded to the gills with fatuous political and ideological garbage. Maybe he's had an epiphany? =eod

(28-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

It's a "War on Mumbai" by an attack from the sea.

|

According to Indian intelligence sources, here's what happened: A cargo ship left Karachi, and hijacked a sophisticated fishing trawler, which docked near Mumbai. Three speedboats, laden with weapons and supplies, and containing some 20-25 terrorists, left from there and landed at different points in the Colaba fishing harbor in the heart of Mumbai. They broke into smaller groups and went from site to site, opening up indiscriminate gunfire with AK47s and hand grenades, killing and wounding hundreds of civilians.

There were attacks across the length and breadth of Mumbai (a city that used to be known as Bombay). The Taj Mahal Palace Hotel in Mumbai was the major site of the attacks, but not the only site. There was an attack at the Oberei Hotel, where there are 4-5 hostages on the 19th floor, and attacks at the Camo Hospital, for women and children, the Metro Cinema, the CST Railway Station, Cafe Leopold, and the US Consulate. The terrorists were searching for people with US or British passports, and took several of these people as hostage. About 15-30 hostages are still being held at various sites - the exact number is not known.

|

|

"The Taj" hotel was built in 1903, and is one of the nation’s most famous landmarks, an iconic building that encapsulated both the pomp and grandeur of the British Raj and the enduring vibrancy of India’s film and financial capital. It was clearly the intent of the terrorists to completely destroy this building, as they set of grenades with the intent of starting a fire. Take a quick look at the article on the massive attack on the Marriott Hotel in Islamabad in September, and the picture of the devastation. This may have been the inspiration for the attack on the Taj. A little known group, the Deccan Mujahadeen, possibly named after the Deccan Plateau in southern India, is claiming responsibility. But intelligence sources say that this name was chosen as a red herring.

|

The complexity and sophistication of this operation indicates that it was well funded by a group that knew what it was doing. There are three major groups that are being investigated:

Right now, LeT is considered the most likely choice. LeT-related groups, linked to al-Qaeda, have launched terrorist attacks through the region, from Afghanistan to Kashmir. In this case, the terrorists who have been captured speak a Pakistani variant of the Punjabi language.

Al-Qaeda's hand seems very strong here. The demand for American and British passports might have been a (successful) publicity stunt to gain international attention, but it also feeds into al-Qaeda's objective to trigger an international war between Muslims and the Western "infidels."

As this is being written on Thursday morning ET, the Mumbai situation is still ongoing. The Taj and Oberei hotels are still on fire, and fresh gunfire and grenade explosions can still be heard from both sites. There are still many people, including hostages, trapped in both hotels.

(Comments: For reader comments, questions and discussion, see the Mumbai Shootings thread of the Generational Dynamics forum.

Other hot topics being discussed in the forum include the following:

Watching the world spin out of control.

Anyone who was interested in mathematics in the 1950s and 1960s has probably read George Gamow's book, One, Two, Three ... Infinity. That's the title that's been popping into my mind the last few days, watching the process that's going on.

Last week, it seemed that the fervor for bailouts was finally subsiding. Half of the $700 billion bailout was going to be left for the Obama administration, and the auto maker bailouts seemed to be foundering.

But that was last week, an eternity ago. And now, as eternity comes to a close, the bailout amounts seem to be approaching infinity. Even George Gamow would be amazed.

President-elect Barack Obama is leading the way. In his radio address on Saturday, he said:

|

On Monday, Obama announced his star economic team -- and to show how serious he is, there wasn't a single loony leftist in the lot. Obama added the following:

Obama's team is putting out that things will change overnight when Obama takes office on January 20. His new team will "hit the ground running" when he takes office. He and the Democratic party Congress will cooperate to spend whatever money is necessary to "jump start" the economy on January 21. There are no limits.

And the amounts seem to grow by the second. Last week, it was just the $700 billion dollar stimulus package. But on Sunday, Senator Charles Schumer (D-NY) put out the word that "I think it has to be deep. In my view it has to be between five and seven hundred billion dollars."

And that's on top of the original $700 billion bailout. So within a few days, the original $700 billion bailout has doubled. The stimulus money will be spent on infrastructure projects -- schools, roads, etc. -- and on unemployment insurance.

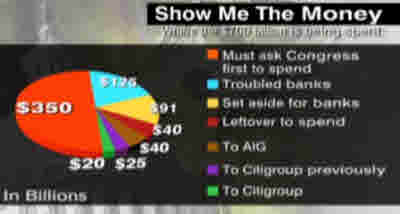

|

And where is all this money coming from? Just counting what's been planned so far, there's already a one trillion dollar deficit in the current fiscal year. Now we have the new $500-700 billion stimulus package will be on top of that deficit, so the deficit is approaching $2 trillion.

There's no doubt everyone is scared. The bailout of Citibank that was announced on Sunday is truly staggering. Citibank received a $20 billion bailout just a couple of months ago, and that was supposed to be the end of it. Now, Citi is laying off 50,000 employees, and still needs another $25 billion bailout, on top of the $20 billion.

And even that doesn't even come close to telling the whole story. In addition to the new $25 billion bailout of Citibank, the Fed will guarantee an additional $306 billion in loans and securities in Citi's portfolio.

And not just for Citibank, but for other banks as well. On Monday the US government said that it was prepared to spend $7.7 trillion to fight the credit crisis.

$7.7 trillion? Geez. A trillion here and a trillion there, and pretty soon you're talking about real money.

Let's take a nostalgic trip back in time, way into the past -- to October 14. The $700 billion bailout had just been announced a week earlier, and on October 14 a new bailout was being announced -- countries around the world moved to guarantee all bank obligations of every kind. I described it in "We're all Icelanders now, as markets rocket 10% around the world." Essentially, the world had turned into one huge hedge fund.

The move to do that was spearheaded by the UK. That was also the day when Paul Krugman won the Nobel Prize in economics because of his hatred for George Bush. Here's what he said about the new bailout:

Ask, and you shall receive. I asked plaintively for policy makers, at least once, to exceed expectations in this crisis instead of falling short — and it seems that the eurozone governments have delivered, more or less adopting the British plan.

And I should have given props to the British government, which vastly exceeded expectations last week — and has effectively shown the world the way forward."

Krugman made it clear that the new bailout would save the world, and that the bailout was taken because of leadership by the UK. The US didn't do it, according to Krugman, because of "ideology."

Well, it looks like Krugman was wrong. The bailout didn't save the world after all. Has Krugman ever gotten anything right? It doesn't matter -- getting things right is completely irrelevant to winning the Nobel Prize, as long as you have the right ideology.

Today, just five weeks later, that bailout looks small and quaint, compared to $7.7 trillion dollars.

Let's review, once again, the reasons why none of these bailout measures will do any good at all.

Thanks to a lethal combination of stupid Boomers and destructive Gen-Xers, both morally challenged, there were huge credit and real estate bubbles, creating hundreds of trillions of dollars of new investments and new debt.

The new investments turn out to be worthless, but the new debt remains, causing the massive bubble to leak a trillion or so dollars every week. We've been in a massive deflationary spiral for well over a year, and it's accelerating.

That's why the amount of money needed for the bailout is increasing so rapidly. It was a $700 billion bailout in October, and now it's a $7.7 trillion bailout. Soon it will be a $70 trillion bailout. One, two, three ... infinity.

People have been pointing out some claims by Ben Bernanke in a 2002 speech on avoiding deflation. In that speech, Bernanke congratulated steps taken by President Franklin Roosevelt in 1933 and 1934. According to Bernanke, the same steps can be taken now to fix the credit crisis.

This is just another example of why this great brain trust in Washington has no clue about what's going on. Following the bubble of the 1920s, the bubble had been leaking since 1929. By 1934, the deflationary spiral was almost completely spent, and by that time the economy would have improved whether or not the President did anything. This is not particularly difficult to understand, except by professional economists, who are incapable of understanding anything except their computer models, and certainly not anything related to generational theory.

There will be more bailouts attempted, but they will fail. Everything will fail. This is a generational catastrophe, and cannot be stopped any more than a ten mile high tsunami can be stopped.

It's time for people to realize that they should be preparing themselves and their families for the worst, instead of just praying for a huge miracle on January 20. Obama may be able to walk on water, but even he can't stop the huge generational catastrophe that's coming.

There's far worse to come. Expect a huge generational stock market panic and crash, including the imploding of tens or hundreds of trillions of dollars of CDSs and other credit derivatives, and the collapse of 401Ks, hedge funds, and money market funds. Expect many, many millions more of foreclosures, bankruptcies, and job losses. We are headed for a financial disaster of massive proportions, and it's time for people to stop lying to themselves and others about it.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(25-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Tibet's government in exile ended negotiations with China on Saturday.

Although this severing of ties would seem to be a minor event, it could spiral into a significant confrontation, because of the extreme paranoia of the Beijing government.

Frustrated from 30 years of failure from the Dalai Lama's "middle way" approach, young Tibetan leaders have been pushing their elders to declare Tibet's independence from China, while the older leaders support a more conciliatory approach toward Beijing.

|

This generational confrontation took place at an extraordinary meeting of over 500 Tibetan exiles in Dharamsala, India, the headquarters of the exiled Tibetan leadership, led by the Dalai Lama.

The Dalai Lama called the meeting last month after he bluntly said that he has "been sincerely pursuing the middle way approach in dealing with China for a long time now but there hasn't been any positive response from the Chinese side." He added: "As far as I'm concerned I have given up."

In the end, the conference ended on Saturday with a re-affirmation of the Dalai Lama's "middle way" approach, with a goal of autonomy of Tibet within China. The small group of young people demanding independence were outvoted.

As I always like to say, all of this shows Generational Dynamics in action.

Tibet's last crisis war was the Tibetan rebellion against the Chinese in the 1950s. There were riots last spring, timed to commemorate the climax of the rebellions, when the Chinese crushed the rebellion on March 10, 1959. At that time, hundreds of Tibetans, including the Dalai Lama, fled to India, where they've lived in exile ever since.

These riots occurred across a centuries-old fault line between two ethnic groups: the Tibetans themselves, and the Han, the principle Chinese ethnic group. The Tibetans and the Han have fought numerous crisis wars for centuries.

However, it's been only 49 years since the 1959 climax of the last crisis war, and so Tibet is in a generational Unraveling era. That means that last spring's demonstrations would have to fizzle before too long. This is what I predicted last spring when the demonstrations began, and that is in fact exactly what happened.

This generational confrontation among the Tibetans is a further predictable development. The elders, including the Dalai Lama himself, who lived through and survived the bloody, genocidal rebellions of the 1950s, have devoted their lives to making sure that no such war should ever happen again. Thus, the "middle way" is really a fairly standard attitude for people in a generational "Artist" archetype, the survivors of a crisis war.

The younger generation is in the "Prophet" archetype (like America's Boomers). They were born after the last crisis war, and they have no such compunction about avoiding another war, and they do not fear a greater level of confrontation. As years and decades go by, there are fewer survivors of the crisis war remaining, and there are more people in generations born after the war. So the level of confrontation increases until it finally leads to a new crisis war.

In fact, the Han Chinese are already far more confrontational than the Tibetans, a fact which probably neither side recognizes or understands. For the Han Chinese, the last crisis war was the Communist Revolution civil war, ending in 1949.

Earlier this year, we saw a very angry and paranoid Beijing government reacting harshly to the Tibet demonstrations and to the worldwide anti-China protests that preceded the Beijing Olympics. Those protests ended, however, in the worldwide sympathy for the Chinese people following the horrible Sichuan earthquake devastation in May, beginning a period of international good will directed at China.

Thus, the decisions by the Tibetan exiles to sever negotiations with Beijing are liable to be far more significant on the Chinese side than on the Tibetan side, because they might produce an overreaction.

The news from the Tibetan exiles comes on top of an increasingly severe unemployment crisis, as millions of people, especially migrant workers, are thrown out of their jobs by factory closures resulting from sharply reduced exports because of the worldwide financial crisis.

The thing to watch for in the coming weeks is how the Beijing government will handle all this. A new Tibetan crisis, on top of the financial crisis, could cause Beijing's paranoia to return in full force, resulting in miscalculations.

(Comments: For reader comments, questions and discussion,

see the Geopolitical topics thread of the Generational Dynamics

forum.)

(23-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Generational theory asks the question: When will we see a panic?

Congressional bickering caused the failure to pass a plan to provide a $25 billion bailout of the three Detroit auto makers, at a time when the stock market is in free fall and jobless claims are jumping unexpectedly to 16-year high.

In order to save the bailout, Democratic congressional leaders have asked the companies to submit viability plans by December 2. The plans are to lay out precisely how the auto companies will change business practices to survive on the $25 billion bailout.

That'll be a pretty good trick, since the auto companies cannot survive on the $25 billion, and haven't even claimed that they can. It'll be very interesting to see what work of fiction they come up with.

|

The continuing free fall of stock prices on Wall Street and in markets around the world has politicians worried about being blamed for inaction or the wrong action. The most important thing is to make sure that someone else will be blamed.

As I've been saying since 2002, the country is headed for a new 1930s style Great Depression, with a stock market collapse to the Dow 3000-4000 level or lower.

From the point of Generational Dynamics, there are actually two separate but related things growing on here:

At it's close on Thursday, the Dow Industrials index was down 47% from its high 11 months ago. This is roughly where the stock market was after its 1929 peak. So the fall in stock prices this year has been roughly the same as in 1929-1930.

The big difference is that we haven't yet had a major generational panic.

Every day I keep asking myself whether this massive panic is in fact a requirement of generational theory. And every day I keep reviewing the reasons in my mind, and reach the conclusion that it must. A massive panic is necessary to launch the next 70-90 year cycle, and if it doesn't occur one day, then it's more likely to occur the next day, until it occurs.

So we're still waiting for the generational panic and crash, and I've described it this way several times in the past:

You'll have millions or even tens of millions of Boomers and Generation-Xers in countries around the world, never having seen anything like this before, not even believing it was possible, and in a state of total mass panic, trying to sell all at once. Computer systems will crash or will be clogged for hours, or perhaps even for a day or two. People who had hoped to get out just as the collapse is occurring will be totally screwed, and will lose everything. Brokers and other institutions will go bankrupt."

This might happen tomorrow, next week, next month or thereafter. We can't predict when it will happen, but it's coming soon with absolute certainty.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(21-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Labor unrest is becoming a "top concern" for China's government, as China admits that unemployment has become a "grim situation."

There have been few mass protests so far, but Chinese leaders are warning of further protests.

Here's the situation as described by BBC's Singapore business reporter Juliana Liu:

|

The man in charge of one of China's biggest employment agencies told me that his job at that time was normally very quiet, but October-November what he was trying to do was simply prevent a stampede at this employment agency, where thousands of people could come in in a single day. ...

We did start to see factory closures at the beginning of the year, because of the strengthening of the renminbi [currency]. But in the last few months we've started to see many more factories going bankrupt, many more people being laid off.

I have to say there are no really good numbers on this. The best estimate I've seen is that one million people have lost their jobs in Guangdong province alone, and that 46,000 factories have closed up. Again, the numbers don't tell the full scale of the story. When we were in Guangdong, the pain was very real."

China is entering a generational Crisis era, and has been almost coming apart at the seams for a few years. China is headed for a secular civil war, as I wrote in 2005. In March, 2007, before the credit crisis had even begun, Chinese premier Wen Jiabao said that China is "unsteady, unbalanced, uncoordinated and unsustainable."

During the last six years, I've written some 1,500 articles for this web site, describing where the world was going, based on generational trends that are decades and centuries old. Many of those articles were almost theoretical, describing things that would occur with near 100% certainty, but which seemed bizarre within the context of the world at that time.

But in the last few weeks, the feeling has been increasing that we're seeing massive events occurring, bringing about these generational trends. The worldwide financial system is collapsing more and more every day, pushing millions and tens of millions more people into poverty and starvation, especially in densely crowded megacities around the world. These large populations are becoming increasingly restless, and increasingly facing a choice of starvation or war.

To understand what's going on in the world today, you have to go beyond looking at individual statistics or political nonsense. You have to look at the world as a huge system, with large components that are now in motion and heading for collisions. It's like watching a huge movie epic that ends in tragedy, except for the unfortunate fact that the movie epic is actually real life.

(Comments: For reader comments, questions and discussion,

see the Geopolitical topics thread of the Generational Dynamics

forum.)

(20-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Fears grow of a Detroit auto maker bankruptcy.

|

For over a year, the markets have been following a continuing downward trend. On Wednesday they reached a new low, as the Dow Industrials index closed at its lowest level since March 31, 2003.

The economic news on Wednesday was terrible:

|

The economic news is scary and disastrous. But that's OK. President Obama will save the world within a week or two, after he takes office on January 20.

We're still waiting for the generational panic and crash that I've described so many times. With the market now down 44% from it's peak, I'm really amazed that the deadly chain reaction of imploding CDSs hasn't begun by now, but it has to begin at some point.

(Comments: For reader comments, as well as more frequent

updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(20-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

With no immediate crises going on, politicians just settle for rhetoric.

What's interesting about what happened in Congress on Tuesday is that almost nothing happened.

Treasury Secretary Hank Paulson lauded his achievements, but lawmakers bickered with him over the question of why he hasn't used the $700 billion bailout fund to end foreclosures.

Recall that the original proposal for the Troubled Asset Recovery Program (TARP), the official name for the bailout, was to purchase near-worthless mortgage-backed securities from financial institutions. Then last week, Paulson reversed direction, saying that he would use the money to bail out banks directly.

Committee members who angry about not ending foreclosures had apparently thought that purchasing worthless mortgage-backed securities would mean the end of the foreclosure problem.

Anyway they argued about that for an hour or two.

They also argued about whether some of the $700 billion TARP money should be used to bail out auto manufacturing firms.

In the afternoon, CEOs of GM, Chrysler and Ford came to Congress to beg and plead for a bailout. The car people were almost in tears, but the heartless lawmakers (both Republicans and some Democrats) were looking for some sort of guarantee that the bailout money wouldn't just go down the drain.

So they argued about that for an hour or two.

In fact, Paulson has spent $250 billion of TARP money, and plans to leave the remaining $350 billion unspent, to be used by the incoming Obama administration.

In the play "Finian's Rainbow," the pot of gold at the end of the rainbow finally turns into a pot of worthless dross. One gets the feeling that the same thing has happened to the $700 billion bailout pot.

Meanwhile, Gen-X President-elect Barack Obama gave a talk on Tuesday to a bunch of environmentalists. He promised to spend lots of money to reduce emissions to combat global warming.

He promised to implement the "cap and trade" scheme that's been a total, absolutely failure in Europe.

As I wrote last year in "UN Climate Change conference appears to be ending in farce," I explained that the "cap and trade" plan is scam. The idea is to create a new class of near-worthless securities, backed by "carbon credits," in the same way that near-worthless securities were created from subprime mortgages.

The only good thing I can say about this buffoonery is that there isn't a snowflake's chance in hell that anything will ever come of sham; even a Democratic Congress will find it almost impossible to endorse this scam in the midst of an ever-worsening financial crisis.

Meanwhile, the stock market has been continuing its general downward trend that began in October 2007. It's now down 41% from its peak on October 7, 2009.

On any day when the market goes higher, you hear shrieks of "Hooray! We've reached a bottom."

Last week on Thursday, the market spiked up 6.7%, and Art Cashin, the UBS floor manager at the stock exchange and devoted believer in the "capitulation" theory, announced on Friday morning that capitulation had arrived, and the market was going up again. Unfortunately, it fell sharply on Friday and Monday, so he's had to back off. Tsk, tsk. Well, it rose 1.8% on Tuesday, so let's see what he says on Wednesday morning.

I used to write a web log entry on the economy and the stock market almost every day, but there hasn't been much new lately. It's just the same old bickering and arguing, one idiotic remark by analysts and journalists and politicians after another, the long faces when the market is down, the euphoric cries of "we've reached bottom" on days when it goes up.

We haven't had a major financial crisis for a few weeks now, so it shouldn't be too long now.

(Comments: For reader comments, as well as more frequent

updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(19-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

On Thursday, the FDA issued a nationwide alert, banning Chinese dairy products and food and feed products manufactured in China that contain dairy ingredients.

This alert by the US Food and Drug Administration is an extremely broad ban because it covers goods from an entire country, rather than from a single rogue manufacturer.

Even though this situation has barely made the news in America, the size of this growing disaster in China is almost beyond comprehension. Over the last few years, Chinese manufacturers of milk products have been adding a chemical called melamine to their products. Melamine is an industrial chemical used to make plastics and fertilizer.

The advantage of adding melamine to food products is that it boosts nitrogen levels in the food, and the higher nitrogen levels give the appearance of higher protein levels, when standard tests are used.

The disadvantage of adding melamine to food products is that not only is it not real protein, but it's actually poison. Melamine can cause kidney stones and renal problems, and eventually death.

And that's what's happened -- to babies on baby formula. According to Beijing's figures, some 54,000 babies have fallen ill and been hospitalized with kidney stones and related problems. Beijing has also claimed that only four babies have died from melamine poisoning, but there is plenty of anecdotal evidence that far more babies have died.

There was an early warning of this disaster in 2007. Early in 2007, it was found that dogs and cats were dying in America because pet food imported from China had been contaminated with melamine. The result was one of the largest pet food recalls in American history.

At first, China denied that any such thing had happened, and even claimed that melamine could not harm pets. Finally, in May, 2007, China said that it had found two Chinese companies guilty of intentionally exporting contaminated pet food ingredients to the United States.

Well, the problem was "contained," and it had been resolved by finding the two guilty parties.

But it exploded into the news in China two months ago, on September 10, when China revealed that 14 babies had fallen ill from drinking the same brand of milk powder, marketed by the Sanlu Group. It soon turned out that the milk powder had been contaminated with melamine.

Once again, the problem was thought to be "contained," with only one guilty company. Still, it was shocking that the same contaminant that had been used with pet food was now found to be used with human food.

In the last two months, the tentacles of this scandal have spread throughout China and around the world. Here are some examples:

There seems to be no end to these revelations. Here's how one Chinese analysis describes it:

To avoid similar tragedies in the future, the Chinese authorities have vowed to overhaul the chaotic industry and provide the necessary help to affected farmers and some enterprises. However, the most important thing should be to emphasize the importance of business ethics, and to strictly punish those evil-doers. Only then will public trust in China’s dairy sector begin to be restored."

What's becoming increasingly clear is that the melamine problem is becoming widespread and ubiquitous.

To realize how incredible this is, just imagine an American food producer purposely contaminating food, resulting in the hospitalization of even a few dozen babies. Think of how shocked everyone would be, and what an enormous scandal there would be.

Now realize that in China it wasn't just one food producer, but many, many food producers, supported by a wide variety of officials in other organizations -- government agencies, testing agencies, other manufacturers, and so forth.

Astute long-term readers of this web site will have guessed by now where this is going.

I've written frequently about the ubiquity of the deception and fraud that occurred in the subprime crisis: Homeowners who lied on their mortgage applications, and accepted mortgage loans they had no hope of repaying; collusion of homebuilders and lenders to inflate the market value of homes; lenders who praced "predatory lending" practices; financial advisers who misled investors to get commissions; investment banks that created fraudulent mortgage-backed securities; ratings agencies that gave these securities AAA ratings; "monoline" bond insurers that provided near-worthless insurance; hedge fund, mutual fund, money market fund managers who sold these worthless securities to investors; journalists, analysts, pundits and politicians, supposed experts in finance, who lied and said everything was ok; government regulators who banks to commit fraud by lying about the values of their assets.

The same ubiquity applies to China's melamine scandal. The depth and breadth of the criminal activities can only be explained generationally.

On this web site, I've written in extensive detail how it happened. In the 1990s, the risk-averse generation of Great Depression survivors all retired. The arrogant, incompetent Boomers took the senior management positions, and created the dot-com bubble, which burst in 2000. After that, the nihilistic, destructive Generation-Xers reached middle management positions, and created the CDOs and other complex financial instruments that have destroyed the world financial system.

China's melamine poisoning has reached into food products around the world, just as the CDOs have reached into financial portfolios around the world. The financial scandal is farther along than the melamine scandal, and in the end, both may end up being equally destructive.

There's also a parallel with academic support for the activities, according to an Asia Times analysis:

Recent reports have found that China's top scientific research body - the Chinese Academy of Sciences (CAS) - "discovered" as early as 1999 that adding melamine to food could boost its protein levels. In turn, the reports allege that rogue biologists cashed in on their chemical invention by promoting the sale of products containing melamine - even charging for training in how to use them - for years. ...

The prestigious, government-funded CAS was among the first to be linked to the chemical.

Last month, Chinese bloggers exposed that as early as in 1999, a CAS institution placed advertisements for an additive to cattle feed called "DH Composite High-protein Fodder Supplement". The advertisement claimed that the technology could be used to manufacture "high protein fodder using organic nitrogen and special catalysts".

The technology was sold by the Appliance Technology Institute of CAS for 10,000 yuan (US$1,466) plus an extra 5,000 yuan ($700) for training, according to the advertisement. The online ad was soon posted on major websites and forums. Many believed that "DH Composite High-protein Fodder Supplement" was based on melamine.

The CAS, however, was quick to deny the charge. Jiang Xiezhu, spokesman of the CAS, told the media that an investigation launched by the academy showed that the supplement "had nothing to do with melamine". His explanation was that the advertised technology could not produce the high temperature needed for the production of melamine.

Few are convinced by the explanation, however, because the investigation was done unilaterally by the CAS. Without an independent observer, people began to doubt the objectivity of the results. And while denying that "DH Composite High-protein Fodder Supplement" is based on melamine, the spokesman also failed to publicize its formula or ingredients.

The CAS also failed to mention who invented the technology. It only said that the contact person named in the advertisement, Gao Yinxiang, was not a scientist, implying that Gao was not the inventor.

This is not true. In an interview with the Beijing Evening News, Gao acknowledged taking part in the development of the product. The Beijing Evening News later exposed Gao as a former director of the Appliance Technology Institute of CAS, and a biologist."

I won't quote any more - read the original article if you want more details. The point is that there were a cadre of academics and scientists like Gao Yinxiang who developed these poisonous products, and they're now using sleazy lies and excuses to keep from being identified.

|

The American equivalents of Gao include Robert Engle, 2003 Nobel Prize Winner in Economics, and Joseph Stiglitz, 2001 Nobel Prize Winner in Economics. I wrote about these two when they appeared on CNBC in an article, "Brilliant Nobel Prize winners in Economics blame credit bubble on 'the news.'"

These two Nobel prize winners actually developed the theoretical support for the CDOs and other financial instruments, but according to Stiglitz, forgot to account for things like recessions and rising interest rates.

I've seen Stiglitz in particular on numerous shows, pointing the finger at everyone but himself. A couple of times I heard him blame the whole subprime crisis on Bush's war in Iraq, which is exactly the kind of stuff that the mainstream financial media loves to hear, even though it makes as much sense as blaming it on the weather.

The melamine crimes have poisoned tens or hundreds of thousands of people, including many babies, perpetrated by people who knew what they were doing, but wanted to make money.

By the beginning of 2007, it was clear that the computer models that supported the subprime securities were wrong, and that the models were falling apart. This did not stop the deception and fraud, as I've discussed many times. Instead, the deception and fraud actually INCREASED, because the greedy Gen-Xers and compliant Boomers wanted to continue to collect their fat commissions and bonuses.

The same kind of thing is also true of the melamine crimes. When the pet food scandal broke in 2007, it was clear that there was a problem, but the melamine contamination didn't stop. Instead, it apparently increased and spread to more and more human food, including milk for baby's formulas.

An article with another analysis describes the situation as follows:

“The scale of the problem proved that it was clearly not an isolated accident but a large-scale intentional activity to deceive consumers for simple, basic, short-term profits,” commented a spokesman of the World Health Organisation. He said that this was one of the largest food safety events it has had to deal with in recent years."

The people who perpetrated these crimes exhibited the same kinds of behaviors as America's Gen-Xers and Boomers.

In order to make a better comparison, it's necessary to identify China's generations. In generational theory, generations follow well-defined archetypes: Heroes (like our World War II GI generation, and the young Millennial generation), Artists (like our Silent generation), Prophets (like our Boomers), and Nomads (like our Generation-X).

(For information about American generations and eras, see "Basics of Generational Dynamics.")

In 2006, I developed a list of China's generations and eras, but I've never posted it on this web site. Now seems like a good time to do so. I believe that the time intervals for these eras are accurate, but the names for the eras and generations are my own, and might be improved upon by scholars.

This is the crisis period that triggered the unification of China into a single country, rather than a group of independent provinces. The major war was the Taiping Rebellion, but there were other revolts in other parts of China. (This is an example of what's called "merging timelines," when different regions with separate timelines merge together into a single timeline.) The principal revolts were the following:

Humiliated Generation (Artists) - Growing up during this enormous and bloody civil war, they missed their chance for the fight. As adults, they and all of China were humiliated in 1895 in the Sino-Japanese war.

The Recovery era began with the “Self-Strengthening Movement," the study of Western skills, government, technology and industry. China had been humiliated in the Opium Wars of the 1840s, and it was argued that China could become stronger by learning Western ways and adapting them to Chinese culture. It was successful, and the next few decades saw China advance far towards catching up with the rest of the world in technology, finance and trade.

Revolutionary Generation (Prophets) - Remarkably, Taiping era crisis did not dislodge the government of the Qing dynasty of the Manchus, although the Manchus (from Manchuria), had governed China for centuries. This generation first brought down the Manchus, in 1912, and then led the Communist Revolution in the 1930s and 1940s.

The Awakening era began with the first of many attempts to overthrow the Qing dynasty by means of secret revolutionary societies. The first was formed by Sun Yat-sen (1866-1925), who failed and was forced to flee to Hawaii and the United States, but later returned after the success of the 1911 revolution to become President of China.

As soon as the 1894 revolution failed, China was defeated and humiliated by the 1895 Sino-Japanese War. China was forced to sign a treaty which ceded Korea, Taiwan and other territories to Japan, a small neighbor on whom China had formerly looked on condescendingly.

The 1911 Chinese Revolution replaced the Qing Dynasty with a Republic that lasted only two years, and was replaced in turn by a military dictatorship.

The Awakening era ended with the Bolshevik Revolution in Russia and the formation of the Communist International (Comintern) and its plan to conquer the world.

??? Generation (Nomads) -

There were massive student demonstrations in Tiananmen Square and elsewhere on May 4, 1919, resulting in a student union of the Republic of China. This became known as the "May 4 movement." (Paragraph updated 2-June-2009)

The central government disintegrated, leaving power in the the hands of small groups of militarists and their armies in constant battles for power. This led to the formation of two power groups:

The two factions fought through an unraveling war until Mao and his army were surrounded and faced with defeat in 1934.

Communist Generation (Heroes)

All the separate revolts and rebellions of the Taiping era were now merged into a single civil war between the Mao and Chiang, resulting in the victory of the Communist Revolution.

Mao escaped the encirclement through the Long March, the longest retreat in history, lasting a year. This began the civil war.

The two sides were forced to unify because of Japan's invasion, especially after the "Rape of Nanjing" in December 1937.

The civil war resumed after WW II, forcing the nationalists onto Formosa (Taiwan).

Preparatory Generation (Artists)

(Like our Silent generation). Led by the current president, Hu Jintao, this generation has been preparing China for its greatest challenge, all-out war with the U.S., Japan and India.

Mao consolidated his power by executing millions of people in the 1950s. Mao said "Let a hundred flowers bloom," meaning that free expression should be encouraged, but intellectuals who expressed grievances were executed or sent off the work camps.

The worst was Mao's Great Leap Forward, 1958-60, during which some 20 to 30 million people died of starvation in a man-made famine. This was a disaster of almost unimaginable proportions and created many enemies for Mao.

Miserable Generation (Prophets)

(Like our Boomer generation) I call them the "Miserable Generation," a name that I picked up several years ago in an article by a Chinese author. They were starved by Mao's Great Leap Forward, and they got no education, thanks to Mao's Great Cultural Revolution. They turned into a political force after he 1989 Tiananmen Square massacre, and now their Falun Gong movement is being violently suppressed.

To retaliate against his enemies, Mao launched the Great Cultural Revolution (1965-68) and formed the Red Guards, mostly young students, to implement the assault on dissidents. They brought the country to the verge of chaos, carrying out summary execution, forcing tens of thousands from their homes or into labor camps. Schools and universities were shut down for several years.

During this period, China developed a rapprochement with the United States, joined the United Nations, instituted many educational and government reforms, and launched the "Democracy Wall" movement. In 1980, China launched the "one-child" policy. By the end of the era, Mao was openly criticized.

Tiananmen Generation (Nomads)

(Like our Generation-X.) Growing up in the aftermath of the chaos of the cultural revolution, this generation formed the bulk of the millions of students that crowded into Tiananmen Square in 1989, in a generational echo of the May 4 Movement that began on May 4, 1919. (See above) (Paragraph updated 2-June-2009)

The era was launched by the Tiananmen Square massacre on June 4, 1989, triggering the huge movement, followers of the Falun Gong. Their leaders believe it to be the modern version of the God-Worshipper's Society, a spiritual movement which launched the Taiping Rebellion, and was a form of Christianity combined with Buddhism. By 1999 the movement was so widespread that Beijing clamped down on it. It's rumored that millions of adherents have been jailed. (Paragraph updated 2-June-2009)

Today, China's social structure is unraveling rapidly, as can be seen from the tens of thousands of regional rebellions each year, over 100 million migrant workers, high food prices, high rust belt unemployment, addiction to a bubble economy, unraveling of Mao's social structure and secessionist provinces.

Today, China has either already entered, or is about to enter, a Crisis era.

One-child Generation (Heroes) - This generation bore the brunt of the one-child policy which has created an enormous surplus of young males, meaning that a large segment of this generation will never get married. This generation almost has nothing to lose by going to war -- against Beijing, against Japan, or against the U.S. And they will be guided by the last Prophets - the Miserable generation -- and supported by the last Nomads -- the Tiananmen generation.

Since the 1930s, the US has been the world leader in finance. The US developed most of the laws and regulations for finance that are followed around the world. Thus, the subprime crisis is a rejection by younger generations of a major achievement of America's WW II survivors, and expresses contempt for their values.

For China, a principal achievement of the last 70 years has been the conquest of famine. With 2.4 billion people, the spectre of famine is always close in China, but since the 1960s, China has been successful in feeding its population. Thus, the melamine scandal is a rejection by younger generations of a major achievement of China's Communist Revolution survivors, and expresses contempt for their values.

A lot more research into the melamine scandal is needed in order to fully identify completely how it unfolded generationally. But this article provides a first pass at showing how the melamine scandal is very similar to America's subprime scandal, with the same kinds of generational overtones.

(Comments: For reader comments, questions and discussion,

see the Geopolitical topics thread of the Generational Dynamics

forum.)

(17-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

A new constitutional amendment leaves people wondering what he's planning.

The amendment to Russia's constitution, the first since the constitution was adopted in 1993, is being rushed through the Parliament at top speed.

The new law will extend the President's term of office from four years to six years, and the term of office of a member of parliament from four years to five years.

The amendment was put forth by Russia current President, Dmitry Medvedev, with the backing of former President and current Prime Minister Vladimir Putin. The amendment easily passed its first vote in the State Duma (the lower house of Russia's parliament), since Putin's political party, the United Russia party, is in control of the Duma. The Federation Council (the upper house) will approve it next week.

The vote in the Duma was 388-58. The only major objecting group was, ironically, the Communist Party.

|

Putin served two terms as President, from 2000-2008, but was forced to step down because of a constitutional limitation to no more than two consecutive terms. Putin's hand-picked successor, Medvedev, won the Presidency for a term running from 2008 to 2012. Putin became Prime Minister, and the constitution will allow him to run for President again in 2012, since the three terms won't be consecutive.

Both Medvedev and Putin claim that the amendment doesn't apply to them. If that's true, then why are they pushing it, and why are they pushing it at top speed to get it passed within just a few days?

The speed certainly is related to the scheduled November 20 national meeting of Putin's United Russia party. Rumors are buzzing that Medvedev will step down, leaving the way open from Putin to become President again within a few weeks, after another election. Then Putin could be President for two six-year terms, until the 2020s.

This is all speculation right now, but if it happens, it will be completely consistent with all the game-playing that's been going on this year.

The United Russia party was formed last year to support Putin, who had not previously been in any political party, and on December 2, 2007, United Russia won the Russian Parliamentary election by a landslide.

Then Putin arranged a deal so that his ally Dmitry Medvedev. Medvedev would win the March 2 elections and become President, allowing Medvedev to appoint Putin as Prime Minister.

The assumption has always been that Putin would run again in 2012, but the worldwide economic crisis is forcing Putin to consolidate power very quickly. It was only ten days ago, on November 5, that Medvedev announced that he would be proposing the new amendment. Now, the entire Russian political landscape is apparently changing in the blink of an eye.

I've written about Putin many times, and about his rock-star cult status in Russia. Did Putin arrange to have Alexander Litvinenko poisoned with polonium? That's fine with the Russians. Did Putin arrange to nationalize Yukos and other Russian companies by the vilest means possible? The Russians love it. Did Putin have journalists killed? Did Putin arrange for a cyber attack on Estonia? That's great, according to the Russians. And it was just a few months ago that Putin shut down an entire newspaper, throwing all the employees out on the street, for committing the crime of reporting rumors that Putin was having an affair with a glamorous Olympic gymnast.

From the point of view of Generational Dynamics, it's impossible to predict Putin's future. Any prediction about a single person could be proven wrong by a simple traffic accident, for example. Generational Dynamics predicts the attitudes and behaviors of large masses of people, entire generations of people, as a group.

But what is clear is that the Russian people are looking for someone to lead the country through its worsening crisis, and Putin is the obvious choice. Russia is going through a major stock market crash, triggered by the collapse in price of its main export, oil, from a peak of $147 per barrel to a new low this week of $55 per barrel. Russia has been coming apart at the seams for two decades now, with increased xenophobia around the country, and terrorist activity in the Caucasus provinces of Chechnya, Dagestan and Ingushetia.

Putin was able to keep things under control by using the vast wealth generated by oil sales, but now that control is collapsing as the oil wealth collapses. According to some analyses, Putin's domestic situation is so bad that he'll be forced to manufacture an international crisis to unite the Russian people behind him.

There is a parallel that we can draw here with Iran. President Mahmoud Ahmadinejad's desperate domestic situation causes him to manufacture crises with Israel, with the US and with Europe. (For an extensive analysis of Iran's strategy, see "China 'betrays' Iran, as internal problems in both countries mount.")

However, although Putin's and Ahmadinejad's strategies may be similar, a Generational Dynamics analysis explains why they're having and will continue to have very different results.

Iran is in a generational Awakening era, which means that the Iranian people are "attracted away from" war. Ahmadinejad's attempts at unifying the Iranian people behind him only backfire, because the Iranian people, who are largely pro-American, blame him for making Iran look foolish in the world.

But Russia is in a generational Crisis era, which means that the Russian people are "attracted toward" war. That doesn't mean that they want war, but it means that they'll choose confrontation over conciliation and compromise, and that they'll support Putin in any international crisis.

In particular, it's very likely that the Russian people will support Putin in this palace coup, if it occurs. And those who believe that a new Obama administration will mean the end of international crises with Russia can expect those hopes to be dashed.

(Comments: For reader comments, questions and discussion,

see the Russia thread of the Generational Dynamics forum.)

(15-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Wall Street stock prices plummeted 5% on Wednesday, reflecting investor reaction to the move.

|

As I write this on Wednesday evening, Asian stock markets have also fallen 5% on Thursday morning.

Treasury Secretary Henry M. Paulson began his press conference almost by declaring victory:

Of course, investor confidence is still dangerously low. In fact, the commentary by the tv analysts on Wednesday sounded almost as gloomy as I do.

As I assess where we are today, I believe we have taken the necessary steps to prevent a broad systemic event. Both at home and around the world we have already seen signs of improvement. Our system is stronger and more stable than just a few weeks ago."

Then Paulson dropped a bombshell: the $700 billion bailout money would no longer be used to purchase toxic mortgage-backed securities.

The original plan was to use the $700 billion to purchase near-worthless mortgage-backed securities, so that financial institutions wouldn't be forced to write down their assets because of mark-to-market rules. Apparently they will now have to do exactly that. Perhaps Paulson is hoping that there are no more toxic mortgage-back securities.

The reason for the change in direction is that it's now becoming apparent that structured securities backed by consumer loans are just as toxic as structured securities backed by mortgage loans.

So the new plan is to throw money at financial institutions that are in trouble because of things like credit card loans, student loans and auto loans.

Meanwhile, pressure is building to throw money at the automobile companies. Democrats in Congress are demanding that some of the $700 billion be used to bail out the automobile companies.

We can expect more of these. If you're an employee of a company that the Democrats favor, you might hope for a bailout; but if you're an employee of a company that Republicans favor, expect to be out on the street.

Here is the Guardian's summary of where the money has gone:

There is one major event that we're still waiting for, the generational panic and crash, that I've described this way several times in the past:

You'll have millions or even tens of millions of Boomers and Generation-Xers in countries around the world, never having seen anything like this before, not even believing it was possible, and in a state of total mass panic, trying to sell all at once. Computer systems will crash or will be clogged for hours, or perhaps even for a day or two. People who had hoped to get out just as the collapse is occurring will be totally screwed, and will lose everything. Brokers and other institutions will go bankrupt."

This might happen tomorrow, next week, next month or thereafter. We can't predict when it will happen, but it's coming soon with absolute certainty.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(13-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

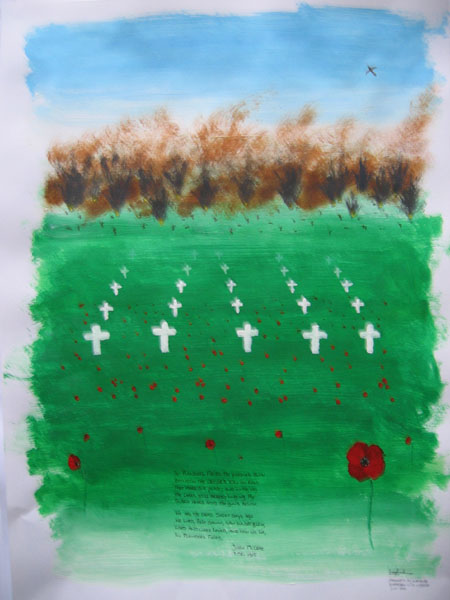

(I posted this on Veterans Day / Remembrance Day / Armistice Day two years ago. It's one of my favorites.)

|

In Flanders Fields

By: Lieutenant Colonel John McCrae, MD (1872-1918)

Canadian Army

IN FLANDERS FIELDS the poppies blow

Between the crosses row on row,

That mark our place; and in the sky

The larks, still bravely singing, fly

Scarce heard amid the guns below.

We are the Dead. Short days ago

We lived, felt dawn, saw sunset glow,

Loved and were loved, and now we lie

In Flanders fields.

Take up our quarrel with the foe:

To you from failing hands we throw

The torch; be yours to hold it high.

If ye break faith with us who die

We shall not sleep, though poppies grow

In Flanders fields.

(11-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

This was another hugely historic day, though few people paid attention.

China announced a 4 trillion yuan stimulus package on Sunday.

This equals around $570 billion, and it's absolutely enormous, representing 18% of the country's annual GDP of $3.3 trillion.

By contrast, America's $700 billion bailout represents 5% of the country's $14 trillion GDP.

Here's China's announcement:

A stimulus package estimated at 4 trillion yuan (about 570 billion U.S. dollars) will be spent over the next two years to finance programs in 10 major areas, such as low-income housing, rural infrastructure, water, electricity, transportation, the environment, technological innovation and rebuilding from several disasters, most notably the May 12 earthquake."

This is a desperate move, in response to an economy that's increasingly in serious trouble.

But there were many more signs of desperation on Monday.

Putting all of these together, it probably amounts to $1 trillion in bailouts -- all in one day! That's truly historic!

And yet, it's hardly being noticed in the news. If there are any news reports at all, they're at the level of the latest crop reports.

Once upon a time, long, long ago, any loosening in the Fed Funds rate would be big news. But now, the world has become so blasé that a $1 trillion bailout hardly brings a nod.

Two things are obvious:

As I've explained numerous times, the collapsing credit bubble is removing a few trillion dollars from the world every day, and there's no possibility that any number of bailouts will work at all.

I'd like to explain why I believe that the Chinese bailout in particular cannot possible work as intended. This is a very general argument at a "system level," rather than focusing on specific details of the Chinese economy.

Suppose you have an old desktop computer, and you want to speed it up. So you buy a new, faster hard disk, and a new CPU that runs twice as fast, you plug them into the system board, and away you go. Unfortunately, the computer is barely faster at all. Why? Because you have to speed up the whole system -- the data buses, the memory, and so forth. It can almost be said that the system will be as fast as its slowest component. Even worse, a speed mismatch between different components may actually cause the system to run slower!

That's the problem with China's bailout. It targets certain "components" of China's economy, but it creates mismatches that will prevent the economy as a whole from benefiting. In fact, the mismatches may cause a great deal of waste, making the situation worse.

It's mind-boggling how long this process has gone on. Absolutely nothing has worked, but each failure has only brought on a bigger bailout and more failures. The dreaded massive failure -- a huge collapse of the entire financial system -- has been avoided so far, by targeting each bailout to a specific point of failure. But as in China, the bailouts have made the entire financial system diseased and distorted, guaranteeing that the massive failure will be worse than it would have been if all the bailouts hadn't been tried.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(11-Nov-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Economists are shocked that the fight against inflation is over.

The spectre of deflation forces a historic change in economic theory:

Economists are shocked that the fight against inflation is over....

(8-Nov-2008)

What's coming next: Understanding the deflationary spiral:

Why are the dollar and the yen getting stronger, while the euro is getting weaker?...

(27-Oct-2008)

Roubini: The situation is "sheer panic," as hundreds of hedge funds are going bust:

Policy makers may need to close markets for one or two weeks....

(24-Oct-2008)

There's never before been a day like this on Wall Street.:

Possible exception: One of the days just before or after the 1929 crash....

(11-Oct-2008)

Ben Bernanke's Great Historic Experiment is at the brink:

Desperation sets in as credit markets continue to seize up....

(25-Sep-2008)

Government promises to buy bad debt to end the credit crisis:

Stock markets stage huge comeback as giddy investors pile in....

(19-Sep-2008)

Another stunning and historic bailout: Fannie Mae and Freddie Mac:

Giddy investors are popping the champagne corks....

(9-Sep-2008)

Long-term negative market trends asserting themselves strongly:

Stock and commodities prices plummet as worldwide foreclosures and recessions worsen....

(5-Sep-2008)

Money supply contracts dramatically, as credit markets continue to seize up.:

Former IMF chief: Worst of global financial crisis is yet to come....

(24-Aug-2008)

As commodities plummet worldwide, the meaning is unclear.:

We speculate on some possibilities....

(11-Aug-2008)

Alan Greenspan calls this a "once in a century" liquidity crisis.:

Says that the "big surprise" is the "impressive" American economy...

(3-Aug-2008)

More questions from readers on finance and investing:

Anxious readers wonder what's going on, what to do next....

(18-Jul-2008)

Pundits and analysts are baffled by the market's performance:

They have some interesting fantasies, as well....

(10-Jul-2008)

Questions from readers on finance and investing:

On fraud, the FDIC, China, and other subjects....

(23-Jun-2008)

Royal Bank of Scotland issues global stock crash alert:

"A very nasty period is soon to be upon us - be prepared,"...

(18-Jun-2008)

A clearer explanation of credit default swaps.:

How credit default swaps (CDSs) present a systemic risk to the global financial system...

(4-Jun-2008)

WSJ's page one story on Bernanke's Princeton "Bubble Laboratory" is almost incoherent:

So is Thursday's speech on bubbles by Fed Governor Frederic S. Mishkin....

(18-May-2008)

Brilliant Nobel Prize winners in Economics blame credit bubble on "the news":

Meanwhile, the deflationary spiral is in progress, but hyperinflation is not....

(27-Apr-08)

Investment bank UBS is now "writing down" clients' auction rate securities:

From individual investors to tech firms, people are losing their money....

(29-Mar-08)

Both consumer and commercial credit is disappearing as deflationary spiral accelerates:

Wall Street markets plummet 3% on Tuesday, as service sector contracts sharply....

(6-Feb-08)

Will hyper-inflation make the dollar worthless (like the Weimar republic)?:

I've gotten this question several times this week from web site readers,...

(21-Dec-07)

Questions and answers about the "credit crunch":

What's going on, and what you can do about it....

(6-Dec-07)

Understanding deflation: Why there's less money in the world today than a month ago.:

As the markets continue to fall, the Fed is increasingly in a big bind....

(10-Sep-07)

Bernanke's historic experiment takes center stage:

An assessment of where we are and where we're going....

(27-Aug-07)

Ben Bernanke's Great Historic Experiment:

Bernanke doesn't believe that bubbles exist. His Fed policy will now test his core beliefs....