Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

The new Merrill Lynch asset writedowns are triggering a race to the bottom.

|

In March, Meredith Whitney, Oppenheimer's executive director of equity research, appearing on CNBC, said that banks have been trying to avoid having to write down their assets for as long as they can avoid it. But the longer they wait, the worse it is, because the mortgage-backed assets keep falling as time goes on.

Whitney went much farther -- she predicted a full-scale panic when banks finally are forced to mark these assets down. Because the market will be loaded down with these securities from all sorts of financial institutions, they really will be almost worthless.

Last Friday, National Australia Bank marked its CDOs down to 10% of their original nominal value. In writing about this markdown, I noted that the extraordinary size of the writedown might be the trigger that launches this panic.

On Monday, Merrill Lynch announced a large writedown of its CDOs to 22% of a portion of their CDO portfolio, originally valued at $30.1 billion, to $6.7 billion. They had already been written down to $11.1 billion during the second quarter, so Monday's action represents an additional $4.4 billion writedown.

On Wednesday, Whitney appeared again on CNBC, and indicated that she feels that her March prediction is in progress. In answer to the question, "Who's next?", she answered:

I think that Wachovia, not with the same exposures, will be in the market soon. ...

Look, these institutions are not alone, because everyone was involved in mortgages.

You know it's interesting ... how much of Wall Street banking revenues really gravitated towards the mortgage market. I mean these were lopsided business models. And because they're so levered in the mortgage market, they have so much downside to the mortgage market. And so I think we're going to see '25 plus' institutions come back for capital inside of the next two months."

These '25 plus' institutions, beginning with Citi and UBS, will be coming to the capital markets within the next two months because they'll be forced to write down their assets that are similar to those held by Merrill.

|

When asked whether Lehman Brothers Holdings Inc. would even survive, she answered as follows, grinning:

Ummmmm, I think we get the message. Lehman Brothers is now the smallest Wall Street investment bank, ever since Bear Stearns collapsed in March, and investors have been fearing a collapse ever since.

When asked whether we've seen the worst of the credit crisis, she answered as follows:

And the valuations and the assumptions that companies are using and carrying assets, are still unrealistic.

The central root of all this issue is housing prices. House prices continue to decline, and these assets are valued at really aspirational values, so you're going to continue to be writedowns, capital will continue to be raised, recapitalizations by so many of the financial institutions, and the whole notion of equity is really designed to fund growth. This equity is just plugging holes. It's not funding any growth. And as a result, there's less and less lending available. And that means that there's more and more strain on businesses, and more and more strain on the consumer."

Once again, Whitney is not directly answering the question, but she's sending the message that there's much worse to come.

The appearance of a panicked sale was described earlier in the day by CNBC reporter Charlie Gasparino, who said the following about the Merrill Lynch deal:

But what was going on, and what has been going on recently, not just Monday, is growing trepidation among institutional clients about this continued drip of bad news. You put both of those things together, and from what I understand, sometime late last week, they just decided, let's pull the trigger.

They had this hedge fund, this Lone Star fund, willing to do the deal. They thought, OK, this is not the best deal -- this is heavily financed, there's a lot of bells and whistles to this, but we have the firm that's ready to do it, we could be the first out of the box.

I think one of the things that Merrill was worried about - was that if they weren't first out of the box, if they have to compete for selling this stuff with maybe a Lehman Brothers or a Citi, which holds similar assets, they wouldn't get as good a deal.

So they decided -- and from what I understand they worked the entire weekend -- to pull the trigger, and they got it done."

|

There are a couple of interesting things about this statement.

The first is that it indicates that panicked selling was in play. Panicked selling occurs when people sell as quickly as possible, because they fear that prices are going to go even lower. That's what happens in a stock market crash, and Gasparino is describing it here in Merrill's case.

The second issue is one that nobody ever seems to mention these days (except of course for me on this web site).

Question: What's missing from the reasons reported by Gasparino for wanting to get the writedown out of the way?

Answer: What's missing is the reason that they should have written down these assets right away because it's the honest thing to do.

For those who aren't aware of it, banks are required to "mark to market" their assets, so that there assets are always valuated at the best possible price. There's no market for the CDOs, but there have been enough writedowns in the last few months so that it should be possible to determine that substantial writedowns must occur. Not doing so is fraud, because investors in the bank are fooled into thinking that the bank is worth more than it actually is worth. But let's face it. Fraud is OK these days because everybody is doing it, and because government officials are actively encouraging banks to do it.

|

What did John Thain know, and when did he know it?

That's the question being asked by a lot of bloggers this week, referring to John Thain, the CEO of Merrill Lynch.

There have been a lot of writedowns, as the adjoining diagram shows. Each time a writedown occurs, there's a big announcement, and a promise that there won't be any more.

Here's how the EconomPicData blog describes the situation:

|

On the other hand, there's a Reuters article that says that Thain's credibility survives:

So far, though, investors seem to be cutting him a fair amount of slack. In fact on Tuesday after John Thain's latest about-face, Merrill's shares rose 7.9 percent.

But patience for the former Goldman Sachs and NYSE executive's flip flops may wear thin, critics said.

"This may be the last time, or you could see more writedowns. You just don't know," said Jim Huguet, co-chief executive at fund manager Great Companies.

Merrill Lynch said on Monday it was raising $8.5 billion capital after agreeing to sell toxic debt assets at a loss.

The share sale comes less than two weeks after Thain said on a conference call with investors, "Right now, we believe we are in a very comfortable spot in terms of our capital."

Thain has been making positive statements about the bank's capital for months. In an April interview with Japan's Nihon Keizai Shimbun, Thain said, "The goal is to maintain our current ratings. No more capital raising; I'm sure we have enough capital."

I really have to laugh at this. How many flip-flops does a CEO have to make before his credibility "wears thin" enough to be un-credible?

If Thain or any of these CEOs at least made a gesture to their fiduciary, ethical and legal duties, by saying something like, "We wrote down these assets for many reasons, one of which is that we owe our investors and the public the truth" -- if one of them ever said something like that, I'd be so shocked, I might actually believe him.

But these guys are exhibiting no ethics whatsoever. If they ever tell the truth, it's because they have no choice or because they're trapped or because they accidentally stumble into it.

For a lengthier discussion of (lack of) ethics, read, "'Operation Malicious Mortgage' indicts 406 people including Bear Stearns execs."

(31-Jul-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

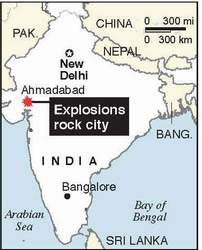

Relations between India and Pakistan are coming under increased strain after terrorist bomb attacks in cities in India on Friday and Saturday.

|

46 people were killed in the two attacks. The southern city of Bangalore, a major Indian information technology (IT) hub was struck on Friday.

On Saturday the city of Ahmedabad, near the Pakistan border, was struck by an extremely sophisticated series of 17 synchronized bombs. The first group of bombs exploded in a crowded marketplace, and the second group exploded half an hour later at the crowded emergency rooms of two nearby hospitals.

A little known group calling itself "Indian Mujahideen" has claimed credit for the Ahmedabad bombings.

Although Indian Mujahideen is not a known terrorist group, it's thought to be linked to one or all of the following:

Many Indian analysts suspect the hand of Pakistani groups in these and other terrorist bombings in India, and possibly even Pakistan's government itself. According to one analyst, "The way in which the attack in Ahmedabad took place – the multiplicity of the bombs and the way in which they were coordinated – suggests a level of expertise not yet associated with any Indian group. It is reasonable to say this group has benefited from external involvement."

In fact, there's a kind of "attitudinal imbalance" on the Kashmir/Jammu issue between Pakistan and India; namely, India is satisfied with the status quo, and Pakistan isn't.

|

Kashmir+Jammu (K+J) is an overwhelmingly Muslim area, but has been disputed by both Pakistan and India since Partition occurred in 1947. At that time, the Indian subcontinent was partitioned into two nations, India and Pakistan, but Partition led immediately to a massively bloody genocidal crisis war between Muslims and Hindus. K+J itself was partitioned by a boundary known as the "Line of Control," but the status was never settled.

In the years after Partition, it was the objective of both countries to gain control of all of K+J. The Pakistanis claimed that it should be Pakistani because the population was mostly Muslim, while the Indians claimed it should be Indian for historical reasons.

The 1971 war between India and Pakistan changed things somewhat.

(Aside: Prior to 1971, Bangladesh was part of Pakistan, and was known as East Pakistan. As a British colony, it was known as Bengal. The 1947 Partition also partitioned Bengal into (and here it's a bit confusing) West Bengal, which became the easternmost part of India, and East Bengal, which became East Pakistan.

The 1971 Pakistan-India was a non-crisis war in the east, between Pakistan and India, but Bengal was always on a different generational timeline, and the 1971 war was a generational crisis war for that region. One consequence was that East Pakistan broke away from Pakistan and became Bangladesh.)

Part of the agreement that ended the 1971 war was that the Line of Control would become a permanent international boundary, according to D. Suba Chandran in The Future of Kashmir. In the aftermath, that was satisfactory to India, but not to Pakistan, which insisted that the J+M people should determine control of the entire regions.

Things came to a head in May 1998 with the Kargil conflict, which was launched by Pakistan to gain some territory. (Kargil is a district within Kashmir.) An additional objective was to "internationalize" the conflict, gaining international sympathy for Pakistan's desire for a vote by the K+J people. The result was a humiliating defeat for Pakistan.

The Kargil conflict was launched just after Pakistan and India had signed, in February 1998, the Lahore Declaration, a peace agreement that provided a framework for resolving the K+J disputes. The agreement turned out to be meaningless, and so one byproduct of the Kargil conflict was that Indians are immediately suspicious of Pakistani involvement in any terrorist act. This suspicion usually focuses on Pakistan's Inter-Services Intelligence (ISI) agency.

The suspicion applies to Afghanistan as well. Earlier this month, a suicide bomber drove a car into crowds of people outside the Indian embassy in Kabul. Afghan president Hamid Karzai said that "outsiders" wanted to "damage good relations between Afghanistan and India." There is no doubt that he was referring to Pakistan's ISI. Pakistan has denied the charges, but Karzai canceled a series of planned meetings with Pakistan whose purpose had been to reduce tension.

Almost all contemporary analyses of the relationship between Pakistan and India refer to it mainly as a conflict between Muslims versus Hindus.

Actually, the truth is quite different, as I've discovered doing this research. In fact, it's much more accurate to say that it's Sunni Muslims versus Hindus and Shia Muslims.

Pakistan claims the entire K+J region, and points out that the partitioning of Kashmir supposed to be temporary, and that the UN Security Council mandated an election in 1951 to permit Kashmiri self-determination. That election has never been held.

What is becoming increasingly significant, as illustrated by the latest wave of bombings in India, is that the various Muslim groups dissatisfied with the status quo in Kashmir are increasingly linking up and working with one another.

For years, the conflict in Kashmir has been a proxy for the larger conflict between Pakistan and India (i.e., between Muslims and Hindus). However, it's increasingly the case that militant Taliban terrorists now see the war in Afghanistan as an even more effective proxy for the Pak-Indian conflict, with the additional advantage of involving the United States and NATO. This became most apparent on July 7 when a car bomb exploded in front of the Indian embassy in Kabul, killing dozens.

When we talk about the Pak-Indian conflict as being between Muslims and Hindus, that's not the whole story. The Taliban, al-Qaeda, and the various terrorist organizations (SIMI, Lashkar, JuNI) are all Sunni terrorist organizations.

There's a "politically correct" tendency at this point in a generational Crisis era to assume that ethnic and religious differences really don't matter the way they used to. Thus, Palestinians and Israelis could live side by side in two states in the Mideast; the English and the French really can live together in a European Union; and Sunni and Shia Muslims are just two sides of the same Muslim coin.

Sometimes this belief leads to total craziness, as when Iranian leader Mahmoud Ahmadinejad, whose Shia Muslim beliefs are deep and mystical, arranges to give money to terrorist Sunni organizations like Hamas. His fantasy is that one day Iran will have hegemony over all Muslims, Sunni and Shia, throughout the Mideast - a concept as bizarre as Napoleon's belief that he could have ruled all of Europe, or Hitler's belief that he could have ruled the world.

If you're trying to figure out what's going on in the world, you're much more likely to be right if you assume that Sunni/Shia hatred runs very deep, and that Sunni/Hindu hatred also runs very deep. And when leaders of Sunni terrorist groups like al-Qaeda and the Taliban refer to "infidels," they aren't just talking about Christians and Jews -- they're also talking about Shiites, whom they consider to be "not Muslim."

(As an aside, Iraq has been an exception, as I've described many times. Sunni/Shia differences in Iraq run deep, but in their last two crisis wars, the Great Iraqi Revolution of 1920 and the Iran/Iraq war of the 1980s, Iraqi nationalism united the Iraqis, trumping the Sunni/Shia differences.)

Sunni/Shia differences do run very deep in Pakistan and Afghanistan, despite attempts by politically correct political leaders to pretend that they don't exist. A bizarre example of this is the assassination of Benazir Bhutto. When I was trying to analyze the consequences of the assassination right after it happened, I read dozens of news articles, and I don't recall that a single one mentioned that Bhutto came from a well-known Shia Muslim family, which she did.

The Sunni terrorist group Tehrik-e-Taliban Pakistan (TTP or Taliban Movement of Pakistan), has taken credit for the assassination of Bhutto. There may be many reasons why TTP wanted to assassinate Bhutto -- her links with the West are always given as a major reason -- but Sunni hatred for Shias is certainly at the top of the list.

Shia militancy began to increase following Iran's Islamic Revolution in 1979, and this led to the creation of Sipah-e-Sahaba Pakistan (SSP), an anti-Shia Sunni terrorist group. That gave rise to Sipah-e-Muhammad Pakistan (SMP), a Shia terrorist group.

People with memories may recall than when the Afghanistan war began after 9/11, it was a battle between the Taliban and the Northern Alliance. For a lot of people (including me), it wasn't clear what either of these groups were, except that the Taliban was harboring Osama bin Laden and al-Qaeda terrorists.

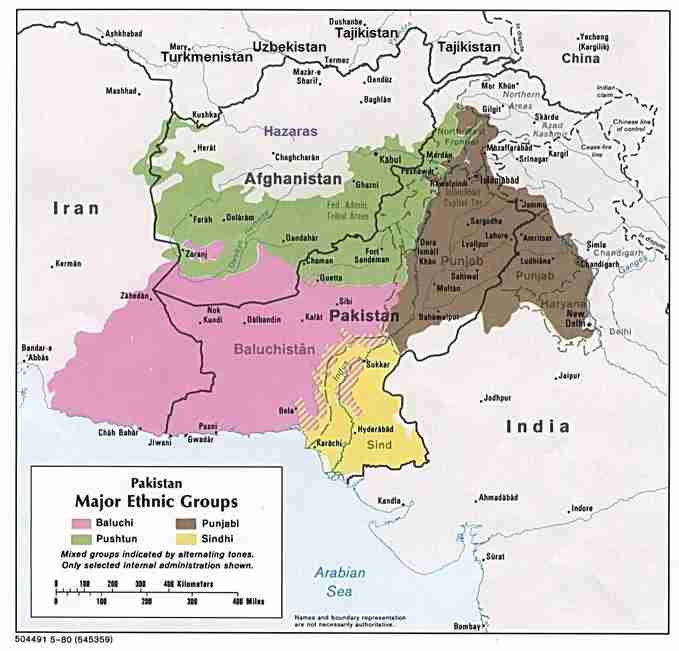

It's now possible to clarify the nature of these groups, starting with the following map, which I've modified from a map at columbia.edu:

|

Let's touch on a few features of the above map:

|

Recall that the Soviets invaded Afghanistan in the 1980s. That war was largely fought by the Soviets versus the Pashtuns, with the US supporting the Pashtuns against the Soviets. At that time, Turmenistan, Uzbekistan and Tajikistan did not exist, but were part of the Soviet Union.

|

After the collapse of the Soviet Union in 1991, the ethnic groups in Afghanistan realigned. In the massive, bloody Afghan civil war that followed from 1992 to 1996, many Uzbek and Tajik fighters continued with the Northern Alliance, but many Sunnis joined up with the Pashtuns and the Taliban. The Taliban ruled Afghanistan until 9/11, when the Afghan war began and the Taliban were defeated.

Today, the Pakistan FATA region has to be considered the terrorism center of the world, thanks to the safe haven provided to Taliban and al-Qaeda terrorists.

The FATA region provides for terrorist training camps for terrorists who act within both Afghanistan and Pakistan. The "al-Qaeda" name has become a brand name for young al-Qaeda terrorists around the world from southeast Asia through the Mideast to northern Africa.

When we talk about the conflict between Pakistan and India, we usually refer to it as Muslim versus Hindu (and Sikh). Actually, it's Sunni Muslim versus Hindu (and Sikh).

Hindus have a long historical relationship with Shia Muslims and, in fact, some histories show that a large Hindu family fought with the Persian Shias versus the Sunnis in the seminal battle of Karbala that created the Sunni/Shia split in 680 AD.

India sided with the Soviets in the 1980s Afghan war, with the result that India lost all influence in Afghanistan when the Taliban took over in 1996. However, after 9/11 and the defeat of the Taliban, India has worked hard to regain influence in Afghanistan, providing more than $500 million in assistance to Afghanistan.

For India, Afghanistan is an important strategic relationship, since it provides a link to the Shia Muslim community and Iran. In particular, India and Iran are proposing to build an the Iran–Pakistan–India (IPI) gas pipeline, although the US considers this proposal to be a security risk to US interests.

For Pakistan, India's increasing involvement in Afghanistan is somewhat threatening. Pakistan increasingly feels surrounded by its former (and future) enemy, India. Relations between the Afghan and Pakistan governments are becoming increasingly hostile. India and Afghanistan are blaming numerous terrorist attacks in their countries on Pakistan's Inter-Services Intelligence (ISI) agency.

For its part, Pakistan is accusing India's Research and Analysis Wing (RAW) and Israel’s Mossad of working together to plan terrorist attacks within Pakistan. (To make clear what we're talking about, ISI, RAW and Mossad are all intelligence agencies, like the CIA in America, or Britain's MI5.)

In a previous article, I promised to do a complete analysis of the Afghan war. With this article, we're about 2/3 of the way there.

What we see is a "gathering storm" of increasing tension and conflict in the entire region.

Basically, the Sunni terrorists (Taliban and al-Qaeda) are succeeding. They see the 1979 Iranian Shia Islamic Revolution as a model for achieving a Sunni Sharia state in Pakistan by precipitating a massive war (revolution).

Ironically, the success of the American forces in driving al-Qaeda in Iraq out of Iraq has made Afghanistan and Pakistan far more dangerous than they were. Thanks to the Anbar Awakening in Iraq, al-Qaeda had no safe haven, and was eventually driven out by Iraq's own Sunnis.

This has caused a strategy change for al-Qaeda. The safe havens in Pakistan's FATA give al-Qaeda the perfect home from which to pursue their objectives.

One result is that foreign fighters -- Sunni terrorists from Arab countries and North Africa -- have been traveling to FATA and Afghanistan to fight the jihad. This is making al-Qaeda a much more powerful fighting force, and they're becoming far more successful than they ever were in Iraq.

Kashmir has been relatively calm since a peace agreement was signed in 2003, but violence has increased in recent weeks, and a news report on Wednesday indicates that there is currently "heavy fighting" along the Line of Control in Kashmir.

Then in December, the assassination of Benazir Bhutto has had a chain reaction effect that's left Pakistan's government completely paralyzed and rudderless, unable to cope with the country's substantial problems.

(I had a chuckle at a BBC news report yesterday that said that Washington can't figure out how the new government works. That's very funny, because neither can the Pakistanis.)

The most plausible scenario for a major war in this region is one that begins with a Sunni vs Shia ethnic fighting within Pakistan itself. With Pakistan and India in a generational Crisis era, such fighting would quickly spread into a civil war and then an international war -- and then a nuclear war, as both Pakistan and India are nuclear powers.

Paradoxically, such a war would NOT spread in a meaningful way to Afghanistan itself, because Afghanistan's last crisis war was recent -- the 1992-96 civil war. Afghanistan is in a generational Recovery era, and it's impossible for any Crisis war to start during a Recovery era. If any war begins, it will fizzle before long.

However, Afghanistan's immunity to a crisis war wouldn't make much

difference. The United States and Russia would be quickly drawn into

such a regional fight, on the side of India, and China and Bangladesh

would be drawn in on the side of Pakistan.

(30-Jul-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Saying that soaring US mortgage defaults require preparing for a "worst case scenario," the Melbourne-based National Australia Bank (NAB) Ltd., set aside A$830 million (US$795 million) for credit market losses. This followed a decision to write down its CDO portfolio, nominally valued at A$1.2 billion (US$1.15 billion), by 90%, to 10% of its nominal value.

(For those interested in the math behind the creation of CDOs from CDSs, see "A primer on financial engineering and structured finance." For a discussion of credit default swap (CDS) counterparty risk, see "Brilliant Nobel Prize winners in Economics blame credit bubble on 'the news.'")

An analysis by Credit Suisse indicates that other Australian banks may now be required to make similar writedowns of their US mortgage-based assets.

This NAB action has the potential to be extremely significant.

This appears to be the next step in the scenario predicted by Oppenheimer analyst Meredith Whitney.

Speaking on CNBC, Whitney said that banks are trying to avoid having to write down their assets for as long as they can avoid it. But the longer they wait, the worse it is, because the mortgage-backed assets keep falling as time goes on.

Whitney went much farther -- she predicted a full-scale panic when banks finally are forced to mark these assets down. Because the market will be loaded down with these securities from all sorts of financial institutions, they really will be almost worthless.

The NAB writedown of 90% establishes a market value for the CDOs in its portfolio. Other Australian banks may be forced to make similar writedowns, through either public or regulatory pressure. That same public or regulatory pressure may move to other countries, including America, and force American banks to start making more aggressive writedowns of their near-worthless mortgage-based assets. This could create a domino effect which, over a period of weeks, might trigger the panic that Whitney predicted.

I've estimated that the probability of a major financial crisis (generational stock market panic and

crash) in any given week from now on is about 3%. The probability of

a crisis some time in the next 52 weeks is 75%, according to this

estimate.

(28-Jul-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Obama is hurting himself by bobbing and weaving on the success of the "surge."

Some people have been accusing me of an "ideology" biased in support of John McCain for President. So let me make clear that I do not support either McCain or Barack Obama. My only "ideology" is the one that has appeared on the home page of this web site for six years: I am "pro-American."

I've taken no position on health care policy, immigration policy, economic policy, trade policy, the New Yorker, or other "hot" political issues. Most of what politicians of either party say on these issues is fatuous political nonsense, and rarely even makes sense, so I leave it to others to reach monumental conclusions.

My concern on this web site is the survival of the United States in the coming financial crisis and "Clash of Civilizations" world war. To that end, I expect American politicians to support America's interests.

So in the 2004 presidential campaign, I thought it was outrageous that John Kerry refused to repudiate his 1971 testimony to Congress, in which he essentially accused the American armed forces in Vietnam of being the equivalent of Nazi storm troopers, committing atrocities and war crimes on a day to day basis, with the full awareness of officers at all levels of command.

I was (and am) absolutely infuriated by those views, and I stated at the time that unless he repudiates those views, then he's not qualified to be President. How can the President lead America's war against terror if he believes that the American soldiers are worse than the terrorists?

Kerry has repeatedly whined that he was "swift-boated," referring to political ads criticizing his actions while serving in Vietnam. He claimed that the accusations were false, but what he never understood, and still doesn't understand, is that the accusations were credible because he refused to repudiate his 1971 testimony. In fact, in 2006, Kerry finally reaffirmed his belief that American soldiers in Vietnam were just a bunch of torturers, rapists and murderers. Let us all be grateful that this man never became President, and I'm still ashamed that a man with those beliefs represents my state of Massachusetts in the Senate.

The point I'm making here is that Kerry shot himself in the foot by refusing to repudiate his 1971 testimony, and now Obama is doing the same by refusing to repudiate his earlier comments about the "surge" in Iraq.

There are evidently many, many other people who feel the same way. On Meet the Press on Sunday morning, where the entire show was devoted to an interview with Obama, he bobbed and weaved about his attitudes about the "surge" under questioning by Tom Brokaw.

Here's a brief excerpt from the transcript:

SEN. OBAMA: You know, we don't know, because in my earlier statements--I mean, I know that there's that little snippet that you ran, but there were also statements made during the course of this debate in which I said there's no doubt that additional U.S. troops could temporarily quell the violence. But unless we saw an underlying change in the politics of the country, unless Sunni, Shia, Kurd made different decisions, then we were going to have a civil war and we could not stop a civil war simply with more troops. Now, I, I..."

It went on in this vein for several more questions.

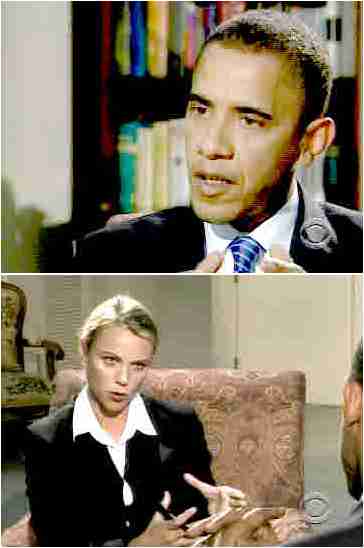

During this portion of the interview, there were several screens displayed that showed how lacking in credibility Obama is:

|

What all of this shows is that Obama, who is doing so well on other issues, is hurting himself badly on the issues surrounding his Iraq policy.

In fact, Democrats have almost no credibility on Iraq. It's worth remembering that John Kerry's position on the Iraq war in 2004 was almost identical to George Bush's. The Democrats supported the war in 2002 and 2003, when it was popular to do so, they started equivocating in 2004 when they weren't sure what would be popular, they opposed the war in 2006 and 2007 when it was popular to do so. And now, after taking the politically expedient position at every time in the last six years, now that the "surge" has succeeded, Obama is claiming that he was right all along.

Let's excerpt another part of Obama's interview:

We should note in passing that Obama is not making the same mistake that Kerry made in saying that American soldiers are no better than a bunch of torturers, rapists and murderers. He makes a point of expressing his pride in America's soldiers every chance he gets.

However, the second part of his answer is an insult to everyone's intelligence, since he's implying that the Anbar Awakening was part of his calculation when he opposed the "surge." I don't think anyone doubts that he was making a politically expedient decision at the time.

In fact, at some level I find this response to be personally insulting. In my 2003 article, "Terrorist suicide bombings in Iraq may backfire against terrorists," I wrote that Iraq was in a generational Awakening era, and that "During an awakening period, terrorist acts cause masses of people to shrink from more violence." I said that, "The massive bombings of the United Headquarters headquarters, oil pipelines, and the Jordanian embassy may backfire against the terrorists by causing the population, currently going through an awakening period, to turn against the terrorists."

If you go back and read that article, you'll find that I was absolutely right about what was going to happen in Iraq. I repeated those predictions many times after 2003, even at times when they seemed a fantasy. My Iraq predictions have been completely right, over and over, and I don't know of anyone else in the world who has gotten Iraq right. And that was only one of numerous predictions that I got completely right, following the Generational Dynamics forecasting methodologies.

(See "List of major Generational Dynamics predictions" for more information about these predictions.)

When I wrote "Iraqi Sunnis are turning against al-Qaeda in Iraq,", and again with "The 'Anbar Awakening' may be good news in Iraq," I was describing exactly this phenomenon. The Anbar Awakening, which even used the generational word "Awakening," was the fulfillment of exactly what I predicted in 2003.

But the Democrats had no idea of this when they were voting on the "surge." Here are some of the things that I wrote about at the time:

For example, Silvestre Reyes, a 5-term Democratic Congressman, who had been on the House Intelligence Committee for five years, and was about to become its Chairman, when asked whether al-Qaeda was a Sunni or Shiite organization, said, "Predominantly — probably Shiite." This was a leading Congressional expert, and yet could not possibly have had a single clue about the Anbar Awakening.

So we can be pretty sure that Senator Reid didn't know anything about the Anbar Awakening when he stated his opinions about the "surge."

I wrote many articles on this subject at the time, giving many more examples of this type of stuff. And I said many times that it's an absolute disgrace that these congressmen, as well as many other politicians and journalists and analysts -- and web sites like http://moveon.org and http://dailykos.com -- have committed their careers and credibility to America's defeat and humiliation in Iraq. These people were openly aiding and abetting the enemy, in a manner that was close to being treasonous.

So now, here comes Senator Obama, saying that he was right all along because of the Anbar Awakening. He must think that I and a lot of other people were born yesterday to believe that crap.

As I've said many times, the coming financial and war crises will be coming irrespective of who is President. Nobody can predict which of McCain or Obama would be better able to ensure America's survival during these crises. McCain would be steadier and Obama would be likely to overreact, but even that observation doesn't indicate who would be the better President. From the point of view of Generational Dynamics, the choice of President has no PREDICTABLE effect on the outcome of the financial crisis or the Clash of Civilizations world war, and so I personally do not have any preference.

Based on the polls and what I've seen so far in the campaign, Senator Obama has a very good chance of winning the Presidential election. But if he loses, it will probably be because of his handling of the Iraq issue.

In the screen shots of Sunday's Meet the Press above, there's a quote from a USA Today editorial asking these questions: "Why ... can't Obama bring himself to acknowledge the surge worked better than he and other skeptics ... thought it would? What does that stubbornness say about the kind of president he'd be?"

That's exactly the question I'm asking.

(27-Jul-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Obama enthralls huge German audience with a history-making speech.

Europeans have little credibility these days, as was really apparent in the bizarre aftermath to the Irish vote against the Treaty of Lisbon. Europeans like to sit in their easy chairs, enjoy their 35-hour work week, complain about the "Anglo-Saxon model," make pompous statements about "global warming" but do nothing about it, and make pompous statements about the wars in Iraq and Afghanistan, but never live up to their own commitments.

The best way to get Europeans excited is to say something anti-American. Europeans hated George Bush from the day he took office, as they mocked his Western accent and cowboy hat. Not surprisingly, they hate anything that Bush stands for, even if they love the same quality in Barack Obama.

It's worthwhile remembering all this, if you want to understand the European reaction to Barack Obama's speech in Berlin on Thursday.

|

Why do the Europeans love Obama? The German newspaper Bild.de tries to explain (English version here):

Obama's speech in front of Berlin's Sieges Saule ('victory column') memorial in the Tiergarten park has been was greatly anticipated by Germans who see a hopeful future in the charismatic candidate, not only for the US but for the whole world. But why are so many Germans excited about the American Senator from Illinois? BILD breaks down the reasons for Germany's 'Obamania':

He's young! ...

He's multicultural and modest! ...

He doesn't just talk, he preaches! ...

He stands for freedom!

Within 16 months, Obama wants to withdraw the US troops in Iraq, a total of 4,125 soldiers. He wants to meet with the mullahs in Tehran and close Guantánamo Bay. In short, he hopes to make the world a better place. American publicist Roger Cohen said: "Europeans see Obama as the good American."

He's not Bush! ...

Bush in Germany is considered by many as a warlord, Obama stands for diplomacy."

This is what the Germans want to believe about Obama.

So here's a portion of Obama's speech:

Will we acknowledge that there is no more powerful example than the one each of our nations projects to the world? Will we reject torture and stand for the rule of law? Will we welcome immigrants from different lands, and shun discrimination against those who don't look like us or worship like we do, and keep the promise of equality and opportunity for all of our people?

People of Berlin - people of the world - this is our moment. This is our time."

Guess what got the wildest applause? It was the anti-American sentence, "Will we reject torture and stand for the rule of law?" No surprise there.

Here's another portion of the speech:

This is the moment when we must renew our resolve to rout the terrorists who threaten our security in Afghanistan, and the traffickers who sell drugs on your streets. No one welcomes war. I recognize the enormous difficulties in Afghanistan. But my country and yours have a stake in seeing that NATO's first mission beyond Europe's borders is a success. For the people of Afghanistan, and for our shared security, the work must be done. America cannot do this alone. The Afghan people need our troops and your troops; our support and your support to defeat the Taliban and al Qaeda, to develop their economy, and to help them rebuild their nation. We have too much at stake to turn back now.

This is the moment when we must renew the goal of a world without nuclear weapons. The two superpowers that faced each other across the wall of this city came too close too often to destroying all we have built and all that we love. With that wall gone, we need not stand idly by and watch the further spread of the deadly atom. It is time to secure all loose nuclear materials; to stop the spread of nuclear weapons; and to reduce the arsenals from another era. This is the moment to begin the work of seeking the peace of a world without nuclear weapons."

This is NOT the message that the Germans wanted to hear, so there was little or no applause.

The fight in Afghanistan is supposed to be a NATO fight. That means that the Europeans should be participating. The Europeans do have small contingents of troops in Afghanistan, but they're forbidden from fighting. They teach schools and build roads and plant gardens, but they don't fight the terrorists. That work is left to the Americans, the British and the Canadians.

So Obama is chiding the Europeans for not wanting to fight the war on terrorism in Afghanistan. He points out, indirectly, that al-Qaeda in Afghanistan was responsible for the subway bombings in London and Madrid, for the massive terrorist bombings in Indonesia and Lebanon, and for the terrorist acts of 9/11. He's telling the Europeans that they aren't doing their part, and until that happens, the terrorist acts on their own cities are going to continue.

But the Europeans don't want to hear that. They don't want to hear anything that implies a commitment on their part. They don't want anything except to join in the whining about America and about George Bush, the warlord.

The Europeans certainly don't hear that Obama is turning into quite a warlord himself. He's been talking about a much larger commitment to the war in Afghanistan, as I wrote last week in "Barack Obama endorses growing American troop force in Afghanistan."

And when he says that it's necessary "to stop the spread of nuclear weapons," he's talking about Iran. In an earlier speech in Israel, Obama made it clear that President Obama would not tolerate nuclear weapons in Iran. But that's not what the Europeans want to hear.

I'm now going to make a comparison now to Hitler, but I'm MOST EMPHATICALLY NOT comparing Obama to Hitler. The comparison I'm making is the reaction of the German people to Hitler, as compared to the reaction of the German people to Obama.

Here's a quote from a speech that Hitler gave in 1939:

One can imagine the cheers that Hitler received when he gave this speech. Did those cheering people even know what they were cheering at?

It's been one of the greatest enigmas of the last 65 years, how the people of Germany could have voted for Hitler and cheered all his speeches, knowing what he stood for. How was that possible?

We get a glimpse of it here, as we see Germans cheering wildly for a Barack Obama that doesn't really exist, except in their minds. They must have thought that Hitler was going to save the world, and now they think that Obama is going to save the world.

But I'm unfair picking on the Germans. The Americans seem almost as

crazed about the great Obama in the sky as the Germans are. The

journalists can barely contain their enthusiasm. After Obama's

Berlin speech, CNN's lovely smitten anchor Kyra Philips could barely

contain her joy and enthusiasm, as she used the phrase "powerful

speech" about five times. I wonder if she even knew what the speech

was about? Or is she just happy that he isn't George Bush?

(25-Jul-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

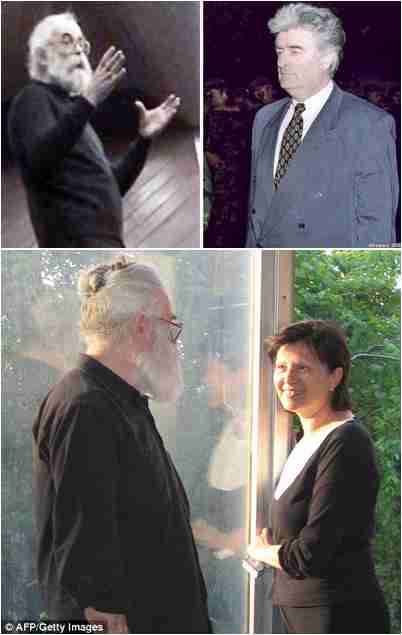

Hiding in plain sight, he grew a beard and posed as a new age guru with a mistress.

|

Radovan Karadzic, the military commander responsible thousands of deaths and numerous atrocities in the 1990s war in Bosnia, was captured on Monday near Belgrade, in Serbia.

Karadzic, an Orthodox Christian Serb, is considered a war hero by most Serbs for his military accomplishments in the war against Bosnian Muslims in 1992-95. But for most of the Western world, he's considered a war criminal, and has been indicted by a UN war crimes tribunal on charges of genocide and crimes against humanity.

After the war ended, Karadzic went into hiding, where he was given protection by those in the Serb population who knew who he was. During the 13-year manhunt for Karadzic, he was thought to hiding out in a farm somewhere where in Serbia where few would recognize him.

As it turns out, the bloodthirsty murderer had changed professions and become a new age health guru, taking the assumed name Dr. Dragan Dabic, and disguising himself with a long, grey beard and glasses. He lived for years in a Belgrade suburb with his mistress Mila, and frequently hung out with her in Madhouse bar, sitting unrecognized underneath a large wall picture of himself from his war days.

The Bosnian War was a 1990s re-fighting of World War I, along the same Orthodox/Muslim religious fault line.

Historically, there is no greater hatred between two civilizations than between Islam and Orthodox (Eastern) Christianity. There have been major wars between Western Christianity and Orthodox Christianity, and between Sunni and Shia Muslims, but not as deeply penetrating as the wars between Orthodox Christianity and Islam.

From the point of view of Generational Dynamics, East Europe and West Europe are on different generational timelines.

World War II was a generational Crisis war for Western Europe, with England, France and Germany being the main protagonists.

For Eastern Europe, World War I was the Crisis war, and the Balkans (the former Yugoslavia), Russia, Turkey (the Ottoman Empire) and the Mideast were the main protagonists. England, France and Germany were involved in WW I, but not as a crisis war.

(For information about generational Crisis wars, and the differences between World Wars I and II, see "Basics of Generational Dynamics.")

For the most part, the East European crisis wars have been between two great civilizations: The Orthodox Christian civilization and the Muslim civilization. These wars have been fought not only in the Balkans, but also farther east in the Crimea and in the Caucasus.

World War I was triggered when a Serb high school student assassinated Austrian Archduke Franz Ferdinand on June 28, 1914 in Sarajevo. The spreading war led to the Bolshevik Revolution in Russia, and the destruction of the Ottoman Empire.

From the point of view of Generational Dynamics, the next Balkans war began pretty much right on time -- in 1992, just 78 years after the assassination of Archduke Ferdinand.

|

The Siege of Sarajevo was directed by Serbian president Slobodan Milosevic, and was executed by his two generals, Ratko Mladic and Radovan Karadzic.

The Orthodox Christian Serbs completely blockaded the city of Sarajevo, allowing no one to get out, or any supplies to get in. They then shelled the Muslim civilians in the city, and Serb soldiers went from one neighborhood to another committing horrendous atrocities.

In her book, World on Fire, here's how author Amy Chua describes the Bosnian war: "In the Serbian concentration camps of the early 1990s, the women prisoners were raped over and over, many times a day, often with broken bottles, often together with their daughters. The men, if they were lucky, were beaten to death as their Serbian guards sang national anthems; if they were not so fortunate, they were castrated or, at gunpoint, forced to castrate their fellow prisoners, sometimes with their own teeth. In all, thousands were tortured and executed."

The Bosnian War climaxed when tens of thousands of Bosnian Muslims had taken refuge in the Bosnian town of Srebrenica, supposedly a "United Nations Safe Area." The Serbs massacred thousands of Muslim men in what has become known as the Srebrenica massacre. (See "Srebrenica massacre: Survivors commemorate."

|

Since the end of the war in 1995, Milosevic, Mladic and Karadzic have all been charged with ethnic cleansing, genocide, crimes against humanity, and war crimes.

Former Serb President Slobodan Milosovec was the first to be brought to trial. The trial was never completed, as he was found dead in his cell in March, 2006.

The capture of Radovan Karadzic brings another manhunt to a close, but the search is still on for the remaining general, Ratko Mladic.

There are all kinds of ironies going on in this situation.

The Bosnian War genocide occurred in the same general time frame as the Rwanda genocide of 1994. United Nations officials have repeatedly held commemorations and ceremonies, declaring "Never again will we allow this to happen." But they always do.

In fact, the Bosnian War was only the most recent of a regular series of East European / Mideast crisis wars between the Orthodox and Muslim civilizations. Karadzic himself has said that he was avenging 1389, referring to the Battle of Kosovo that ended in 1389. Since then, new wars along the same fault lines have recurred with relentless regularity: the Fall of Constantinople (1453), Ottoman conquest of Syria and Egypt (1520), War with Habsburgs (1606), War with Holy League (1699), War with Russia (1774), Crimean War (1856), World War I (1922).

The following map from The Independent shows the various ethnic and religious fault lines in the Balkans:

|

Most people think that wars are somehow rational, driven by greedy or obsessed politicians, inflicted on unwilling masses. If that were true, then Karadzic wouldn't be considered a war hero by masses of Serbs. Non-crisis wars are rational, but crisis wars are visceral, and are as much part of the human DNA as sex is. The human race could not have survived without sex, nor could it have survived without massive, genocidal, bloody crisis wars.

After each war, there's a vow of "Never again" among the generations of survivors. And as soon as those survivors are gone, replaced by younger generations born after the war, a new, horrible war begins again.

Here's what Telegraph reporter Martin Bell wrote yesterday, remembering the Bosnian war:

My ... thought was: this is bad, and it is bound to get worse - a modern European city under siege by weapons mainly of First World War vintage, hundreds of thousands of people at risk and the world outside hardly cares. We should have needed no history lessons concerning the repercussions of a first shot fired in anger in Sarajevo.

Something else I found, as the front lines were established over that summer, was that a war like this could be a thing of spectacular beauty. It kept all hours. The Jewish cemetery, between Muslim and Serb-held parts of the city, was fought over day and night.

Parachute flares illuminated the ruins and added allure to devastation. Tracer fire rose and fell in a perfect parabola like a rain of molten hyphens. We caught it all on camera, and still no one cared.

Civilians, it seemed to me, were not just caught in the crossfire but were being deliberately targeted. There was a shortage of bread, so the snipers targeted the bread queues. There was a shortage of water, so they targeted the standpipes. ...

With the possible exception of Rwanda, it was the UN's darkest hour in modern times."

It's interesting that Bell's commentary at least mentions a connection between the Bosnian War and WW I, although he evidently considers it to be nothing more than a coincidence.

But why would it be the "UN's darkest hour in modern times?" The "killing fields of Cambodia" in the 1970s was a crisis war with some 8 million civilians killed. Why isn't that the UN's darkest hour? And of course, there's the current Darfur crisis civil war. Isn't that the UN's darkest hour in modern times?

In fact, the UN is completely irrelevant to these crisis wars. The UN could no more stop a crisis war than it could stop a tsunami.

Many of the great battles of World War I were refought in the 1980s and 1990s -- as the Iran/Iraq war, the Syria-Lebanon war, the Lebanese civil war, the Bosnian War, the Afghan war. But many other great WW I battles -- the Russian civil war, the Armenian massacre, the Mexican revolution -- have not yet been refought, and are still awaiting the right trigger.

In the meanwhile, it's getting to the time where some of the great WW II battles are due to be refought, especially Japan's invasion of Manchuria and China, and China's own Communist Revolution (civil war). Other battles of WW II might wait a few years to be refought, but with the right trigger they could begin again today.

When a war is "refought," it isn't a duplicate war. Quite the opposite, the new war appears sufficiently different that it catches the world by surprise. But when you look beneath the surface, the same old fault lines and hatreds are back. As Mark Twain said, "History doesn't repeat itself, but it does rhyme."

As we approach the "Clash of Civilizations" world war, history is

about to rhyme again. Just as the Bosnian War wasn't a duplicate of

WW I, the new world war won't be a duplicate of WW II. The UN and

its politicians are completely irrelevant to this. The coming world

war is a ten-mile-high tsunami that was launched decades and even

centuries ago, and no politicians even have a clue that it's coming,

let alone know how to stop it.

(24-Jul-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Good news: Disastrously low financial services earnings are still "better than we feared"

As regular readers know, every week or two I post the table of S&P 500 average corporate earnings estimates, based on figures from CNBC Earnings Central supplied by Thomson Reuters.

Here's the latest table for second quarter earnings:

Date 2Q Earnings estimate as of that date ------- ------------------------------------ Jan 1: +4.7% Feb 6: +3.5% Apr 1: -2.0% Jun 6: -7.3% Jun 13: -8.1% Jun 20: -9.0% Jun 27: -11.3% Jul 3: -12.4% Jul 8: -13.0% Jul 11: -14.7% Jul 18: -17.1%

Once again, earnings have taken a very big hit; during the last week, earnings growth estimates went from -14.7% to -17.1%.

As usual, a fall in earnings estimates means an increase of price/earnings ratios estimates. Here's the latest version of the graphic that appears on the bottom of the home page of this web site. Here's last Friday's version:

|

Price/earnings ratios are maintaining a stratospheric level of 21 or 22, far above the already extremely high level of 18 that investors have been targeting for the preceding four years. Assuming that investors continue to follow the same formulas that they've been following, market indexes will have to fall another 15% to bring P/E ratios down to 18.

|

However, that didn't happen on Tuesday or Wednesday. We said last week that the short-term direction of the market would probably depend on the actual earnings for financial services firms.

Well, those earnings have been pouring in, and they're absolutely devastating -- often -40% or -50% compared to second quarter of last year.

But guess what? Investors had been expecting -60% or -70%, and so the actual earnings are better than expectations!! So investors have concluded that the worst is over, and that it's time for the stock market bubble to start growing again!

Listening to the babble on CNBC, all I can do is repeat my usual total astonishment at the stupidity and obliviousness of the analysts, journalists, investors and politicians.

I'm not the only one who's noticing it this time. The Financial Times blog notes: "Five of the largest US financial institutions, led by Wachovia and Washington Mutual, reported combined quarterly losses of more than $11bn but their shares jumped an average of 14% on rising hopes that bank stocks have fallen about as low as they can go."

In fact, here's an article from Wednesday's New York Times that would be absolutely hilarious if it weren't describing a disaster:

After the last week brought another round of woeful quarterly results from the industry, capped by news on Tuesday of multibillion-dollar losses at the Wachovia Corporation and Washington Mutual, that question is nagging banking executives and their investors.

Kenneth D. Lewis, the chief executive of Bank of America, insisted this week that the industry was turning the corner, after his company reported a mere 41 percent drop in profit. Many investors seem to see signs of hope in red ink that once would have shocked them.

But it has now been a year since the credit crisis erupted, and, so far, the optimists have been proven wrong time and again. Skeptics say it could take years for banks to recover from the worst financial crisis since the Depression. And even when things do improve, the pessimists maintain, banks’ profits will be a fraction of what they were before.

There are many reasons for caution. Home prices continue to decline, and defaults are accelerating on a wide range of loans. As lenders struggle, loans are becoming even more scarce for hard-pressed consumers and companies. That, in turn, could slow any recovery in the broader economy.

For now, at least, some investors seem to have become so inured to the bad news that results that would have once been viewed as disastrous are now seen as good, or even great. The sober phrase often used on Wall Street to describe solid corporate results — “better than expected” — has been replaced by “not as bad as feared.”"

Even now, after all this time has passed, there's no hint here of any understanding of the world global situation from a system point of view, or how something that occurred decades ago could be affecting us today. There's no grasp of the fact that the stock market is overpriced by a factor of over 200%, as I described in "How to compute the 'real value' of the stock market."

With these people at the New York Times or CNBC or Wall Street Journal, history always begins this morning, and 99% of the time they don't have the vaguest clue what's going on. At least the Times finally acknowledges that they've been wrong over and over again.

The Telegraph's Ambrose Evans-Pritchard, who says that the European economic situation is worse than America's, now says, "The global economy is at the point of maximum danger. It feels like the summer of 1931. The world's two biggest financial institutions [Fannie and Freddie] have had a heart attack. The global currency system is breaking down. The policy doctrines that got us into this mess are bankrupt. No world leader seems able to discern the problem, let alone forge a solution."

And we might as well throw in the fact that the super-high prices for energy and food have thrown the economies of Vietnam, Bangladesh and Pakistan and other Asian countries into a near-crisis situation.

I've estimated that the probability of a major financial crisis (generational stock market panic and

crash) in any given week from now on is about 3%. The probability of

a crisis some time in the next 52 weeks is 75%, according to this

estimate.

(23-Jul-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Treasury Secretary Henry M. Paulson Jr. is arduously pushing his bailout plan for Fannie Mae and Freddie Mac, the government sponsored entities (GSEs) that guarantee about half of the mortgages on American homes, worth some $6 trillion.

Paulson is essentially asking Congress for a "blank check" to do whatever is necessary to keep the two companies afloat. "Congress understands how important these institutions are," said Paulson.

The message is clear: Fannie and Freddie are too big to fail.

If they failed, it would be disastrous to the American mortgage marketplace, and would trigger a severe chain reaction of bank failures.

|

But there's another reason why they're too big to fail: Almost $1.5 trillion worth of Fannie and Freddie bonds are held by foreign investors. If Fannie and Freddie failed, then foreign investors would lose all faith in the credit quality of the entire US government.

As I've said for several years, it's been clear for a long time that the US government would never be able to redeem all the long-term Treasury bonds that it's issued -- something like $9 trillion dollars worth. However, last weekend's near failure of Fannie and Freddie has made that fact obvious even to normally oblivious investors.

The bailout of Fannie and Freddie would essentially mean that the $6 trillion of their debt would be added on to the US government's debt, which would now owe $15 trillion.

This is causing investors to start asking for the first time: Is America too big to fail.

An article on that subject goes into a great deal of detail to explain why it is:

Globalization, in other words, allowed China and Japan to amass the fortunes they have been lending to the United States."

The article blames globalization for the situation, and implies that it's a rather new phenomenon to be in this situation.

In fact, that's not true. As we've said many, many times, from the point of view of Generational Dynamics, if you go back through history, there are many small or regional recessions. But since the 1600s there have been only five major international financial crises: the 1637 Tulipomania bubble, the South Sea bubble of the 1710s-20s, the bankruptcy of the French monarchy in the 1789, the Panic of 1857, and the 1929 Wall Street crash.

These are called "generational crashes" because they occur every 70-80 years, just as the generation of people who lived through the last one have all disappeared, and the younger generations have resumed the same dangerous credit securitization practices that led to the previous generational crash. After each of these generational crashes, the survivors impose new rules or laws to make sure that it never happens again. As soon as those survivors are dead, the new generations ignore the rules, thinking that they're just for "old people," and a new generational crash occurs.

So there's nothing new about the current situation. What's going to happen next? We can look to the past to get an idea.

If you haven't read the fascinating story of "The bubble that broke the world," then now is a good time to do so. It's the story of what happened in 1930 and 1931, when the world's central bankers got together to save the world from financial collapse.

However, when you read that story, and compare to the situation today, remember that America was a creditor nation in 1931, but a debtor nation today. The debtor nation in 1931 was Germany, and the creditor nation today is China. Thus, we should expect China today to act like America in 1931, and America today to act like Germany in 1931.

Central bankers in Britain, the US and France got together with a plan to prevent the financial collapse of Germany by injecting huge amounts of liquidity into the European banks. It worked for a while, but not for long.

On May 11, 1931, the Credit-Anstalt bank of Austria failed. This triggered mass panic and bank failures throughout Central Europe, and generated a worldwide banking crisis. On July 13, the German Danatbank failed. Foreign investors in Germany quickly withdrew their capital from Germany, heightening the crisis, leading to the complete collapse of the German economy. By the end of the year, there were over 6 million unemployed, and the resulting social tension gave rise to Communism and Naziism.

The statement "America is too big to fail" is the first step in

repeating that process. Countries like China and Japan will realize

that America is never going to repay its debt anyway, and so they'll

cancel the debt, just as we canceled Germany's debt in 1931. But it

won't work for long. How that failure will affect America and world

remains to be seen.

(23-Jul-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The loony left ironically forces Obama to change from "anti-war" to "pro-war."

I was shocked earlier this week when CNN International gave 45 minutes of its one-hour prime newscast to Senator Barack Obama's speech to the NAACP. Senator John McCain's speech to the NAACP, arguably a more important news story, got about 30 seconds coverage. I guess I really shouldn't be surprised, after CNN practically turned the network over to the Democrats in the 2006 Congressional campaign. And now Obama is getting wall-to-wall "roadblock" coverage on all news networks on his overseas trip.

Obama has overwhelmingly one-sided news coverage. He appears to have the ability to get almost unlimited campaign funding. Almost everyone under 45 adores him, and Generation-Xers particularly love his contempt for and rejection of Boomer and Silent generation core values.

So it seems increasingly more probable that Obama will be our President next year, and increasingly more worthwhile for this web site to analyze not only how his attitudes reflect, and are affected by, public attitudes, but also how these attitudes will affect American foreign policy under an Obama presidency.

Leading Democratic party figures including Obama, disgraced themselves early in 2006 by committing themselves to America's failure and humiliation in Iraq. Obama himself specifically said that the "surge" would fail. Now that the surge has apparently been spectacularly successful, these Democrats have to face up to their positions.

As I wrote several weeks ago, Obama was attempting to "refine" his position in Iraq, but the loony left may harm him by forcing him to stick to his "immediate withdrawal" policy, which is not sustainable.

This has in fact happened, and Obama has apparently abandoned any attempt to "refine" his position on Iraq.

The thrust of the loony left in the Democratic Party might be characterized as "anti-Bush," "anti-American," and sometimes even "pro-terrorist." But the attitude was never really "anti-war," in any meaningful sense, and that's becoming increasingly apparent as Obama's policy towards Afghanistan becomes increasingly "pro-war."

This is the really ironic thing. As Obama is boxed into his "immediate withdrawal" position by the loony left, he's becoming increasingly strident and war-like in his policies toward Afghanistan.

Obama summarized his opinions in an interview with CBS foreign affairs correspondent Lara Logan in Kabul, broadcast on Sunday morning on Face the Nation:

"The Afghan government needs to do more. But we have to understand that the situation is precarious and urgent here in Afghanistan. And I believe this has to be our central focus, the central front, on our battle against terrorism."

...

"The United States has to take a regional approach to the problem. Just as we can't be myopic and focus only on Iraq, we also can't think that we can solve the security problems here in Afghanistan without engaging the Pakistan government."

Logan: "And how do you compel Pakistan to act?"

Obama: "Well, you know, I think that the U.S. government provides an awful lot of aid to Pakistan, provides a lot of military support to Pakistan. And to send a clear message to Pakistan that this is important, to them as well as to us, I think that message has not been sent."

Logan: "Under what circumstances would you authorize unilateral U.S. action against targets inside tribal areas?"

Obama: "What I've said is that if we had actionable intelligence against high-value al-Qaeda targets, and the Pakistani government was unwilling to go after those targets, that we should. My hope is that it doesn't come to that - that in fact, the Pakistan government would recognize that if we had Osama bin Laden in our sights that we should fire or we should capture him."

Logan: "Isn't that the case now? I mean, do you really think that if U.S. forces had Osama bin Laden in their sights and the Pakistanis said 'No,' that they wouldn't fire or wouldn't go after him?"

Obama: "I think actually this is current doctrine. There was some dispute when I said this last August. Both the administration and some of my opponents suggested, 'Well, you know, you shouldn't go around saying that.' But I don't think there's any doubt that that should be our policy."

Logan: "But [not going after him] is the current policy."

Obama: "I believe it is the current policy."

Logan: "So there's no change, then?"

Obama: "I don't think there's going to be a change there. I think that in order for us to be successful, it's not going to be enough just to engage in the occasional shot fired. We've got training camps that are growing and multiplying."

Logan: "Would you take out all those training camps?"

Obama: "Well, I think that what we would like to see the Pakistani government take out those training camps."

Logan: "And if they won't?"

Obama: "Well, I think that we've got to work with them so they will."

Logan: "Would you consider unilateral U.S. action?"

Obama: "I will push Pakistan very hard to make sure that we go after those training camps. I think it's absolutely vital to the security interests for both the United States and Pakistan."

Logan: "You do have a situation seven years on into this war where Osama bin Laden and all his lieutenants and all the leaders of the Taliban, they're still there. They're inside Pakistan."

...

Logan: "What would be a 'mission accomplished' for you in Afghanistan?

Obama: "Well, a 'mission accomplished' would be that we had stabilized Afghanistan, that the Afghan people are experiencing rising standards of living, that we have made sure that we are disabling al-Qaeda and the Taliban so that they can longer attack Afghanistan, they can no longer engage in attacks against targets of Pakistan, and they can't target the United States or its allies."

Logan: "Losing is not an option?"

Obama: "Losing is not an option when it comes to al-Qaeda. And it never has been. And that's why the fact that we engaged in a war of choice when were not yet finished with that task was such a mistake."

Logan: "Do you believe the war on terror can't be won if Osama bin Laden is still alive and if he's still out there?"

Obama: "I think there would be enormous symbolic value in us capturing or killing bin Laden, because I think he's still a rallying point for Islamic extremists. But I don't think that by itself is sufficient. I think that we are going to have to be vigilante in dismantling these terrorist networks."

...

Logan: "Do you have any doubts?"

Obama: "Never."

When Obama says "Losing is not an option," he's talking a lot as President Bush did before (and after) the 2003 Iraq ground invasion. But why is he a little vague about those 2-3 brigades?

It seems that there's more to this story.

Like most mainstream news reporters these days, Face the Nation moderator Bob Schieffer has been totally in the tank for Obama for some time now. That's the only reason I can think of why the most newsworthy part of the interview was cut out from the presentation on his show.

The way that I know this is that those other parts are in a portion of the interview that was broadcast earlier on CBS News Sunday Morning. And the portions that were cut out are the portions where Obama made the most strident remarks about Afghanistan.

The following is my transcript:

|

Logan: "How deep is your commitment to that goal? How long would you be prepared to keep US troops in Afghanistam?"

Obama: "We have to win in Afghanistan."

Logan: "So losing is not an option."

Obama: "Losing is not an option when it comes to al-Qaeda, and it never has been."

Logan: "So what are the tangible changes that US troops on the ground will experience under your presidency?"

Obama: "Well, if you've got two or three additional brigades in Afghanistan, that's gonna obviously relieve the pressure on the troops who are currently here, who have to cover a huge amount of territory."

Logan: "So, two or three additional brigades won't make that much difference."

Obama: "Actually, it can make a significant difference here."

Logan: "And if those additional troops are not enough, then what?"

Obama: "We're gonna keep on going until we make it work."

Logan: "Would you send more of them?"

Obama: "I think right now let's see if we can get those two or three in."

I'm sure that if CBS were asked why this was left out of the Schieffer version, they'd give some spin answer. But the tone of this portion of the interview is far more warlike and strident than the other parts, even though CBS News Sunday Morning is really an entertainment show, while Face the Nation is supposed to be a hard-news show.

At any rate, this portion of the interview makes it clear that Obama is just as strident about Afghanistan as Bush was (and is) about Iraq. Obama is just as "pro-war" as President Bush is, as vice-president Dick Cheney is, Donald Rumsfeld is, as the neo-cons are, etc., etc., except that he's "pro-war" about a different war, and a far more dangerous war, and a war far more likely to escalate.

There's a side story here, as well. The interviewer is Lara Logan. Which of the following describe her?

The answer is "All of the above."

And now, Dear Reader, I'm sure you must be thinking, "Why in heaven's name is this stuff in the story? Is this just another one of your excuses to include a picture of a good-looking woman in the story?"

That may be one reason, but there's another reason, and it relates to the entire point of this story.

Lara Logan is young, super good looking, caught having an affair with a married colleague, pregnant, but still wants to be taken seriously as a foreign affairs correspondent. She has to work twice as hard to prove herself.

Bob Schieffer can doctor an interview tape and even be completely in the tank for Obama, and get away with it, because everyone "knows" that he's a hard-news, hard as nails, "unbiased" reporter.

But Logan can't get away with anything like that. She has to prove that she can handle the tough assignments and stand up to everyone. That's why she always had that weird, grim expression on her face during the interview. If she once smiled at Obama, she would be perceived as finding him sexy, and in the tank for him.

That's also why she asked Obama some very tough questions, and really cornered him on Afghanistan. It wouldn't surprise me to learn that Obama was surprised by the toughness of the questions, and perhaps got word to Schieffer to leave the tough parts out of the Face the Nation version of the interview.

Barack Obama has similar problems. He's young, he's a rock star, and having an affair with the loony left. He's not pregnant, but he's impregnated with their nihilistic, destructive view of the world, and can't break free, and still wants to be taken seriously as a Presidential candidate. He has to work hard to prove himself in foreign affairs.

John McCain doesn't have to prove himself. Everyone knows that he's a war hero, and that he's taken numerous trips abroad. If he took a position that was "soft" on Iraq or Afghanistan, he could get away with it, and no one would accuse him of being "soft."

But Obama can't get away with anything like that. He has to prove that he can handle the tough situations and stand up to everyone. That's why, after taking a weak position in Iraq, he has to compensate by taking a "strong" position in Afghanistan.

So swimsuit model Logan and rock star Obama have a lot in common and are very similar. Both want to advance in their careers. Both have used their good looks to advance this far. But now they want to get further ahead, and their good looks are perversely calling their abilities into question.

Actually, Logan has already gotten her promotion, as reported in an effusive Washington Post story that provides many details. In April, she was promoted to CBS's chief foreign affairs correspondent, and she now works in an office in Washington.

Obama is now looking for his own promotion -- to President. His trip this weekend is intended to prepare him for that.

Logan and Obama have something additional in common: Although they need to work hard to prove that there's more to them than their youthful good looks, in both cases most of their adoring fans really couldn't care less how much they know.

|

Admiral Michael Mullen, chairman of the Joint Chiefs of Staff, was interviewed at length on Fox News Sunday. He responded to the "timetable" question for Iraq:

MULLEN: I think the consequences could be very dangerous in that regard. I'm convinced at this point in time that coming — making reductions based on conditions on the ground are very important.

We've been able to do that. We've reduced five brigades in the last several months. And again, if conditions continue to improve, I would look to be able to make recommendations to President Bush in the fall to continue those reductions.

WALLACE: Why dangerous to set a timetable now for what's going to happen over the next two years?

MULLEN: When I have discussions with commanders on the ground, basically — and I did a couple weeks ago — they are very, very adamant about continuing progress, about making decisions based on what's actually happening in the battle space, and I just think that's prudent.

That's served us very well in — certainly, since the surge, which has been very successful, and I think will continue to serve us well based on the overall conditions that I see in Iraq right now.

WALLACE: And why? What would happen if you don't do it as condition-based? What if you sit there and say, "Right now, timetable, two years, all combat troops out?" What's the downside?

MULLEN: Well, it's hard to say exactly what would happen. I'd worry about any kind of rapid movement out and creating instability where we have stability.

We're engaged very much right now with the Iraqi people. The Iraqi leadership is starting to generate the kind of political progress that we need to make. The economy is starting to move in the right direction. So all those things are moving in the right direction.

And from the standpoint of moving forward, I think it's a pretty good path right now."

Obama is going to continue to have a great deal of trouble dealing with this question, thanks to his inability to stand up to the loony left.

I'm currently working on a full analysis of the war in Afghanistan, so I'll just briefly mention a couple of things here.

Obama's "two or three brigades" is modeled after the "surge" that worked so well in Iraq. However, Afghanistan is quite different, and a similar "surge" will not work in Afghanistan.

Afghanistan has much more complex ethnic and religious rivalries. Their last crisis war, the extremely bloody and violent 1992-96 civil war, involved multiple ethnic groups aligned largely as a war between Sunnis and Shia in Afghanistan.

That was never true in Iraq. Historically, in crisis wars, Iraqis have considered themselves to be Iraqis first, and Sunnis and Shia second.

Iraq was infiltrated by Sunni al-Qaeda fighters, but they had no safe haven, and were eventually expelled by the Iraqi Sunnis themselves.

Afghanistan has been infiltrated by Sunni al-Qaeda fighters, but they have safe haven in the Pakistan tribal regions (FATA). Furthermore, they're supported by the Sunni Pashtun/Taliban groups in the general public in Afghanistan, who see them as their allies in opposing not only the NATO forces, but also the Shia Hazara and related ethnic groups in the north.

In many ways, the Afghan war is, like the conflict in Kashmir, part of a larger proxy war between India and Pakistan. That proxy war is only going to escalate. As the US itself escalates in Afghanistan, it will eventually be pulled into the larger war, on the side of India.

There's one more very interesting thing that Obama said in the above interview. He referred to his previous statements that if he knew as President where Osama bin Laden was hiding in Pakistan, and Pakistan refused to do anything about it, he would send American forces into Pakistan to kill him.