Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Anyone who has seen "The Sound of Music" knows that Austria played a pivotal role in the development of the European war in the 1930s.

Europe's major bank failures began in Austria in 1931, triggering mass panic and bank failures throughout Central Europe. By the end of the year, there were over 6 million unemployed, and the resulting social tension gave rise to Communism and Naziism, and the rise to power of Adolf Hitler.

And so deep memories were stirred on Sunday, when Austria's two far-right parties, the Freedom Party and the Alliance for the Future of Austria, together took nearly 29% of the vote in the general elections.

The Social Democrats won the election with 30%. But they, and the conservative People's Party, with 26%, suffered their worst results since 1945, while the far right showed its greatest strength since the end of World War II.

The coalition of the center parties, the Social Democrats and the People's Party, had ruled until recently. But, like many governments today, the Austrian government became paralyzed with bickering, and they were forced to call a new election.

Heinz-Christian Strache, the leader of the Freedom Party, has been accused of links to neo-Nazis, but he denies that. The Freedom Party has called for a halt to immigration and a ministry for repatriating foreigners. The election campaign targeted young people, and focused on economic and income issues. It is also opposed to globalization and to being part of the European Union.

In 2000, when the Freedom Party briefly became part of Austria's governing coalition, Austria received sanctions from the European Union, and Israel recalled its ambassador from Vienna.

Today, the reaction is expected to be less harsh, largely because right-wing anti-immigrant parties have been gaining in other European countries, including Switzerland, Netherlands, Belgium and Denmark.

However, an Israeli Ministry spokesman said that:

The rise of the far right in Austria may or may not have great significance, as it may simply be a protest vote against the incompetence of the current government.

However, as the change in political direction coincides with the continuing collapse of the world financial system, the fears of a repeat of the events of the early 1930s are being stirred.

(Comments: For reader comments and discussion, see the

Austria thread of the Generational Dynamics forum.)

(29-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Banks in America and Europe are falling like dominoes, as credit constructor tightens its grip.

As of Monday morning, it was already clear that the promise of a that the "Bailout of the World" (BOTW) plan would solve everyone's problems.

In Europe, bank activity was almost frozen, as interbank lending interest rates (as measured by the TED Spread and the Libor/OIS spread that I mentioned last week) rose to historic highs.

Furthermore, on a weekend when America's Wachovia bank failed and had to be bailed out, European banks seemed to be falling like dominoes, with three banks failures in Europe: Germany's Hypo Real Estate Holding AG had to be bailed out, Britain's Bradford & Bingley was nationalized, and and the Netherlands and Luxembourg partially nationalized Dutch-Belgian banking giant Fortis NV with a $16.4 billion rescue. European stock markets fell 5%.

|

The big shock of the day came around 1:40 pm, when the votes started coming in from the House of Representatives on the bailout bill, and it became clear that the bill was going to lose. The Dow Industrials index was already down 270 points, but it immediately fell another 350 points within just a few minutes. The index recovered slightly, but then fell several hundred more points in the last few minutes of the trading day.

I've gone into this detail because I want to emphasize the atmosphere of total panic that was pervading the Wall Street atmosphere today.

The market indexes are now 25% from their October, 2007, highs. At some point, the fall in share prices will trigger forced selling, leading to a worldwide panic.

The Bailout of the World plan is, at its bottom, an expensive psychological ploy to "restore confidence in the markets," but it doesn't change the fundamentals enough to make any real difference.

It used to be that the Fed could lower interest rates 1/4% to get a huge psychological boost among investors, but now even the promise of $700 billion doesn't do the trick. Investors have decided, "Fool me once, shame on you; fool me twice, shame on me."

Even so, pundits have been predicting what everyone will do next: There will be another attempt at some point to pass the bailout bill; the Fed will lower interest rates again. These are both quite possible.

Pundits are expecting a continuing bloodbath on Tuesday, but in fact it's equally probably that the stock indexes will rise, possibly by a great deal.

What's going on are two sides of the same coin -- panic buying and panic selling. Both of them are panic, and what's particularly significant of the last few days is that the level of panic, whether up or down, has been increasing.

It's worthwhile to take another look at what happened in 1929. If we look at my Dow Jones historical page, we can see what happened before the 1929 crash, some of which is extracted here:

1929: Daily change in Dow Industrials

--------------------

Mon 10-07 ( +6.32%)

Tue 10-08 ( -0.21%)

Wed 10-09 ( +0.48%)

Thu 10-10 ( +1.79%)

Fri 10-11 ( -0.05%)

-------------------

Mon 10-14 ( -0.49%)

Tue 10-15 ( -1.06%)

Wed 10-16 ( -3.20%)

Thu 10-17 ( +1.70%)

Fri 10-18 ( -2.51%)

------------------

Mon 10-21 ( -3.71%)

Tue 10-22 ( +1.75%)

Wed 10-23 ( -6.33%)

Thu 10-24 ( -2.09%) Black Thursday

Fri 10-25 ( +0.58%)

-------------------

Mon 10-28 (-13.47%) Black Monday

Tue 10-29 (-11.73%)

Wed 10-30 (+12.34%)

Thu 10-31 ( +5.82%)

Fri 11-01 (Closed)

-------------------

Mon 11-04 ( -5.79%)

Tue 11-05 (Closed)

Wed 11-06 ( -9.92%)

Thu 11-07 ( +2.61%)

Fri 11-08 ( -0.70%)

-------------------

Mon 11-11 ( -6.82%)

Tue 11-12 ( -4.83%)

Wed 11-13 ( -5.27%)

Thu 11-14 ( +9.36%)

Fri 11-15 ( +5.27%)

-----------------

As you can see, the 1929 crash was not a huge 20-30% drop in one day. There were several days of wild swings over many days, netting sharply down. It's important to remember that the stock market didn't just fall one or two days; it continued to fall for four years, and from 1929-33 stocks had fallen 90%, to 10% of their peak values.

Here's a comment from a web site reader:

No! It is Rather a Disgrace and Rip-Off Benefitting only the Shareholders and Unsecured Creditors of Banks

Read More Here: Link: http://www.rgemonitor.com/ Nouriel Roubini on Sep 28, 2008.

A recent IMF study of 42 systemic banking crises across the world provides evidence on how different crises were resolved. http://www.imf.org/external/pubs/ft/wp/2008/wp08224.pdf

Government purchase of bad assets was the exception rather than the rule. It was used only in Mexico, Japan, Bolivia, Czech Republic, Jamaica, Malaysia, and Paraguay.

The Treasury plan is a disgrace: a bailout of reckless bankers, lenders and investors that provides little direct debt relief to borrowers and financially stressed households and that will come at a very high cost to the US taxpayer. And the plan does nothing to resolve the severe stress in money markets and interbank markets that are now close to a systemic meltdown.

It is pathetic that Congress did not consult any of the many professional economists that have presented - many on the RGE Monitor Finance blog forum - alternative plans that were more fair and efficient and less costly ways to resolve this crisis. This is again a case of privatizing the gains and socializing the losses; a bailout and socialism for the rich, the well-connected and Wall Street. And it is a scandal that even Congressional Democrats have fallen for this Treasury scam that does little to resolve the debt burden of millions of distressed home owners."

It doesn't make any difference whether they had talked to the "professional economists" or not. Roubini, the IMF, and the others still don't understand what's going on.

This collapse has been in play at least since the dot-com bubble began in 1995. The bubble grew for 13 years, morphing into a real estate bubble and a credit bubble, and now it's going to collapse for many years.

The deflationary spiral is accelerating, and things are getting much worse very quickly. I'm expecting a generational crash (the first since 1929) pretty soon. Forced selling is picking up among hedge funds, and it won't be long before it turns into total panic. So now would not be a good time for anyone to make any monetary commitments.

It's worth remember again that we're waiting for a similar epochal event -- the massive generational panic that will be remembered forever. This must occur at some point. The last one occurred in 1929, and the next one is overdue. Millions or tens of millions of investors around the world will panic and try to sell everything, causing computer systems to crash or be clogged for hours, or perhaps a day or two. This MUST happen, and it might happen this week, next week, or in the weeks that follow, but it seems very close right now.

(Comments: For reader comments, as well as more frequent

updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(29-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The details of the $700 billion Bailout of the World (BOTW) plan are now being evaluated by investors around the world.

The fight is not yet over, but there's a basic agreement in place. According to the plans, it will be debated in Congress during the week, and passed as a bill by the end of the week.

The American public is overwhelmingly opposed to the BOTW -- by something like to 300 to 1, according to what I've heard.

The two Presidential candidates completely punted on this question during the debates. Their scripted answers threaded the needle between not endorsing anything so unpopular, and not rejecting something that might save the world.

In fact, there's one overwhelming fear in Washington that's so great that it overshadows everything else and makes everything else almost irrelevant. It's not a great fear of economic meltdown: It almost seems to be taken for granted that some kind of economic meltdown is in the cards. No, the greatest fear for each of these Washington officials is the fear of being blamed for the economic meltdown.

In listening to the commentary for the last few days about the BOTW, the most telling thing that I've heard was the answer by Treasury Secretary Henry M. Paulson Jr. to these questions: "Why are we in such a rush? Why can't we do this in stages? Why do we have to approve the entire $700 billion in just a couple of days?"

The answer: "We have to restore confidence to the markets, and we need the full amount to do that, and we have only a couple of days to do that before we face disaster." (This is paraphrasing, but that's essentially what he said.)

As this weekend progresses, we've been faced with a familiar deadline: The bailout agreement has to be reached by about 7 pm ET on Sunday, because that's when the markets are opening Monday morning in Asia. 7 pm Sunday ET has been a do or die deadline for several recent weekends.

And listening to the pundits this weekend, they're all going to be holding their breath watching the markets on Sunday evening and Monday morning.

"If it doesn't work, then we face disaster on Monday, but I don't think that's going to happen," said one.

The phrase "doesn't work" means "doesn't restore confidence to stock market investors."

There's an airhead quality to all this discussion. There's no connection with anything real. It's not exactly like playing a move in a chess game ("If I do this, he does that, then I do this.")

It's more like a big poker game: "I've lost every bet so far. This time I'm going to go all in, and bet every penny I have on the next turn of the card. I hope this works."

It's hard to overestimate how incredible this is, since it's not a poker game. The prevailing view in Washington is that the fate of the entire world economy hinges on the turn of a card, and I don't think that there's anyone who even claims to have any idea which way that card is going to turn.

And so, everyone in Washington is going to be paying rapt attention

to the markets on Monday, because you have to be a very nimble player

to avoid the greatest catastrophe of all -- being blamed.

(28-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

South Korea is considering retaliatory economic action, if North Korea goes ahead with its plans develop nuclear weapons. South Korea has been providing massive food and energy aid to North Korea, and is considering suspension of the energy aid. Foreign Minister Yu Myung-hwan points out that a resumption of nuclear weapons development would violate an existing 2006 UN Security Council resolution, and added, "This is related to the 'action-for-action' principle. North Korea is well aware of how we will react if it goes beyond the current parameters."

The situation is viewed very gravely in South Korea, because the two countries are technically still in a state of war, since the Korean War armistice in 1953.

According to a statement by Defense Minister Lee Sang-hee, following the North Korean announcement, "North Korea maintains a vast military and forward deploys more than 70 percent of its ground forces. It stands ready to mount a surprise attack any time. It continues to develop weapons of mass destruction such as nuclear, chemical and biological weapons and missiles and is a grave threat to the stability, not only of the Korean peninsula, but also the region."

|

In fact, according to a study (PDF) by the Congressional Research Service, North Korea spends the highest percentage of its GDP of any country in the world on military expenditures. This is despite the fact that the country's Communist government is unable to feed its people, resulting in frequent famine and starvation. In view of the country's spending priorities, it's reasonable to conclude that the country is preparing for war, and it's reasonable to assume that war would be directed against both South Korea and its hated enemy, Japan.

Concern has been heightened by the statements of a North Korean defector that North Korean president Kim Jong-il had used the disarmament negotiations as a ploy to get international aid, and that he already had an inventory of nuclear material and weapons.

According to the typical punditry in Washington, the North Koreans changed their minds because the Americans were insisting on inspecting their nuclear facilities. This is part of the hubris that assumes that everything that happens anywhere in the world happens because Washington does something or doesn't do something.

What's much more likely is that the sudden announcement was precipitated by an ongoing succession struggle.

When Kim Jong-il failed to appear on September 9 at 60th anniversary celebrations for the country, speculation about ill health began immediately.

It's now been 44 days since Kim has appeared in public, although North Korean officials have angrily denied that Kim is in ill health, and are bitterly criticizing "speculation by ill-intentioned people." It's now widely assumed that Kim has suffered a paralyzing stroke. This will be confirmed or refuted on October 10, when Kim is expected to appear at another major anniversary celebration.

|

North Korea resumes nuclear weapon development amidst generational succession struggle:

South Korea is considering retaliatory economic action,...

(27-Sep-2008)

North Korea shuts down nuclear reactor.:

North Korea's Yongbyon nuclear facility was closed on Saturday,...

(16-Jul-07)

South Korea gives in to North Korea demands, and supplies rice unconditionally:

So far, North Korea seems to be reneging on its promises to dismantle its nuclear program....

(22-Apr-07)

It's the Year of the Pig in North Korea:

On Kim Jong-il's birthday, he gloats about humiliating the U.S. ...

(17-Feb-07)

South Korean politicians are 'euphoric' over North Korea nuclear deal:

The young "386 generation" that run the government may well be in over their heads....

(16-Feb-07)

South Korea to deploy deadly robots on border with North Korea:

This is the scariest video you've ever seen....

(3-Feb-07)

North Korea announces a nuclear weapon test.:

Has Pyongyang passed the point of no return?...

(9-Oct-06)

Iranian representatives witnessed North Korea's July 4 missile tests:

According to Assistant Secretary of State Chris Hill,...

(21-Jul-06)

Why did China agree to join a U.N. Security Council resolution condemning North Korea?:

Henry Kissinger has one theory, but mine is quite different....

(19-Jul-06)

In an Independence Day surprise, North Korea launches multiple test missiles towards Japan:

Sticking its thumb in the eye of the United Nations and the United States,...

(4-Jul-06)

North Korea exporting women into slavery:

10,000 to 15,000 North Koreans, mostly women, are working as slaves...

(30-Dec-05)

North Korea plays a little joke on the world:

North Korea's "no more nuclear" pledge startled the world, but now they say, "Ha, ha, fooled ya."...

(21-Sep-05)

U.N. predicts severe North Korea famine this fall:

This could be a reason why North Korea is close to preemptive war....

(10-Aug-05)

North Korea agrees to resume nuclear non-proliferation talks:

The six-party talks will start the week of July 25, thirteen months after the last round,...

(9-Jul-05)

Rumsfeld expresses alarm over militarization of China and North Korea:

Defense Secretary Donald Rumsfeld spoke in Singapore on Saturday...

(4-Jun-05)

World becoming panicky over North Korean nuclear test threat:

UN nuclear chief calls it "disastrous"; US lawmaker calls it a "cataclysmic" event....

(10-May-05)

Korea - Japan relations nosedive over long-disputed islands:

2005 is supposed to be "Korea-Japan Friendship Year,"...

(18-Mar-05)

North Korea announces that it will resume testing missiles:

North Korea continues its war mobilization begun a year ago,...

(04-Mar-05)

Ambassador to Japan calls North Korean threat "deadly":

While the Bush administration has been trying to give a muted, non-alarming response to the North Korean threat,...

(18-Feb-05)

North Korea says Japanese sanctions will trigger "war" and an "effective physical" response:

Japan has threatened to freeze food aid to North Korea and impose other sanctions...

(16-Dec-04)

| ||

A succession battle would throw the country into enormous turmoil for a long time. The Kim family has ruled North Korea since it declared independence in 1948, and speculation centers on his children, as well as his fourth wife, Kim Ok, who visited Washington in 1999.

It's also possible that the succession struggle is being dominated by China, who will act to install a China-friendly leader in North Korea.

Kim Jong-il, born in 1941, is a survivor of WW II and the subsequent war between North and South Korea. Like America's "Silent generation," the children who grow up during a crisis war suffer a kind of generational child abuse, and turn into reserved, indecisive adults.

His children and his young fourth wife have no such inhibitions, and are going to be far more confrontational and competitive. The new announcement of the resumption of nuclear development is exactly the kind of brinksmanship that one would expect of a more arrogant younger post-war generation.

Even if Kim recovers his health, the current development signals a new period of great international turmoil over North Korea's intentions. If the defector's statements are true, then North Korea could be ready to launch nuclear missiles at South Korea or Japan in a fairly short time frame. And, as usual, what matters in these situations is the perceptions rather than the truth. If the masses of South Koreans or Japanese believe that North Korea is now preparing for war, the probability of a miscalculation spiraling into war becomes greater.

An editorial from the German paper Süddeutsche Zeitung describes the situation as follows:

It seems that the country is now going through an important transformation. The negotiated disarmament program is being sacrificed and uranium enrichment is being restarted. North Korea is making itself dangerous again, thus destroying the progress achieved in negotiations over the past six years.

Why? There is no obvious answer to so much irrationalism and from the outside it is hard to understand the motives. It is obvious that the outrageous provocations have something to do with the credible reports about the poor health of Kim Jong Il. If Kim is really not recovering or is even already dead, then the North Korea that will be unleashed on the world will be marked by power struggles and wild survival tactics. The restarting of the nuclear program would be a central part of any claim to power. Whoever has the bomb has the power. The country is once again becoming one of the world's problem cases."

From the point of view of Generational Dynamics, there will be a

crisis war of Korean unification with near 100% certainty, and that

Japan will be pulled into this war. My expectation is that China

will be North Korea's ally in this war, especially because China is

already planning for a war with America over Taiwan.

(27-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Officials are bitterly divided over the $700 billion Bailout of the World (BOTW) plan, as meetings ran into the night on Thursday evening. The bailout plan appeared to be in disarray, as leading Republicans proposed an alternative plan.

The original plan, advocated by Secretary of the Treasury Henry M. Paulson Jr. and Federal Reserve chairman Ben Bernanke, gives the Administration authority to pay up to $700 billion for near worthless mortgage-back securities from financial institutions.

The theory is that, one day soon, the bubble will return, and the government can sell those securities and make money. (Please stop. I can't type when I have tears in my eyes from laughing so hard.)

The new plan, proposed by Alabama Sen. Richard Shelby, the ranking Republican on the Senate Banking Committee, would authorize the the Administration to loan $700 billion to financial institutions. Once the bubble returns, they would pay back the loans with interest, and the government would make money. (Once again, I can't stop laughing.)

The real news on Thursday is that people are now speaking of a "credit market crash." Banks simply are unwilling to lend money to each other at interest rates the borrower can afford.

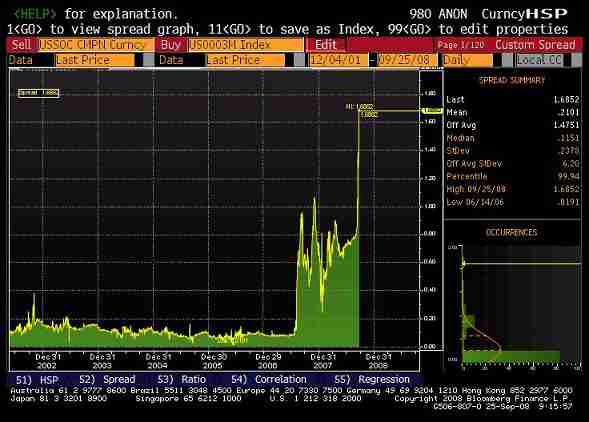

Yesterday I posted a graph of the TED spread, which has risen again today. Here's a graph of the Libor-OIS spread posted Thursday on the FT site:

|

Libor measures the interest rate for bank to bank lending for 3 months; OIS (Overnight Index Swaps) measures the interest rate for overnight lending. Usually it's more risky to lend someone money for 3 months than for overnight, and so the interest rate is normally a little higher.

The above graph shows that this difference in interest rate is historically higher.

What all this means is that interbank lending is frozen. Bloomberg tv referred to it several times as a "credit market crash." A US News article uses the same words.

A USA Today article points out that many banks would now be collapsing, if it weren't for massive lending by the Fed.

Today's explanation is the same as yesterday's explanation: The leaking of the credit bubble is accelerating, the amount of money in the world is disappearing more quickly. The deflationary spiral is accelerating. The $700 billion from the Bail Out the World plan wouldn't even begin to keep up.

There are some people who, after many months and years, are finally beginning to understand this. The credit bubble was created by "leveraging" -- using a little money to borrow a lot. This was done by everyone: People bought homes with no money down, often lying about their income, or they used credit cards to pay their living expenses. And financial institutions would buy securities "on margin," often paying on 2-5% of the cost, and borrowing the rest. This means that they "leveraged" their money by 50 to 1 or 20 to 1.

Now everyone's talking about "deleveraging." Gillian Tett wrote a Financial Times article that summarizes this:

In the go-go days of the credit bubble, Washington policymakers blithely assumed that the Western financial system had plenty of capital to cope with any potential risks. Consequently, as one former BIS official admits: "Worrying about leverage wasn't fashionable at all - no one wanted to hear."

Fast-forward a couple of years and, my, how those Western financiers are having to eat humble pie (even to the point of accepting a helping hand from the once-ailing Japanese). After all, the events of the past year have now made it patently - horrifically - obvious that the Western banking system has become dangerously undercapitalised in recent years, to the point where even the Federal Reserve is having to shore up its defences.

Moreover, it is now also clear that Western policymakers are belatedly trying to correct this state of affairs. The days when high leverage, mega bonuses and wacky instruments were equated with financial virility have gone; instead a more humble, back-to-basics and slim-line approach is what investors are demanding. Thus, deleveraging is now all the rage - in whatever form it might take."

So far, so good. Tett points out that deleveraging must now occur for most firms. This is something that a lot of people are saying. But she added the following interesting paragraph:

In other words, suppose that investment banks cut their leverage ratios from 30 times to 20 times. That one action would cause $6 trillion dollars in assets to be sold, and since that money was essentially "created" from credit, there would be $6 trillion dollars less money in the world. And it would be much worse if the cut the leverage ratios to 10 times, or 5 times, or (gasp!) two times.

And that doesn't even count hedge funds!

That's a good example of why money is disappearing in the world, and also explains why the $700 billion Bail Out the World plan doesn't have a snowflake's chance in hell of making much of a difference, whether it passes or not.

Thursday also saw the biggest bank failure in history: Washington Mutual Inc. has collapsed, and its assets will be acquired by JP Morgan Chase & Co.

A web site reader posted the following question in the Generational Dynamics forum:

The answer is that it means all of the above, if you don't have the very highest credit rating, and even then, you'll be paying sky-high interest rates. It's very hard to get credit now, but in a while it'll be almost impossible.

So we have two very different pictures here: On the one hand, we have the clown circus in Washington, with bickering politicians arguing over a plan that can't possibly work. Why are the circus clowns performing? Because they hope to get our votes in a couple of months. What a sad, pathetic bunch.

When the credit bubble was expanding, there was plenty of money around, and it was like a huge champagne party for the everyone from consumers who lied to get loans to investment executives who lied to investors that their mortgage-backed securities were "good as cash."

Now the champagne party is over, and a lot of people are going to be hurt badly, undoubtedly including many people reading this web site, unfortunately.

It's a very, very sad time. If you're nostalgic for the old days, whether for the champagne party or for your long-lost youth, then take a moment and relax, and listen to Judy Garland and Mel Tormé sing "The Party's Over" on the New Year's episode of the Judy Garland Show:

Now you must wake up,

All dreams must end.

Take off your makeup,

The party's over.

It's all over, my friend.

(26-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Desperation sets in as credit markets continue to seize up.

I've posted over 1,200 articles on this web site over the years, and I've often expressed amazement about what's going on, but I think that I can safely say that it all pales to insignificance compared to what's been happening in Washington this week. The overwhelming insanity leaves me breathless unless I can shut it out of my mind. The phrase "rearranging the deck chairs on the Titanic" comes to mind.

Things are being said and done this week that will go down in history. Things have been said that will be repeated over and over, like Herbert Hoover's "Prosperity is just around the corner," his constant mantra as the country sank deeper and deeper into the Great Depression.

There are many lists of dumb-sounding statements from officials speaking in 1929. How about: "I see nothing in the present situation that is either menacing or warrants pessimism... I have every confidence that there will be a revival of activity in the spring, and that during this coming year the country will make steady progress." - Andrew W. Mellon, U.S. Secretary of the Treasury, December 31, 1929.

Today's Secretary of the Treasury, Henry M. Paulson Jr., joined Fed chairman Ben Bernanke to testify before the Joint Economic Committee of Congress on Wednesday.

Actually, it wasn't just testimony. Ben Bernanke was haggard, grim-faced and ashen. His opening statement was a desperate plea, begging Congress to spend $700 billion to Bail out the World (BOTW), so that the world could be saved:

While perhaps manageable in itself, Lehman's default was combined with the unexpectedly rapid collapse of AIG, which together contributed to the development last week of extraordinarily turbulent conditions in global financial markets. These conditions caused equity prices to fall sharply, the cost of short-term credit--where available--to spike upward, and liquidity to dry up in many markets. Losses at a large money market mutual fund sparked extensive withdrawals from a number of such funds. A marked increase in the demand for safe assets--a flight to quality--sent the yield on Treasury bills down to a few hundredths of a percent. By further reducing asset values and potentially restricting the flow of credit to households and businesses, these developments pose a direct threat to economic growth. ...

Despite the efforts of the Federal Reserve, the Treasury, and other agencies, global financial markets remain under extraordinary stress. Action by the Congress is urgently required to stabilize the situation and avert what otherwise could be very serious consequences for our financial markets and for our economy."

But the congressmen were very skeptical. They demanded answers to questions that Bernanke couldn't answer: "Is $700 billion the actual cost?" "What's so urgent that we have to pass this bill this week?" "Suppose we pass the bill -- are you sure it will work?"

In fact, they made it clear that the public is VERY negative about the BOTW bill. One pundit said that constituent calls to congressmen were running 99 to 1 AGAINST the bill.

|

Meanwhile, the credit markets continue to seize up. One measure of how bad things are is called the "TED spread," the difference between 3-month interest rates for Treasury bills and European dollar bank loans. (TED = Treasury vs Eurodollar).

As you can see from the graph, there were three previous crisis points: August 2007, when the credit crisis began; December 2007, when the Fed began its aggressive liquidity programs; and March 2008, when Bear Stearns had to be rescued.

Now, in September, 2008, the credit crisis is worse than ever. We've already had the nationalization of Fannie Mae and Freddie Mac, the bailout of AIG, the bankruptcy of Lehman Brothers, the acquisition of Merrill Lynch by Bank of America, and several other related changes. Wall Street is already unrecognizable from where it was just a month ago, and the credit crisis is worse than ever.

The Bailout of the World (BOTW) is Ben Bernanke's last desperate attempt to stave off a new Great Depression.

As his Great Historic Experiment collapses, Ben Bernanke scrambles to save his reputation:

Who "lost" the economy? The finger-pointing is getting intense....

(15-Jan-2009)

Ben Bernanke's Great Historic Experiment is at the brink:

Desperation sets in as credit markets continue to seize up....

(25-Sep-2008)

Fed Chairman Ben Bernanke defends his Great Historic Experiment before Congress:

The Fed-led rescue of Bear Stearns last week was closely questioned...

(7-Apr-08)

A historic day in Ben Bernanke's Great Historic Experiment:

In its biggest move yet, the Fed bails out a collapsing Bear Stearns....

(15-Mar-08)

Bernanke's historic experiment takes center stage:

An assessment of where we are and where we're going....

(27-Aug-07)

Ben Bernanke's Great Historic Experiment:

Bernanke doesn't believe that bubbles exist. His Fed policy will now test his core beliefs....

(18-Aug-07)

Ben S. Bernanke: The man without agony :

Bernanke and Greenspan are as different as night and day, despite what the pundits say.

(29-Oct-2005)

Federal Reserve congratulates itself on jawboning policy:

Fed says it propelled the economy upward merely by promising to keep interest rates low....

(17-Sep-04)

| ||

I've criticized many bizarre beliefs and statements that Bernanke has said before -- especially that the 1930s Great Depression could have been avoided if the Fed had lowered interest rates sooner, or that jawboning affects the economy, but fundamentals don't.

But the centerpiece of Ben Bernanke's life has been his Great Historic Experiment, and the failure of the Great Historic Experiment must be apparent, even to him.

The plea he made to Congress today was an act of desperation, on two levels:

He enjoys at least the consolation that he'll be able to blame Congress for the disaster.

One more thing:

When I wrote my 2003 book, Generational Dynamics: Forecasting America's Destiny, I never really understood how Congress could have passed the Smoot-Hawley Tariff Act in June 1930. The law was opposed by President Hoover's administration and overwhelmingly by economists at the time. But it was several months after the 1929 stock market crash, and Americans were blaming high unemployment on foreigners stealing jobs away from Americans. The public demanded that the law be passed. The Smoot-Hawley act didn't didn't help the American economy, but it crippled imports from other countries, especially silk from Japan. Japan was already suffering economically anyway, but this act shut down its silk industry. It infuriated the Japanese, who invaded Manchuria and China in subsequent years, and bombed Pearl Harbor a few years after that.

Assuming that the current political trend continues -- if the BOTW bill is delayed or watered down -- it will be seen as a disastrous move by Congress, and may even be seen as the CAUSE of the crash, just as many people see the Smoot-Hawley Tariff Act as the CAUSE of much of the misery of the Great Depression.

On Wednesday evening, President Bush made a televised address to the nation, outlining the danger and calling on Congress to pass the BOTW bill. His speech contained warning language that hadn't been heard publicly before. It's not clear yet whether the speech will spur the public to support the BOTW bill, or whether it will cause people to become even more anxious and panicky.

From the point of view of Generational Dynamics, of course, the BOTW

bill won't have any effect one way or the other, whether it's passed

or not. The financial calamity is coming.

(25-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

And we have some expert advice on preserving your savings.

Democrats and Republicans voiced standard ideological objections to the proposed Bailout of the World, and some of them were very nasty.

The Democrats complained that the bailout helps the banks, but doesn't help the man on the street, the average homeowner being foreclosed.

|

The Republicans complained that the bailout gives too much power to the Federal government, and to one person (Treasury Secretary Henry Paulson).

Perhaps most vicious was was Republic senator Jim Bunning, who said, "This massive bailout is not a solution; it is a financial socialism, and it's un-American." Whew!

I admit to being fairly bemused, watching the Washington circus, because the proposed $700 billion BOTW won't make any difference at all to what's coming.

There are $6 trillion in money market funds, and the fear is that people will panic and draw their money out. The size of the real estate bubble is over $5 trillion.

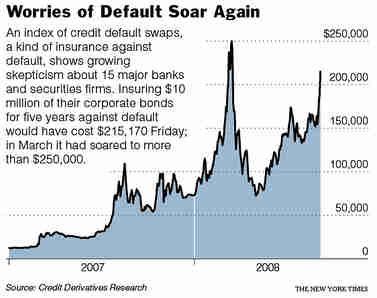

And there are $62 trillion in credit default swaps. CDSs played a prominent role in the previous rescue efforts -- for Bear Stearns, Fannie Mae, Freddie Mac, AIG -- and now there's pressure to regulate them.

A web site reader pointed out to me that, according to the latest figures from the Bank of International Settlements (BIS), there are not just $750 trillion in credit derivatives in portfolios around the world, as I'd said, but there are now $1,000 trillion. It's nice to know that the credit bubble is still expanding somewhere, but that's $1 quadrillion.

When I was a kid, my friends and I were more comfortable dealing with numbers than with girls, and so we got involved in various number discussions. We learned the names of the large numbers -- hundreds, thousands, millions, billions, trillions, quadrillions, quintillions, sextillions, all the way up to vigintillions. (This is the American system - the European system is a little different.)

We knew that many of these numbers were essentially imaginary. We figured that there might be a million or billion of something. But unless you count atoms and molecules, there was certainly nothing in the trillions (this was the 1950s) or anything higher.

So today we have $1 quadrillion in credit derivatives, and that makes my brain explode.

We've been debating this subject in the new Generational Dynamics forum..

One person suggested that these credit derivatives are imaginary, but they're not. They are very real, and they're like tens of trillions of time bombs that will be going off whenever there's a sufficiently big "credit event." Maybe those credit derivatives are sufficiently interlocked so that the explosion of one time bomb will cause a vast chain reaction. Maybe those credit derivatives are so correlated that there's one particular kind of credit event that will cause 10% of them to explode at the same time.

The thing is, nobody has any idea. There are no measures, no sensors, no devices that tell us the nature of this $1 quadrillion in credit derivatives. They're like a huge ocean that's calm on the outside, but may explode and drown everyone at any time.

So Congress is debating the BOTW -- for $700 billion. $700 billion is 0.07% of $1 quadrillion. It's like tossing a bucket of water into the ocean. It makes no difference at all.

It's worth remembering that the world has been here before, from the point of view of Generational Dynamics. If you go back through history, there are many small or regional recessions. But since the 1600s there have been only five major international financial crises: the 1637 Tulipomania bubble, the South Sea bubble of the 1710s-20s, the bankruptcy of the French monarchy in the 1789, the Panic of 1857, and the 1929 Wall Street crash.

These massive generational crashes occur every 70-80 years. Each one occurs when the survivors of the previous one are all gone, and so they're spaced by the approximate length of a human lifetime. We're overdue for the next one.

A web site reader sent me the following:

One just asked about how on Fox they are talking about "Credit Swaps" and asked me if I knew anything about that! It's hit the mainstream!

These are people around my age who are reasonably intelligent professionals. They have IQs of maybe around 120 and have a few hundred thousand in net worth.

They have all left themselves wide open to losses. They have absolutely no idea what is going on. So they have come to me because they don't trust anything they hear from the financial industry and figure I can answer their questions (they admit that). Once I answer them, they just go do whatever I tell them to do. There's no hesitation.

They are telling me how much is in their accounts, exactly what it is, and then asking me what to do with it. I have been warning every one of these people for years and am finding out that they never listened to or absorbed one thing I said! I guess only when two lunkheads like Bernanke and Paulson go on TV and say that the financial system is within days of collapse does it register that oh my God, that's what I've been saying all along.

UNBELIEVABLE!!!"

I wrote back to ask him what advice he gave, so I could repost it, and he sent me the following. This top-notch financial advice from an expert:

Question number two was from a guy who had $250,000 in a Deferred Compensation account. You might know that many people have these types of accounts and that there are only certain options available to them. I told him that "what you would want to do is look at the money market funds offered and then pick a "treasury only" money market fund if they have that option. Otherwise, look at the prospectus for each fund offered and pick the one with the least amount of junk paper in it. That would probably be the one that pays the least interest. The other thing you might be able to do is get into a short term US government bond fund with maturities in the 2-5 year range or something like that."

Question number three was from someone who asked if they should go to the bank and take out their cash and how to do it. I advised them to call the bank and speak to someone who they are familiar with about what they would like to do. I mentioned that any withdrawal over $10,000 will likely trigger a SAR (Suspicious Activity Report) and that will be on file in Federal government database in Detroit for something like 7 years. I advised them to speak with the rep at the bank to confirm that. I warned them not to go to various branches and try to withdraw amounts less than $10,000 in order to avoid an SAR as that is called "Structuring" and is a federal crime. I told them that the bank would not likely have the amount of cash on hand that they were looking to withdraw or may not be wanting to give it up due to liquidity concerns, but that perhaps the bank could order the cash and have it available for pickup the next day. They aborted the conversation before I was able to explain that Federal Reserve notes are partially backed by junk now that the Fed has exchanged their good collateral out through the TSLF, and that t-bills are probably the better option. Although, at this late date I am not really sure whether there would be enough time to establish a treasury direct account and I do not really know whether having a bank hold treasury bills is 100% safe. I think so but am just not sure as I never considered that option."

As usual, it's impossible to predict the exact timing of the coming crisis, but it seems very close now.

Once the full crisis is on, the attitude of the nation will change

dramatically. The Congressmen will stop bickering, and they'll be

only to happy to give plenty of power to someone -- the Secretary of

the Treasury or the Fed Chairman or the next President -- anyone they

think can end the crisis and stop the awful pain.

(24-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

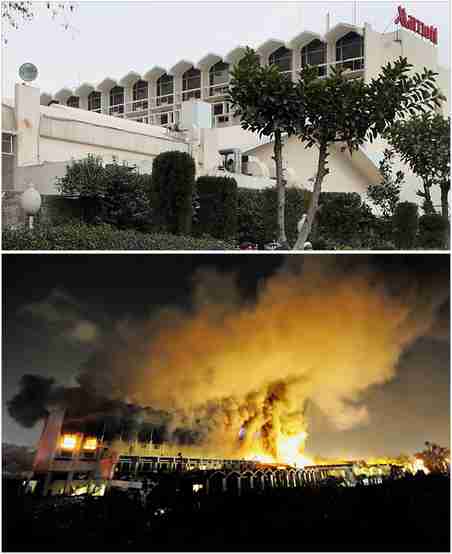

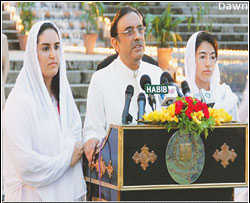

"Pakistan's 9/11" has left the country in a state of shock, reeling from the terrorist attack in Islamabad, the nation's capital, on Saturday evening. At least 53 people were killed, and 266 were injured.

|

A huge truck bomb, carrying 600 kg (1300 pounds) of high-quality explosives, exploded at the entrance to the Marriott Hotel. The bomb left a vast crater, 40 feet wide and 25 feet deep, shattering windows in buildings hundreds of yards away. It ruptured a gas pipeline, triggering a huge blaze throughout the hotel.

The Pakistani Government is blaming al Qaeda operatives for the terrorist bombing.

The hotel was located a block or two away from the federal government buildings in Islamabad.

The bombing occurred just hours after Asif Ali Zardari, widower of Benazir Bhutto, who won the election for President just days ago, gave his maiden speech to Parliament, in which he said that Pakistan is passing through a critical phase and must root out all forms of terrorism and extremism from its soil:

Let everyone have an opportunity to make an informed judgment about the risks to our beloved country and about how we should move forward with responsibility and clarity of vision.”"

At 2 am Sunday morning, he gave another speech, this time to the nation:

[I appeal to] all democratic forces to come forward and save Pakistan.

We will not be afraid of these cowards. We will not fear these cowardly attacks. Pakistan is a fearless and steadfast nation. We Pakistanis believe that our death is in the hands of Allah and we do not fear dying.

Death will come one day but Inshallah (god willing), we will purify Pakistan of this cancer. The day will come when all these people (terrorists) will bow before you."

The successful bombing is a tremendous shock to the Pakistani people. It occurred in the heart of Islamabad - the equivalent would be an explosion a block away from the White House in Washington. For that reason, it's being called Pakistan's 9/11.

It occurred at a time when government meetings were in progress, and the truck supposedly had to pass through five or six security checkpoints to reach the Marriott.

The Pakistanis are going through a process of increasing horror that is very similar to the process Americans are going through over the financial crisis.

Up until 2-3 weeks ago, most Americans were living in a dreamland of denial, believing that the bubble (and their 401Ks) would begin to grow again soon, and that people like me who said we were headed for a financial meltdown were either crazy or motivated by some ideology (though I've never been sure what ideology).

In the last two weeks, Americans have seen some major "terrorist bombings" occur: The Fannie and Freddie nationalization, the Lehman Brothers bankruptcy, the AIG bailout, and now the $800 billion bailout being worked on over the weekend.

These "terrorist bombings" have frightened ordinary Americans, and made them suddenly realize that their savings and their entire way of life are at stake. This is causing an American "regeneracy" to begin -- referring to the end of political bickering, and the restoration of civic unity for the first time since the end of World War II.

(For information about the term "regeneracy," see "Basics of Generational Dynamics.")

Now let's return to Pakistan.

Up until a month ago, when Pervez Musharraf resigend as President, the entire Pakistani population was in a state of total denial about the suicide bombings that were going on. The "logic" was this: The reason for the suicide bombings was that Musharraf was cooperating with the Americans, and the suicide bombings were really targeted at the Americans. And so, the fantasy reasoning continued, when Musharraf goes, then the violence will disappear automatically.

Since then, there have been several "terrorist bombings". The biggest until now occurred two days after the resignation in the town of Wah, just outside of Islamabad. The Pakistani people are now realizing that their entire way of life is at stake.

The reactions will be similar among government officials in Washington and Islamabad:

At some point, something so horrible will happen that a complete

regeneracy will occur, in both America and Pakistan, and then the

real crisis will begin.

(22-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Discuss world events and generational theory.

I've been wanting to set up a Generational Dynamics forum for a long time, and I now have.

I know a lot of people have wanted to be able to discuss the issues of this forum with other people, and now you have a place to do it.

The forum address is http://GenerationalDynamics.com/forum.

I'm hoping to have invited guests give e-lectures and possibly even e-courses in the future.

I thank the ever-increasing number of readers of this web site for continuing to visit, and I hope that this forum adds value for you.

You can still use the comment link at the top of the page to send me an individual comment.

For all my online friends and acquaintances, I wish you the best as

we're apparently very close to entering a true crisis period. I hope

that this web site has helped you prepare for this day, and I hope

that this web site can continue to help you get through it.

(21-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Congress and administration officials are working through another weekend to try to find a way to prevent a systemic financial crisis.

According to the NY Times story:

WASHINGTON — It was a room full of people who rarely hold their tongues. But as the Fed chairman, Ben S. Bernanke, laid out the potentially devastating ramifications of the financial crisis before congressional leaders on Thursday night, there was a stunned silence at first.

Mr. Bernanke and Treasury Secretary Henry M. Paulson Jr. had made an urgent and unusual evening visit to Capitol Hill, and they were gathered around a conference table in the offices of House Speaker Nancy Pelosi.

“When you listened to him describe it you gulped," said Senator Charles E. Schumer, Democrat of New York.

As Senator Christopher J. Dodd, Democrat of Connecticut and chairman of the Banking, Housing and Urban Affairs Committee, put it Friday morning on the ABC program “Good Morning America,” the congressional leaders were told “that we’re literally maybe days away from a complete meltdown of our financial system, with all the implications here at home and globally.”

Mr. Schumer added, “History was sort of hanging over it, like this was a moment.”

When Mr. Schumer described the meeting as “somber,” Mr. Dodd cut in. “Somber doesn’t begin to justify the words,” he said. “We have never heard language like this.”

“What you heard last evening,” he added, “is one of those rare moments, certainly rare in my experience here, is Democrats and Republicans deciding we need to work together quickly.”

Although Mr. Schumer, Mr. Dodd and other participants declined to repeat precisely what they were told by Mr. Bernanke and Mr. Paulson, they said the two men described the financial system as effectively bound in a knot that was being pulled tighter and tighter by the day.

“You have the credit lines in America, which are the lifeblood of the economy, frozen.” Mr. Schumer said. “That hasn’t happened before. It’s a brave new world. You are in uncharted territory, but the one thing you do know is you can’t leave them frozen or the economy will just head south at a rapid rate.”

As he spoke, Mr. Schumer swooped his hand, to make the gesture of a plummeting bird. “You know we’d be lucky ...” he said as his voice trailed off. “Well, I’ll leave it at that.” ...

Lawmakers in both parties described the meeting in Ms. Pelosi’s office on Thursday night with Mr. Paulson and Mr. Bernanke as collaborative, and that they were prepared to put politics aside to address the needs of the American people."

According to several commentators on Friday, a major issue being address is a possible worldwide panic on money market funds. Furthermore, the effects of the Lehman Brothers bankruptcy are still being felt.

From the point of view of Generational Dynamics, there are three important points:

What we're seeing now is the first signs of the regeneracy. This situation is so serious that political bickering has been sharply reduced, though not yet eliminated. Once an actual panic occurs, then the real regeneracy will occur.

(For information about the term "regeneracy," see "Basics of Generational Dynamics.")

I'll repeat what I've been writing for the last six months:

I've estimated that the probability of a major financial crisis (generational stock market panic and crash) in any given week from now on is about 3%. The probability of a crisis some time in the next 52 weeks is 75%, according to this estimate.

Things must be very close now, and I could probably increase the "3%" figure to about 10%.

A big sign of how close things are is the major "crash upward" in

several of the world's stock markets -- 6% in two days on Wall

Street, 8% in Europe, and 26% in Russia.

(20-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Stock markets stage huge comeback as giddy investors pile in.

Exactly one year ago today, central bankers here and in Europe flooded the markets with liquidity, far in excess of what had been expected.

The results were spectacular. The credit crunch was brought to a halt. The markets had been falling, but now they shot up 2½% in a single day. They kept on going on, reaching a new high on October 9.

Do you remember what that massive monetary loosening was, Dear Reader? The fed lowered the Fed Funds rate by a full ½ point, when only ¼ point was expected. At the same time, the Bank of England guaranteed that depositors in the faltering Northern Rock Bank would be safe.

What was huge and massive a year ago now seems like a tiny baby step. Since then, Northern Rock Bank has been nationalized. Several American financial institutions have been rescued or nationalized as well -- many in just the last two weeks!

|

On Thursday, government officials took two major new actions:

It's worth noting that the credit crunch is not in money generally, but most specifically in US dollars. The Fed will make dollars available to foreign banks, which can then lend the money to other banks and businesses.

This is similar to actions taken by the Fed in the past, except that it involves a much larger chunk of money.

This new agency would buy up all those pesky near-worthless CDOs and other mortgage-backed securities.

The first announcement didn't cause much of a stock market rally at all. It was the second announcement that really caused the big rally.

Did you get that, Dear Reader? The infusion of $180 billion of new capital didn't have much effect, but the announcement that government officials were going to have a meeting caused a huge market rally. I've said this a million times, but it's worth saying again: What's happening on Wall Street has absolutely nothing to do with reality.

The idea behind this new agency (the revival of the RTC) is that it would restore the banking system by buying up all the outstanding securities that had turned out to be worthless.

Does the US government have enough money to do that?

"Well of course it does," you might say. "The government can print all the money it wants."

Well, that has certain practical difficulties. A few days ago, we described how the Fed was almost out of money.

The Treasury Dept. could sell Treasury bills, or offer them in exchange for near-worthless mortgage-back securities, but how much are we talking about?

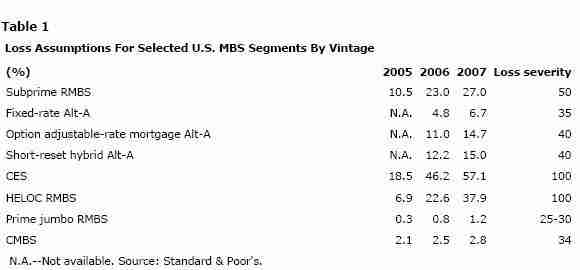

A new report published by Standard & Poors on Thursday (summarized on the FT Alpha site) says that things are getting worse.

|

What's interesting about the above chart is that it shows that the loss assumptions are worse for securities issued in 2006 than for securities issued in 2005, and worst of all for securities issued in 2007.

I've pointed this sort of thing out many times on this web site, and it's very important. By 2006, and certainly by early 2007, it was obvious that the assumptions underlying the creation of these securities were fallacious. But instead of stopping the issuance of faulty securities, the investment banks issued MORE of them, with even MORE faulty terms. This is circumstantial evidence of massive fraud.

But now turning to Thursday's S&P report:

The market is still searching for an equilibrium price on trillions of dollars of structured securities, in particular at the higher end of the ratings spectrum."

So according to S&P's report, there are trillions of dollars of more bad news to come.

The Federal government's budget deficit is twice as big as last year's deficit. The deficit was just under $300 billion for the first 9 months of the fiscal year, and raising that deficit by an additional trillion or two is not politically feasible.

The word "trillions" may be misleading because it leads you to think it might be just a few trillion. Keep in mind that there are $60 trillion dollars in credit default swaps outstanding, and there are $700 trillion of credit derivatives outstanding.

There is simply no possibility that the federal government will absorb all the losses endured by banks through worthless mortgage-back securities.

That's what makes Thursday's huge rally so remarkable. It was based on a meeting, a rumor, a plan, and an implied promise that can't possibly be fulfilled. But that's standard for investors, isn't it.

As I've said, it's really clear that no one has any idea what's going on or what's going to happen next. Look at all the historic events that have occurred in the last few days -- they were all unthinkable as of just a week or two ago.

Listening to pundits on Thursday, you hear statements like this: "This was more of the same, but it's a LOT more of the same. The Fed has to get ahead of the problem. By flooding this money into the banking system, and taking these steps, people will begin to regain confidence in the financial system again. This is the time to buy stocks -- there are a lot of bargains out there, at prices we haven't seen in years. A lot of people will be kicking themselves in a year or two for not buying now, when prices are so low."

These are commonly held views, and they're absolutely incredible. They say that fundamentals are completely irrelevant to the current crisis. The only thing that matters, according to this view, is "confidence," and that depends only on putting on a big circus in Washington, with lots of jawboning.

I started criticizing this "jawboning as policy" concept in 2004. It took me that long because I needed a very long time to realize that government official like Ben Bernanke could actually hold this moronic view.

Here's what I wrote at that time (17-Sep-04) in Federal Reserve congratulates itself on jawboning policy:

The spectre of deflation forces a historic change in economic theory:

Economists are shocked that the fight against inflation is over....

(8-Nov-2008)

What's coming next: Understanding the deflationary spiral:

Why are the dollar and the yen getting stronger, while the euro is getting weaker?...

(27-Oct-2008)

Roubini: The situation is "sheer panic," as hundreds of hedge funds are going bust:

Policy makers may need to close markets for one or two weeks....

(24-Oct-2008)

There's never before been a day like this on Wall Street.:

Possible exception: One of the days just before or after the 1929 crash....

(11-Oct-2008)

Ben Bernanke's Great Historic Experiment is at the brink:

Desperation sets in as credit markets continue to seize up....

(25-Sep-2008)

Government promises to buy bad debt to end the credit crisis:

Stock markets stage huge comeback as giddy investors pile in....

(19-Sep-2008)

Another stunning and historic bailout: Fannie Mae and Freddie Mac:

Giddy investors are popping the champagne corks....

(9-Sep-2008)

Long-term negative market trends asserting themselves strongly:

Stock and commodities prices plummet as worldwide foreclosures and recessions worsen....

(5-Sep-2008)

Money supply contracts dramatically, as credit markets continue to seize up.:

Former IMF chief: Worst of global financial crisis is yet to come....

(24-Aug-2008)

As commodities plummet worldwide, the meaning is unclear.:

We speculate on some possibilities....

(11-Aug-2008)

Alan Greenspan calls this a "once in a century" liquidity crisis.:

Says that the "big surprise" is the "impressive" American economy...

(3-Aug-2008)

More questions from readers on finance and investing:

Anxious readers wonder what's going on, what to do next....

(18-Jul-2008)

Pundits and analysts are baffled by the market's performance:

They have some interesting fantasies, as well....

(10-Jul-2008)

Questions from readers on finance and investing:

On fraud, the FDIC, China, and other subjects....

(23-Jun-2008)

Royal Bank of Scotland issues global stock crash alert:

"A very nasty period is soon to be upon us - be prepared,"...

(18-Jun-2008)

A clearer explanation of credit default swaps.:

How credit default swaps (CDSs) present a systemic risk to the global financial system...

(4-Jun-2008)

WSJ's page one story on Bernanke's Princeton "Bubble Laboratory" is almost incoherent:

So is Thursday's speech on bubbles by Fed Governor Frederic S. Mishkin....

(18-May-2008)

Brilliant Nobel Prize winners in Economics blame credit bubble on "the news":

Meanwhile, the deflationary spiral is in progress, but hyperinflation is not....

(27-Apr-08)

Investment bank UBS is now "writing down" clients' auction rate securities:

From individual investors to tech firms, people are losing their money....

(29-Mar-08)

Both consumer and commercial credit is disappearing as deflationary spiral accelerates:

Wall Street markets plummet 3% on Tuesday, as service sector contracts sharply....

(6-Feb-08)

Will hyper-inflation make the dollar worthless (like the Weimar republic)?:

I've gotten this question several times this week from web site readers,...

(21-Dec-07)

Questions and answers about the "credit crunch":

What's going on, and what you can do about it....

(6-Dec-07)

Understanding deflation: Why there's less money in the world today than a month ago.:

As the markets continue to fall, the Fed is increasingly in a big bind....

(10-Sep-07)

Bernanke's historic experiment takes center stage:

An assessment of where we are and where we're going....

(27-Aug-07)

Ben Bernanke's Great Historic Experiment:

Bernanke doesn't believe that bubbles exist. His Fed policy will now test his core beliefs....

(18-Aug-07)

Japan's real estate crash may finally end after 16 years:

To see where America is going, look what happened in Japan....

(20-Feb-07)

This week's financial data points to trend back toward deflation.:

Several inflationary indicators are down for June...

(17-Jul-04)

| ||

The claims are based on a study led by Fed Governor Ben Bernanke. The study found that merely by making statements that interest rates would be kept low for a "considerable period," the Fed changed public expectations so much that the values of stocks increased from 2003 to 2004. The conclusion is that the Fed can continue to use verbal statements to affect the economy positively.

I cannot say how strongly I disagree with this conclusion. It presumes that stock prices are based totally on emotions, and not on fundamentals.

Maybe that does work once, for a few months, but could Bernanke and the others possibly believe this strategy could ever work again? The only reason it worked this time is because it's never been used before. If it's ever tried again, people will remember, and won't be fooled a second time. ...

What really bothers me about all this is that Fed governors actually seem to believe this stuff.

I listen to high-priced analysts on TV all the time, and for them there's never any bad news. When stocks go up it's good news because stocks are going up; when stocks go down, it's good news because prices are low and people can buy more stocks cheaply. If these analysts were more balanced in their appraisals I might find them more credible, but when it's good news all the time, my conclusion is that they're in a serious state of denial.

Bernanke's report leads me to conclude that the Fed governors are in denial too, if they really believe that they can continue to get away with using a jawboning policy.

As we've previously said, the fundamentals are clear that we're in a period of long-term deflation, and can expect prices to fall by 30% in the next few years. Jawboning might postpone (and indeed has postponed) that result, but the fundamentals will win out sooner or later."

In 2004 I was simply astonished, but today it infuriates me that our Fed Chairman could believe such blithering nonsense, and is basing his entire policy on it.

Thursday's announcements are just more of the same that we've been getting for years. Say the right thing, do the right dance, have the right ringmaster, and investors will "regain confidence," and start expanding the bubble again. The journalists eat it up, the analysts sagely agree. What a pathetic bunch of idiots running things.

There's still a lot of debate surrounding the question of whether we're headed for a deflationary spiral versus whether we're headed for hyperinflation.

Hopefully, those who still believe that we're headed for hyperinflation will be able to see for themselves in the next few days how impossible that is.

The Fed is now injecting $180 billion of new money into the banking system. That should cause enormous amounts of hyperinflation right there.

Instead, what you'll see is a continuing deflationary spiral.

The credit bubble created hundreds of trillions of dollars of new money. The credit bubble is leaking now, and those trillions of dollars are disappearing. The Fed is injecting $180 million, and that's a tiny, paltry, drop-in-the-bucket sum compared to the leaking of the credit bubble.

On Thursday afternoon at about 4:30, CNBC reported "an astounding headline" that total money market fund assets are down $169 billion in the last week. This is based on a a new report by the Investment Company Institute.

This adds to other anecdotal evidence that panic selling is increasing.

This has been happening on international markets as well. The worst hit is the Russian stock market, whose index has fall 60% in the past quarter. Panic selling has been so prevalent that Russian President Dmitry Medvedev has had to shut down the stock market for most of the week.

See "Panic selling may be close, as money market fund 'breaks the buck,'" for more information

on the consequences of panic selling.

(19-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

The man with 86 wives, and a fatwa against Mickey Mouse.

Saudi cleric Sheikh Muhammad Munajid is at it again.

|

Last month, he was criticizing the Olympics games as impure because there were bikini-clad women competing.

Now he says that Mickey Mouse must die!:

If a mouse falls into a pot of food – if the food is solid, you should chuck out the mouse and the food touching it, and if it is liquid – you should chuck out the whole thing, because the mouse is impure.

According to Islamic law, the mouse is a repulsive, corrupting creature. How do you think children view mice today – after Tom and Jerry?

Even creatures that are repulsive by nature, by logic, and according to Islamic law have become wonderful and are loved by children. Even mice.

Mickey Mouse has become an awesome character, even though according to Islamic law, Mickey Mouse should be killed in all cases."

But Mickey Mouse's troubles don't compare to the troubles of Mohammadu Bello Abubakar, a Nigerian man with 86 wives and 170 children.

In the Quran, Mohammed limits the number of wives that a man can have to 4. (Polygamy is absolutely essential in warring societies, since a woman whose husband is killed in war still needs the protection of a husband.)

So Abubakar was arrested, and charged with "insulting religious creed" and "unlawful marriages".

When I heard this story reported on the BBC, the (female) anchor said that "a man can get into a great deal of trouble with 86 wives."

Abubakar was quoted as saying, "Only a real man could handle 86 wives. Other men would have difficulty handling even just 10 wives."

To which I would add: A lot of men get into trouble with just one

wife.

(18-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

It's beginning to sink in.

One reader wrote as follows:

Hell, the week isn't over yet!

That's my expectation.

It's a weird feeling just sitting here and watching the market crash. You can see it coming but there's not a blessed thing you can do about it."

It's never too late to start preparing. Don't wait until you run out of choices. Take steps today to preserve as much money as you can.

Amazing! An analyst who actually takes price/earnings ratios into account! They'll probably have to fire him now.

This comes from someone in the Silent generation:

Brother, can you spare a dime?

I am SO glad I paid off the house and car and rental condo, moved my account over to [a Federal Credit Union], and got a lot of the major work done on the house, yard, and self before this hit. It's a pity I am no longer up to such things as putting in vegetables myself.

I've been advising people to seek out any genuine Senior Citizens among their kinfolk and acquaintances and get their stories before it's to late."

This is a sensational idea. If you have somebody in your life who's 70 years old or older, then get a tape recorder and go talk to that person. Find out what you're going to be facing in the next few years.

The following is from an old online friend, living in Florida:

Here's what I wrote in answer to a question from a web site reader several months ago, "More questions from readers on finance and investing":

Answer: "Picture a world where you're a 30 year old father with 3 kids under 5, you've lost your job with no hope of getting another job, so you and your family have to live for the foreseeable future on what you have today. How would you change your life?

You would save every penny, knowing that if you can save a dollar today, then that dollar may save your life a year from now. You would cut out every expense not necessary for survival - magazine subscriptions, piano lessons for the kids, clothes, movies, pizzas, wide-screen tvs, lights left on when nobody's around, driving when you can take the bus, etc., etc.

The best advice I can give you is to speak to your family now, tell them what's coming and why you have to save every penny, and then follow through.

One more thing: Many people should start thinking about moving in together. Two families sharing a home will save a lot of money. If your rich cousins have a couple of extra bedrooms in their mansion, ask them if you could live there. You'll both save a lot of money."

I thank the ever-increasing number of readers of this web site. I spend most of my spare time on this web site, but it's you that make it all worth it.

The amount of e-mail has been increasing, but I'm still managing to answer pretty much all of it, although sometimes it takes me longer than it used to. As usual, you're invited to send me a comment or question via the "COMMENT" link at the top of each page.

I'll end with the same message I've given many times: No politician can stop what's coming, any more than they can stop a tsunami. You can't stop what's coming, but you can prepare for it. Treasure the time you have left, and use it to prepare yourself, your family, your community and your nation.

Once again, my friends: Treasure the time you have left.

(18-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Ordinary people with 401Ks will start losing their investments.

For the average man trying to raise a family and hoping that his 401K and other investments are safe, the year-long credit crisis, with its talk of "collateralized debt obligations" and "credit default swaps" has been something that affected only major institutions, not him.

For him, the soothing words of government officials that "the fundamentals are sound" and "nobody has lost money in an FDIC-insured account in 50 years" have been all he needed to continue to trust that the "system" is OK, and that he and his family are OK. In particular, he felt that his money market funds are ok.

Now a money market fund has announced that it will "break the buck." The value of its assets has fallen sharply, thanks to big investments in the now bankrupt Lehman Brothers.

The Reserve Primary Fund, run by the New York-based Reserve Management Corp., is reducing the value of its shares from $1.00 per share to 97¢ per share. This means that a person with a 401K who had $10,000 invested yesterday has only $9,700 today. Actually, he can't get his money out at all, so really he has no money today.

|

There's panic in the air. The soothing words of politicians are no longer working. People no longer worry about whether they can earn ¼% more interest; they're worried about losing their money.

Several commentators have said that there's anecdotal evidence that people are already pulling money out of their money market funds, and S&P is keeping its eye on 9 other money market funds that may be close to the same decision, thanks to heavy investments in Lehman.

A lot of people where hoping that the bailouts of Fannie and Freddie, and then of AIG would end the problems. I heard some total idiots on CNBC Wednesday say that stock prices are poised to take off.

But, Dear Reader, nothing has changed. ABSOLUTE NOTHING. The real estate bubble is still collapsing. Thanks to "resets" in adjustable rate mortgages, the foreclosure rate will continue at least well into 2010. There's no question about this. Bailing out AIG has NOTHING to do with that. And price/earnings ratios are still at astronomical levels. Bailing out AIG has nothing to do with that either.

You have to understand, Dear Reader, that NOTHING has changed. This cannot possibly get better. It MUST get worse, MUCH worse. It's a mathematical certainty, no matter what the idiots on CNBC or in Washington or on the campaign trail say.

As we've said many, many times, from the point of view of Generational Dynamics, if you go back through history, there are many small or regional recessions. But since the 1600s there have been only five major international financial crises: the 1637 Tulipomania bubble, the South Sea bubble of the 1710s-20s, the bankruptcy of the French monarchy in the 1789, the Panic of 1857, and the 1929 Wall Street crash.

These are called "generational crashes" because they occur every 70-80 years, just as the generation of people who lived through the last one have all disappeared, and the younger generations have resumed the same dangerous credit securitization practices that led to the previous generational crash. After each of these generational crashes, the survivors impose new rules or laws to make sure that it never happens again. As soon as those survivors are dead, the new generations ignore the rules, thinking that they're just for "old people," and a new generational crash occurs.

I've described a generational crash as an elemental force of nature, like a tsunami. There will be millions or even tens of millions of Boomers and Generation-Xers in countries around the world, never having seen anything like this before, and not having believed it was even possible, suddenly in a state of total mass panic, trying to sell all at once. It's impossible to predict the date when that will happen, but it's going to happen with absolute certainty.

It's worth noting that at the end of Wednesday's trading session, the

Dow Industrials index was 26% below the high that occurred last

October, as you can see from my Dow Jones historical page. At this depth, a massive panic becomes

increasingly likely.

(18-Sep-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal