Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Closed end funds seem to be like a roach motel: You can check in, but you can't check out

I've been mentioning these arcane, obscure "auction rate securities" for a few days now -- in "Pundits are now referring to a spreading 'subprime virus'" and "'Credit crunch' domino effect is now affecting student loans."

The situation appears to be worsening significantly, according to a report by Steve Lieseman on CNBC on Wednesday morning.

As you read this, just get a sense of it, and don't worry about the technical details of what the different kinds of funds and securities are. Just remember that we're talking about the "safest" AAA rated securities -- supposedly as safe as cash -- securities that your pension fund, your college's endowment, your mom's money market fund or your employer might have invested in, because they're so "safe."

Here's my transcription of the report:

|

Major investment banks telling some of their richest investors that so-called "auction-rate preferred securities" -- they can't have their money back, and that the investors can't even sell the securities at a loss because there's no secondary market. They're in the financial equivalent of limbo here.

|

|

CNBC spoke with one investor in Miami Beach who has $2 million of these securities with closed end funds run by Blackrock, Gabelli, Calamos and Pimco. She says she can't withdraw her money to purchase a house she's contracted to buy, and she risks losing her $190,000 deposit if she walks away. She's told she can't have her money back. Other investors can't withdraw to make hefty tax payments that are coming due. These securities are sold at auctions in $25,000 units to wealthy investors and institutions. They expire every 7 to 28 days, at which point a new auction is held, but lately, the auctions are failing as part of the broader credit crunch. Not enough buyers are showing up, but more importantly, because the big investment banks -- they act as lead managers on these deals -- they're refusing to perform the role they've played for 25 years, and provide liquidity to the markets when they're out of balance.

|

|

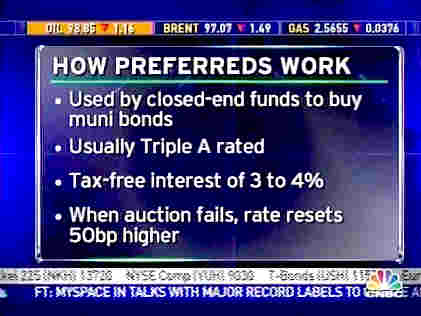

The funds from these auctions are used by closed-end funds. They lever up and they buy muni bonds. The auction rate preferreds are usually triple A rated -- a lot of good that's doing people now. They pay a tax-free interest rate of 3 and 4%. When the auction fails, they only reset a little bit higher.

I talked to Mario Gabelli [chairman of Gabelli Funds] by phone. He would not comment on the record but he asked me to give the broker of the investor we talked to his number. He called the broker, hoping that something could be worked out, without offering anything specific.

A Blackrock executive says, "These are unprecedented times in the industry." He held out little hope for investors.

The closed end funds are in a bind. Wall Street is getting a black eye from some of its best customers. But if they pay off the preferred holders, they risk hurting the holders of the common shares in the closed funds.

Here is a note: These are not regulated money market funds. They [who?] cannot buy these securities. ...

Before I came on air, about 15 minutes ago, Mario Gabelli calls me back again from the gym. He says that on our behest Gabelli has issued a statement. And the statement says that "the board of directors on this Gabelli equity trust has authorized the fund and advisors to explore alternatives, including the repurchase of these preferred in a secondary market. But since there are so many legal loopholes to navigate, it's going to take time."

Becky: The people in these funds are people who tend to be very conservative investors. These are people who are not looking for anything but to be in the safest securities, and the question is, were they marketed to these people as that.

Lieseman: I've spent 2½ days trying to understand these securities. They are the most messed up securities. There is no contingency plan for the failure of the auction. If the auction fails they simply hold your money, try to redo the auction again."

Here's part of the text of Gabelli's statement (PDF), as it currently appears on their web site:

The Board of Directors of the Equity Trust has authorized the Fund and its Adviser to examine and explore all alternatives including the possibility of repurchasing a portion of these preferreds if a secondary market develops.

Since there are many legal hoops and regulatory hurdles to navigate in order to provide liquidity, and since a secondary market for ARPs may be in the process of being developed, we are only able to move as quickly as legal counsel provides the necessary guideposts, the Board approves the appropriate measures, and the market opportunities develop."

Those who would like to understand more of the nitty-gritty details can find more information at these locations:

The point is that these were AAA rated securities, meaning that any investor or corporation or investment fund could feel completely safe in purchasing them. They were as good as cash. Of course US Treasuries are the safest of all, but the AAA rated securities are also as safe -- because they're AAA rated, right? -- and often pay a good, solid ½-1% more interest than Treasuries. That makes them worthwhile, doesn't it?

As usual, pundits and analysts, who believe that "history always begins this morning," have no idea what's going on. "What's wrong with these investors," they seem to be saying. "Why won't they attend these auctions and bid on the auction-rate securities? Why don't they know that they're still safe?"

A big part of the reason, as I've previously said, is that investors don't believe these pundits and analysts any more, because the pundits have always said that it was safe to ignore any bad news that comes along. As I wrote recently, the moral to the Aesop's Fable "The boy who cried wolf" is that "Nobody believes a liar, even when he's telling the truth."

However, there is a big picture here, as I've been saying for several years: There's been a mammoth worldwide liquidity and credit bubble, and now it's deflating, leaving less money in the world each day, as we head for a new 1930s style Great Depression. I didn't know several years ago that one part of the scenario would be that "auction rate securities" would be frozen -- hell, I never even heard of them until a couple of weeks ago. But I knew that the bubble would deflate, and that little chunks of the world economy would collapse, one after the other, until the whole thing collapses in a generational panic and stock market crash, the first since 1929.

When I first pointed this out to people in 2002, I was treated like an idiot, even though it's easy to prove, then and now, that the stock market is way overpriced. But nobody's calling me that now. Everything that I predicted is coming true, for the reasons that I predicted.

Another thing going on is the soap-opera drama of the "bailout" of the bond insurers (MBIA, Ambac, FGIC, ACA) that I recently discussed at length. It has been the Sisyphean task of New York Insurance Superintendent Eric Dinallo to arrange this bailout, but every time he proposes something new, it collapses and he has to start over again. (King Sisyphus of Greek mythology was sent to Hades and condemned forever to roll a huge boulder up a hill, only to have it roll down again on nearing the top.)

However, calling it a Sisyphean task may be giving Dinallo way too much credit. As far as I can tell, Dinallo is simply sitting at the bottom of the hill, not moving the boulder up the hill at all, but always telling everyone that it's near the top and will reach the top within a day or two. In other words, he's just stalling, holding off the inevitable failure of the bailout. It's easy to understand why he would stall -- an announcement that the bailout has failed inevitably means hundreds of billions of dollars in more writedowns by banks of near-worthless CDOs, and the stock market will fall still further, and guess who'll be blamed? Dinallo.

Speaking of the stock market, I used to talk about the euphoric mood of the investors, describing it as "Good news is good news because it's good news; and bad news is good news because it means that the Fed will lower interest rates, so it's still good news."

Then I described periods where investors adopted an anxious, panicky mood, where "even good news is bad news," because good news can't be trusted. This has generally been the mood since December, as the market fell almost continuously, reaching a recent bottom on January 22, as you can tell from my Dow Jones historical page.

Since then, the Dow Industrials index has remained in the low to middle 12000s, as if investors are shell-shocked and are just waiting for something to happen. And they are. The optimists are waiting for someone that they trust (i.e., not a proven liar) to say the "credit crunch" problems have been solved. The pessimists (like me and anyone else who knows what's going on) are waiting for the bond insurer bailout to fail.

If the optimists are right, then the Dow will jump up past 13,000, and the bubble will start growing again.

If the pessimists are right then, according to various pundits, the market will crash through the January 22 low (Dow 11971.19) and fall a lot lower.

There is one very big, very specific change that I've noticed in the opinions of pundits and analysts lately: Finally, almost everyone seems to realize that lower Fed interest rates are not going to solve the credit crisis, or keep the "subprime virus" from spreading.

That's not to say that they expect the Fed to stop lowering -- some pundits (I believe Lieseman is one) say that the Fed will continue lowering the Fed Funds Rate until it reaches 0%.

This may seem shocking, but it's what the Bank of Japan did for their funds rate in the 1990s. Even today, the BOJ funds rate is only ½%! So I agree that the Fed Funds rate will go a lot lower.

But it won't do any good, because the amount of liquidity that the Fed can inject into the financial system is tiny compared to the amount of liquidity being lost every day as the credit bubble deflates. So the sharp fall in the Fed Funds Rate will do no good whatsoever to stop the ravaging deflation (and certainly will not cause "hyperinflation," a nonsense concept that web site readers keep writing to me about to explain their purchases of gold at astronomically high bubble prices of nearly $1000/oz, plus commissions.)

But the point is that investors finally seem to realize this, where they didn't several months or even several weeks ago. They understand that oil prices at $100/barrel don't seem to push the markets down much, and 1-2% Fed Funds Rate decreases don't seem to push the markets up much.

Estimates of fourth quarter earnings have finally stabilized (after falling a little lower again). Here's the summary from Friday from CNBC Earnings Central:

414 companies in the S&P 500 have reported earnings for Q4, 62.08% have beaten estimates, 11.84% were in-line, and 26.09% have missed. (Data provided by Reuters Estimates)

The blended earnings growth rate for the S&P 500 in fourth-quarter 2007, combining actual numbers for companies that have reported, and estimates for companies yet to report, fell to -21.1%.

At the start of the quarter, the growth rate for Q4 was 11.5%. (Data provided by Thomson Financial)"

At this point, 414 companies out of 500 have reported actual earnings, so we don't expect much change any more in the 4Q earnings estimates. Soon we'll be seeing estimates for 1Q earnings, and the fun can start again.

We can now update the table of the changes in fourth-quarter earnings estimates since the beginning of the fourth quarter, as follows:

Date 4Q Earnings estimate as of that date ------- ------------------------------------ Oct 1: +11.5% Dec 7: -1.3% Dec 14: -3.8% Dec 31: -6.1% Jan 4: -9.5% Jan 11: -11.3% Jan 18: -19.0% Jan 25: -20.5% Feb 1: -20.7% Feb 8: -20.2% Feb 15: -21.1%

Despite falling a little farther, the earnings estimates are finally relatively flat, and not likely to cause further concern.

Right now, the only thing that matters (apparently) to investors is the bond insurer bailout. There's a huge amount of tension over this issue and, barring a surprise, things will be on hold until that issue is settled -- or until investors conclude that Dinallo has no real plan and is just stalling.

People are always asking me to name a specific date when a financial crisis might occur. The market is overdue for a generational panic and crash, but I usually avoid the specific date by saying something like, "It might happen next week, next month or next year, but it's happening with absolute certainty, and probably sooner than later." That wording conveys a sense of urgency without specifying an exact date.

A web site reader recently asked me about a prediction being made on another web site that a major financial crisis will occur in October of this year.

Unfortunately, it's not possible to predict a financial crisis eight months in advance. This is provable from Chaos Theory. If the October prediction turns out to be right, it will be by pure luck. There's no methodological way to reliably arrive at such a prediction and, as I said, this is provable from Chaos Theory.

What I've tried to do in the Generational Dynamics forecasting methodology is to match historical patterns to present day situations, knowing that the long-term trend (a generational stock market panic and crash, and a 1930s style Great Depression) are 100% certain.

But it's like a weather forecaster predicting the date of the next hurricane. He knows that a hurricane is coming some day, but he doesn't know when. In fact, Chaos Theory was originally invented in the 1960s to provide a mathematical framework around the discovery that it's impossible to predict the weather more than a few days in advance. The same theory applies to a wide variety of other situations as well, including this one.

The only thing that weather forecasters can do is prepare models that identify certain patterns that, in the past, have preceded hurricanes. As soon as one of these patterns appears, then they can say that "the probability of a hurricane next week is around 50%." As the patterns get more and more definite, it's possible to adjust that percentage. Once the hurricane is bearing down on the Florida keys, you can be pretty accurate, but even then, there's a question of where the hurricane will make landfall.

And so, we have all this turmoil going on in the financial markets. What's the probability of a financial crisis next week? I consider it to be pretty high -- perhaps as high as 3%. That may not seem high, but in "normal" times it would be more like 0.0000001%. Furthermore, as various indicators (wheat prices, trade deficit, corporate earnings, home sales, etc.) continue to deteriorate, that 3% will remain steady or grow higher.

So what does that mean in practical terms?

Here's how you can get a feel for it. Get a pair of dice, and roll them. The probability of getting snake eyes (1+1) is just under 3%. So roll your dice over and over. Each roll corresponds to one week of waiting. See how many rolls it takes to get snake eyes. If you get snake eyes on the first roll, then your model predicts a financial crisis in one week. If you get snake eyes on the 50th roll, then your model predicts a financial crisis in 50 weeks, or almost a full year.

(If you don't have any dice around, then just use 5 ordinary coins. Toss all five in the air, and see if they come up all heads. Count how many times you have to toss the 5 coins before they come up all heads, and that's the number of weeks that your model predicts when a financial crisis will occur.)

Perhaps that will give you a better feeling for how this works.

While you're waiting, take a moment and shed a tear for those

multi-million dollar investors who can't get their money out of

closed-end funds using auction-rate securities. They thought that

those investments were as safe as cash, but they didn't want to

invest in US Treasuries because the funds paid ½% higher interest

rates. Now they've gotten infected with the bird flu ... errr ... I

mean the subprime virus, and they can no longer get their money out.

Weep for their misfortune.

(21-Feb-08)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004