Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

An 8-hour attack on a residential barracks for police trainees on Monday ended with 10 dead and over 100 wounded.

|

Here's a summary of how it happened:

It was just three weeks ago when the entire nation was shocked by a terrorist attack on Sri Lanka's cricket team, as they were headed to the stadium in Lahore.

There are now several terrorist attacks every week in Pakistan, mostly in the Northwest Frontier Province and the tribal regions. But the two attacks in the supposedly safe city of Lahore, within the same month, have revealed to many Pakistanis that terrorism is spreading rapidly throughout the country.

Here's a list of the major earlier Pakistan terrorist attacks in the last year:

With the fear of terrorism spreading, Interior Minister Rehman Malik urged the country to unite against Taliban extremists. He said Pakistan's integrity was "in danger at this time".

"This is not a law and order issue. This is an attack on Pakistan. We have two choices: hand the country over to the Taliban or fight it out," said Malik.

However, many people support the militants for nationalistic reasons. The militants lead the fight for capturing control of Indian-controlled Kashmir from India. And many young people especially blame the Pakistani terrorism on the United States for inflaming the militants by fighting the war on terror in Afghanistan.

(Comments: For reader comments, questions and discussion,

as well as more frequent updates on this subject, see the Afghanistan, Pakistan and India thread of the Generational

Dynamics forum.)

(31-Mar-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Rapid military buildup focuses on Taiwan, submarines, and anti-satellite weaponry.

If you listen to the words of the People's Republic of China (PRC), then you can believe that we're headed for a "harmonious world," where all countries experience the joys of "diversity" and "equality" in international relations. These claims reflect the guidance of Deng Xiaoping in the early 1990s: "observe calmly; secure our position; cope with affairs calmly; hide our capacities and bide our time; be good at maintaining a low profile; and never claim leadership."

If you look at China's actions, you can see a country preparing for all-out war with the United States. These actions are documented in the Department of Defense's annual report to Congress, "Military Power of the People’s Republic of China." In fact, China gone much farther than it had at the time that last year's report was published.

China has been focusing on "asymmetric warfare" techniques designed to strike at weak points in America's military, and overcome America's military superiority. These include heavy investment in ballistic and cruise missile systems; undersea warfare systems, including submarines and advanced naval mines; counterspace systems; computer network operations; special operations forces; and the "Three Warfares" concept.

The "Three Warfares" doctrine is extremely interesting. It's an information warfare concept aimed at influencing the psychological dimensions of military activity:

From the point of view of Generational Dynamics, the "Three Warfares" doctrine is extremely ominous, because it comes from a complete misreading of generational eras.

This kind of "psychological warfare" works very well during a generational Unraveling era, such as the 1990s or early 2000s. During these times, while many leaders are still from the generations that survived the previous crisis war (like the Silent Generation that survived WW II), there is an aversion to war that makes psychological warfare very effective.

But during a generational Crisis era, when the leaders (like the Boomers) are in the generations born after the last crisis war, then this psychological warfare backfires, and causes the enemy to panic and overreact.

That's why this doctrine is so ominous. It's self-delusional for the Chinese. It leads them to delude themselves into believing that they can attack Taiwan and the US won't retaliate, provided that they put out the right press release to the newspapers.

In other words, this kind of psychological warfare may have been effective when Bill Clinton was President, and perhaps even when George Bush was President, but it will backfire under President Obama, who will be forced by the young public to overreact, and that in turn would cause the Chinese to overreact.

This back and forth overreaction leads to what is called the "regeneracy" in generational theory. The regeneracy occurs when the public is so shocked that political bickering ends, and civic unity is "regenerated" for the first time since the end of the preceding crisis war. When each side's public is united against the other side, a crisis war is triggered.

(For information about the term "regeneracy" and about generational eras, see "Basics of Generational Dynamics.")

But China isn't depending just on psychological warfare. China has been pursuing a massive military buildup for years, as shown by the following graph from the report:

|

The more interesting question is how all this will be affected by the worldwide financial crisis.

World leaders in countries around the world are implementing massive stimulus packages to put people to work in things like infrastructure development.

As we'll discuss further in an article to be posted in a day or two, the most effective form of stimulus spending is military spending. During the 1930s, Hitler was much more effective than President Roosevelt. Both countries were devastated by the Great Depression, but Hitler focused Germany's stimulus spending on weapons development, while President Roosevelt did not. This gave Germany an enormous head start in WW II.

China is now embarking on a very aggressive fiscal stimulus plan. China doesn't say how much of the stimulus is going into the military. But China has already been increasing the military budget by 10-20% a year for years, as they prepare for war with the United States. I think it's quite certain that China will take advantage of this fiscal stimulus program to further increase military spending, possibly substantially.

In the US, by contrast, President Obama is planning to cut weapons systems, in order to pay for the social programs in his fiscal stimulus budget. As the world becomes increasingly dangerous, we're repeating the mistakes of the 1930s.

There is absolutely no guarantee that the USA will do well in the coming world war. Even if the USA "wins" the war, China has promised to blanket America's cities with nuclear missiles. And it's possible that the USA might very well lose the war. One scenario: After a major nuclear war, the Chinese will still have around a billion people. If they've successfully destroyed our defense infrastructure, they could send tens of millions of Chinese to take control of North America. This is all speculation, of course, but the fiscal stimulus plans coming out of the current worldwide financial crisis provides some scenarios that make it a real possibility.

I'm considering this as an addition to Generational Dynamics theory, and something with great practical significance.

As I've said many times, Generational Dynamics tells you what your final destination is, with absolute certainty, but not the path that will take you there or the time frame. The Generational Dynamics forecasting methodology that's been developed over the last seven years has developed a number of tools for narrowing the time window to obtain predictions that are not absolutely certain, but which have probabilities in the range of 80-90%.

Generational Dynamics tells us that we're headed for a "Clash of Civilizations world war," but the question always is, who will be fighting whom? Who will be the new "Allies," and who will be the new "Axis"?

I've commented several times in the past that, based on current trends, we can expect the following: China will be aligned with Pakistan and Sunni Muslims against India; Russia will be aligned with India and Shia Muslims; and India will be aligned with Britain and the west. Japan will be aligned with the West against China.

The "War Scenario Test" that I'm proposing will provide an additional analytical tool for making such forecasts.

Here's the test: For any given country, is there any realistic scenario that would propel the US immediately into a war with that country?

For China, the answer's obvious: China is spending massively on military spending to recover Taiwan, and a Chinese attack on Taiwan would bring us to war within just a few hours.

For North Korea, any move by their army across the border towards Seoul would require us to retaliate immediately.

What about Russia? I can't think of any realistic scenario that would bring us to war with Russia. In fact, last year's war in Georgia almost proves it -- there was never any consideration whatsoever that we would go to war with Russia over Georgia the way we would go to war with China over Taiwan.

India is the same - no chance of war. But Pakistan? There are two realistic possible war scenarios. One is that a war with India would bring us in on the side of India. Another is if Islamist extremists gain control of Pakistan's nuclear arsenal.

Iran is an interesting case. As I've written many times, Iran is a schizophrenic nation, with people who are pro-American, and a government that's anti-American. There is a possible war scenario -- if Iran develops a nuclear weapon, and either the EU, Israel or the US decide that their nuclear capability must be destroyed. But that's far in the future, and my expectation is that in the meantime the pro-West attitudes of the people will diffuse Iran's nuclear threat against the West.

So the idea is that if you can think of realistic war scenario, then we're likely to be enemies in the Clash of Civilizations world war. It makes sense, because if such a scenario CAN occur, then sooner or later it probably WILL occur.

The "War Scenario Test" is an analytical tool, and like all tools, it has to be used carefully and appropriately. When used this way, it provides us additional views of the future that we'll all share.

(Comments: For reader comments, questions and discussion,

see the China thread of the Generational Dynamics forum.)

(29-Mar-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

You may recall back to last fall, when then Secretary of the Treasury Hank Paulsen got Congress to pass his $800 billion TARP (Troubled Asset Recovery Program) proposal, almost overnight.

The idea was this: Banks have huge volumes of mortgage-backed securities in their portfolios. These securities are CDOs (collateralized debt obligations), CDOs-squared (CDOs of CDOs), CDSs (credit default swaps), and numerous other highly leveraged structured securities designed by brilliant financial engineers just a few years ago.

These securities are now being called "toxic assets" or "toxic waste," because they're worth a lot less than thought.

There's no market for these securities any more, and when forced to sell via a "fire sale," banks are getting 20 or 30 cents on the dollar. If banks are forced by "mark to market" rules to mark down the values of these assets to 20-30 cents on the dollar, then many banks immediately become essentially bankrupt, for all practical purposes.

So the TARP program was supposed to purchase the toxic assets at something like 60-80 cents on the dollar, so that banks can get them off their balance sheets, and still survive. Paulsen got his $800 billion, but unfortunately he never got around to buying up all those toxic waste securities. For some strange reason, he just never got around to it. I guess he must have spending too much time working out at the gym, or something.

Anyway, early in February, President Obama gave a press conference at which he announced that the shiny, brand new Secretary of the Treasury, Timothy Geithner, would announce the details for how the banks would be saved. The next day came and and Geithner gave his own press conference but, for some strange reason, he provided absolutely no details whatsoever. I guess he must have spending too much time celebrating the inauguration, or something.

I've said repeatedly what the problem is. The problem is that there are many tens of trillions of dollars worth (nominal value) of this toxic waste, perhaps over a hundred trillion, and there isn't enough money in the world the buy them all.

That's the ice water reality that keeps striking these government officials.

People keep saying, "Why doesn't the government just buy these things up?" Or, "Why doesn't the government just nationalize the banks?" Or, "Why don't we just let these banks fail, and the market will dispose of the toxic waste?"

The problem is that none of these "solutions" has any chance of working. When you're talking about many tens of trillions of dollars of toxic waste, there's literally no way to deal with it, without massive and widespread homelessness, bankruptcies, poverty, and starvation.

The dot-com, real estate, credit and stock market bubbles took almost 15 years to grow. By using leverage, and leverage on leverage, and leverage on leverage on leverage, there are now well over $1 quadrillion worth of structured securities in the world.

All those bubbles have to deflate before things can return to normal. And it can't be done overnight. If it took almost 15 years for the bubbles to expand, then it will take a similar period of time for the bubbles to deflate. This crisis has barely begun.

So finally, Tim Geithner had to do SOMETHING. The investors were demanding it. The Congress was demanding it. The public was demanding it. The President was demanding it.

So he came up with a "public-private partnership" that tries to use allow the market to dissolve the toxic waste. The Treasury won't buy the toxic waste from banks, as it would have with the TARP plan.

Instead, a bank can sell the toxic waste to certain third party investors, and the Treasury will put up 86% of the purchase price. The purchaser need put up only 14% of the purchase price, providing 6 to 1 leverage.

But by another arrangement, the FDIC will put up half of the remaining price. So the investors only puts up 93% of the purchase price, providing 13 to 1 leverage.

It wouldn't be a straight sale. Instead, several of these investors would bid on the toxic waste at an auction. That way (it is hoped), a realistic market value for the toxic assets will be established.

If the value of the toxic waste assets goes up, then the investors will make money. If the value goes down, then the investors lose less than they would have otherwise.

This doesn't solve the size problem in any way that I can see. There are still many tens of trillions of dollars worth of these things, and now the US government only has to pay 93% instead of 100%. That isn't going to make any difference.

As I've been saying for years, we're in a deflationary spiral. People keep asking me why there won't be hyperinflation instead of deflation, but that's impossible. Here's why.

According to the Bank of International Settlements, there are over $1 quadrillion ($1,000 trillion) worth (notional value) of credit derivatives and other structured finance securities in the portfolios of financial institutions around the world.

Now, if mortgage-backed securities are turning out to be worth only 20-40 cents on the dollar, how much will these other securities turn out to be worth?

Some people say that most of them are solid, and that they'll be worth at least 90 cents on the dollar. I have my doubts, but let's suppose it's 90 cents on the dollar.

That means that the $1 quadrillion worth of securities will lose $100 trillion in value. There just isn't enough money in the world to make up for that. And it might be even more than $100 trillion.

So we spent 15 years leveraging debt to create a massive credit bubble over $1 quadrillion in size. Now there's a deleveraging process going on. That bubble is leaking, and all that money is disappearing.

So if there's less money (fewer dollars) in the world, then dollars become more valuable, and that's deflationary. Nothing can be done to stop that.

The above is not a fanciful story. It's really happening. Just a couple of weeks ago, the Bank of International Settlements said that Europe’s banks face a $2 trillion dollar shortage, and they're going to have trouble rolling over their debts. That's deflation.

Pity poor Paul Krugman, the man who received the Nobel Prize for Economics because he hated George Bush. His view of any dilemma was to blame the problem on the evilness of George Bush's ideology, and his solution was to do what anyone else suggested, as long it was different from what George Bush wanted.

On the day that Krugman won the Nobel Prize in October of last year, he was congratulating the UK and the Europeans for announcing a bailout and other steps that "exceed expectations," steps that the US didn't take. He indicated that the reason that the US didn't take these steps earlier is because of "ideology," and that finally there was a plan that WOULD work.

There have been several new bailouts and stimulus packages since then, and nothing has worked. And it can't possibly be because of ideology, because George Bush is gone, and the new President doesn't do ideology; he "makes decision based on facts, rather than ignoring them."

So now Krugman has to deal with the fact that things keep going downhill, and it's not because of some ideology. He's learning a little more about the real world.

In a recent opinion column, he calls Geithner's proposal "cash for trash," and says that it fills him "with a sense of despair."

In an interview on Bloomberg TV he expanded his thoughts on the subject, and said some very interesting things. Here are some excerpts (my transcription):

The problem with the plan is that -- first of all, it's a pretty bad deal for the taxpayers. It's not very well focused on the most troubled banks. And it's very unlikely to produce enough gain in the prices of these things to make the most troubled banks viable again.

It's a very diffuse, ill-defined instrument. ...

There's a reasonable case that [the toxic assets are] somewhat undervalued. So there are banks holding stuff at 60% of face value, and the market value, if they were to try to sell it, is 30 cents. And maybe it's really worth 40 cents. That's a possibility.

But what's pushing that price from 30 to 40 -- first of all wouldn't be enough to make the banks want to sell it, because they don't want to mark down stuff they're holding on their books. They're really afraid of what that would do to their [measure?] capital. Basically they can't handle the truth.

And do we really think that's enough to make the banks whole, even if they do so. It's not enough to say that the stuff may be somewhat undervalued. There's a good case that it is, though that's not for sure. But it has to be grossly undervalued for this plan to be capable of doing more than just handing some extra money to people who are holding toxic waste. ..

[Question: As the economy improves, won't the values of some of these toxic assets increase?]

Well, yeah, but you have to believe that there's really the possiblity of a self-fulfilling prophecy here -- if only people feel better about this stuff that the economy will surge so much, and the value of these assets will surge so much that it will make everything fine.

To believe that, you really have to believe that most of the problems facing the banking system are the results of a more or less irrational panic, that there isn't a fundamental huge loss facing the system. I don't think that's right. Essentially our banking system -- some of the biggest banks -- bet heavily that home prices in 2006 made sense.

The idea that consumer debt at unprecedented levels relative to consumer incomes -- made sense. Those bets were wrong. It's a tremendous loss that you can't wish away. That even if you had full return to the normality of the markets would still be there.

And if you can't make it go away, then the idea that we're going to get this self-fulfilling thing with the economy improves, confidence improves, everything fixes itself is just not going to happen.

Because the other things are not in place. We have stimulus plan that is helpful but not nearly big enough to produce recovery. There is nothing out there suggesting that we're going to have an economic recovery any time soon. We might see the pace of decline level off. But the idea that we're going to bounce back to full employment any time in years is hard to credit at this point.

So you really don't want the centerpiece of your financial strategy to be based up on hope that something isn't true might be true."

This is a very striking assessment from Krugman, much gloomier than anything from him in the past.

Krugman gives specific reasons why Geithner's new proposal won't work, but that's not the most surprising thing.

What's surprising is that Krugman is just one step away from concluding that NOTHING will work.

I could hardly believe my ears when I heard him say, "To believe that, you really have to believe that most of the problems facing the banking system are the results of a more or less irrational panic, that there isn't a fundamental huge loss facing the system."

Krugman is repudiating the common wisdom of the time, that fundamentals don't matter, that only words matter.

I remember how shocked I was in 2004 then Ben Bernanke congratulated himself and the Fed for using words -- Fed statements that interest rates would be kept low -- were all that was necessary to keep stock prices up. I couldn't believe that the head of the Princeton economics department could possibly say anything so stupid. But in fact, Bernanke's claim was just the common wisdom.

This common wisdom is shared by President Obama, Fed Chairman Ben Bernanke, CNBC, Bloomberg TV, the Wall Street Journal, and almost everyone else.

Krugman has now repudiated the common wisdom, and his own ideological beliefs. It will be interesting to see where this leads.

Krugman isn't the only one who's suddenly decided that the common wisdom must be wrong.

Here's what Tom Brokaw said last Sunday on Meet the Press, in explaining why people are so angry:

Apparently the only people who still believe the common wisdom are President Barack Obama and Treasury Secretary Tim Geithner.

President Obama clearly believes that if he goes on the Leno show or ESPN and other media outlets, and he talks confidently, then he'll "restore confidence." He believes that because that's the way he got elected President, and he believes that if he can win an election that way, then he can turn the economy around that way.

Most incredible of all, Obama continually claims that the way to save the economy is essentially to implement universal health care, as well as a large energy program that would defeat global warming. It's possibly his repeated claims that the more you spend the more you'll save that are the most bizarre to me.

From the point of view of Generational Dynamics, "restoring confidence" is impossible. There is a generational change in behaviors and attitudes going on, and it's only begun.

Here are the attitudes that are changing:

Politicians, journalists and analysts expect the opposite of all of these. They imply that with the right words and right incentives and right regulations, trust will be restored to the financial system, and people will start borrowing and spending again.

What they're expecting is that people will return to the "bubble mentality" that's existed for the past twenty years.

From the point of view of Generational Dynamics, that's impossible. The current generations of Boomers and Gen-Xers are suffering from their own abuses, and the young people in the Millennial generation are watching all this and learning lessons about trust, spending, debt and credit that they will live by as long as they're alive -- just like your grandparents.

More important, all the bailouts and TARP programs, as well as Geithner's new plan, depend heavily on the assumption that people will quickly return to this "bubble mentality." If there were no other reason why Geithner's plan has to fail, this reason would mean its failure anyway. No one alive today will return to the "bubble mentality" of the past years.

Last week, Jay Leno asked President Obama why people weren't being sent to jail. Obama said, "Here's the dirty little secret though: most of the stuff that was done was perfectly legal."

I strongly disagree, and I'll briefly repeat the reasons.

As I wrote a year ago in "Brilliant Nobel Prize winners in Economics blame credit bubble on 'the news,'" experts who were complicit in originally creating the toxic assets, like Nobel Prize winner Joseph Stiglitz, are lying and making excuses, like blaming it on the news or on the Iraq war.

The universal excuse is that when these toxic assets were designed in the early 2000s, no one knew that they would fail. But even if that were true in the beginning, that excuse falls apart later.

Maybe that excuse works for toxic assets sold in 2003, 2004, 2005, or even 2006. But by 2007, it was perfectly clear that the housing bubble had burst, and that interest rates were rising. So by 2007, the financial engineers should have stopped creating new toxic securities, the bank marketing departments should have stopped selling them, the ratings agencies should have stopped giving them AAA ratings, and the monoline insurance agencies should have stopped insuring them.

But that didn't happen. By 2007, the volume of toxic assets actually increased substantially, and they were designed, sold, rated and insured as before. What happened was that everyone wanted to get their fat fees and commissions before the game was up.

This is overwhelming circumstantial evidence that massive fraud was committed in 2007, by people who knew exactly what was going on. There is no question in my mind that it could be proven that hugely illegal activities were going on, and that they could be proven in court by prosecutors who could subpoena the relevant paperwork.

The reason that isn't happening is that, like Stiglitz, the prosecutors were complicit in the fraud. The government regulators and prosecutors had access to the data that these toxic assets were becoming worthless, but they did nothing about it, probably because they didn't want to harm their own investments.

I frequently quote John Kenneth Galbraith on this web site, especially his 1954 book The Great Crash - 1929. His son, James K. Galbraith, is an economics professor at University of Texas.

In an a recent interview with Der Spiegel, James Galbraith described what's been happening as a "culture of complicity" in response to a question about the German bank Hypo Real Estate:

The representation of such a quality of this security without examination is fraud. Perhaps Hypo Real Estate has legal recourse to these rating agencies for having relied on their fraudulent ratings.

Actually I doubt that, as there was some hidden understanding between such banks and rating agencies. The language they used reveals a different story than the one bank managers are selling to the public these days. "Liars' loans," "toxic waste," or my favorite: "neutron loans" -- loans that destroy the people but leave the buildings intact. These were the words to describe these loans and they were used by the people who were working in this industry. They reveal a culture of fraudulence on a massive scale. And of course governments now have to come to recognize that these are things they have to deal with. ...

There was clearly a systemic failure. But that does not mean there was no criminal energy around. The language one uses to describe these things is very important. I tend to stay away from neutral terms like "systemic failure" or "bubble," because these terms imply the innocence of the people involved -- and I can't see that. ...

The reality of the financial crisis is that it was caused by a culture of complicity. That makes it so difficult for people to come to grips with it, especially for people who were involved, who were denying it themselves and who were partially aware of the extent of the damage. Probably many of them thought they would get away with it and now they realize that they have created an enormous slump."

This is exactly the point that I've been making. When politicians and analysts make excuses for what happened, it's to hide their own complicity.

So what did President Obama mean when he said that nothing illegal had occurred? Is he completely ignorant of what's going on, or is he hiding his own complicity? You decide.

And let's make it clear: The culture of complicity has not disappeared. The people in the same lethal combination of Boomers and Gen-Xers that caused the current catastrophe are still around, and they're still making it worse. Geithner's plan, as well as the various bailouts and stimulus plans, are part of the culture of complicity and are making the problem worse, prolonging it, and guaranteeing that the bankruptcies, homelessness and poverty will be even worse than they might have been.

You'll recall the Bernie Madoff is the man who defrauded thousands of investors out of $65 billion.

Madoff himself has been quoted as saying, "In today’s regulatory environment, it's virtually impossible to violate rules. This is something that the public really doesn’t understand. But it's impossible for a violation to go undetected, certainly not for a considerable period of time." When Madoff said that, he had already been violating the rules and defrauding people for decades.

Two weeks ago, the CBS show 60 Minutes ran a news segment on Harry Markopolos, the man who repeatedly complained to the SEC that Bernie Madoff's claimed returns were mathematically impossible. He made five separate submissions to the SEC, in May 2000. October 2001. October, November, and December of 2005, and then again June 2007, and finally April 2008.

Markopolos said there were only two plausible explanations: either Madoff was using insider information to rack up the huge profits or he was running a giant Ponzi scheme. Both of those are illegal.

I identify very closely with Markopolos' story. In 2002, I was eating lunch at the mall reading the Boston Globe, when I saw a graph of the Dow Industrials going back to the early 1900s. I took one look at it and said, "Ohmigod, the stock market is going to crash." (Yes, it was that obvious, just from the graph.) Later, I did the detailed analysis.

I was really naïve at that time. I thought that once this problem was identified, people would want to know about it and take immediate action. Instead, I was simply blown off. That's what happened to Markopolos.

There's another similarity. Markopolos said, "I would say that hundreds of people suspected something was amiss with the Madoff operation. If you look at who the victims were not, you'll notice that the major firms on Wall Street had no money with Mr. Madoff."

In other words, Markopolos believes that hundreds of people knew that Madoff could be criminal, though he doesn't know precisely who they were.

I set up this web site in 2002-2003 with the purpose of publishing analyses and predictions, so that people could judge for themselves whether the predictions were right or wrong. There are tens of thousands of people who now read this web site regularly. I don't know who they are, but I assume that most of them know that we're headed for a major financial crash, and they're preparing for it.

Just as Markopolos said that it was mathematically impossible for Madoff to have been doing what he was doing legally, I've shown that it's mathematically impossible to avoid a major stock market crash and a new 1930s style Great Depression. (See: "How to compute the 'real value' of the stock market.")

But most people go to great lengths to main their state of denial.

I was talking to a friend, and I told him that I believe that one of the most important statements of the last decade was Alan Greenspan's testimony to Congress in February 2005, when he completely repudiated his earlier views on the dot-com bubble.

My friend said, "You must be wrong, because if what you're saying is right, then it would have been very big news, and all the news shows would have reported it."

I said, "You can check Greenspan's testimony for yourself," but to no avail. This person did not want to know the truth, and nothing could change his mind.

There was another 60 Minutes segment that I want to comment on -- the March 12 interview with Fed Chairman Ben Bernanke.

As I watched the interview, I realized that I have a great deal of respect for him as a man.

Now, no one has been as bitingly critical of him as I have. I've been relentless in mocking his policies, and pointing out that they couldn't possibly succeed, as indeed they haven't. And last year I wrote, "WSJ's page one story on Bernanke's Princeton 'Bubble Laboratory' is almost incoherent."

But of the people that I criticize, I find most of them to be personally sleazy, taking ideological positions on the left or right designed to cover up their own personal failings, and their own complicity in the disasters of our time.

But what I see in Bernanke is a somber, modest man who talks openly and honestly about what's going on, who really believes what he's saying, who doesn't put an ideological spin on it, and who feels personally devastated about the state of the economy, much of which he feels personally responsible for.

As much as I want to believe Bernanke, I just can't understand what's going through his mind. I don't expect the average man on the street to understand the Law of Mean Reversion, but I do expect the head of the Princeton University Economics Department to understand it, and how it provides a mathematical proof that a new Great Depression is almost 100% certain. In the 60 Minutes interview he said that he expects the recession to level off this year, and growth to begin again next year. Does he really have so little understanding of the long-term damage caused by the dot-com, real estate, credit and stock market bubbles? Or is he saying what he's saying because he doesn't dare talk about what he knows to be the truth? You decide.

Last year, I wrote the article, "One, Two, Three ... Infinity," in which I compared to the ever-increasing government spending plans to a book by George Gamow that I read in school in the 1950s.

I've really lost track of it all. It seems that ever week there's a new stimulus plan or new budget or new bailout plan that adds a trillion dollars to the national debt. It's a process that has no possibility of succeeding, and is mind-boggling in its stupidity.

One phrase I hear all the time from the journalists, politicians and analysts is, "When this thing is over ...."

Thus, you might hear this: "When this thing is over, the Fed will have to raise interest rates again."

The assumption always seems to be that "this thing" will be over by the end of this year, or the beginning of next year. The assumption is that people will return to their "bubble mentality," and the credit bubble will start growing again. Of course that's impossible, as I explained earlier.

But there's another insidious assumption being made. The assumption is that the reason for the budget deficit in the Bush administration is from the Iraq war, and that Obama is going to end the Iraq war, and end the deficit.

Here's a chart that I posted a couple of years ago. It comes comes from the Calculated Risk blog from 2005:

|

This graph shows that the huge deficit, which was supposedly caused by the Iraq war, actually began in 2000, the last year of the Clinton administration, with the dot-com crash. The outlays caused by the Iraq war were not particularly large by the standards of the preceding three decades. What mattered was the collapse of tax revenues.

At the beginning of 1996, President Clinton declared that "the era of big government is over." What nobody knew then was that tax revenues were going to increase substantially in 1996, and every year after that, thanks to the dot-com bubble.

In fact, tax revenues depend on the state of the economy, and have almost nothing to do with anything else. Tax revenues went up in 2006 because of the credit bubble, and this year they're going to crash dramatically, because corporate earnings, and the economy in general, are crashing.

Just as President Clinton was pleasantly surprised in 1996 when tax revenues surged, President Obama is going to be very unpleasantly surprised this year, when the weakened economy delivers substantially lower tax revenues.

Perhaps that's why the Congressional Budget Office (CBO) published a report last week saying that the deficits will be much larger than President Obama's estimates.

So President Obama is making incorrect assumptions on multiple levels.

He's assuming that "when this thing is over," people will return to their old "bubble mentality," and they certainly will not.

And he's assuming that tax revenues will hold steady, even though reported corporate earnings have been crashing.

All of the Obama administration's assumptions are completely wrong. Tim Geithner's new toxic asset plan doesn't have a prayer of working.

The Obama Administration is a full partner and leading advocate in the culture of complicity. That's why Washington's budget plans are going to be a frigging disaster.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(26-Mar-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

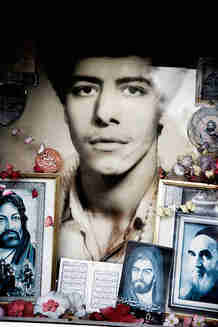

Can reformist Mir-Hossein Musavi beat Ahmadinejad in the June 12 elections?

Most analysts expect hardline Mahmoud Ahmadinejad to be reelected for a second term as Iran's president in the election scheduled for June 12.

Now that popular reform candidate former president Mohammad Khatami has dropped out of the race, Ahmedinejad's principal opponent is lesser known Mir-Hossein Musavi. Musavi is more conservative than Khatami, but is still considered a reform candidate with a chance of beating Ahmadinejad.

|

On Friday, US President Barack Obama send an open letter to the Iranian people in the form of a letter and an online video:

This holiday is both an ancient ritual and a moment of renewal, and I hope that you enjoy this special time of year with friends and family.

In particular, I would like to speak directly to the people and leaders of the Islamic Republic of Iran. Nowruz is just one part of your great and celebrated culture. Over many centuries your art, your music, literature and innovation have made the world a better and more beautiful place. ...

For nearly three decades relations between our nations have been strained. But at this holiday we are reminded of the common humanity that binds us together. Indeed, you will be celebrating your New Year in much the same way that we Americans mark our holidays -- by gathering with friends and family, exchanging gifts and stories, and looking to the future with a renewed sense of hope. ...

So in this season of new beginnings I would like to speak clearly to Iran's leaders. We have serious differences that have grown over time. My administration is now committed to diplomacy that addresses the full range of issues before us, and to pursuing constructive ties among the United States, Iran and the international community. This process will not be advanced by threats. We seek instead engagement that is honest and grounded in mutual respect.

You, too, have a choice. The United States wants the Islamic Republic of Iran to take its rightful place in the community of nations. You have that right -- but it comes with real responsibilities, and that place cannot be reached through terror or arms, but rather through peaceful actions that demonstrate the true greatness of the Iranian people and civilization. And the measure of that greatness is not the capacity to destroy, it is your demonstrated ability to build and create."

Supporters of President Obama has described this as a brilliant move, designed to change the dialog between Iran and the West, and reverse the damage done by the evil Bush administration. Opponents of President Obama have described it as sending a message that, in the Persian mind, will be interpreted as defeat and surrender of the United States to the realities of Iran's strength.

In between these two extremes lies a more sober assessment that can be derived from the principles of generational analysis. From the point of view of Generational Dynamics, Obama's actions appear to have provided support for Ahmadinejad's reform opponents in the upcoming June 12 Iranian elections.

The fact is that Iran is entering an extremely tumultuous political period. It's now 21 years since the end of Iran's last crisis war, which began with the Islamic Revolution of 1979 and continued with the Iran/Iraq war, climaxing in 1988. Thus, we can roughly compare today's generational mood in Iran to the generational mood in America in 1966, 21 years after the end of World War II. In 1966, college students were mobilizing for the nationwide protests that led to the Summer of Love, the violent riots that accompanied the Democratic convention in Chicago in 1968, the collapse of President Lyndon Johnson's presidential campaign, and the bombings and violence perpetrated by the Weather Underground.

Remember what happened during the 1960s, America's last generational Awakening era. It began in August 1963, when Martin Luther King led a march on Washington in which over 200,000 people participated. Later, President Kennedy was assassinated, and so was King. There were numerous demonstrations and riots throughout the country. There were "long, hot summers," led by the Black Panthers, and there were bombings and declarations of war against the government, led by the Weather Underground.

That's precisely the kind of tumultuous period that Iran is entering right now.

On the one hand you have the older generations that survived the Iran/Iraq war, and who revere those who were killed in the war as martyrs. For these people, the spirit of the Islamic Revolution is as strong today as it was in 1979, and Islamic morality is essential to keeping any such disaster as the Iran/Iraq war from happening again.

On the other hand, you have the generations born after 1984 or so, with no personal memory of either the Islamic Revolution or the Iran/Iraq war, who see the imposition of austere Islamic morality as the ideological demands of doddering old fools.

|

The most obvious symbol of this generational conflict has been the requirement that Iranian women must wear headscarves that entirely cover their hair, and I've enjoyed making fun, from time to time, of Ahmadinejad's campaign to arrest young women in Tehran who don't follow the strict dress code. (See "Iranian police swoop down on women with loose headscarves.")

In Iran's largest and most violent protests yet, nephew of opposition leader is killed:

Iranian police fired on protesters on Sunday,...

(28-Dec-2009)

Iran fails to smash student protests, as the Dubai crisis batters its economy:

Huge peaceful student protests in cities across Iran were met with violence...

(9-Dec-2009)

Theological split in Iran widens as opposition protests continue:

The Islamic Republic of Iran versus the Persian Republic of Iran....

(9-Nov-2009)

Iran plays a grand game in international nuclear weapons talks:

Will she or won't she?...

(26-Oct-2009)

Furious Iran blames Pakistan, US and Britain for Sunday's terrorist attacks:

Iran's Revolutionary Guards vow revenge....

(22-Oct-2009)

Big Iran street protests greet Ahmadinejad's fiery denunciations of Israel:

Iran's political crisis continues to grow, as the college year begins....

(19-Sep-2009)

Escalating civil war in Yemen threatens to pull in Iran, Saudi Arabia and U.S.:

Last week, President Obama said we would help Yemen in its "fight against terrorism,"...

(13-Sep-2009)

New Iran demonstrations commemorate the student protests of July 9, 1999:

Hardline Iranian mullahs had thought that they had crushed the demonstrations ...

(10-Jul-2009)

Ayatollah Ali Khamanei relives his childhood, as Iran arrests UK Embassy employees:

Following a week of massacres, protestors have taken to the rooftops,...

(28-Jun-2009)

Iran's Khamenei appears desperate, as reports of Tehran massacres grow:

An amazing generational battle is proceeding in Iran....

(26-Jun-2009)

A generational explanation of Iran's political crisis:

What happens when an irresistible force meets an immovable object?...

(23-Jun-2009)

Iran's government panics, as Supreme Leader hints at violence against protesters:

Friday's speech by Ayatollah Ali Khamenei was a significant escalation...

(20-Jun-2009)

Iran: Violent street demonstrations follow Ahmadinejad's landslide election victory:

Opposition supporters are claiming massive election fraud,...

(14-Jun-2009)

President Obama casts a vote against Iran's President Ahmadinejad:

Can reformist Mir-Hossein Musavi beat Ahmadinejad in the June 12 elections?...

(22-Mar-2009)

Stock markets in Iraq and Iran are surging.:

Iran's President Mahmoud Ahmadinejad says "it is the end of capitalism."...

(17-Oct-2008)

Wall Street Journal describes Iran's generational Awakening era:

Young Iranians turn away from the Quran and go for self-help and New Age....

(1-Jul-2008)

China "betrays" Iran, as internal problems in both countries mount:

Diplomats say that China has provided Iran's nuclear weapons plans to the UN....

(5-Apr-08)

Iranian speedboats threaten to blow up US ships in Gulf of Hormuz:

Question: Why did Iran do it?...

(9-Jan-08)

Students at Tehran University risk protest against Ahmadinejad:

When Iranian President Mahmoud Ahmadinejad spoke at Columbia University...

(8-Oct-07)

Iran's President Ahmadinejad facing a growing "generation gap":

Gas rationing and restrictions on women are infuriating the college-age generation....

(2-Jul-07)

Iranian police swoop down on women with loose headscarves:

Sorry, I just can't stop laughing at this one....

(25-Apr-07)

An Iranian scholar says that Tom and Jerry cartoons are a Jewish conspiracy:

Professor Hasan Bolkhari is loonier than Ahmadinejad....

(29-Mar-07)

Iran is using cartoons to fight decline in anti-Americanism:

Anti-Americanism has been declining in Iran for ten years,...

(24-Mar-07)

Iran and Russia increasingly at odds over Iran's nuclear development:

Saying that Moscow "will not play anti-American games" with Iran,...

(17-Mar-07)

Iran's President Mahmoud Ahmadinejad holds two-day Holocaust denial conference:

He says that Israel "will soon be wiped out."...

(13-Dec-06)

Iran and Ahmadinejad are waiting for the Mahdi:

Most people know about the belief by Christian fundamentalists about the Second Coming of Christ,...

(22-Aug-06)

Iranian President Mahmoud Ahmadinejad is a very charismatic leader:

In his 60 Minutes interview, he was witty, charming, confident and deadly....

(14-Aug-06)

State of the Union speech displays continuing misreading of Iran:

It's wishful thinking to believe that an overthrow of the Mullahs is coming....

(1-Feb-06)

Europe resigns itself to a nuclear Iran:

Defiant Iran President Mahmoud Ahmadinejad continues to lead Iran to be the regional superpower,...

(16-Jan-06)

Iran appears to be positioning itself as a post-war superpower:

Iran restarts its nuclear enrichment program while calling for Israel's removal....

(11-Jan-06)

Feminism flourishes in Iran, as the international crisis on nuclear weapons intensifies:

Iran's new president, Mahmoud Ahmadinejad, named a hardline Islamist cabinet on Sunday,...

(15-Aug-05)

Iran's plan to develop nuclear fuel is "irreversible":

France calls it a "major international crisis"...

(3-Aug-05)

Ultraconservative Mahmoud Ahmadinejad wins Iran Presidential election:

I try to find humor wherever I can for this serious web site, and with this guy it's easy....

(25-Jun-05)

Iran: Tehran University student unrest is building against the government:

"Moderate" President Mohammad Khatami blamed the hard-line Muslim clerics...

(8-Dec-04)

Iraq Today vs 1960s America (Revised):

They have much in common: Bombings, assassinations, student demonstrations, violent riots, calls for insurrection and civil war and harsh rhetoric. That's much more than a coincidence.

(8-May-2004)

Riots in Iran: Will there be a violent overthrow of the Iranian Mullahs? Generational Dynamics says 'No.' (25-Jun-03) | ||

However, the morality drive did not begin with headscarves in 2005. For Ayatollah Ruhollah Khomeini, the leader of the Islamic Revolution of 1979, the revival of Islamic morality was an integral part of the Revolution. Khomeini himself created the Islamic "morality bureau" in 1979, to uproot corrupt pre-revolutionary cultural habits.

By the late 1990s, as the first of the young post-Revolution generation began to reach manhood, Tehran's culture was changing. Kids were willing to accept Islam as their religion, but saw no contradiction in also adopting European and American styles and behaviors. The morality police were beginning to arrest young people who violated Islamic dress and behavior rules.

That gave rise to the "reformist" movement and the election of Mohammad Khatami (whom we mentioned at the beginning of this article) in the 1997 presidential elections. He was reelected in 2001.

In November 2002, and again in May 2003, violent student protests raged in Tehran over the death sentence imposed by the Islamic courts on Hashem Aghajari, a history professor at a Tehran university.

Aghajari was a Iran war hero -- have lost his leg while serving in the Iran/Iraq war.

However, he enraged conservatives in Iran in 2002 when he questioned the rule of clerics, and said that Muslims should not follow Islamic clerics "like monkeys". The student protests were triggered when he was sentenced to death for blasphemy in November 2002, and again when the sentence was confirmed in 2003. Finally, he was released in 2004 in reaction to increased political pressure from students and intellectuals.

By 2003, the student movement was growing, and so was anger at "reformist" Mohammad Khatami, according to student leader Saeed Razavi-Faqih, in a 2003 interview:

Old fogies in America's Boomer generation may feel a certain familiarity with the above rhetoric -- it's very similar to the rhetoric used by students in America's Awakening era in the 1960s. If you have a moment, go back and read the letter from Mark Rudd of Columbia University that I quoted several years ago. The more you read about this kind of rhetoric from students during Awakening eras for students in different countries, you realize that it's all bluster and that it all sounds the same.

Razavi-Faqih continued as follows, when asked what the students will do next:

Thus, the election of hardline Mahmoud Ahmadinejad to the presidency in 2005 was a major blow to the student movement.

I've written about student unrest in Iran a number of times on this web site. (See for example "Iran: Tehran University student unrest is building against the government" for unrest targeting President Khatami in 2004, and "Students at Tehran University risk protest against Ahmadinejad" from 2007.)

I've written about it because it's the hallmark of a generational Awakening era, one that begins a generation past the end of a crisis war.

(For information about generational Awakening eras, see "Basics of Generational Dynamics." For information about America's Awakening era in the 1960s-70s, see "Iraq Today vs 1960s America." For information about the Summer of Love, see "Boomers commemorate the 40th anniversary of the Summer of Love.")

One thing that I've always found pleasing -- going back as far as 2000 -- was that I'd occasionally read news stories about pro-American student demonstrations in Tehran. It was such a pleasant contrast to the anti-Americanism that seemed to exist everywhere else, including even the American press. And when Palestinians were dancing in the streets after the 9/11 attacks, Iranians were expressing genuine sympathy.

I've written several times about the schizophrenic national strategy that Iran has been exhibiting. From the point of view of Generational Dynamics, what's important is the behavior and attitudes of large masses of people, entire generations of people. The attitudes and behaviors of the politicians are irrelevant, except insofar as they reflect the attitudes of the people.

Thus, when I've analyzed Iran's strategy, I've had to emphasize the effects and potential outcomes of the drastically different attitudes of the older generation politicians and people -- the "kids." I have absolutely no doubt that the kids are going to win this political battle. The only question is -- when?

And when we discuss politics, we have to go back to 2002. Possibly no single sentence has roiled Iranian politics in the last decade more than President Bush's statement, in 2002, naming Iran, Iraq and North Korea as the new "axis of evil."

Here's what NY Times columnist Thomas Friedman wrote in 2002:

But what is striking is how much President Bush's branding of Iran as part of an "axis of evil" (along with Iraq and North Korea) intensified this discussion. At first, reformers in Parliament and the media were embarrassed by Mr. Bush's statement, which hard-liners used against them as "proof" that America would never have ties with the Islamic Republic. But since then, reformers have retaliated by pointing to the "axis of evil" accusation and saying to the hard-liners: "Look where your policies have led us."

Add to this the reduction in U.S. visas for Iranians since Sept. 11, which has dispirited many Iranian college students, and the shock the Iranians had two weeks ago when Russia, their longtime backer, effectively joined NATO, and you can understand why a lot of people here are rethinking ties with Washington. ...

I don't know what the final outcome will be, but I do know this: If Secretary of State Colin Powell were to announce tomorrow that he was ready to fly to Tehran and put everything on the table -- an end to sanctions, Iran's nuclear program, its support for Palestinian terrorists, diplomatic relations -- he would light this place on fire."

That column appeared on June 12, 2002. And now we're headed for an election on June 12, 2009, and President Obama has done -- sort of -- what Thomas Friedman has suggested. When we say "sort of," we mean that no real policies have yet changed. The Iranians are still enriching uranium and producing plutonium (ingredients in both reactor fuel and nuclear weapons). And last week, Obama signed a renewal of the US economic and trading sanctions against Iran.

Still, for those who believe that words can change the world, will Obama's remarks "light [Tehran] on fire?"

Since the kids are going to win the generational political battle eventually, the kids may get a victory on June 12, and that's the possible scenario that has to be considered.

Analysts that I've heard on BBC say that Ahmadinejad is heavily favored to win. They point to his popularity in parts of Tehran, and especially in the rural villages scattered around Iran's countryside.

However, Ahmadinejad may not be as popular in rural areas as he used to be, according to one recent news story:

According to the March 6 Guardian report on the incident, after the repeated shoe-throwing and booing's, the security guards scrambled to catch the offending individuals but were unable to do so. Instead, the president's automobile quickly sped away to avoid further embarrassment. Following the incident, all the president's provincial excursion tours have been indefinitely cancelled and the Iranian media have been strictly forbidden to report on the episode—for very good reason."

Of course much of the world press, including the Iranian press, has been very gleeful in describing the shoe-throwing incident directed at then-President George Bush visiting Iraq. So these new incidents might be described as examples of the old saying, "What goes around comes around."

From the point of view of Generational Dynamics, it's not a surprise that there's a change in attitude among rural voters that's similar to the change in attitude among Tehran students. After all, the change is a generational change, and the same young generations are growing up in rural areas.

So if the shoe-throwing incident in Orumieh represents a widespread change in rural attitudes towards Ahmadinejad, then he could indeed be in serious trouble in the June 12 election.

That's the reason why the title of this article is, "President Obama casts a vote against Iran's President Ahmadinejad." In the current climate, the kids are going to support the reformist candidate, and Obama may have given their cause a boost.

The main reformist candidate was originally going to be Mohammad Khatami, but he stepped down last week, giving as a reason that there were several "reformist" candidates, and he didn't want to split the vote, although other news stories hint that he was pressured, and perhaps threatened with violence.

That leaves the hopes of the reformists in Mir-Hossein Musavi. Musavi also served in the Iran/Iraq war, but he's less well-known than Khatami, and his "reformist" credentials are sometimes questioned by student groups. Furthermore he will have to split the vote with another "reformist" candidate, Medhi Karrubi.

Today, the election favorite would have to be Ahmadinejad. However, the election is now 2½ months away, and that amount of time is an eternity in politics.

If Ahmadinejad loses, then President Obama's supporters will undoubtedly claim some of the credit for him. This will be a bright spot for him, since the financial crisis and other policy areas will give him little or nothing to crow about.

(Comments: For reader comments, questions and discussion,

as well as more frequent updates on this subject, see the Iran

thread of the Generational Dynamics forum.)

(22-Mar-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Here are some "dead cat bounce" factoids from Credit Suisse, posted by the FT Alphaville site.

"Dead cat bounce" is the gruesome phrase used by investors to describe a brief rally that occurs during an overall bear market. As you might suspect, it's based on the observation that even a dead cat cat may bounce if dropped from a sufficient height.

Wall Street markets have been rallying, even since they reached a low point less than two weeks ago, on March 9. Everyone wants to know how long the rally will last.

During the period 1929-1932, the Wall Street markets fell 90%. However, during that four year period, there were several substantial rallies. Here's a list of them:

Start End Duration Size of market increase

--------------- --------------- --------- -----------------------

Nov 1929 April 1930 5 months 49%

June 1930 September 1930 3 months 16%

December 1930 February 1931 2 months 25%

June 1931 July 1931 1 month 29%

October 1931 November 1931 1 month 35%

January 1932 March 1932 2 months 25%

--------------- --------------- ---------- ----

AVERAGE 2 months 30%

So the market didn't fall steadily from 1929 to 1932. There were several rallies, one as long as 5 months. The average length of these rallies was 2 months.

Moving back to today, the market has fallen almost 50% since it peaked in October, 2007. During that time, there have been several rallies (I've updated the last line to the current date):

Start End Duration Size of market increase

--------------- --------------- --------- -----------------------

26-Oct-07 10-Dec-07 45 days 8%

10-Mar-08 16-May-08 67 days 12%

15-Jul-08 11-Aug-08 27 days 7%

27-Oct-08 4-Nov-08 8 days 18%

20-Nov-08 6-Jan-09 47 days 24%

09-Mar-09 19-Mar-09 10 days 16%

--------------- --------------- ---------- ----

AVERAGE 34 days 14%

So for those of you wondering how long this dead cat bounce will last, it might be over already, or it might last several more weeks. We won't know until after it's over.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(20-Mar-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The President goes from outrage to outrage.

Last month, on February 19, CNBC market reporter Rick Santelli unleashed a rant against President Obama's bailout plan. The video of the rant achieved "viral status," as it spread around the internet. It became so popular, that even White House Press Secretary Robert Gibbs felt forced to make disparaging comments about it.

Suddenly it became CNBC versus the White House, with other journalists taking sides.

Thus, two days later, I heard CNN's senior report John King say that Santelli made his rant because he was a Republican and wanted to score points against the President. With this ideological statement, both King and CNN completely missed the important story.

Santelli's rant was nothing new. He delivers rants all the time. Most of his rants are simply ignored and forgotten within five minutes after they're delivered.

Thus, the big story about this rant was not the rant itself, but the reaction to it. This was a first real sign of what's now being called "populist anger" at the President. This story was completely missed by CNN and by everyone else, as far as I know.

The populist anger has been growing, and has become palpable in the anger directed against bonuses contractually owed to executives at American International Group (AIG), which was first bailed out in September of last year. AIG has received $173 billion in bailouts, and says that it's contractually obligated to pay $165 million in bonuses.

The politicians in Washington were quick to jump on the bandwagon, with one Senator after another posturing for the cameras.

President Barack Obama led the way:

In the last six months, AIG has received substantial sums from the U.S. Treasury. And I've asked Secretary Geithner to use that leverage and pursue every single legal avenue to block these bonuses and make the American taxpayers whole. (Applause.) I want everybody to be clear that Secretary Geithner has been on the case. He's working to resolve this matter with the new CEO, Edward Liddy -- who, by the way, everybody needs to understand came on board after the contracts that led to these bonuses were agreed to last year.

But I think Mr. Liddy and certainly everybody involved needs to understand this is not just a matter of dollars and cents. It's about our fundamental values. All across the country, there are people who are working hard and meeting their responsibilities every day, without the benefit of government bailouts or multi-million dollar bonuses. ... And that is an ethic that we have to demand."

It was just a few days ago that Administration officials OK's a new bailout of AIG, and did nothing about the bonuses. But "populist anger" has grown so quickly that President Obama has suddenly that honoring existing employment contracts is an "outrage," and violates our "fundamental values."

Now, I don't think most of these people deserve bonuses either. I've been writing for years that there's plenty of circumstantial evidence of criminal activity. The main evidence is the sharp increase in the issuance and sale of mortgage-backed securities in 2007, at a time when it was obvious to everyone that these securities were becoming worthless.

But what bothers me about the AIG bonus imbroglio is that it's based on mob anger, rather than on anything reasonable. In fact, decisions are now being made increasingly by mob demands.

The point I want to make is that Washington is no longer making any decisions.

As I heard one pundit put it, President Obama is now "bouncing from outrage to outrage."

This is nothing new, and not surprising. It's the latest extension of the paralysis in Washington that's been increasing for several years.

I've been writing for years about the political bickering that's paralyzed Congress for several years, during both Republican and Democratic party control. This caused a certain amount of Schadenfreude two years ago, when political paralysis blocked a Congressional pay raise.

Many people believed that the paralysis was all in the past, after Obama won the election, and won a Democratic party majority in both branches of Congress. In fact, it's back in full force, and it's going to continue to get worse.

Not only that, but Obama's approval rating has been slipping steadily since he took office, and his disapproval rating has been growing.

My personal belief is that he brought a lot of this on himself by his smug, overconfident claims that all the world's ills would be cured the day after he took office. He made these claims of "change you can believe in" throughout the campaign, never explaining exactly what the change was, and even continued the inflated claims after the election was over. Now the public is living with the reality that nothing is changing, that the bickering is continuing, that the economy is getting worse all the time, and that the new Administration has made numerous missteps. Pundits who could find nothing about Obama to joke about in the past are now saying things like, "Obama is paying for the bailout by collecting unpaid taxes from people in his own cabinet."

This parallels what has been happening in other countries.

Japan's Prime Minister Taro Aso took office in September, and saw his approval rating fall rapidly from 50% to 16% in four months. In the article I wrote at the time, I suggested that the same thing might well happen to Obama, thanks to his arrogance and his contempt for any opinion other than his own (e.g., "I'm guided by the facts, rather than ignoring them.").

In fact, Japan has had three Prime Ministers in a row who began with great hope and popularity, but whose approval ratings plummeted quickly when problems arose. Each of these Prime Ministers ended up with approval ratings lower than those of the previous Prime Minister. The same thing may happen to Obama with respect to President Bush's approval ratings.

This is not surprising. A constant theme of this web site is that the government of one country after another, among those who fought in WW II as a crisis war, has become paralyzed. I've discussed this about many countries, including Japan, Israel, Europe, China and France.

For several years, I've been warning readers to expect increased anger at criminal activities as the economy worsened. I repeated this warning in my "The outlook for 2009."

I made this statement because of parallels in history. I've quoted several sources in the past that indicated that it happened after the 1929 crash. And I saw it for myself when the Enron scandal broke in 2000 and 2001, when many people were calling for the CEO of EVERY corporation to be sent to jail.

One of the most vivid historical examples of what's going on today is the bankruptcy of the French Monarchy in 1789 that led to the French Revolution. In the Reign of Terror that followed, any person who was an aristocrat, a relative of an aristocrat, a friend of an aristocrat, a servant of an aristocrat, or even had a resemblance to an aristocrat, would be tried and quickly convicted and sentenced to the guillotine, where his head would quickly and efficiently be severed from the rest of his body.

The mortgage-backed securities of that day were "assignats," bonds that represented the value of real estate confiscated from the clergy. Like today's CDOs, the assignats became increasingly worthless, leading to the Reign of Terror.

Some people have suggested to me that the US could be headed for a new civil war, as the economy gets worse. Ironically, I recall my father telling me that the rioting was so bad in the 1930s that he thought that the US might not survive.

From the point of view of Generational Dynamics, there are no signs of a civil war at the present time. It's one thing to have political riots and demonstrations, it's quite another to have people go to kill their next door neighbors. A civil war requires a fault line based on differences in skin color, religions, geography, or something similar. The only fault line that's apparent these days is the one between "Yanks" and "Latinos," but any conflict across that fault line will be fallout of a new Mexican revolution.

But there will be increasing riots and demonstrations as the economy worsens. It will be harder and harder for Obama and the Washington politicians to get anything done except respond to the populist anger.

In June, 1930, eight months after the stock market crash, Congress passed the Smoot-Hawley Tariff Act. Almost every economist said that it was a very bad idea, but an angry public demanded it, thinking that it would protect American jobs by reducing imports.

Instead, it caused enormous economic hardship throughout the world, and in America as well as other countries retaliated. In Europe, it weakened the economy further, and led to the major banking crisis of 1931. And in Japan it shut down the silk industry and infuriated the Japanese people, who bombed Pearl Harbor several years later.

As I always say, Generational Dynamics studies the attitudes and behaviors of large masses of people, entire generations of people. It doesn't care about the attitudes and behaviors of individual people or politicians, except insofar as they reflect the attitudes of the masses of people.

Whether we're talking about the war in Darfur, Sudan, or the meltdown in Pakistan, we're seeing politicians increasingly lose control, and government actions increasing directed by mob action. The same thing is happening in the US.

In a sense, it's very exciting to read the news these days, because we're seeing the approach of some of the greatest events in human history. Unfortunately, these events will also be the most disastrous in human history. As part of these, we'll have to see if the AIG bonus story leads to anything.

(Comments: For reader comments, questions and discussion, as

well as more frequent updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(19-Mar-2009)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Wrong so many times, what do they make of last week's stock market rally?

Last week on Bloomberg TV (or was it CNBC?) I heard a discussion of the latest corporate earnings reports for Q4 of 2008. The analyst said, "Those figures can't be right. That would mean that the S&P index should be around 300." (That's roughly equivalent to a Dow Industrials index of 3000.)

Welcome to the new world of financial journalism and analysis. The folks at CNBC and Bloomberg TV and the Wall Street Journal and other financial media have been using fudged figures for years to justify the bloated stock market bubble, and now they completely believe their own lies.

There's a feeling of total chaos in these media outlets these days, because no one knows what to say about the price/earnings ratios (also called "valuations"), as Q4 earnings have turned negative.

I've complained many times on this web site about the out and out lies of analysts, advisors and journalists. Even today, you still hear about "valuations being at historic lows," which is total crap.

These analysts, who make 6 and 7 digit salaries by collecting fat commissions from their clients, use a variety of techniques to lie about valuations.

The most common is to use "forward earnings" to compute the P/E ratio. That means you divide the stock price by the bloated estimates for earnings in the following year. By making earnings as high as possible, the P/E ratio becomes lower.

But something has happened in the last few weeks. After several quarters where actual earnings turned out to be far lower than earlier estimates, investors don't automatically believe the bloated "forward earnings" estimates any more.

As we wrote last month, fourth quarter reported earnings are crashing. The actual reported earnings are far below the analyst estimates of only a few weeks earlier. This means that people who use "forward earnings" to compute P/E ratios now have to face the reality that "forward earnings" estimates are crashing along with reported earnings.

The same is happening with another form of dishonesty - the use of "operating earnings." Once again, the objective is to bloat the earnings estimates up as much as possible, so that the P/E ratio is as low as possible.

"Operating earnings" came into fashion during the dot-com bubble of the late 1990s. Analysts and brokers and financial advisers needed a way to justify recommendations to buy stock during the dot-com bubble, even though valuations were extremely high. And so they invented a form of earnings that doesn't count "one-time expenses" and whatever else they felt they could get away with excluding. This boosted the earnings figures, and lowered the P/E ratios.

But now analysts are confounded again, because even "operating earnings are crashing, along with reported earnings.

Since I posted my article last month on the crash in reported earnings, several web site readers have written to me, asking where they could get price/earnings ratio figures. This question has been heavily discussed in the Financial Topics thread of the Generational Dynamics forum, where a number of suggestions have been posted.

Here are several places that regularly provide price/earnings ratios:

Let's take a look at the last item, because it contains some shocking news. If you download the spreadsheet and load it into your spreadsheet program, you'll see the following:

|

The data shown on this spreadsheet is as of 2-March-2009. The S&P500 index on that day was 700.82. Please note the following points, indicated by the balloons in the above graphic:

Your eyes are not deceiving you. The earnings crash that we've been discussing indicates an astronomical P/E later this year, assuming that the S&P index remains at 700.

The Decision Point Earnings Summary that I described above is updated every week. Here are their summaries in their 13-March-2009 report:

|----------------------------------------------------------| | | Price/Earnings Ratios based on | | Quarter | Reported Earnings |Operating Earnings| |-------------------|-------------------|------------------| |Q4 2008 | 43.5 | 15.4 | |Q1 2009 (Estimated)| 74.0 | 16.5 | |Q2 2009 (Estimated)| 134.9 | 17.0 | |Q3 2009 (Estimated)| 296.0 | 16.5 | |Q4 2009 (Estimated)| 23.3 | 11.8 | |----------------------------------------------------------|

Here is the graphic accompanying Friday's report showing historical data from 1926 to the present:

|

Notice the sharp spike in P/E ratios in the third graph, thanks to the crash in reported corporate earnings.

In practical terms, what all this means is the following: The S&P 500 index is going to have to fall much further, to the 300 range or lower. This means that the Dow Industrials index will fall to the 3000 range or lower.

That's why journalists and analysts are freaking out. They're looking desperately at any way to avoid talking about those figures. Instead, they point to last week's market rally, and say, "Let's hope and pray that it continues."

I guess a P/E ratio of 181 isn't good enough for them. Perhaps they'd prefer to see it go up to 1000.

(To understand why it can't continue, see "The outlook for 2009" and "How to compute the 'real value' of the stock market.")

The Obama administration is evidently feeling exactly the same kind of desperation. On Sunday morning on Meet the Press, Dr. Christina Romer, head of Obama's Council of Economic Advisers, was asked "What is the responsible thing for consumers to do at the height of this global crisis?" Here's her response:

|

Regular readers of this web site, who understand my sense of humor, will not be surprised to know that I couldn't stop laughing when I heard this moronically stupid statement. But this is what passes for common sense among the politicians, analysts, journalists, winners of the Nobel Prize in Economics, and others in Washington.

Several web site readers have asked me recently whether last week's modest Wall Street rally means that things have turned around -- or will the market fall again below the levels of two weeks ago?