Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

One of the most interesting aspects of this growing crisis is the increasing condemnation of bankers, brokers and other financial executives.

When I was growing up the in the fifties, my mother and many other people frequently spoke of the greediness of bankers and brokers. I didn't understand it at the time, and actually forgot about it later, as the societal bitterness toward bankers disappeared in the decades that followed.

Now the bitterness toward bankers is returning quickly, and we can see the secular cycle completing itself right before our eyes.

President Obama said the following:

|

When I saw an article today that indicates that Wall Street bankers had given themselves $20 billion worth of bonuses, the same amount of bonuses as they gave themselves in 2004, at a time when most of these institutions are teetering on collapse and they are asking for taxpayers to help sustain them, and when taxpayers find themselves in the difficult position that if they don't provide help then the entire system could come down on top of our heads, that is the height of irresponsibility.

It is shameful."

These words definitely ring a bell for me. I heard this kind of rant in the 1950s. Everything that's old is new again.

As you can see from the graph above, Wall Street bonuses have increased in a runaway exponential manner since 1984 -- the time when the survivors of the Great Depression began to retire. As the years went by, there were fewer and fewer Great Depression survivors, and Boomers began to fill senior management positions, and awarded themselves ever increasing bonuses.

Then in the 2000s decade, the Gen-Xers reached mid and upper level positions, and started creating and selling fraudulent securities. Boomers and Gen-Xers granted themselves even higher bonuses and commissions, in return for their fraud.

This is simply one more aspect of something that I've described many times before on this web site -- the lethal combination of stupid, arrogant, greedy Boomers being led by nihilistic, destructive, greedy Gen-Xers.

(For numerous examples, see "The outlook for 2009," which describes where we are, who's to blame, and what's going to happen next.)

From the point of view of Generational Dynamics, what's really interesting about all this is the changes in behavior and attitudes by the great masses of people in such a short period of time, and in such a predictable manner. I've been warning people for years that if you embezzled money or if you're a broker defrauding your clients, you'd better have your bunker picked out, because people are going to be coming after you.

During the huge bubble, when everyone was making money, nobody cared about a fraud and embezzlement; in fact, nobody even paid attention. But now, every paper trail from the last ten years is going to be reviewed and audited, with the purpose of punishing people who cut corners during the bubble.

Speaking of the attitudes and behaviors of the great masses of people, it astounds me that so many analysts and pundits are so ignorant of history that they assume that, without question, the market will bottom out soon. They debate whether it will recover in the last half of this year, or wait until 2010, but they assume that that the end is in sight.

What we're hearing over and over is what people heard in the early days of the Great Depression. I've read articles my whole life making fun of what people said in the early 1930s. I posted such an article in 2007, giving a long list of such quotes. Here are just a few examples:

You can hear exactly the same sorts of statements every day on CNBC and Bloomberg TV, or read them in the Wall Street Journal.

I would like to warn web site readers against the easy seduction of believing that "the worst is over," that "there'll be nothing worse than long recession" and that "there won't be a panic."

There is absolutely no possibility that any of these things are true. There is no theoretical support for any of these views, and there are no historical examples of these scenarios. The global economy is headed for a massive black hole that will make all current discussions irrelevant. Any belief otherwise is simply wishful thinking.

The Law of Mean Reversion has not been repealed by the new Democratic party Congress. Since the stock market has been far overpriced since 1995, as I described in "How to compute the 'real value' of the stock market," and since the Law of Mean Reversion still applies, there must still a generational panic and crash in store.

It could come next week, next month or thereafter, but it's coming with absolute certainty, and nothing that has happened or is being planned has any possibility of stopping it, no matter how angry President Obama becomes.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(30-Jan-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Aso promised "bold measures" for Japan's economic crisis, in a key speech delivered to the Diet (parliament) on Wednesday.

"The world is entering an unprecedented recession and Japan cannot evade this. By taking bold measures, I seek to have Japan be the first to emerge from this recession," said Aso.

Aso is known to have used some of Barack Obama's speeches as models. He added that, "It’s not that everything gets better if you let the markets determine things. Big government versus small government isn’t the only way of looking at things."

Aso was echoing the words of Obama's inauguration speech: "The question we ask today is not whether our government is too big or too small, but whether it works. ... this crisis has reminded us that without a watchful eye, the market can spin out of control."

It's oddly appropriate that Aso is is imitating Obama's speeches, inasmuch as Obama's fiscal stimulus package imitates Japan's policies since Japan's financial crisis began in 1990.

But Aso is going to need more than a speech to save his job.

Aso's approval rating was almost 50% when he first took office in September -- just four short months ago. Last month, it fell to 16.7%, lower than either of his two immediate predecessors when they resigned, each after a one-year turn in power.

A constant theme of this web site is that the government of one country after another, among those who fought in WW II as a crisis war, has become paralyzed. I've discussed this about many countries, including Japan, Israel, Europe, China, France, and even the United States.

The enormous collapse of Aso's popularity, within four months of taking office, shows that Japan is still in the grip of paralysis.

We first discussed how the Chinese lodged strong objections against former PM Junichiro Koizumi for his visits to a war shrine and for Japanese textbooks that allegedly play down Japan's role in the war. For a time in 2005, it almost appeared that Japan and China might go to war.

When Koizumi stepped down in September, 2006, the new Prime Minister was Shinzo Abe. Abe was the first PM to be elected from the generation born after World War II (like America's Boomer generation), and he was considered to be young and hawkish.

Abe's government was brought to collapse within a year, mainly because of highly visible scandals in national health and pension systems.

Abe's replacement was a surprise choice -- Yasuo Fukuda reverted to the older generation of survivors of World War II. Kids who grow up during a crisis war (like America's Silent Generation) are distinguished by their willingness to bring about compromise.

Fukuda was particularly skillful at compromise, and even developed a good relationship with China, thanks to a four-day "feel-good" trip to Beijing in January, 2008. However, that wasn't enough to save him, as problems with the economy continued.

Fukuda's departure was as much of a surprise as his rise to power. He unexpectedly resigned in September, 2008, in an effort to break a political deadlock.

The charismatic Taro Aso, the secretary-general of Fukuda's Liberal Democratic Party (LDP), was chosen in his place. Aso was initially very popular, but now, four months later, his future in office is very much in doubt.

Thus, Japan has had three Prime Ministers in a row who began with great hope and popularity, but whose approval ratings plummeted quickly when problems arose.

I'm sure you can guess, Dear Reader, what the obvious question is: Can and will this happen to Barack Obama?

The answer is that it depends on events, but it certainly could happen.

I cringe these days almost every time I hear Barack Obama say something.

For example, the other day I heard him say, "We're guided by the facts, rather than ignoring them." The purpose of this remark was restate his claim that President Bush ignored facts and did everything for ideological reasons, while he (Obama) is guided by facts, rather than ideology.

Now you'd have to be a total moron to believe that Bush ignored facts. In fact, in the case of the "surge" in the Iraq war, the opposite was true. One major reason that the left despised President Bush is that they were committed to America's defeat and humiliation in the Iraq war, and he decided on the "surge" that effectively won the war, the left was infuriated. In this case, it was the left that was full of ideological hatred, and the Bush administration that was "guided by the facts."

Now, I can understand why Obama would say, "We're guided by the facts, rather than ignoring them" during the election campaign. Obviously, during an election campaign, each side says anything it can to smear the opponent.

But what really bothers me now is that the election is over, Obama is still saying the same things. In his inaugural speech he said, "On this day, we come to proclaim an end to the petty grievances and false promises, the recriminations and worn out dogmas, that for far too long have strangled our politics." Obama still has the same contempt for Boomer values and accomplishments that I wrote about two years ago, in "Barack Obama to Boomers: Drop dead!"

The signs of discontent with Obama are spreading quickly, thanks to his arrogance and his contempt for any opinion other than his own (i.e., "guided by the facts, rather than ignoring them").

The most dramatic so far occurred on Wednesday, when the House of Representatives passed Obama's stimulus package without a single Republican vote.

This was a surprise because Obama had lobbied the Republicans hard, hoping to get a bipartisan bill. But pundits have been saying that Obama talked about inclusiveness, but never agreed to any of the Republican proposals. In the end, Democrats dismissed them by saying "We won" the election.

By contrast, when President Bush asked the Congress last year to pass the $700 billion bailout package, he got overwhelming support from both Democrats and Republicans. This is a significant difference.

The reason I've gone in to all this political garbage is because it portends a very serious situation for President Obama.

During the campaign, Obama promised to heal the world, and he said that things would start changing on January 21. A lot of desperate people believed his unrealistic promises, and when the economy gets worse (as it will for certain), they're going to be angry at him.

Obama will blame any problems on the leftovers from the Bush administration, and that may work for a while. But Obama has painted himself into a corner with his ultra-extravagant promises. He promised "change you can believe in" from day one, and he'll have some difficulty retracing that promise.

Obama will thus experience the same kind of falling approval ratings that the last three Japanese Prime Ministers did, and the fall may occur just as quickly.

Ironically, what Obama has to "hope" for is some disaster. A disaster of some kind will unite the country behind him, and give him the flexibility to get things done.

From the point of view of Generational Dynamics, this is going to happen soon enough. The country is falling faster and deeper into a deflationary spiral. The "good" news for Obama is that this will cause a major crisis that will unify the country behind him. The bad news is there'll be nothing that he can do to keep the crisis from getting worse.

(Comments: For reader comments, questions and discussion,

see the Geopolitical topics thread of the Generational Dynamics

forum.)

(29-Jan-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

An explosive battle among 300,000 civilians is feared.

I frequently use the phrase "explosive climax" on this web site to refer to the ending of a generational crisis war. Readers of this web site who have wondered what I meant may now be able to see an example in the current news.

14-Mar-10 News - Sri Lanka Tamils reject homeland:

A German college student validates Generational Dynamics...

(14-Mar-2010)

27-Jan-10 News - Sri Lanka elections, and Turkey returns to its roots:

Higher tensions between North and South Korea....

(27-Jan-2010)

Tamil Tigers renounce violence, to join Sri Lanka political process:

New photos show "genocidal fury" at climax of civil war....

(25-May-2009)

Jubilant Sri Lanka celebrates, as President reaches out to the Tamils:

But President Rajapaksa will need to follow words with actions....

(20-May-2009)

Tamil Tigers surrender, ending the Sri Lanka crisis civil war:

"We have decided to silence our guns. Our only regrets are...

(17-May-2009)

Sri Lanka, Pakistan and Gaza are all following the same path.:

But the end is in sight for Sri Lanka....

(11-May-2009)

Tens of thousands of Tamil civilians flee fighting, in last days of Sri Lanka war:

A "human avalanche" of refugees threatens to overwhelm internment camps....

(22-Apr-2009)

Sri Lanka army ready for final assault on Tamil Tiger rebels:

1000 Tigers are trapped in a "safe zone" with 100,000 Tamil civilians....

(16-Apr-2009)

Cricketing world in shock after attack on Sri Lanka team in Pakistan:

Lashkar-e-Taiba is suspected in the brutal attack in Lahore,...

(4-Mar-2009)

International community asks Tamil Tigers to surrender in Sri Lanka civil war:

In "nightmarish situation," hundreds of thousands of civilians are trapped in battle....

(3-Feb-2009)

Sri Lanka crisis civil war nears climax, as army captures Mullaittivu:

An explosive battle among 300,000 civilians is feared....

(28-Jan-2009)

Gaza war heads toward cease-fire, while violence surges in Sri Lanka:

Thousands of civilians' lives are at risk by army attacking terrorists responsible for suicide bombings....

(19-Jan-2009)

In Gaza and Sri Lanka, war slides into genocide.:

Both wars are getting increasingly meaner and nastier....

(6-Jan-2009)

Sri Lanka crisis war appears close to a genocidal climax.:

There are two crisis wars in the world today: Darfur and Sri Lanka....

(27-Dec-2008)

Sri Lanka government declares all out war against Tamil Tiger rebels:

Sri Lanka has said it is formally withdrawing from a 2002 ceasefire agreement...

(4-Jan-08)

Tamil Tiger rebel aircraft bomb government airfields, escalating Sri Lanka civil war:

Sri Lanka may soon join Darfur as another generational crisis war....

(26-Mar-07)

Bird flu spreading rapidly in Asia during New Year's celebrations:

This is the most dangerous time of the year for possible pandemic mutation....

(17-Feb-07)

Australian Govt. warns citizens to avoid Sri Lanka:

The war between Tamil Tiger rebels and Sri Lanka government continues to escalate,...

(20-Oct-06)

While world watches Lebanon, Sri Lanka goes to war:

Tamil Tiger rebels have engaged Sri Lanka government forces in heavy fighting...

(3-Aug-06)

Massacre of civilians in Sri Lanka leading the way to a crisis war:

From the point of view of Generational Dynamics, the gratuitous murder of civilians in a war...

(18-Jun-06)

Violence leading to Sri Lanka war is increasing:

Tamil Tiger rebels are being blamed for a mine attack on a bus, killing 60 people including children....

(16-Jun-06)

Sri Lanka appears close to war:

A naval attack by Tamil Tiger rebels and government retaliation by air may spiral into full-scale war....

(12-May-06)

Indian MP says that bird flu is a 'scam' to sell 'Tamil-flu':

This sounds like a joke, but unfortunately it isn't....

(3-Dec-05)

| ||

There are two or three generational crisis wars going on in the world today. One is in Darfur in Africa. This war continues without a climax because of "peacekeeping forces" by the United Nations and African Union, and the creation of massive refugee camps. What the United Nations and the African Union don't understand is that their actions are preventing the explosive climax that's required to end this war.

The Gaza war may or may not be called a crisis war at this point. There were plenty of genocidal acts on both sides in the recent battle between Israel and Hamas, but genocidal violence in its greatest form has not yet occurred. This will be a crisis war soon, but not just yet.

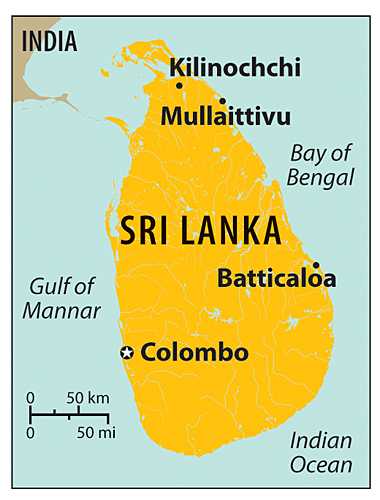

The Sri Lanka civil war is a crisis war that's approaching a conclusion.

|

Three weeks after capturing one Tamil Tiger stronghold, in Kilinochchi, government forces have now captured the port city of Mullaittivu, the last major stronghold for the rebels.

The remaining army of about 2,000 fighters has been forced into smaller towns and into the jungle.

From the point of view of Generational Dynamics, this is a fairly standard war between two ethnic groups.

The civil war between the two Sri Lankan ethnic groups -- the market and government dominant Sinhalese vs marginalized Tamils.

The Sinhalese came to the island of Ceylon from northern India around 500 BC, and adopted the Buddhist religion around 300 BC, developing a great civilization. They speak the language Sinhala, and today they're about 70% of the population of Sri Lanka (the modern name for Ceylon).

The Tamils occupied the southern tip of India as early as 1000 BC, in what is now the Indian province of Tamil Nadu. They adopted the Hindu religion, and came to Ceylon in the 7th century AD. In the 14th century, they seized power in northern Ceylon and established a Tamil kingdom. They speak the Tamil language, and today they're about 10% of the population of Sri Lanka. (Muslims and Christians comprise the remainder of the population.)

The conflict began in 1976, with the formation of a separatist group, the Liberation Tigers of Tamil Eelam (LTTE), informally known as the Tamil Tiger rebels. The goal was and is an independent Tamil state on Sri Lanka. The LTTE began low-level terrorist attacks and battles with government forces in 1983, until a ceasefire was signed in 2002.

The ceasefire started falling apart in 2005, and violence took a big surge upward in summer 2006, while the world was watching the war in Lebanon, as I described at the time.

A significant change took place in January of last year, when the Sri Lanka government declared all out war against Tamil Tiger rebels, and committed itself to defeating and destroying the rebel movement by the end of 2008.

Now a year has gone by, and the LTTE army has suffered numerous defeats, and is confined to a small region in northeast Sri Lanka. There are hundreds of thousands of Tamil civilians in the same region. The army has set up refugee camps or "safe zones," to which Tamil civilians may flee from the fighting.

So let's summarize the situation:

|

Here, Dear Reader, is where you can understand what the concept of an "explosive climax" is, and why it appears that Sri Lanka war is close to one.

In this kind of standoff, the 300,000 civilians are a pawn. Each side is going to claim that it's protecting the civilians, and that the other side is killing civilians.

And yet, neither side is going to permit any number of civilian deaths to stand in its way. This is a fight to the death, and civilians are simply collateral damage.

Thus, we have Sri Lankan government officials saying that 300 civilians have been killed and 1,110 injured in heavy fighting, and the fault is with the LTTE.

On the other hand, the LTTE claims that there government forces are firing into "safe zones," and that far more than 300 have been killed. They're also claiming that Sri Lankan soldiers are raping Tamil women who flee to the safe zones.

This is the mechanism by which a generational crisis war turns increasing genocidal, as time goes on. And you can see how the Gaza war is headed in the same direction, though it's not as far along.

If you want to understand how the world works, then you have to understand how this trend works. As gruesome as the Sri Lanka civil war is, it gives everyone a chance to see how this trend works in real time.

We can't be sure, but it now seems that the Sri Lanka war is headed for an "explosive" climax. The government forces will win, and the "explosive" part will be the recriminations over the number of civilians killed and injured, and possibly over "war crimes" such as rape.

Once the war climaxes, and winners and losers are identified, then Sri Lanka will change from a generational Crisis era to a generational Recovery era. The survivors will be horrified by what they've done, and they'll all vow that, as long as they're alive, it must never be permitted to happen again. And so the cycle will begin again.

The following video from al-Jazeera, titled "Inside Story - Is it the end for the Tamil Tigers? Jan 27," is an excellent report on the current situation in Sri Lanka. It's well work the 11 minutes it takes to watch it.

(Comments: For reader comments, questions and discussion,

see the Sri Lanka crisis civil war thread of the Generational Dynamics forum.)

(28-Jan-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Economic trends continue to accelerate downward.

On Monday morning, I listened to the Caterpillar, Inc., conference call with investors and analysts. It was extremely depressing. Here are some excerpts from the transcript:

As you might expect, to deliver the profit number, we need to take action. The $40 billion of sales and revenues reflects the sales volume decline for new machines and engines of about 30%. We need to sharply lower production schedules and our manufacturing cost structure to respond to the declining demand. In addition, we are reducing SG&A and R&D costs by about 15%.

To move the manufacturing cost structure down with sharply lower volume and to make major cuts in SG&A and R&D, we are taking action. We expect nearly 20,000 people, who are with us as we started the fourth quarter, to be out of the business, most by the end of the first quarter.

That includes actions we have already initiated; like the elimination of almost 8,000 temporary contracts and agency workers, actions we’ve already put in place around the world, voluntary separations of 2,500 support and management employees and voluntary and involuntary separations and layoffs of about 4,000 production employees, and we expect further layoffs of support and management employees of about 5,000.

In addition to these actions, we have many facilities working shortened work weeks and thousands more people will be affected by temporary layoffs and full and partial plants shutdowns around the world. We have suspended salary increases for the vast majority of salaried and management employees. And with profit at $2.50 a share excluding the redundancy cost, our short-term incentive plan would not trigger repayment next year. That would generate a considerable cost reduction from 2008.

Executives and Senior Managers will see significant reductions in total compensation. We are cutting discretionary expenses, we are delaying R&D programs and we are cutting CapEx almost 40%. ...

Our production volume in the first quarter will be very depressed. That coupled with most of the people-related cost reductions, not being fully effective until the second quarter and with most of our full year expectation for redundancy costs coming in the first quarter that means that first quarter profit will be under severe pressure and in fact we may have a loss in the first quarter."

It was just one of many depressing events in a very bloody Monday, which saw one large company after another announce massive layoffs.

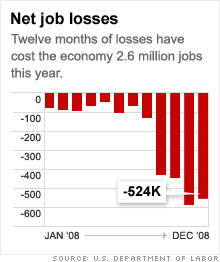

There were over 71,000 layoffs announced on Monday alone. Last week, 40,000 job cuts were announced. More than 200,000 job cuts have been announced so far this year, according to company reports. Nearly 2.6 million jobs were lost over 2008, the highest yearly job-loss total since 1945.

Here's a table of the largest job cuts this year so far:

Company name Date of # Jobs Percent of

announcement cut work force

---------------------- --------- ------ ----------

Texas Instruments 1/26/2009 3,400 12%

Caterpillar 1/26/2009 20,000 18%

Home Depot 1/26/2009 7,000 2%

Sprint Nextel 1/26/2009 8,000 13%

Pfizer 1/26/2009 8,300 10%

ING 1/26/2009 7,000 5%

Philips Electronics 1/26/2009 6,000 5%

Corus 1/26/2009 3,500 10%

Harley-Davidson 1/23/2009 1,100 11%

Microsoft 1/22/2009 5,000 5%

Huntsman 1/22/2009 1,175 9%

Intel 1/21/2009 6,000 7%

UAL 1/21/2009 1,000 2%

Eaton 1/20/2009 5,200 6%

Bose 1/20/2009 1,000 10%

Rohm & Haas 1/20/2009 900 5.7%

Clear Channel 1/20/2009 1,850 9%

ConocoPhillips 1/16/2009 1,300 4%

Circuit City 1/16/2009 34,000 100%

Pfizer 1/16/2009 3,200 3%

AMD 1/16/2009 1,100 9%

Hertz Global Holdings 1/16/2009 4,000 13%

Wellpoint 1/16/2009 1,500 3.6%

Saks 1/15/2009 1,100 9%

MeadWestvaco 1/15/2009 2,000 10%

Autodesk 1/15/2009 750 10%

Motorola 1/14/2009 4,000 6%

Barclays 1/14/2009 2,100 1.3%

Neiman Marcus 1/13/2009 375 3%

Cummins 1/13/2009 800 2%

Seagate Technology 1/12/2009 800 10%

Cessna 1/12/2009 2,000 N/A

Boeing 1/09/2009 4,500 7%

Walgreen 1/08/2009 1,000 9%

Lenovo Group 1/08/2009 2,500 11%

EMC 1/07/2009 2,400 7%

Logitech International 1/06/2009 500 5%

Alcoa 1/06/2009 15,000 14.5%

Cigna 1/05/2009 1,100 4%

That's just the start of the gloomy news. Moody's and S&P are predicting record corporate defaults in 2009, including dozens of retail store chains.

This is no surprise whatsoever in view of the continuing collapse in corporate earnings from 2008. These earnings are used by investors in the computation of price/earnings ratios (also called "valuations"), and this is the major factor analyzed by most automated stock buy/sell programs.

As regular readers know, for the last few quarters I've been posting the table of S&P 500 average corporate earnings estimates, based on figures from CNBC Earnings Central supplied by Thomson Reuters. These tables have shown sharp falls in corporate earnings estimates from week to week in each of the past five quarters.

Here's the updated fourth quarter earnings growth estimate table:

Date 4Q Earnings growth estimate as of that date ------- ------------------------------------------- Feb 6: 50.0% Jul 1: 59.3% Start of previous (3rd) quarter Oct 1: 46.7% Start of quarter Dec 5: 10.0% Dec 12: 5.9% Dec 19: 0.5% Dec 26: -0.9% End of quarter Jan 2: -1.2% Jan 9: -15.1% Jan 16: -20.2% Jan 23: -28.1%

Estimates appear to be falling far more rapidly than in previous quarters. Right now, it looks like the final value is going to end up somewhere around -40%.

And don't forget something important: These percentage changes for the fourth quarter of 2008 are based on the fourth quarter of 2007, and that quarter ended 21% down from 2006. Thus, we might end up with corporate earnings down 65-70% from two years ago.

As I wrote recently in "Collapse of corporate earnings portends imminent stock market plunge," this rapid fall in corporate earnings estimates will not be ignored by investors -- particularly by automated buy/sell computer programs.

One person in the Generational Dynamics forum criticized this statement, saying that investors aren't interested in earnings, because earnings look backwards rather than forwards.

It's true that individual investors -- and I mean real human people -- make buy/sell decisions based on all kinds of "forward-looking" measures -- whether you like the company's products and think they'll sell, whether you like the company's management, and think they'll do well next year.

But billions and billions of stock shares are traded every day, probably in tens of millions of individual transactions. It seems clear from that volume of trades that the overwhelming preponderance of trades are not being made by individual investors evaluating the companies' products and management. They have to be executed by computerized buy/sell algorithms. There just aren't enough humans around for that volume of trades.

And those kinds of touchy-feely evaluation measures are not available to computer programs. The only consistently and reliably available statistic on which to base buy/sell decisions is reported earnings.

And reported earnings IS a forward-looking measure -- in the sense that the best indicator of next year's earnings is last year's earnings.

But some people will point out that even a computer program can use analysts' recommendations to make buy/sell decisions. To that I say "HAH! You've got to be kidding."

Take another look at the table estimating 4Q earnings, a few paragraphs back. Analysts started the fourth quarter predicting that earnings would grow almost 50% from the previous year. How time flies! Now we see that earnings are estimated to be falling 28% from the previous year. Any computerized buy/sell program that depends on analysts' recommendations is going to screw you. You'd be better off using the computer's random number generator to make buy/sell decisions.

One of these days, in the next week or two, these latest estimated earnings results are going to be factored into the computerized buy/sell algorithms, and that's got to mean another leg down in the stock market.

From the point of view of Generational Dynamics, the world is really just chugging along at a fairly even keel, as we await the generational panic and crash. These have occurred at regular intervals throughout history, the last one in 1929, and we're overdue for the next one. I've described many times what I expect to see happen; here's a summary: An elemental force of nature, where millions or even tens of millions of Boomers and Generation-Xers in countries around the world, never having seen anything like this before, and not having believed it was even possible, suddenly try to sell everything in a mass panic. This will bring down computer systems for hours, perhaps even for a day or two, as people watch tv in glazed horror as their life savings disappear.

This might happen next week, next month, or next year, but it's coming with absolute certainty.

(Comments: For reader comments, questions and discussion,

as well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(27-Jan-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Speak with people around the world in a 1500-word version of English.

The French and the English have fought many, many wars over the centuries, on battlegrounds throughout Europe. But the latest war, over linguistic superiority, is being fought all over the world, and the winning side appears to be (the) English.

|

There has long been a dream of a universal language that would allow any two people in the world to talk with each other and be understood. There are some special purpose universal languages: for example, a Chinese Catholic bishop and a Mexican Catholic bishop can carry on a conversation in Latin.

In the 1800s, French became the international language of diplomacy, and the French language was spoken all over the world. However, it was replaced in this role by English in the 1900s. This has been and continues to be a source of enormous frustration and anger for the French, but I would argue that they have no one to blame but themselves, by conquering England in 1066.

Although there are many European languages, and most of the west European languages fall into two major categories:

These two language groups collided in England in 1066 with the French Norman conquest. Suddenly, the Teutonic Anglo-Saxon language had to coexist with the Romance old French language. It was not a happy time.

But it did have a remarkable result. The English language became enormously simplified as a result of this comingling. Let's take a look at some of the features of the English language that make it much simpler than other languages:

The French Normans and the English Anglo-Saxons just couldn't keep those genders straight, and so the incredible happened: In English, males are masculine, females are feminine, and other things are neutral. Much easier to remember!

We should mention that there are two areas where English is considered more difficult than other languages: First, English is a very large language, with tens of thousands of words taken from other languages around the world. And second, English spelling and pronunciation rules are inconsistent.

A third criticism of English is that it's very Euro-centric, and much harder to learn for Asians, and it's worth remembering that more people speak Chinese today than any other language on earth.

On the Continent, French and German have remained distinct languages, with little signs of merging. But in England they did merge, creating an English language that's much simpler grammatically than either of them.

Some historians claim that English replaced French as the international language in the 1900s because Britain was more successful in colonizing. But I would argue that the converse is at least as true: Britain's success in colonizing at least partially occurred because their language was easier to learn by the colonists than the French language.

Now a remarkable new simplification of the English language is beginning to take hold. Apparently this new language was born out of necessity. People from different countries needed to do business with one another. They may have studied English in school, or they may have learned a few words from television, so a Korean and a Mexican would speak or e-mail to each other using the English words that they both know.

The existence of this language was discovered by Jean-Paul Nerrière, an IBM executive working in Paris with colleagues of about 40 nationalities. He discovered that foreign language speakers were successfully conversing each other using what he called a "perverted form of English."

The irony is that the foreign language speakers could speak and understand each other this way, but native English language speakers never understood a word.

Nerrière became a champion of this "perverted" language. He formalized and wrote instruction books for native speakers of different language. His web site (mostly in French) is http://www.jpn-globish.com/, but English speakers should read his partner's web site, http://www.bizeng.net/globish.htm.

It's just as hard (or easy) for a native English language speaker as it is for a native foreign speaker. Here's an example:

As you can see from this example, you have to speak in very short sentences, and you have to restrict yourself to the list of 1500 words. You must avoid humor or metaphors. If the word you need isn't among the 1500, then you have to find another way, as in using "instrument with black and white keys" for "piano," and "an animal chased by cats" for "mouse." As you can see from this example, this can be as difficult for native English speakers to learn as for others.

(Comments: For reader comments, questions and discussion,

see the Geopolitical topics thread of the Generational Dynamics

forum.)

(26-Jan-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

This refutes the nonsense about oil speculators last summer.

A great drama is playing out around the world. While transportation of most commodities and finished goods has come practically to a standstill, the business of transporting oil is suddenly booming. Oil is being transported from one place to another ... and back again ... and round and round it goes.

With oil prices falling from $147 per barrel last summer to below $35 recently, speculators are storing about 80 million gallons of oil in supertankers around the world. They purchased the oil at the current low prices, in the hope of being able to store it long enough to make a lot of money when the price of oil goes back up.

For several weeks, Morgan Stanley has been negotiating to secure an oil supertanker, in order to store millions of barrels of oil in the Gulf of Mexico. (The deal may have collapsed on Monday.)

Six months ago, when oil was above $140, oil companies were struggling to rush oil to market to keep up with increasing demand and soaring prices. But that's all changed now, and the same companies are acting in ways that would have been unimaginable until recently.

There was a lot of nonsense last summer, as analysts and pundits were proclaiming that the high price of oil was the fault of "speculators," artificially driving the price up to make money.

That never made any sense anyway, because the spike in oil prices coincided with similar spikes in copper, iron ore, wheat, and other commodities. But no one was claiming speculators were driving up the price of copper -- just oil -- so the whole claim was silly.

What was the cause of all the price spikes? It was pretty clear that they were all caused by the demands of China's exponentially growing bubble economy. And it's no surprise that all of these bubbles burst, all at once, along with the recent collapse of China's economy, following the Beijing Olympics.

I'd still like to know exactly what happened. In June, I made an interesting speculation: "I can't prove this, but my intuition tells me that some sort of tipping point has been reached -- perhaps a structural limit in the markets that can't be cured in the short run. It might be that all easily available land is used up, or perhaps the worldwide transportation and shipping infrastructure is so overloaded that it's locked up in some way, and can no longer expand in the short run. I think that we're seeing the Law of Diminishing Returns in action. In "normal" times, these situations would be self-correcting in a few months, but some long-term structural limitation is keeping the supply/demand mismatch from clearing up."

I still think something like that happened, and it would be very interesting to understand it better.

I also wrote that bubble would burst soon because of a war, or because "a financial crisis that will bring the increasing demands for oil and food in China and India to a screeching halt."

That's exactly what appears to have happened.

The way a speculator works is by buying up almost all of some commodity in order to drive prices up, and then selling it off in small quantities to take advantage of the high prices. In order to be successful, the speculator has to have time on his side. He has to be able to store the commodity for a while, to allow prices to rise. If he's forced to sell what he has, then he'll be flooding the market with produce, driving prices down, and he'll lose a lot of money.

You might be able to do that with gold or silver or maybe even wheat, if you can find a huge stadium or something where you can store the commodity until you're ready to sell.

But with oil, you can't do that. The only reasonable place to store it is in tankers -- that's what's happening now, but it wasn't happening then.

What confuses pundits and analysts who insist that speculators were at work last summer is that they don't understand the difference between oil and oil futures contracts.

You could try to corner the market by buying up all of next month's futures contracts, which means that you're buying up the oil that will be delivered next month. The problem is that you don't have time on your side. There's a "drop-dead date" on these futures contract -- when the contract date arrives, then you must take delivery of the oil. You have to get rid of the oil, or else store it in tankers, so we're back to where we were.

On the day that someone takes delivery of 10 million barrels of oil and wants to sell it, the price he gets will depend on the market for oil on that day, and only that day. The prices of past or future oil contracts is irrelevant.

The fact that the oil bubble coincided with other commodity bubbles, and also coincided with the China's construction bubble, makes it almost doubtless that it was demand from China that caused the oil bubble. And the fact that the bubble collapsed when China's economy collapse makes it absolutely certain.

It's interesting to take a look at the reasoning used to claim that speculators were at work last summer.

The CBS show '60 Minutes" had a segment last week called, Did Speculation Fuel Oil Price Swings? The '60 Minutes' story reeks of the confusion between oil and oil futures contracts. It quotes an oil industry executive as saying,

That's exactly right -- speculation among futures contracts -- and the speculators have to get rid of them before they have to take delivery of the oil.

Another executive says, "We've had three price changes during the day where we pick up products, actually don't know what we paid for it and we'll go out and we'll sell that to the retail customer guessing at what the price was. The volatility is being driven by the huge amounts of money and the huge amounts of leverage that is going in to these markets."

But those weren't three prices changes in the price of oil; those were three price changes on the price of oil futures contracts.

Another quote: "Did China and India suddenly have gigantic needs for new oil products in a single day? No. Everybody agrees supply-demand could not drive the price up $25, which was a record increase in the price of oil."

No, that's not true. That was a record increase in the price of oil futures contracts. And the gigantic needs of China and India didn't occur in a single day -- they grew for years.

The only place where the report even mentions oil is to say, "Morgan Stanley has the capacity to store and hold 20 million barrels." Well, that's less than 25% of a single day's supply, hardly enough to make a dent in world supply for more than a brief period.

And what ended the oil bubble, according to 60 Minutes?

So the report concludes that these high-powered speculators, driving prices up in order to make many millions of dollars, were driven off by the mere threat of an investigation? I don't think so.

This 60 Minutes report made no sense whatsoever. It never explained why speculating in oil futures causes oil prices to rise, it never explained why price rises in oil were different from price rises in other commodities, and it ignored the collapse of China's economy. All in all, it was an extremely shoddy piece of journalism.

There's something about oil that drives ideologues (on the left and right) crazy. Oil is part of every conspiracy theory. People are ideologically obsessed with oil. There was one guy I worked with a while back who could take any international news story and turn it into a story about oil, usually involving President Bush, as if nothing else mattered besides oil. I used to joke with him that he probably thinks that Hannibal attacked Rome around 200 BC just to get the oil.

If you look at the things today that are likely to cause a world war, oil just isn't near the top. The Jews and Palestinians have lots of issues, but none is about oil. And Taiwan is a big issue for the Chinese, and I don't believe that there's any oil on Taiwan. The really big issues today are land, food and water, with oil farther down the list.

I came across this article by Jeff Madrick on Huffington Post when I was doing research for my recent article, "Blog Watch: Naked Capitalism's Yves Smith blames economists for being wrong."

Madrick's article was written in August, at the height of the election. This article is absolutely fascinating because it makes no sense whatsoever, and is pure ideology:

Madrick does have the sense to refer to other commodities, but what is his reason for believing that speculators were to blame?

This shows the danger of expressing an opinion on economics while under the influence of an ideology. Most people are concerned about pain for the world's poor, but ideologues are only concerned about such pain when they can make a political point. Phony outrage about the world's poor has nothing to do with speculators.

It's just like the stock market. Do stock prices reflect only rational projections of corporate earnings and dividends? We've had enough of irrational exuberance and its opposite to know better now. Then why should oil futures prices reflect only genuine shifts in supply and demand?"

Here's where he goes off the rails. Like the 60 Minutes report, he makes no attempt to explain why speculating on oil futures is the same as speculating on oil.

When you take delivery of 10 million barrels of oil, and you have to sell it, the price you get will depend on the oil market on THAT DAY, not on how much oil futures contracts are selling for two months later. The two prices are completely unrelated.

Why is it so hard to understand that buying 10 million barrels of oil is very different from buying securities?

|

I'm not saying that Madrick is ignorant of all the basic laws of economics, or that he's not bright, though those are possibilities.

I'm saying that Madrick's brain has been completely fried by his ideology.

And that's always the problem. All you have to do is listen to ideologues like CNBC's Larry Kudlow on the right or Congressman Barney Frank on the left. They say such incredible things that they make your head spin.

And that brings us to the big economics issues of the day: The causes of and cures for the current financial crisis. I wrote about this in my article "The outlook for 2009."

You have people on the right saying that we should follow the lead of Ronald Reagan: just cut taxes and let the economy take care of itself.

You have people on the left saying that we should follow the lead of Franklin Roosevelt: just spend money, and that will cure the economy.

Both of these ideological positions are wrong. Reagan was President during a generational Unraveling era, so anything he did is irrelevant to today's crisis era.

Roosevelt was President during the last generational Crisis era, so his example is a better choice. But as I explained in "The outlook for 2009" and in "As his Great Historic Experiment collapses, Ben Bernanke scrambles to save his reputation," the timing is wrong, since it's too early in the deflationary spiral. Even worse, the plans to spend are growing chaotically into the trillions of dollars, with politicians acting like kindergarten children in a candy store, fighting over the best pieces of candy.

We're lucky that we have oil tankers treading water these days, put there by speculators storing oil, hoping to drive the price up, but failing miserably. It gives us a chance to see how punditry about the oil price spike last summer was purely ideological.

But we're unlucky because there's a far worse financial problem on the horizon, and the ideologues running things in Washington have no more idea what's going on than do the 60 Minutes producers or Jeff Madrick, and it looks like they're going to only make things worse.

(23-Jan-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Thousands of civilians' lives are at risk by army attacking terrorists responsible for suicide bombings.

|

That's what's happening in Sri Lanka, where 350,000 civilians are trapped in the narrow confines of the Jaffna peninsula, where government forces are advancing to surround and capture the Tamil Tiger rebels.

This is occurring just two weeks after the army won a significant victory over rebel forces in Kilinochchi. Aids groups are fearful that tens of thousands of civilians will be killed as "collateral damage" as the government forces close in.

UN Secretary-General Ban Ki-Moon, traveling to the region, said, "To both sides, I say: Just stop, now. Too many people have died. There has been too much civilian suffering. Too many people, Israelis and Palestinians, live in daily fear of their lives."

Oh, sorry, I got that mixed up. Ban was talking about the Gaza war, not the Sri Lanka war.

Actually, Ban Ki-Moon and the rest of the world are pretty much ignoring the Sri Lanka war. I don't know why -- maybe Tamil civilians aren't worth as much as Palestinian civilians.

That's one of the many ironies of politics in general. Politicians enjoy lecturing us on the sanctity of human life, and how every man, woman and child is a valuable human life. Moral outrage is always a fun game for politicians seeking to score a political advantage.

But as we're seeing here, some lives are politically valuable, and some lives are politically worthless. In this case, a Palestinian civilian life has a great deal of political value to Ban Ki-Moon, while a Tamil civilian life has little. A person -- any person -- is worth no more and no less than what the politicians say it is. The value of a human life can be thought of as a continuous measure, say on a scale of 1 to 10, with some lives worth 1 and some lives worth 10, and with most of us somewhere in between.

As I explain frequently on this web site, Generational Dynamics doesn't use the strict legal definition of the word "genocide." In generational theory, "genocide" refers to any action that clearly gives little value to individual life. Generally this means that the society gives much higher political priority to scoring a victory in war than it gives to the goal of preserving individual lives, especially civilian lives.

This concept is very useful because "genocidal" is also a continuous measure, say on a scale of 1 to 10. Some wars might be "a little genocidal" (level 1), or "very genocidal" (level 10). Almost every major crisis war becomes "very genocidal" by the end, as when the Germans were slaughtering Russians in WW II, and the Allies were firebombing Dresden.

What's undeniable is that the conflicts in the Mideast are becoming increasingly genocidal. Conflicts fought with stones and handguns and even suicide bombings have turned into huge explosions that kill many people.

Both sides are doing what they have to do. Hamas have to protect their missiles by surrounding them with schools and homes filled with children and civilians. The Israelis have to destroy the missiles. Neither side has a choice. From the point of view of strict generational theory, it doesn't even make sense to say that either side is "at fault," any more than it makes sense to say that a tsunami is "at fault" for killing people. It just is what it is.

The United Nations and international pressure cannot do anything to stop this, any more than they can stop a tsunami. Moral outrage may be pleasing and useful to the politicians, but its effectiveness is weak and temporary and, in the end, useless.

Still, it seemed to work on Sunday, as both Israel and Hamas both claimed victory in a cease-fire agreement for the Gaza Strip.

Israeli officials declared that they had succeeded in their main objective of limiting Hamas’s ability to fire rockets from Gaza into southern Israel. Hamas officials said it had survived a massive onslaught, and would continue to fire rockets into Israel.

From the point of view of Generational Dynamics, what's most important is that the "genocide trend line" is clear. A cease-fire has been reached, but no one seriously believes that it's more than temporary, and the next conflict will be even more genocidal than the current one. It may even involve Muslim Brotherhood forces from Egypt, and renewed Fatah/Hamas fighting.

Today the Mideast conflict is growing into a major war, while the Sri Lanka war is building to a climax.

Furthermore, as worldwide trade and transportation grind to a halt, millions of people are losing their jobs and being pushed into poverty, creating increased instability among poor, desperate, restless populations in countries throughout Asia and other parts of the world.

The Clash of Civilizations World War can't be too far off now, and then we'll get to see how REALLY worthless a human life can be.

(Comments: For reader comments, questions and discussion,

see the Mideast thread and the Geopolitical topics thread of the Generational Dynamics

forum.)

(19-Jan-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The deficit was "only" $40.4 billion in November, and falling.

|

Back in 2003 and 2004, when people were calling me a psychopath for predicting, among other things, a stock market crash and new Great Depression, I would occasionally get a serious question, something like, "If there's no stock market crash one year, you'll just say it hasn't happened yet. What has to happen for you to admit that you're wrong?" My response would be to display a graph like the one above and say that I'll admit I'm wrong when public debt starts falling again, which hasn't happened since the 1950s. Well, public debt hasn't started falling yet. In fact, with the kindergarten kids in Washington fighting over who gets to spend the trillion dollar stimulus package, public debt is certain to continue an ever faster exponential climb. Stein's Law: If something cannot go on forever, then it won't. At some point, something (i.e., a generational financial panic and crash, the first since 1929) will happen, and then public debt will finally begin to fall. That's still in the future, but one component of the public debt is, for the first time in decades, showing the tiniest signs of beginning to level off.

|

|

In November, the US trade deficit shrank by 29%, by the most in 12 years, and more than forecast. Both imports and exports were reduced. Imports were reduced by a record 12%, mainly because of the collapse in oil prices, from a high of $147 per barrel last summer to around $40 per barrel at the end of the year. Exports were reduced by 5.2%, as foreign purchases of American cars and other manufactured goods fell. Since exports fell less imports, the difference between the two, the trade deficit, fell. However, instead of this being a sign that the American economy is becoming more healthy, it's rather one additional sign that worldwide trade and transportation is grinding to a halt. In a dramatic new development, freight rates have fallen to zero for containers shipped from Asia to Europe, underscoring the dramatic collapse in trade. Apparently zero rates are being offered in the hope of moving empty boats out of South China ports, where they're lined up, one after the other. It's amazing and frightening to watch this going on. It's almost like a science fiction movie -- "The day the earth stood still" -- except that it's really happening (metaphorically), and it's disastrous.

|

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(18-Jan-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Other trends indicate that the world is grinding to a halt.

Regular readers know that I don't write about every economic indicator, but I do write about economic trends. And what's incredible is how disastrous the trends have been getting, especially since September or so.

Thus, last month I wrote "World wide transportation and trade sink farther into deep freeze," about the shocking 90%+ collapse of the Baltic Dry Index, a measure of worldwide shipping rates. In November, I wrote "Unrest grows in China as unemployment situation becomes 'grim,'" to describe the situation in China.

|

This past week, the latest jobs report showed that over half a million jobs were lost in December alone, and this has been mostly an increasing trend for a year. Most economists expect job losses to grow. However, there's little evidence that stock market investors pay much attention to bad news in the jobs market. Economists like to point out that this is a "lagging indicator," indicating that you can still hope for a stock market surge, even while the job market worsens.

But corporate earnings are different, because they're used in the computation of price/earnings ratios (also called "valuations"), and investors definitely pay close attention to these ratios. In fact, as I've written many times, the evidence is that valuations are a major factor analyzed by most automated stock buy/sell programs.

As regular readers know, for the last few quarters I've been posting the table of S&P 500 average corporate earnings estimates, based on figures from CNBC Earnings Central supplied by Thomson Reuters. These tables have shown sharp falls in corporate earnings estimates from week to week in each of the past five quarters.

Now, the fourth quarter estimates are becoming available. It's now been two weeks since the fourth quarter ended, and here's the result:

Date 4Q Earnings growth estimate as of that date

------- -------------------------------------------

Feb 6: 50.0%

Jul 1: 59.3% Start of previous (3rd) quarter

Oct 1: 46.7% Start of quarter

Dec 5: 10.0%

Dec 12: 5.9%

Dec 19: 0.5%

Dec 26: -0.9% End of quarter

Jan 2: -1.2%

Jan 9: -15.1%

Jan 16: -20.2%

The trend indicated by this table is substantially worse than the trends for the preceding quarters (see here for the final third quarter table). In the table for the third quarter, the earnings estimate was +12.6%, and by the 2nd week after the end of the third quarter, the estimate was -7.8%, with the estimate falling by 3-4% per week. In the fourth quarter estimates, if the trend continues, the fourth quarter will be significantly worse than the preceding quarters.

To understand why this means that another stock market plunge is in the offing, take a look at the following chart. There's a price/earnings ratio chart at the bottom of this web site's home page, and it gets updated automatically every Friday. Here's last Friday's version of the chart:

|

Notice that P/E ratios (shown in the top portion of the chart) held steady at around 18 for the entire years 2006-2007. This happened despite the fact that stock prices (shown on the bottom half of the chart) varied wildly.

The only way that this could have happened is if investors purposely held stock prices at the right levels, and that means that the buy/sell algorithms in their computers made decisions based on whether a stock's price was above or below 18 times earnings. There's no other reasonable explanation for how P/E could have held steady at 18 for over 2 years.

Remarkably, the same value P/E=18 held for several months, at a time when corporate earnings estimates were beginning to plummet for the first time in years. This means that investors pushed stock prices down, matching the falling earnings estimates, in order to maintain P/E=18.

Sentiment changed dramatically on March 15, 2008. To understand why it changed, look at the following chart that I first posted in February, 2008. The data in the first two columns was supplied by Thomson Reuters in February 2008, and I've added the third column:

Period Earnings growth estimate Actuals ------- ------------------------ ------- Q1 2008 2.6% -17.3% Q2 2008 3.5% -22.0% Q3 2008 20.0% -18.7% Q4 2008 50.0% -20.2% (As of Jan 16, 2009)

By March 15, investors were reeling from the constant fall in corporate earnings estimates, but they still believed that the economy would surge in the second half of 2007, and that we'd see incredibly high earnings growth -- 20-50% each quarter.

That's why sentiment changed. When the Bear Stearns bailout occurred on March 15, investors breathed a sigh of relief and said, "The worst is over."

That's when they abandoned the P/E=18 formula, and pushed stock prices and P/E earnings up to around 25. This was, I believe, almost entirely based on the assumption that earnings growth would be 20-50% in each of the last two quarters.

These sentiments came crashing down in September, when 3rd quarter earnings estimates turned negative. It was suddenly apparent that earnings would not grow 20% in the 3rd quarter, as had been hoped, but would actually follow the pattern of the preceding 3 quarters, which meant that they would fall around 15-20%. Stock prices fell sharply, returning the P/E index to 18, according to what passes for standard formulas these days.

Since mid-November, stock prices have been fairly steady, but earnings estimates have continued to fall, and P/E ratios have again been creeping upwards, now around 20.

Today, investors are going to be facing another moment of truth. We've seen that economic trends around the world started falling rapidly in the fourth quarter of last year, bringing worldwide trade and shipping almost to a standstill. So it's not surprising that corporate earnings estimates might fall much faster than usual for the fourth quarter, and they've already begun to do so, as shown by the table at the beginning of this article.

It seems to take a few weeks for investors to react to this kind of change, but you should expect that reaction to be another plunge in stock prices over the next month or so.

Finally, to close off this new discussion of P/E ratios, let's return to an old discussion, and a graph that I first posted a year ago in "How to compute the 'real value' of the stock market":

|

Investors have been using the formula P/E=18 in their buy/sell decisions, but that number is WAY above historical averages, which means that it's going to fall way below average, by the Law of Mean Reversion. (Incidentally, a couple of web site readers in their messages to me have been confusing the Law of Mean Reversion with Regression to the Mean, which is a very different thing. I discussed this further in the Generational Dynamics forum.)

The historic average of the P/E1 (price divided by one-year trailing earnings) is about 14. From 1995 to the present, it's averaged around 25, creating a huge bubble. By the Law of Mean Reversion, the price/earnings ratio will fall well below 10 for a dozen years or so. You can see that it's poised to fall quickly in the near future, leading to a stock market crash.

I've received a tiny bit of criticism for continuing to be so gloomy as the inauguration of Barack Obama approaches, when everyone else is celebrating. There's no question that this is a wonderful historic moment for the United States of America, and perhaps I should be more infected with the worldwide enthusiasm for this moment. If I were capable of being so infected, I'm sure I'd be a more wonderful person, but I also would have a completely different personality, and wouldn't be able to be nearly as effective in writing for this web site. So let everyone else cheer and celebrate the healing of the world on January 21, and I'll continue to be a curmudgeon and focus on what's REALLY going to happen.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(18-Jan-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Why doesn't she also criticize bloggers like herself?

In a posting on Monday, entitled "Why So Little Self-Recrimination Among Economists?", blogger Yves Smith wonders, "Why is it that economics is a Teflon discipline, seemingly unable to admit or recognize its errors?"

Now this is a subject of some interest and bemusement to me, because I've been criticizing economists, analysts, financial journalists and bloggers for years for not having the vaguest clue what's going on. In fact, I've received much criticism from readers of this web site for calling these people morons, and blaming them for saying things that are so stupid they couldn't possibly believe them.

For example, I've been criticizing Ben Bernanke's speeches for years, and just recently posted another such article, "As his Great Historic Experiment collapses, Ben Bernanke scrambles to save his reputation."

Today it's clear that economists have been massive failures. They still have absolutely no idea what's going on today. Also, they have no idea why all of last year's bailouts have had no effect at all, and seem to have made things works.

So when blogger Yves Smith criticizes economists for not admitting that they've been wrong, I perk up and listen.

Here's what she says:

Economic policies in the US and most advanced economies are to a significant degree devised by economists. They also serve as policy advocates, and are regularly quoted in the business and political media and contribute regularly to op-ed pages.

We have just witnessed them make a massive failure in diagnosis. Despite the fact that there was rampant evidence of trouble on various fronts – a housing bubble in many countries (the Economist had a major story on it in June 2005 and as readers well know, prices rose at an accelerating pace), rising levels of consumer debt, stagnant average worker wages, lack of corporate investment, a gaping US trade deficit, insanely low spreads for risky credits – the authorities took the "everything is for the best in this best of all possible worlds" posture until the wheels started coming off. And even when they did, the vast majority were constitutionally unable to call its trajectory.

Now of course, a lonely few did sound alarms. Nouriel Roubini and Robert Shiller both saw the danger of the housing/asset bubble; Jim Hamilton at the 2007 Jackson Hole conference said that the markets would test the implicit government guarantee of Fannie and Freddie; Henry Kaufman warned how consumer and companies were confusing access to credit (which could be cut off) with liquidity, and about how technology would amplify a financial crisis. Other names no doubt belong on this list, but the bigger point is that these warnings were often ignored."

Now, there are a few peculiarities about this. First, Smith points to a June 2005 article in the Economist, and so there were SOME people pointing out the danger as early as 2005.

So why does she give credit to people like Roubini and Hamilton, who's warnings only first appeared in 2006 and 2007?

(And, as I always whine, I was warning people as early as 2002. How come I never get credit for these and other predictions? See "List of major Generational Dynamics predictions" for more information.)

In fact, I quoted a Morgan Stanley study in an article from July 30, 2004, "Real estate is in an overpriced bubble all over the world." According to the Morgan Stanley study, residential properties in countries around the world, including America, Australia, the United Kingdom, China, South Korea, Spain, the Netherlands, and South Africa, were overpriced by 50% or more, and that the global economy should expect "potentially devastating aftershocks" when the property bubble finally bursts.

So, there WERE economists sounding warnings, and the question to be asked is this: Why did economists purposely ignore these warnings -- and did they do so for their own benefit?

Actually, Smith doesn't ask the question of why these economists didn't foresee the crisis. She asks a different question: Having failed to foresee the crisis, why are these economists not admitting their failures?

And that of courses raises exactly the same question of Smith herself.

Smith is obviously very knowledgeable about economics and macroecomics, and she's also very knowledgeable about the finance industry. She was in a perfect position to see the stock market, credit and real estate bubbles as early as 2002 (as I did) or as early as 2004 (when Morgan Stanley did), or as early in 2005 (when Greenspan was talking about them).

In order to investigate this further, I decided to look at some of the articles that Yves Smith wrote in the early days of her blog. As far as I can tell, her blog began in December 2006. Now, surely by that time the real estate bubble must have been obvious to every person in the world with knowledge of economics. If Smith is going to criticize others for not saying anything, then it's fair to ask whether Smith said anything.

So it turns out that she wrote three articles that month, as follows:

I did some other random checking around in Smith's blog, and didn't find anything where she foresaw the crisis.

And so, Smith is guilty of exactly the same thing she's blaming everyone else for. The title of her posting is, "Why So Little Self-Recrimination Among Economists?" To which I ask, "Why so little self-recrimination in Yves Smith?" Basically Smith did what everyone else does -- blame everyone else for her own sins and failings.

The above three articles, especially the last two, are left of center themes, and in fact many of Smith's articles are ideologically on the left, and she's often bitterly critical of the Bush administration.

That's fine, but that's her problem. We have strongly partisan ideologues on the right, like CNBC's Larry Kudlow, who has always talked about how he loves free markets and the Bush administration; and we have strongly partisan ideologues on the left like Nobel Prize winners Paul Krugman and Joseph Stiglitz, both of whom are praised by Smith. This is particularly egregious in the case of Stiglitz, since he actually participated in the theoretical development of the mortgage-backed securities that turned out to be fraudulent. Smith is simply another ideologue on the left.

You could say that Larry Kudlow and Yves Smith are mirror reflections of one another, ideologues at opposite ends of the spectrum.

There's nothing wrong with being an ideologue, of course, but you can't make rational judgments about complex economic subjects if you are.

And that's why I never take any political or ideological positions, except to be pro-American. As soon as you let a political thought enter your mind -- as soon as you allow yourself to think "I like what Barack Obama is saying," or "I like what John McCain is saying," then your mind becomes tainted and you interpret every event through the same political and ideological filter.

That doesn't explain everything, of course. There are undoubtedly other economists who aren't ideological, but who still never foresaw the current problems, and who are still not admitting guilt. As for them, I have little doubt that they're just like the financial engineers who created the fraudulent mortgage-backed securities -- they were in it for the money and personal benefit, rather than ideology.

I started this web site in 2002, and I've become infuriated and sickened by the ubiquitous fraud and deception at every level in every situation, self-justified by ideology and personal gain.

The real answer to Yves Smith's question is that people cannot talk about what they did in the past because to do so would be to admit to their own fraud and deception, and their own ideological biases.

I've been watching pundits on CNN and other news stations talk about the coming inauguration, and it's amazing how much they're drooling over the Obama presidency. I'd say that it's insane, but it's just part of today's insane world. These reporters, like everyone else, are desperately hoping that Obama is going to save them personally, and the world in general. Instead, they're all acting their parts in a script that's been played many times in history, and which never has a happy ending.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(17-Jan-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Who "lost" the economy? The finger-pointing is getting intense.

"This moment of anticipation is like the calm that settles after all hopes have died."

That's what Hannah Arendt wrote in a different context, and that's the atmosphere among investors today.

As his Great Historic Experiment collapses, Ben Bernanke scrambles to save his reputation:

Who "lost" the economy? The finger-pointing is getting intense....

(15-Jan-2009)

Ben Bernanke's Great Historic Experiment is at the brink:

Desperation sets in as credit markets continue to seize up....

(25-Sep-2008)

Fed Chairman Ben Bernanke defends his Great Historic Experiment before Congress:

The Fed-led rescue of Bear Stearns last week was closely questioned...

(7-Apr-08)

A historic day in Ben Bernanke's Great Historic Experiment:

In its biggest move yet, the Fed bails out a collapsing Bear Stearns....

(15-Mar-08)

Bernanke's historic experiment takes center stage:

An assessment of where we are and where we're going....

(27-Aug-07)

Ben Bernanke's Great Historic Experiment:

Bernanke doesn't believe that bubbles exist. His Fed policy will now test his core beliefs....

(18-Aug-07)

Ben S. Bernanke: The man without agony :

Bernanke and Greenspan are as different as night and day, despite what the pundits say.

(29-Oct-2005)

Federal Reserve congratulates itself on jawboning policy:

Fed says it propelled the economy upward merely by promising to keep interest rates low....

(17-Sep-04)

| ||

The same sense of desperation pervades discussions, after a year when one bailout after another has failed. The political sniping over the fiscal stimulus plan is increasing -- as people realize that no plan actually exists. The discussions are sounding more and more like kindergarten kids in a candy store, with different kids fighting over the tastiest morsels of candy. The impression is that the fiscal stimulus plan appears to be descending into chaos.

I heard Massachusetts ultra-liberal Barney Frank on the news yesterday deliver a long partisan harangue that the reason for all our problems is that the Bush administration didn't spend the TARP bailout money correctly. He, of course, knows the correct way to spend bailout money, and he's going to make sure that it works this time. We'll be looking forward to enjoying the benefits of his expertise.

The failure of a year of bailouts is also a failure of Fed Chairman Ben Bernanke, considered by many to be the world's greatest expert on the Great Depression. Bernanke developed his theories starting while he was on his grandmother's knee as a child. By the time he reached the position of Chairman of the Princeton University Economics Department, he had "proven" that the 1929 stock market crash war nothing, a mere piffle, and that the Great Depression was caused by an accounting error by the Fed.

He also "proved" that deflation was impossible with a fiat currency like the American dollar, since you can always print more dollars. He held onto this belief well into the 2000s, even after a deflationary spiral struck Japan and proved his theory wrong. For all I know, he still believes it today.

On Tuesday, he fought back. He gave a speech at the London School of Economics to defend his policy, and to claim that his ideas were still needed:

However, as is usually the case when discussing Bernanke's speeches, all you can do is shake your head in utter disbelief in what he's saying because it's such nonsense.

Here's a paragraph from Tuesday's speech:

What is he thinking? This is so bizarre that I can barely believe I'm reading it. He actually still thinks that he can give a speech or issue a policy statement, and that's all that's needed to move markets. I was already criticizing Bernanke for this in 2004, after a speech he gave claiming that it was his clever rhetoric and policy statements that were keeping inflation and long-term interest rates under control.

Now, four years later, he's making the same kind of claim. He says that his policy statements "they exert downward pressure on longer-term rates, stimulating aggregate demand."