Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Greek public sectors unions plan big May Day demonstrations on Saturday.

That was the headline for Thurday's EuroIntelligence briefing, which began as follows:

|

In fact, Angela Merkel is getting a great deal of blame for her apparent flip-flop on the issue. Merkel originally insisted that Greece would only receive money "as a last resort," and that was when Germany's share was going to be only 8.4 billion euros. But now that the total bailout has tripled, to 135 billion euros over 3 years, German's share is now 25 billion euros. Merkel's political opponents are claiming that she ensured that a "last resort" would come to pass, according to FT.

The German people have been opposed to aiding Greece from the beginning, and now that the amount of aid has tripled, opposition has increased. German newspapers are whipping up an anti-Greece fury, according to the Guardian. The headline on the tabloid Bild says, "The Greeks want even more of our billions! Will Greece become a bottomless pit for German taxpayers?"

Reuters quotes the conservative newspaper Frankfurter Allgemeine Zeitung as saying,

The choice of words -- "complacency turning to panic" -- is interesting because that's the Generational Dynamics paradigm for what happens during generational Crisis eras. The survivors of a crisis war (like WW II) are very cognizant of the dangers, and they create austere rules and institutions to prevent any recurrence. The younger generations born after the crisis war (like our Boomers and Generation-Xers) rebel against the austere rules and become complacent about the dangers. Then, when an emergency occurs during a Crisis era, these younger people turn from complacency to panic, and often over-react.

European officials are now meeting to come up with a commitment to aid Greece, by loaning Greece 130 billion euros at low interest rates over a three year period.

This will require agreement by the German Bundestag (parliament), and there will also be court challenges. But now that complacency has turned to panic, there is an urgent desire to get a agreement signed over the weekend.

As I understand the press reports, Merkel expects to get the necessary German law passed in the same way that President Obama got his health care bill passed. Merkel plans to use her governing coalition to force a favorable vote in the Bundestag, irrespective of the opposition of the German people.

There is also a possible compromise scenario. Greece has to make an 11 billion euro payment on its debt on May 19. If EU officials cannot get the full 130 billion euro bailout passed, then they might simply provide an 11 billion euro bailout, and then start the negotiating process all over again after May 19.

But what if no agreement can be reached at all? Above we mentioned the possibility of an over-reaction, and this would be it.

Even if an agreement is reached on a bailout of Greece, there still remain the problems of Portugal and Spain. Both of these countries have had their debt ratings lowered, although not to the level of junk status that Greece's debt occupies.

When you take into account all of the PIIGS countries (Portugal, Italy, Ireland, Greece and Spain), a total of 600 billion euros in aid would be required, according to Bloomberg.

This brings us to the "nuclear option." Stated simply, the European Central Bank would "print" 600 billion euros, creating new money, and then use the money to purchase bonds at nominal value from all the PIIGS countries.

The article points out that there are plenty of political and legal obstacles to such a proposal. But Ambrose Evans-Pritchard, writing in the Telegraph, says that although this option would be prohibited by existing treaties in normal times, the ECB can buy unlimited quantities of assets in times of systemic crisis.

A proponent of the nuclear option is Jacques Cailloux, the chief Europe economist at the Royal Bank of Scotland.

The article quotes him as follows:

The ECB has been side-lined in the Greek crisis so far but do you allow a bond crash in your region if you are the lender-of-last resort? They may have to act as contagion spreads to larger countries such as Italy. We started to see the first glimpse of that today, [referring to Portugal and Spain].

This feels like the banking crisis in late 2008 post-Lehman, though it has not yet spread to other asset classes. The ECB will have to act it if does."

The nuclear option would be a world-changing event. It would inflate and weaken the euro currency, and would effectively be a devaluation. However, the dollar would be considerably strengthened, as investors fled to the dollar for safety.

Merkel isn't the only one being blamed for the euro crisis. Some people blame the speculators Spiegel, while other people blame the American ratings agencies Spiegel.

Ratings agencies are still making huge amounts of money in fees and commissions on the collateralized debt obligations (CDOs) that they originally rated AAA, before they turned into "toxic assets." Regular fee payments were built into the original deals, irrespective of the accuracy of the ratings. Financial Times

Neil Barofsky, head of the Administrations SIGTARP program, is criticizing Treasury Secretary Timothy F. Geithner for his role in the AIG bailout in 2008. Bloomberg

Al-Qaeda in Iraq is running short of suicide bombers. AFP

A major confrontation between Islamist extremists and the Pakistan army is looming in the tribal areas of North Waziristan. Asia Times

Belgium's lower house of parliament has voted overwhelmingly to ban all clothing that covers or partially covers the face, effectively banning the Islamic Burqa. Deutsche Welle

(Comments: For reader comments, questions and discussion,

see the 30-Apr-10 News -- Politicians assign blame as euro crisis deepens

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(30-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Continuing 'Red Shirt' protests in Thailand lead to violence

The bad news just kept pouring out on Wednesday.

The S&P ratings agency downgraded Spain's debt on Wednesday -- not a lot, but enough to concern everyone that dominoes are falling, the day after the Portugal's debt was downgraded, and Greece's debt was lowered to junk status. AP

Financial officials, including International Monetary Fund (IMF) chief Dominique Strauss-Kahn and Jean-Claude Trichet, head of European Central Bank (ECB), met with German lawmakers in an attempt to break the impasse over the aid package to Greece. The London Times reports that the main result of the meeting was an understanding the planned 45 billion euro bailout package was not nearly enough, and it would have to nearly triple to 120 billion euros over three years.

Nouriel Roubini, who changes his mind as often as the weather, and who was predicting a U-shaped recovery just a few weeks ago, is now talking about the collapse of the euro currency. The LA Times quotes him as saying, "The reality is that what has happened in the last few months is the first test of the viability of the European market [and the euro currency].

He added that the possibility of the European monetary union coming apart is "significantly rising."

Worldwide attention is now being focused on Germany, which is increasingly facing the reality that they're going to be blamed for this debacle.

Highly respected financial columnist Wolfgang Münchau, writing in FT Deutschland, wrote the following (translation):

You can have a number of different opinions on how to respond to the crisis in Greece, but no matter how the German interest is defined, it is really very difficult to reconcile the German interest with the postion of the Chancellor.

Politically, the strategy was to sign declarations of solidarity in Brussels, and then to describe herself at home as "Madame Non," but this has backfired.

Angela Merkel would have taken more than one benefit from it, to delay the decision on helping Greece until after the May 9 NRW elections, if the tactic had not been so obvious. And economically it makes no sense, if you examine the story to its logical end."

Münchau goes on to examine the various options, and concludes that the only option that won't be disastrous for the German economy is to bail Greece out. And he suggests that Merkel's motive is to bring about the end of the euro currency.

Many commentators are suggesting that Merkel's delaying tactics are responsible for making the situation much worse, and much more expensive. Thus, an analysis by Der Spiegel indicates that the actual cost will be 135 billion euros, not 120 billion, and it quotes a German opposition politician as saying, "The indecisiveness and dithering of the European Union, instigated by the chancellor, have exacerbated the crisis and driven the consolidation requirement into the heavens."

The claim that Merkel's "dithering" has worsened the crisis is apparently based on the belief that the delay has forced Greece to borrow money at high interest rates, thus increasing their debts. My feeling is that even an early aid package would have reduced the 135 billion euros by only a small amount.

According to recent polls, 86% of the German people are opposed to helping Greece. That poll was taken when the bailout amount was 45 billion euros. Now that the bailout amount is 120 billion euros, or 135 billion euros, it's hard for me to see how the German people are suddenly going to be more willing to help Greece.

This is turning into a potentially ugly situation for Germany. There are still many ill feelings toward Germany in Europe, left over from the last century, and this situation will stoke them.

As I've been saying for some time now, the trend towards a Greek default has a huge amount of momentum, and I don't believe that there is any way of stopping or even slowing that trend, at this point. In fact, the momentum seems to have grown almost every day for the last month.

From the point of view of Generational Dynamics, we're in the midst of a turning point in history. We cannot take our eyes off of it, for the same reason that we can't take our eyes off of a traffic accident. We feel the same morbid fascination, but we also feel horror when we realize that we're not just bystanders to the traffic accident. We're all in the middle of it, and we're all going to suffer from it.

The "red shirt" protests in Bangkok, Thailand, have now been going on for six weeks, much longer than anyone expected, and have been growing. Since the beginning of April, the protestors have occupied the Bangkok's high-class shopping district, forcing stores to close, and leading to a state of emergency. Army troops attempted to clear the protestors on April 10, but suffered a humiliating defeat, with 25 people killed, and hundreds injured.

On Wednesday there was new violence, with the security forces firing rubber bullets at the protestors, causing 16 injuries, according to the BBC. One soldier was killed, apparently by a shot fired by someone in the security forces.

The red shirts, who support former prime minister Thaksin Shinawatra, have promised to end their protest when the government dissolves parliament, and makes way for new elections. Prime Minister Abhisit Vejjajiva has resolutely refused to give in to these demands.

The following Al-Jazeera video gives a pretty good picture of life in downtown Bangkok these days:

One mystery associated with the protests is identity of the mysterious "men in black," well-armed men wearing black, faces covered with hoods, who have appeared in the crowds of red-shirt protestors and opened fire on troops. They're well trained, according to Reuters, and it's feared that they're former army rangers supporting Thaksin Shinawatra.

With the protests going on for so long, and with the loss of money from having the shopping district shut down, it's feared that the army will again resort to violence to disperse the protestors.

From the point of view of Generational Dynamics, Thailand is in a generational Awakening era, and so a full-scale civil war is impossible. However, as we've seen in Iraq and Iran, spurts of violence that can still occur. They may be short-lived, but people get killed all the same.

People who regularly eat chocolate are more depressed than other people. BBC

Russia has posted online Stalin's secret papers on the 1943 Katyn massacre of Polish soldiers. Times Online

A Russian company is selling a long-range precision strike missile that can be hidden inside a shipping container, giving any merchant vessel the capability to wipe out an aircraft carrier, or any other target. Reuters

A drought in western Africa has threatened Niger with total crop failure. Nearly 8 million people are facing starvation. BBC

Migrants in Mexico from El Salvador, Guatemala, Honduras and Nicaragua are facing a "major human rights crisis," according to Amnesty International. Almost half of them are raped or abducted for ransom, often by public officials. BBC

A team of evangelical Christian explorers in Turkey claim that they've found the remains of Noah's ark. National Geographic

Boy Scouts can now earn merit awards for learning video game skill sets. MSNBC

A new map from the state of California shows more than 50 new surface earthquake faults that have been discovered. LA Times

(Comments: For reader comments, questions and discussion,

see the 29-Apr-10 News -- Desperate Europeans try to stave off euro currency collapse

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(29-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

There's been a 'quiet freeze' on new Jewish settlements in east Jerusalem.

I heard a BBC reporter today describe this situation as "embarassing." Well, wearing non-matching socks is embarassing, but having your debt reduced to junk status requires slightly stronger words, don't you think? Apparently investors think so.

There's the smell of panic in the air today.

Markets fell 1.5-3% in Europe, North America and Asia, after the Standard & Poor's Ratings Services announced that it was lowering the rating on Greece's debt to "junk bond" status, and yields on 2-year bonds went to 15%.

But the junk bond rating is not the worst of it, according to FT Alphaville. In its announcement, S&P said that if a default occurs, bondholders will lose 50-70% of their investment.

However, in the spirit of "all talk, no action," officials from the European Union and the International Monetary Fund (IMF) talked about things that they might do to calm the situation.

The NY Times reports that the EU governments may hold a summit meeting on May 10, "in an effort to show unity." Well, what does that mean? They're already the European "Union," so what unity are they going to show?

The May 10 date was undoubtedly chosen because it's the day after the German elections. The hope is that the Germans will be more generous with aid money then. However, according to the Independent, polls indicate a roughly 50-50 chance that Angela Merkel's governing coalition will lose, since the German people so strongly oppose a Greek bailout. This would undermine the stability of the German government, and put the aid package into further doubt.

And Reuters reports that the IMF is in talks to increase its share of the planned aid to Greece to 25 billion euros from 15 billion euros.

The intent would be to increase the size of the total package from 45 billion euros to 55 billion euros. But I wouldn't be surprised if this IMF offer is used as a reason by some IMF countries to reduce their own contributions.

Reuters is providing a summary of the status of the aid package on a country by country basis. If you read through the article, you can see that in most cases, the aid is dependent on approval by the nation's parliament, and there is no committed date. One gets the feeling that the entire aid package is a house of cards.

The Greek financial crisis is gathering momentum. It's already gathered enough momentum that I don't believe that anything can stop it now, even if the will existed to stop it.

S&P also lowered Portugal's credit rating on Tuesday, though not to junk status. Bloomberg reports that the amount of debt as a proportion of GDP that Portugal has to refinance this year is one of the highest in the euro region, leaving the country "vulnerable to changes in investor sentiment," according to S&P.

I've heard several financial pundits claim that because Greece is such a small country, a default by Greece would not have much effect on anyone else. This is the height of wishful thinking.

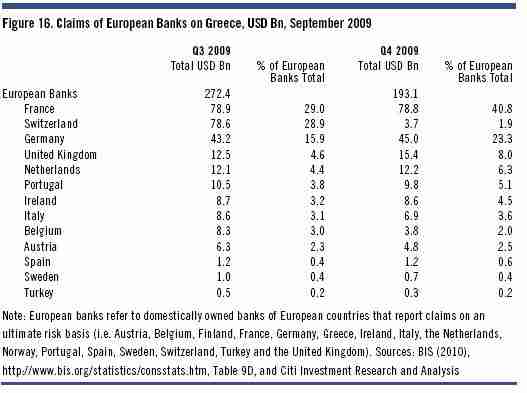

FT Alphaville has provided the following chart of the exposure of European banks to Greek debt:

|

Recall that we stated above that S&P expects holders of Greek bonds to lose 50-75% of their investments if Greece defaults. Thus, European banks will lose hundreds of billions of dollars in assets, in case of a Greek default. Contrast that with the "paltry" 45 billion euro aid package that may or may not get approved.

A lot of people are now thinking about the financial collapse of central Europe in 1931. Here's what I wrote in 2007 in "The bubble that broke the world:" On May 11, 1931, the Credit-Anstalt bank of Austria failed. This triggered mass panic and bank failures throughout Central Europe, and generated a worldwide banking crisis. On July 13, the German Danatbank failed. Foreign investors in Germany quickly withdrew their capital from Germany, heightening the crisis, leading to the complete collapse of the German economy. By the end of the year, there were over 6 million unemployed, and the resulting social tension gave rise to Communism and Naziism.

A lot of people now are worried that this will happen again.

From the point of view of Generational Dynamics, we're headed for a global financial crisis, with 100% certainty. With Greece in almost total meltdown, with Portugal to follow, this may be the trigger that causes the financial crisis.

Israel's Prime Minister Benjamin Netanyahu has stated that there would be no halt to the building of Jewish settlements in Jerusalem, but there's apparently been a "quiet" freeze put into place for new contruction. CS Monitor

Germany has made the Greek crisis worse, through hesitation and patronizing advice. While the Greeks have produced "one false [financial] report after another," the Germans "delight in hindering a rapid and unambiguous European response to the Greek crisis." Der Spiegel

Although US stocks fell on the Greek news, stocks were set to fall anyway, because of deepening unemployment, according to Mitsubishi UFJ Securities Co. Bloomberg

Tired of investing in sinful stocks? Consider the Stoxx Europe Christian Index, which lets you invest in companies that are compliant with Christian moral and social doctrines. Christian Today

Cities in Italy and around the world are being crushed by debt, as the financial crisis continues to worsen. Washington Post

Like China and Japan, South Korea is stealthily building up its armed forces. The need for stealth is one reason why they haven't directly accused North Korea of sinking their warship on March 26. Diplomat

Powerpoint presentations have become an obsession among the military officials responsible for the war in Afghanistan. NY Times

Food prices in India have risen by as much as 20% over the past year, giving rise to nationwide protests and the rise of communist parties. BBC

Posters advertising a small Citroen C3 hatchback car contain the slogan, "Be like Madame Bruni, take a small French model". The ad mocks French president Nicolas Sarkozy, who is shorter than his supermodel wife Carla Bruni, and is causing a scandal. Telegraph

(Comments: For reader comments, questions and discussion,

see the 28-Apr-10 News -- Greece melts down, as bond rating lowered to 'junk' status

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(28-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Talk of Greek default, and dire consequences for euroland, is becoming more widespread.

On the one hand, German chancellor Angela Merkel is facing elections on May 9, and one poll quoted by Financial Times indicates that some 86% of Germans are opposed to the proposed EU/IMF bailout of Greece.

That's why Merkel is taking a "hard line" on the plan, according to the Irish Times.

On the other hand, Greece will default if it can't make an 11 billion euro payment on May 19, and if Greece defaults, then the world is going to blame Germany. Merkel knows this, and that's why Merkel says that "Germany is ready to help," according to Bloomberg.

The two seemingly contradictory positions are rationalized by imposing all but impossible conditions on Greece as a requirement for aid. Thus, Merkel is demanding that Greece go beyond its partial austerity plan for the next year, and commit to even harsher deficit reductions in the two years that follow.

Ironically, a majority of Greeks also oppose the bailout deal. According to a poll quoted by Reuters, 61% of Greeks are opposed.

It appears that the German people and the Greek people agree on something: That Greece should pull out of the eurozone, and return to using its old national currency, the drachma. That may be the people's choice, but it's not the politicians choice. German, EU and Greek government officials have all been unanimous in saying that having Greece leave euroland is not an option.

I believe that a lot of people are hoping that Angela Merkel will soften her position after the May 9 election, and that the aid can be provided to Greece in time for the May 19 payment.

For several weeks we've been describing the rising yields (interest rates) demanded by investors who agree to purchase Greek debt, and those yields have jumped to a substantial new high, with 2-year bond yields exceeding 13%, according to FT Alphaville.

The following graph of Greek 2-year bond yields since January shows what's been happening:

|

Although no politician is saying this, and no mainstream journalist or analyst is reporting this, and no mainstream blogger is blogging this, this is a full-scale panic, as the prices of Greek's 2-year bonds are crashing, pushing yields up. (Recall that with bonds, yields go up when prices go down, and vice versa.)

What this means is that investors are increasingly convinced that 2-year bonds are going to default, which means that they're convinced that Greece is going to default within two years.

This has really been pretty obvious for several weeks, as we've been reporting on this web site. There's a solid chance that aid won't be provided to Greece in time for their May 19 payment. But even if aid IS provided, then Greece has to continue making payments, and the proposed EU/IMF aid package is only enough for a year. This means that the Germans are going to be asked to write another check to Greek next year -- and the year after that, which means that this whole process would have to be repeated over and over. Today, there's no credible chance that that will happen.

For months I've been writing on this web site about the certainty of a Greek default, and the farcical play acting going on in Brussels, as politicians pretend to be working on a way to save Greece, but all the time simply spewing the most fatuous possible nonsense in press releases and press conference statements.

This is just a little nothing web site, so if you're a regular reader, you may be wondering, as I have for years on this and other subjects, why you have to come to this particular web site to actually find out what's going on in the world? Why are journalists and bloggers so credulous that they simply reprint the press release statements of the politicians, who are little more than circus performers?

Well, as credulous as the mainstream reporters and financial experts are, even they are having a hard time going on with this game.

Thus, in the NY Times we read, "Only a few weeks ago, the idea that Greece might restructure its debt seemed like the nuclear option. Now restructuring — a polite alternative to outright 'default' — is not only thinkable, but even likely."

And we're reading even more dire commentary, that a Greek default would mean the end of the euro. FT Alphaville quotes a published note from an analyst at the Royal Bank of Scotland as saying exactly that.

He makes a very interesting technical argument to prove his point, and it has to do with whether or not euro area loans to Greece would be senior to existing Greek debt. What this means is that if the aid package is approved, and enough money is loaned to Greece to meet the May 19 payment, and then Greece defaults anyway, then who will get paid first -- the EU lenders, or the older debtors?

The above is just one example of the complexity of the situation. My reason for presenting it is to show that there is now an active discussion going on about the possibility (or probability) of a Greek "restructuring," or default.

Strategists at the Royal Bank of Scotland seem especially contemplative these days, as FT Alphaville quotes a note from another of their analysts.

This note is so "right on" that I want to quote it at length. The author's name is Bob Janjuah:

I had assumed, after doing what it took in late 08 and early 09 to avoid global depression and systemic financial system collapse, that policymakers & their buddies would see the light and realise that the only path to long term success for the problem economies (US, UK, most of Europe, Japan, etc) would be a period of Austerity, Balance Sheet repair, Deflation, Real Structural Economic reform and Serious Financial System/Accounting regulation/reform. This path is NOT the easy path near term, but it is the ONLY path for ensuring the long term health and success of the problem economies, as well as ultimately the ONLY path which will both successfully iron out the grotesque global imbalances and help ensure the long term success of the global economy.

SADLY, during my period of reflection, I have come round to the view that we have missed this golden opportunity. What instead I am seeing is a desperate attempt to re-write history (‘there was no bubble’, ‘rates too low for too long had nothing to do with it’, ‘it’s all just the fault of a bunch of greedy traders’, etc etc) AND at the same time it is clear global policymakers and their buddies, whilst jaw-boning us about ‘exit’ and ‘austerity/fiscal repair’, simply do NOT mean what they are saying – in other worlds, they are talking ‘responsibly’ but are acting IMHO in a reckless and irresponsible manner. And in my book actions ALWAYS speaker far more clearly and far louder than (cheap) talk.

The Greece bail-out, the goings on at the IMF involving the huge build-up of ‘new bail-out’ reserves, and all the talk in the UK about fiscal repair based on fantasyland ‘efficiency gains’ are the latest evidence that policymakers EVERYWHERE have no appetite to be brave, to be strong and to do the right thing. It seems that it is clearly too painful to do anything else. Instead, policymakers EVERYWHERE seem to have decided that the only way out of the hole is MORE DEBT, MORE DEBASEMENT, MORE BAILOUTS, ugly INFLATION and/or even uglier STAGFLATION, FAKE AUSTERITY, ZERO STRUCTURAL ECONOMIC REFORM, & MINIMAL REGULATORY REFORM.

We are trapped in some horrendous Keynesian/monetarist nightmare, where policymakers, aided/abetted/advised by their buddies in the media, in the lobbyist cabal and in financial system, have YET AGAIN decided to go down the route which merely delays the problem/pushes it down the road, but which virtually guarantees that when the NEXT bubble collapses (I assume it will be the Global Government Debt/Bond Bubble and/or the Global Fiat Money/Paper Money/FX Bubble), there is NO pleasant way back."

Janjuah is essentially predicting a global financial crisis and market crash. That this is coming is well known to readers of this web site, but it's interesting to see the reasoning that brought Janjuah to this conclusion.

He had actually thought that the mini-crisis that we've had so far, since 2007, would actually be enough to get politicians and bankers and journalists to change their behaviors and actually act responsibly.

But that's not how the world works. The world NEVER works that way. Janjuah blames this on "some horrendous Keynesian/monetarist nightmare," but this has nothing to do with schools of economics. This is a generational phenomenon.

Nothing that's happened in the last three years has caused the greedy, nihilistic Gen-Xers in finance, journalism and politics from being willing to screw anyone for their own gain. Nothing that's happened in the last three years has caused the greedy, incompetent Boomer managers to learn how to lead or manage. The same people who created the crisis in the first place are still in their jobs, still following the same types of behaviors.

A web site reader recently wrote to me about how he understands Generational Dynamics:

This is exactly right. From the point of view of Generational Dynamics, you need a major, existential crisis to change the nihilistic, incompetent behaviors of the politicians, analysts and journalists, and force them to adopt new behaviors just to survive.

It's really not so strange. After all, many times an alcoholic will keep on drinking until the day that he completely "reaches bottom," having lost his money, his wife, his family, his job and his home, and only then will he change his behavior. The same is true of the world today.

For the nations of Europe, especially Greece, their geography controls their destiny. NY TImes

I've frequently criticized Paul Krugman for giving up economics to become one of the dumbest left-wing political commentators on the planet. So I was pleasantly surprised to see this article, "Our Giant Banking Crisis—What to Expect," by Krugman and his wife, Robin Wells. It's an intelligent analysis, and contains almost no fatuous ideological nonsense. NY Review of Books

Army of rats invades Manhattan's Upper East Side. No, we're not talking about bankers, lawyers or politicians. WSJ

The Taliban is escalating violence in Kandahar with bombings, as Nato forces prepare to launch the next major offensive of the Afghanistan war. CS Monitor

Hardline Iranian cleric Hojatoleslam Kazim Sadeghi, says women and girls who "don't dress appropriately" cause promiscuity, and promiscuous girls cause earthquakes. "There is no way other than taking refuge in religion and adapting ourselves to Islamic behavior," he adds. CNN

Ukraine marks the 24th anniversary of the Chernobyl nuclear disaster, that changed all of their lives forever. Deutsche Welle

(Comments: For reader comments, questions and discussion,

see the 27-Apr-10 News -- Greece's bonds are hammered, with yields at 13%

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(27-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

South Korea's defense minister blames warship sinking on torpedo

For what the NY Times describes as the "make-or-break offensive" of the entire Afghanistan war against the Taliban, elite American special forces soldiers have been operating in Kandahar, picking up or picking off insurgent leaders to weaken the Taliban.

Once the major battle begins in the weeks to come, the intent is that the major effect will be carried by the Afghan Army and police units.

The Taliban are also taking steps to prepare for the battle, by stepping up bombings and attacks against contractors, religious leaders and public officials allied with the coalition forces.

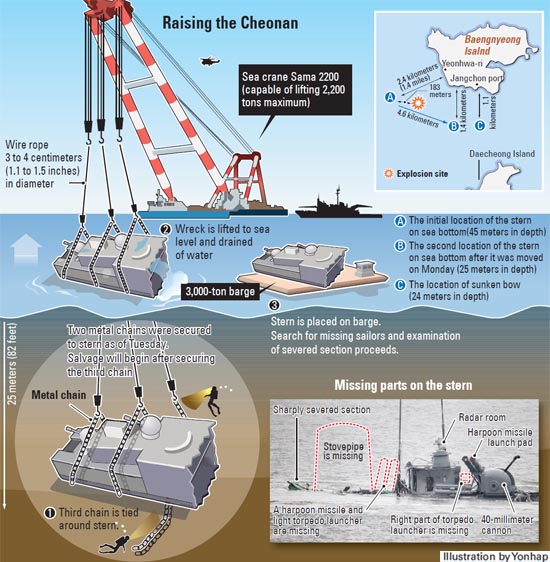

A month ago, the Cheonan, a South Korean navy warship, exploded and sank near North Korean waters, killing 46.

The evidence has increasingly pointed to a North Korean attack, but the South Koreans have carefully avoided saying so, since a direct accusation of that type would inevitably lead to war.

But VOA reports that on Sunday, South Korea's Defense Minister Kim Tae-young said that the evidence is pointing to a torpedo that exploded beneath the boat, creating a powerful shock wand and high-pressure gas bubble that split the ship and sank it.

Although Kim didn't name North Korea, it's generally thought that North Korea is the only place that such a torpedo could have come from.

Tension is building enormously between North and South Korea. Nobody wants a war, but it will take very little additional provocation to start one.

Greece must agree to tough new austerity measures, before it will receive any financial aid from Germany. Reuters

When "The Pill," the oral contraceptive for women, was announced in 1954, it was thought that it would end poverty, divorce, and unwed pregnancy. NY Times

Top ten Goldman Sachs excuses. David Letterman

How to fight debt collection agencies. NY Times

(Comments: For reader comments, questions and discussion,

see the 26-Apr-10 News -- Nato prepares for attack on Kandahar

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(26-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Thailand's prime minister rejects protestors demands.

A month ago, the Cheonan, a South Korean navy warship, exploded and sank near North Korean waters. Only 58 people were rescued out of 104 crew members, and the other 46 drowned. The evidence has increasingly pointed to a North Korean attack, but the South Koreans have carefully avoided saying so, since a direct accusation of that type would inevitably lead to war.

But in a highly emotional televised speech last week, South Korea's President Lee Myung-bak promised "resolute and unwavering" action over the warship sinking, once the investigation has been completed.

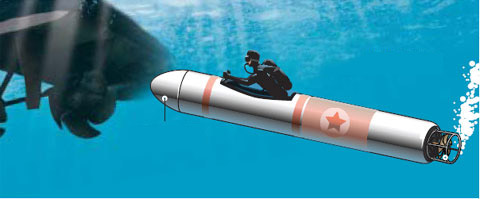

The investigation has been proceeding, and now South Korea's Chosun news agency reports that military officials are focusing on "human torpedoes," like Islamist suicide bombers, or like Japanese "kamikaze" or "kaiten" pilots in WW II.

|

According to the article, defectors from North Korea have reported that human torpedoes are among the most elite of the country's soldiers.

Tensions have been growing between North and South Korea, as it appears more and more likely that the North Koreans will be blamed, Xinhua reports that North Korean leader Kim Jong-il has said that the North Korean army is "fully prepared" to defeat the South Korea enemy, if it comes to war.

U.S. administration officials are calling for a return to the six-party talks on North Korea's nuclear weapons development, but at the same time, Indian Express reports that North Korea is preparing for a new nuclear bomb test.

Anti-government "red-shirted" protestors offered to end their demonstrations if prime minister Abhisit Vejjajiva called new elections within 30 days.

But CNN reports that Abhisit has rejected the call for new elections.

The protests have gone on a lot longer than anyone ever expected, and they've shut down a large part of Bangkok's shopping district.

There have already been killings, first by the army shooting at protestors, and then, last week, by explosive grenades apparently launched by the protestors.

Military officials have expressed reluctance to use force against the protestors, but the government may order them to if the protests continue much longer.

From the point of view of Generational Dynamics, Thailand is in a generational Awakening era, and so the demonstrations may go on for a long time, possibly for years, but they won't spiral out of control into a civil war, since a crisis civil war is impossible during a generational Crisis era.

The German media have been mostly hostile to Greece's request for financial aid from the European Union and the International Monetary Fund, since Germany would end up having to pay for most of the aid. Reuters

To stop a rout, the EU must commit to the bailout. But, as investors have made clear, the turmoil doesn't end with Greece. Speculators will then target Portugal, Spain and Ireland. NY Times

Palestinian President Mahmoud Abbas is urging the Obama administration to impose a forced solution on both Israel and the Palestinians, giving the Palestinians an independent state. From the point of view of Generational Dynamics, a forced solution has no chance at all of succeeding. Haaretz

Voters may be turning against labor unions. In New Jersey elections last week, budget increases were rejected for districts where teachers unions refused to accept wage freezes. Asbury Park Press

Kelsey Grammer, the former star of the situation comedy "Frasier," and currently appearing on Broadway in "La Cage aux Folles," is launching the RightNetwork, a venture aimed at Tea Party supporters. Times Online

Armenia is marking the 95th anniversary of the World War I killing of Armenians by Ottoman Turks. Those killings have been a major issue for decades, with the Turks calling them casualties of war and the Armenians calling them genocide. And now, a deal between Turkey and Armenia to establish diplomatic ties and reopen their common border has collapsed. Washington Post

(Comments: For reader comments, questions and discussion,

see the 25-Apr-10 News -- N. Korea's 'human torpedoes' may have sunk S. Korea's warship

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(25-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

'Generation Zero's Steve Bannon gives blowout speech at NYC Tea Party

If you want to understand why people flocking to the "Tea Party" are so angry, then forget the crap you've been reading in the NY Times, and consider the following quote:

In the last 20 years, our financial elites and the political class have taken care of themselves and led our country to the brink of ruin."

This encapsulates why a lot of people are furious. And long-time readers of the web site are well aware how furious I am at what's been going on, and that I was furious years before the "Tea Party" was even launched (early in 2009). I'm not a member of, or participant in, the "tea party" movement, but I identify with much of their anger, and I see them as having adopted MY anger, rather than the other way around.

The last 20 years include both Republican and Democratic administrations, and both Republican and Democratic Congresses. This is not about party ideology or party politics. It's about greed and arrogance on the part of elite financial engineers and their managers, politicians and journalists, who take the attitude that they can use their power and influence to screw anyone they want for their own personal gain.

The above quote is from a speech given by Steve Bannon, the writer and director of the documentary movie Generation Zero that I've discussed in the past, and in which I appear as commentator. (See "More on the politics of the 'Generation Zero' movie" and "New York City premiere of Generation Zero documentary movie.")

Now, if you'd like to read some mainstream media crap about the Tea Party, read the column by Dana Milbank in the Washington Post.

But if you really want to understand why Tea Party people are so angry, then spend ten minutes listening to this video of Steve Bannon's speech last week. The above quote is at the 2:00 point.

An analysis by Kimberley Strassel in the WSJ describes how the tea party movement is splitting up the Republican Party for the same reasons that it's attracting Democrats.

She says: "The Republican Party is split. But the real divide is between reformers like Mr. Rubio and Wisconsin Rep. Paul Ryan, who are running on principles and tough issues, and a GOP old guard that still finds it politically expedient to duck or demagogue issues. As Republicans look for a way out of the wilderness, this is the rift that matters."

Speaking for myself, I'm just as furious at Republicans who caused this problem as I am at Democrats. When I read how some banker defrauded the public, I don't say to myself, "Oh, he's a Republican, so that's OK," or "Oh, he's a Democrat, so that's fine." I couldn't care less what party they belong to. Politicians of both parties have turned into crooks. As far as I can tell, this attitude is shared by a lot of people in the Tea Party movement, as well.

As I've been saying for years, long before the Tea Party started, America is headed for a new political consensus that will throw under the bus almost all of the agenda developed by the Boomers on the right AND left since the 1960s. The Boomers believe that they changed the world, but the world is about to change them.

From the point of view of Generational Dynamics, this major political realignment is coming, and today it looks like the Tea Party is going to play a role. It obviously makes the Democrats very unhappy, but it's also splitting the Republicans. Take whatever partisan pleasure you'd like from that statement, but in the end, no one is going to be happy about what happens.

A recent NY Times / CBSNews poll finds that Tea Party supporters are wealthier and more educated than the general public. They're more likely to be older -- from the Boomer and Silent generation.

But one thing that always seems to unite them is that they highly disapprove of President Barack Obama and his policies. This has caused the leftist loons to accuse Tea Partiers of everything from racism to stupidity. (Do you remember the Presidential campaign, when Hillary Clinton was running against Obama, and Bill and Hillary Clinton were being called racists? Opposing President Bush's policies was considered patriotic, but opposing President Obama's policies is considered racist.)

The reason that Boomers disapprove of Obama is because Obama, like many Generation-Xers, hates Boomers. I've written about this several times. (See "Barack Obama to Boomers: Drop dead!" and "The nihilism and self-destructiveness of Generation X." Also, with regard to the health care debate last year, see "The Revenge of the Boomers.")

It's as simple as that. Obama and his supporters are constantly directing contemptuous remarks at Boomers, and so Boomers disapprove of Obama.

A related but separate phenomenon from the Tea Parties is the increasing distrust in government felt by people in all generations.

A recent Pew Research Poll finds that:

Rather than an activist government to deal with the nation’s top problems, the public now wants government reformed and growing numbers want its power curtailed. With the exception of greater regulation of major financial institutions, there is less of an appetite for government solutions to the nation’s problems – including more government control over the economy – than there was when Barack Obama first took office.

The public’s hostility toward government seems likely to be an important election issue favoring the Republicans this fall. However, the Democrats can take some solace in the fact that neither party can be confident that they have the advantage among such a disillusioned electorate. Favorable ratings for both major parties, as well as for Congress, have reached record lows while opposition to congressional incumbents, already approaching an all-time high, continues to climb.

The Tea Party movement, which has a small but fervent anti-government constituency, could be a wild card in this election. On one hand, its sympathizers are highly energized and inclined to vote Republican this fall. On the other, many Republicans and Republican-leaning independents say the Tea Party represents their point of view better than does the GOP."

The article is accompanied by a graphic that shows the changing levels of trust in government over time, since the 1950s:

|

This is another one of those many cases where the generational interpretation is so obvious that it almost screams at you. But mainstream media is completely oblivious to it. The Pew Research article tries to explain in terms of Presidential personalities, but in the end, it all comes down to generations.

As with all generational crisis wars, World War II united the country behind the government, and trust in government remained very high during the Recovery era that followed the war. Trust began to fall sharply in the generational Awakening era of the 1960s-70s. That was time of political chaos in America, with assassinations, long hot summers of street violence, and bombings by the Weather Underground.

Incidentally, you can see the same thing happening in countries that are in generational Awakening eras today, including Lebanon, Iraq, Iran and Thailand. There's political chaos in all of these countries, like America in the 1960s, and trust in government is plummeting.

In America, trust bobbed up and down and up during the generational Unraveling era of the 1980s and 1990s, but has been falling sharply since the generational Crisis ear began in the early 2000s.

This is all following the generational script. Right now, trust in government has fallen extremely low, and continues to plummet.

And there's one more thing. As I've been saying for years, many bankers are going to go to jail. That's part of the same phenomenon.

Distrust is turning into public anger and fury, and the Tea Party is rising out of that anger, and will have its revenge.

(Comments: For reader comments, questions and discussion,

see the Generation Zero - The Inconceivable Truth thread of the

Generational Dynamics forum.)

(25-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Arizona governor signs tough immigration law called 'misguided' by Obama

As regular readers of the web site are well aware, it's been obvious for at least a couple of months that Greece is headed for bankruptcy, and that the carnival shows that EU officials put on week after week offered only palliatives. In particular, the EU finally offered a non-bailout bailout. This was a promise of money that would be given only if Greece were about to default, and only if then all the EU states agreed to it. The silly hope was that this mere promise of a future consideration of a bailout would alone be enough to restore investor confidence in Greece.

On Friday, Greece finally "pulled the trigger," and formally asked for the non-bailout bailout package of 30 billion euros.

The letter (PDF) was sent by George Papaconstantinou, Greece's Minister of Finance, to Eurogroup officials, and contained only one sentence:

In accordance with the Statement of the Heads of State and Government of 25 March 2010 to provide financial support to Greece, when needed, and the follow up Statement of the Eurogroup, Greece is hereby requesting the activation of the support mechanism.

Sincerely,

George Papaconstantinou"

Greece's financial deterioration had been gathering momentum, as we've been reporting on an almost daily basis for several weeks. And other countries, especially Portugal, were beginning to suffer from Greek "contagion," meaning that they were showing the same symptoms as Greece.

In fact, Europe appears to be approaching full-scale panic, as can be seen from the following graph from FT Alphaville of credit default swap (CDS) prices from debt from Greece and Portugal:

|

Recall that a CDS is a kind of insurance policy, where the insurance will be paid if the underlying debt defaults. If the CDS price increases, it means that insurers are demanding more money to insure the debt, and investors are losing confidence that a default can be avoided. The above graph shows that Greece's CDS prices are going parabolic, and Portugal's are close behind.

Furthermore, Greece is facing a hard deadline. The country has about 2 billion euros in available reserves, but needs to make payments of 11 billion euros on existing debt on May 19.

This is a freight train careening out of control, headed for a smashup. Will Friday's request for aid stop the freight train, or at least slow it down? We'll see on Monday.

The headwinds are enormous. The 30 billion euros of aid would come from other EU countries. Germany would have to contribute the most -- 8.4 billion euros. Bloomberg quotes German chancellor Angela Merkel has already said that any aid package would depend on Athens satisfying "very stringent conditions."

Those conditions would require additional austerity on the part of the Greeks. Thousands of people from Greece's communist-linked public sector unions marched in Athens on Friday, in protest against the request for aid, as reported by Al-Jazeera. And ongoing demonstrations for next week, and the weeks to come.

Even if the aid package is finalized, then Greece's and Europe's troubles are not over. First of all, the 30 billion euro aid package is only a down payment -- Bloomberg quotes Steven Major, global head of fixed-income research at HSBC Holdings Plc in London, as saying that more than 45 billion euros will be needed beyond this year. Germany didn't like paying reparations to France in the 1920s, and I doubt that they'll tolerate paying "reparations" to Greece in the 2010s.

And even if all those problems are solved, it looks like an aid package for Portugal will be required next.

This is actually going to be fascinating to watch.

Yesterday I wrote about interest rate derivatives are a ticking time bomb.

Credit default swaps (CDSs) are insurance policies that protect the buyer against default of the underlying debt. Interest rate swaps are insurance policies that protect the buyer against changes in interest rates. Both of them are in the category of credit derivatives.

The Bank of International Settlements indicates that in June, 2009, there $604 trillion (notional value) of outstanding derivative contracts, and over half of these, $341 trillion, were interest rate swaps.

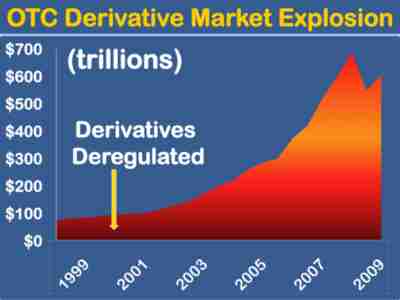

A Washington Post article by Ezra Klein provides a picture of the explosive growth of the derivatives market:

|

This is the major feature of today's global financial system. The size of the American economy is around $14 trillion, which is an anthill compared to the Mount Everest of interest rate swaps. And as yesterday's article indicated, there are the same kinds of fraud for interest rate swaps as there were for the mortgage-backed CDO securities that caused the financial crisis so far.

The big difference is the size. There were only a few trillion dollars of CDOs, and they continue to cause a great deal of trouble.

There are a few HUNDRED trillion dollars of interest rate swaps. These are numbers that are almost unimaginably huge.

CDOs are being written down 50-75%. If interest rate swaps are written down only 5%, that would be a loss of $15 trillion around the world. That would be a huge dislocation. And if that 5% becomes 30%, then the loss would be comparable to the values of all the real estate and businesses in the world.

On Friday, Arizona governor Jan Brewer signed the toughest law against illegal immigration in the country. Church groups, the government of Mexico and civil rights groups opposed the bill, and President Obama called the bill "misguided," according to the LA Times.

Protests against the law have already begun in Arizona, and the law may encounter national opposition.

Several web site readers have written to me objecting to my use of the "xenophobia" to describe the growing public support in Arizona for this law.

In the comments section in the Generational Dynamics forum, one person asked, "A nation protecting itself and its citizens by enforcing Immigration laws (already on the books) against ILLEGAL intruders is 'xenophobia that leads to wars?'" From there, the writer went on to become completely hysterical.

This goes to show how strong the emotions are surrounding this issue.

For one thing, "xenophobia" is one of my favorite words in the English language. (Can anyone guess why?)

But more important than that, the words encapsulates the emotions that are driving this issue. As I've said many times, Generational Dynamics deals with the behaviors and attitudes of large masses of people, entire generations of people. And "xenophobia" describes a fairly common attitude during generational Crisis eras.

In the forum, member "ridgel" responded as follows:

Mexico is in a world of hurt. Their three main export revenue sources, oil, remittances, and tourism are all way off. Because of the decline in their main Cantarell field, they may become oil importers in the next few years. Remittances are way off, I've seen estimates of 20-30% as Mexicans formerly employed in construction and hospitality are layed off. And tourism has been hurt by both the recession and the drug violence. Speaking of drug violence, that's just about the only viable industry left for the common Mexican at this point. And cities like Ciudad Juarez, just south of El Paso, are basically in open warfare at this point."

The "sea change of opinion" is exactly the point. Whether it's good or bad -- and there are plenty of people on both sides of this issue -- there is no doubt that things have changed dramatically in the attitudes of Americans on this subject. The Arizona law is just the beginning of the controversy.

U.S. investors don't think that the Greece problem is any problem at all. The stock market bubble on Wall Street continues to grow, and Friday's session pushed the bubble to new highs since the 2007 credit crunch. Bespoke Investment

Now we know why SEC employees never got around to prosecuting Bernie Madoff. They were spending hours watching porn when they were supposed to be working. CNN

As we've been saying for years, China plans to confront American ships throughout the Pacific and Indian oceans. It's already beginning, and military officials are expressing surprise at how quickly it's happening. NY Times

Free meals in Denmark. All you have to do is ride an exercise bike attached to a generator at the Crowne Plaza Hotel in Copenhagen long enough to produce 10 watt-hours of electricity, and you get a free meal. BBC

(Comments: For reader comments, questions and discussion,

see the 23-Apr-10 News -- Greece, near bankrupcy, makes formal request for aid

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(24-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Grenades explode in Bangkok, Thailand, with dozens of casualties.

Bad news came in gushers on Thursday, for Greece and Europe:

All of these indicators appear to be accelerating in the wrong direction, implying that Greece and Europe are experiencing a classic full-scale panic. It's like a huge ball rolling downhill that keeps gathering momentum until it can no longer be stopped. There's a very real possibility that a full-scale crash is imminent, though of course this isn't the first time I've said that. At the very least, some kind of financial dislocation appears to be coming very rapidly.

The NY Times reports that there are fears that wider violence will be ignited after multiple grenades exploded on Thursday in the heart of Bangkok's business district, killing 3 people and wounding dozens.

The red-shirted anti-government protestors have virtually shut down Bangkok's business district. Thousands of Thai soldiers have been deployed to prevent the demonstrators from spreading further into other areas. It was in the context of this faceoff between the army and the demonstrators that the grenades exploded. Protest leaders denied that they had anything to do with the explosions, but army leaders claim that the grenades came from the area occupied by the demonstrators.

There are fears that the violence will escalate into a full-scale civil war.

But Thailand is in a generational Awakening era, and so such a civil war is impossible.

We've discussed this many times on this web site, with regard to other countries in Awakening eras, including Lebanon, Iran and Iraq. There have been protestors and violence in each of these countries, but any violence that broke out fizzled fairly quickly.

It's worth remembering, for comparison purposes, that there was plenty of violence during America's last Awakening era, in the 1960s-70s. There were assassinations of President John Kennedy, his brother Bobby Kennedy, Martin Luther King, Malcolm X. There were riots and bloodshed at the 1968 Democratic national convention, several "long, hot summers" of riots in the streets, bombings by the Weather Underground, and shootings at Kent State.

This kind of violence occurs during generational Awakening eras, and it will probably get worse before it gets better in Thailand. But it will not spiral into full-scale civil war.

We talk about the dangers of credit default swaps all the time, but the most popular types of derivatives are interest rate swaps.

Both of them are insurance policies, but credit default swaps pay off when the underlying debt defaults, and interest rate swaps pay off when interest rates change.

The thing is that there are hundreds of trillions of dollars (nominal value) of securities based on interest rate swaps in portfolios of financial institutions around the world. Thus a major change in interest rates, such as a rate increase by the Fed, the European Central Bank or the Bank of Japan, might trigger huge payouts at institutions around the world. And since these derivatives are highly correlated, there is a potential for tens of trillions of dollars to be due from sellers to buyers all at once.

A guest post at Yves Smith's Naked Capitalism blog on Thursday is an excellent overview of the systemic dangers of interest rate swaps.

The article shows that interest rate swaps have been marketed to investors even more fraudulently than mortgage-backed securities were marketed several years ago.

The Russians are already angry at the US for allowing the drug trade to grow in Afghanistan, since most of the drugs end up on the streets of Russia. Now the Russian media are wondering if the recent Kyrgyzstan coup was engineered by the drug trade, with the encouragement of the US. The result is a growing Russian-Uzbek alliance against Kyrgyzstan. Asia Times

Although Kyrgyzstan is right on China's border, China is playing it cool as Russia and the US battle for prestige in Kyrgyzstan. However, jihadists in Pakistan and Afghanistan are heading for the Fergana Valley, at the intersection of Kyrgyzstan and Uzbekistan, and a hot summer may lie ahead. Asia Times

When Chinese hackers infiltrated Google's network, the result was increased xenophobia on both sides, with both the US and Chinese increasingly believing that the other side is hacking their computers. Fierce Gov IT

Germans are shocked at the revelation by Google that Germany is number 2 in the world in censoring online content, way ahead of its European neighbors. This has led to some soul-searching. Spiegel

News you can use: FAQ on Eyebrow Grooming for Men. eyebrowz.com

Buying carbon offsets may ease eco-guilt but not global warming. CS Monitor

On Friday, Leonard Nimoy will visit Vulcan, Alberta, to anoint the town as the "Official Star Trek Capital of Canada." After that, he's hanging up his Spock ears for good and retiring. Vancouver Sun

(Comments: For reader comments, questions and discussion,

see the 23-Apr-10 News -- Torrents of bad news for Greece and Europe

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(23-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Greece's financial problems are spreading around Europe

Arizona Governor Jan Brewer is almost certain to a tough immigration bill, according to the Phoenix Business Journal. The law expands police powers to arrest illegal immigrants, and requires the police to check the papers of any who seems suspicious.

The law is motivated by recent crimes perpetrated by illegal immigrants, including the murder of a rancher. But opponents, including Hispanic groups and the Catholic Church, say that the documentation requirements for immigrants smacks of a police state.

According to the article, Brewer will almost certainly sign the bill because a veto would mean that she would probably lose the Republican primary election.

The controversy is taking on national and even international importance.

Mexico's Foreign Relations Department said that the proposed law "could have potentially serious effects on the civil rights" of Mexican nationals.

If the law is signed, it's possible that either the Obama administration or a federal court will intervene,

From the point of view of Generational Dynamics, this kind of xenophobia is typical of a generational Crisis era. We see it targeting the Muslims in Europe and the Christians in India. During a generational Crisis era, this kind of xenophobia grows until it results in war.

I've noticed that many commentators are talking as if Greece has already been bailed out, and it's just a matter of signing a few papers to give Greece its 45 billion euro bailout package from the EU and the IMF.

However, nothing could be further from the truth. Any proposed aid package would have to be reviewed by the German Bundestag (parliament) and Verfassungsgericht (constitutional court), and will face other legal challenges, before any money can be delivered to Greece, and it's altogether possible that the legal challenges will succeed.

Almost every day, Greece's financial situation plummets deeper and deeper into a hole. On Wednesday, according to Bloomberg, credit default swap (CDS) prices -- the cost of insuring Greek debt -- surged to a fresh record of 495, meaning that it costs 495,000 euros to insure 10 million euros of Greek debt for a year. Typical CDS prices before the financial crisis were around 20-30.

Furthermore the yield (interest rate) on Greek 10-year bonds spiked to 8.29%. It was just a couple of weeks ago that Greek officials were alarmed that it had risen above 6%. Interest rates seem to go up by 20-30 basis points almost every day.

Of even greater concern to officials is that it appears that the Greece problem is spreading to other European banks, according to Bloomberg. European banks in general were affected, but Spanish and Portuguese banks led the way with CDS prices for their banks surging to 265 and 269.5 for the respective countries.

This comes on top of a report that Spanish banks' bad loans rose by $2.8 billion in February, to a 14 year high, according to Reuters.

From the point of view of Generational Dynamics, the global financial system is headed for a deflationary crash and a global crisis with certainty. It's impossible to predict with certainty what will trigger that crisis, but more and more each day it looks like it will begin in Europe.

The Fabulous Fab -- referring to Fabrice Tourre, the Goldman Sachs VP whom the SEC accused of fraud along with Goldman Sachs itself -- has agreed to testify in the Senate. That will be a fun day. Bloomberg

With Japan experiencing deflation almost continuously for 20 years, Japanese politicians are demanding that the Bank of Japan adopt a mandatory inflation target, so that inflation will end. The BOJ says that inflation targeting does not work, which is true. Reuters

Mensa Selects Its Favorite Brainy Games of 2010. Wired

For those who, like me, experience sleep apnea, you might try rebalancing your circadian rhythms. NY Times

News you can use: A survey of 1,500 women by Phone 4u finds that men who have an Apple iPhone are more attractive to women than those who do not. "If he has an iPhone then he's obviously intelligent and well-off." Fox Business

For years I've been writing about how Iraq is in a generational Awakening era, like America in the 1960s. Now here's another sign: The art community is blossoming in Baghdad, just like it did in Greenwich Village and Haight Ashbury. Spiegel

Ukraine's new pro-Russian government has signed a deal with Russia that gives the Russians 25 years of access to the Sevastopol naval base on the Black Sea, in exchange for a 30% discount on natural gas. This appears to end a bitter feud that intensified during the Russian war with Georgia, but opposition pro-Western politicians in Ukraine are accusing the government of treason. CNN

(Comments: For reader comments, questions and discussion,

see the 22-Apr-10 News -- Controversy over Arizona immigration law

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(22-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

IMF issues a warning on sovereign debt.

It's been two weeks since Kyrgyzstan's government collapsed after violent street protests.

|

President Kurmanbek Bakiyev fled from the capital Bishkek, and is currently hiding out in Minsk, Belarus, under the protection of that government, according to the AP.

Kyrgyzstan's new interim government, led by Roza Otunbayeva, used violence to oust Bakiyev, and is now has to deal with increasing ethnic violence. The violence, by indigenous Kyrgyz, is directed against other ethnic groups, especially Turks and Russians, as reported by the Independent. (By the way, remember that Turks originally came from central Asia; Turkey was named after the Turks that settled there, rather than the other way around.)

The violence includes ethnic murders, torching of houses and cars, and robbery.

Russian President Dmitry Medvedev has ordered his defense minister "to take measures" to protect ethnic Russians living in Kyrgyzstan, according to Bloomberg. According to the CIA Fact Book, the country is 65% Kyrgyz (religion: Muslim) and 12.5% Russia (Russian Orthodox).

News reports do not indicate what "measures" the Russian government plans to take, but one must assume that they would include the introduction of additional Russian soldiers into the country.

Medvedev has been predicting a civil war in Kyrgyzstan. If he's right, then the fighting could spread through the region, and even ignite something in Pakista.

The International Monetary Fund (IMF) has issued a report that the growing volume of government debt is the biggest single risk to the world economy, according to the Independent.

The offending countries include several countries in Europe, but also include the UK and the U.S.

From the point of view of Generational Dynamics, we're headed for a major global financial crisis with 100% certainty. However, the event that will trigger the crisis is still a question. The Lehman Brothers bankruptcy had a chain reaction effect after it occurred in 2008, and the bankruptcy of a country could have an even worse chain reaction.

The Financial Times reports that "the unthinkable has become thinkable," and market watchers are now increasingly considering the possibility of a Greek default.

As we've been saying on this web site for weeks, a default is not only "thinkable," it's actually all but certain. The theatre that the Europeans have putting on to pretend to be aiding Greece have been nothing but high comedy.

Meanwhile, bond rates and credit default swap prices surged to new highs on Monday, underlining the fact that something very dramatic is going to happen soon.

As if that wasn't enough bad news, Kathimerini (translation) reports that Greece's unemployment rate also surged, to 11.3 in January, compared to 10.2% in December.

Legislation to help the German long-term unemployed has been put on ice, because the possibility of a Greek bailout has thrown the entire German budget into confusion. Now the Germans have one more thing to hate the Greeks for. Euro Intelligence

Younger workers, in their 20s and 30s, are increasingly being asked to take on responsibilities normally reserved for employees with a lot more work experience, since companies are trying save money and cut labor costs. WSJ

The shadow inventory of foreclosed houses keeps growing larger, and will push home prices lower. CNBC

It's the dawning of the Age of Aquarius in London, where the revival of the 1960s musical Hair celebrates the hippie Boomers of the 1960s. Telegraph

The Eyjafjallajökull (ay-yah-FYAH-lah-yer-kuhl) volcano may be shifting from a Surtseyan eruption to a more Strombolian mode. CS Monitor

However, the Eyjafjallajökull volcano is right next door to the Katla volcano, and the eruption of one could well mean an eruption of the other. AP

(Comments: For reader comments, questions and discussion,

see the 21-Apr-10 News -- Ethnic violence grows in Kyrgyzstan

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(21-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Greece hurtles toward financial default.

The issue of the sinking of South Korea's warship three weeks ago took a sharp turn on Monday.

To recap: Three weeks ago, the Cheonan, a South Korean navy warship, exploded and sank near North Korean waters. Only 58 people were rescued out of 104 crew members, and the other 46 drowned. The evidence has increasingly pointed to a North Korean attack, but the South Koreans have carefully avoided saying so, since a direct accusation of that type would inevitably lead to war.

All along I've said that my expectation is that the South Korean government would keep stalling, and would find a way to say that the evidence of a North Korean attack could not be substantiated.

However, Monday's developments have now put that expectation into doubt.

In a rare live televised speech on Monday, South Korea's President Lee Myung-bak made an emotional promise to find the those responsible for the sinking, and to take appropriate action, according to the Korea Times.

|

President Lee tearfully read out the names of the 46 sailors who had been killed, and said the following:

If (the two Koreas) are reunited and genuine peace and prosperity comes to this land, the people will remember your sacrifice again. Your fatherland, which you loved, will not forget you, ever. ...

"A strong military is made not only by powerful weapons but also by strong spirit. What we need now is strong spirit above all," he said. "We need to reflect on ourselves now. We have to find out and fully address what it is that we lack, what the problem is."

My guess is that Lee would have preferred to continue not saying anything, but was forced to make this speech because of the huge and growing fury building up in the South Korean population. This dramatic speech changes everything, since it commits the South Korean government to taking some kind of retaliatory action.

North and South Korea are technically still at war, since the 1950s Korea war ended in an "armistice" rather than a peace agreement. The two sides have been involved in numerous minor military skirmishes over the years, but this one has been growing into the most significant.

It's possible that this situation will spiral into full-scale warfare, but I would imagine that the Americans and the Chinese are already talking to one another about how to bring the two sides under control.

According to Yonhap, the United States State Dept. supports bringing the sinking incident before the United Nations Security Council, if North Korea's involvement is confirmed. Since that would provide an almost ironclad guarantee that nothing would be done, we'll have to see if the South Korean people people are satisfied with that solution.

Financial inspectors from the European Union and the International Monetary Fund (IMF) were supposed to go to Athens on Monday to discuss the terms of a bailout, but the meeting was called off because of the volcanic ash crisis that has shut down much of Europe's aviation industry. The meeting has now been postponed until Wednesday.

In the meantime, the prices of credit default swaps (CDSs) that insure Greece's debt rose to historic highs, according to Bloomberg.

This means that investors increasingly believe that Greece is going to default, which means that they increasingly believe that there will be NO aid or bailout package. This should be no surprise to regular readers of this web site, which has repeatedly pointed out that each supposed aid plan for Greece has been a farce and a delusion.

Commentators are beginning to catch on that there's no solution to the Greek financial crisis.

The commentary from Frankfurter Allgemeine notes mournfully that Germany will have to pay the largest share of the 45 billion euro bailout, costing each German citizen 100 euros. "But what's the use?" This bailout is just enough to make the current month's payment, and "the debt is still there." The commentary (translated) adds:

The current motto is: We have the money ready as a last resort, but it will cost the public nothing. But even this statement is likely to last only a short period of time.

And the fundamentals justify the distrust. The truth comes closes to the sentence: We will provide the money and we don't know if it's enough, and whether we'll ever see it again."

Because of the great distrust and opposition by the German people and because of the inevitable challenges in Germany's Verfassungsgericht (constitutional court), it's hard for me to believe that Germany will ever provide any bailout money.

The attitude is growing that if Greece is going to default sooner or later, then it might as well default sooner, and save everybody else some money.

This brings us to the commentary by Wolfgang Münchau in Financial Times.

You may recall that last week I quoted Münchau as saying that Greece would not default this year, but would default next year.

Now he says,

Once again, Münchau makes that case that there's no point in bailing out Greece, because Greece is going to default anyway.

What would it take to save Greece from default? Greece would have to implement very severe additional austerity measures, such as raising taxes, cutting pensions, cutting spending and wages, and increasing the retirement age. In fact, that's what the IMF and EU officials will tell the Greeks during their meeting on Wednesday.

However, Greece has already raised taxes and cut spending. According to Bloomberg, Greece’s biggest unions threatened new strikes and a “social storm” if the government cuts pension benefits. Civil servants already plan their third 24-hour strike of the year for Thursday, to protest the austerity measures.

Remember how the SEC ignored one warning after another about Bernie Madoff's Ponzi scheme? Well, apparently the SEC also ignored warnings about another Ponzi scheme, the one operated by R. Allen Stanford. USA Today

A European Union commissioner has declared that vacations are a "human right," and that anyone too poor to afford vacations should have them subsidized by the taxpayer. Times Online

For techies: How Google's Chinese hackers infiltrated the software developers' computers, and gained access to Google's top secret source code. NY Times

China's real estate bubble has led to the construction of millions of shoddy buildings. China Daily

Cuba's Roman Catholic cardinal says that the country is in its worst political crisis, as people are demanding that changes be made immediately. NY Times It sounds like Cuba is close to having its Awakening era climax crisis.

A new suicide bombing in Peshawar, Pakistan, kills 23. BBC

Kenya is being very hard hit by grounded European airplanes, as 1,000 tons of Kenyan produce and flowers per day cannot be shipped to Europe. VOA

(Comments: For reader comments, questions and discussion,

see the 20-Apr-10 News -- South Korea may retaliate over sinking of warship

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(20-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Israelis fear Scud missiles in Lebanon, and Iran's nuclear development.

Since the death of Yasser Arafat in 2004, there have been three wars in the Mideast: Israelis vs Hizbollah in Lebanon in 2006, Palestinian Fatah vs Hamas in Gaza in 2008, and Israelis vs Hamas in Gaza in 2009. It's possible that a new war is approaching.

All three of these wars have ended, but not definitively. Each war was left in a kind of limbo, where both sides agreed to stop shooting at each other for a little while.

Thus, threats of a fourth war, this summer, are not exactly a far-fetched thought.

The thoughts of war are being triggered by a report by Israeli intelligence that Syria is supplying long-range Scud ballistic missiles to Hizbollah in Lebanon.

During the 2006 war between Israel and Hizbollah, Hizbollah launched missiles at Israel, but they weren't long range enough to reach Tel Aviv or Jerusalem. The Scud missiles would have that capability.

The result is that Israel has sent a secret warning to the Syrians that if Hizbollah launches missile attacks on Israel, then Israel will launch retaliation against Syria itself, according to the London Times. An Israeli minister, speaking off the record, says, "We’ll return Syria to the Stone Age by crippling its power stations, ports, fuel storage and every bit of strategic infrastructure if Hezbollah dare to launch ballistic missiles against us."