Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Saying that the Republicans drove the country into ever deeper deficits, former Fed chairman Alan Greenspan criticized "out of control" spending in the Republican Congress, and President Bush's failure to veto those bills.

The comments appear in his new 500 page book, "The Age of Turbulence: Adventures in a New World," to be published on Monday.

Greenspan reserves his highest praise for President Bill Clinton who, he said, maintained "a consistent, disciplined focus on long-term economic growth."

All of this will resonate with the Washington politicians, but I can't help but laugh at it because from the point of view of economics, Greenspan's remarks are total gibberish.

Here's a graph that appeared on the Calculated Risk blog in 2005, showing government income and outlays, but not including Social Security:

|

This graph shows that the deficit has absolutely nothing to do with the Bush administration. Note the following:

So Greenspan's remarks really are TOTAL GIBBERISH.

There's something that I remember very vividly, because I was so shocked by it when it happened in 1996.

In 1996, Clinton gave his "the era of big government is over" speech, and worked with the Republican Congress to end the welfare entitlement because it was too expensive. It was becoming clear that the government was going ever deeper into debt, and it had to stop.

Here's what President Clinton said in his 1996 State of the Union speech:

The era of big government is over. But we cannot go back to the time when our citizens were left to fend for themselves. Instead, we must go forward as one America, one nation working together to meet the challenges we face together. Self-reliance and teamwork are not opposing virtues; we must have both. ...

I say to those who are on welfare, and especially to those who have been trapped on welfare for a long time: For too long our welfare system has undermined the values of family and work, instead of supporting them. The Congress and I are near agreement on sweeping welfare reform. We agree on time limits, tough work requirements, and the toughest possible child support enforcement. But I believe we must also provide child care so that mothers who are required to go to work can do so without worrying about what is happening to their children.

I challenge this Congress to send me a bipartisan welfare reform bill that will really move people from welfare to work and do the right thing by our children. I will sign it immediately.

Let us be candid about this difficult problem. Passing a law, even the best possible law, is only a first step. The next step is to make it work. I challenge people on welfare to make the most of this opportunity for independence. I challenge American businesses to give people on welfare the chance to move into the work force. I applaud the work of religious groups and others who care for the poor. More than anyone else in our society, they know the true difficulty of the task before us, and they are in a position to help. Every one of us should join them. That is the only way we can make real welfare reform a reality in the lives of the American people."

None of that is the shocking part; it's just the usual politics. The shocking part is what happened afterwards.

Understanding deflation: Why there's less money in the world today than a month ago.:

As the markets continue to fall, the Fed is increasingly in a big bind....

(10-Sep-07)

Alan Greenspan predicts the panic and crash of 2007:

He's said this kind of thing before, but this time it's resonating....

(08-Sep-07)

Bernanke's historic experiment takes center stage:

An assessment of where we are and where we're going....

(27-Aug-07)

How to compute the "real value" of the stock market. :

And some additional speculations about stock market crashes.

(20-Aug-2007)

Ben Bernanke's Great Historic Experiment:

Bernanke doesn't believe that bubbles exist. His Fed policy will now test his core beliefs....

(18-Aug-07)

Redemptions of money market funds now fully in doubt:

Wednesday is the deadline for 3Q redemption of many hedge fund shares....

(15-Aug-07)

Alan Greenspan defends his Fed policies, as people blame him for the subprime crisis:

Greenspan never ceases to amaze, and he did so again on Monday....

(8-Aug-07)

Nouriel Roubini says: "Worry about systemic risk." Whoo hoo!:

His arguments show what's wrong with mainstream macroeconomics....

(6-Aug-07)

Robert Shiller compares stock market to 1929:

He says the recent fall was caused by "market psychology," but is puzzled why....

(20-Mar-07)

A conundrum: How increases in 'risk aversion' lead to higher stock prices:

Maybe because the global financial markets are increasingly "accident-prone."...

(12-Mar-07)

Pundits are suddenly talking about (gasp!) "risk aversion":

Fearing full-scale panic in the mortgage loan marketplace,...

(6-Mar-07)

Alan Greenspan blames the housing bubble on the fall of the Berlin Wall:

Meanwhile, the stock market keeps skyrocketing and appears unstoppable to many investors....

(25-Oct-06)

System Dynamics and the Failure of Macroeconomics Theory :

Mainstream macroeconomic theory, invented by Maynard Keynes in the 1930s, has failed to predict or explain anything that's happened since the bubble started, including the bubble itself. We need a new "Dynamic Macroeconomics" theory.

(25-Oct-2006)

Alan Greenspan gives another harsh doom and gloom speech:

Saying that "the consequences for the U.S. economy of doing nothing could be severe,"...

(4-Dec-05)

Ben S. Bernanke: The man without agony :

Bernanke and Greenspan are as different as night and day, despite what the pundits say.

(29-Oct-2005)

Fed Chairman Alan Greenspan says that the deficit is out of control:

France's Finance Minister Thierry Breton quoted Greenspan...

(25-Sep-05)

Fed Governor Ben Bernanke blames America's sky-high public debt on other nations:

I'm normally wary of applying specific generational archetypes to individuals, but Bernanke is acting like a Baby Boomer....

(14-Mar-05)

Greenspan's testimony further repudiates his earlier stock bubble reasoning:

The Fed Chairman has now completely reversed his previous position on the stock market bubble...

(17-Feb-05)

Alan Greenspan warns that global economic dangers are without historical precedent :

In a speech on Friday, Greenspan buried a major change of position in a speech admitting that his assumptions about the economy for the last decade were wrong.

(6-Feb-2005)

| ||

Around April or May, news stories said that tax collections were unexpectedly high. Tax receipts kept getting higher and higher, and it was a COMPLETE SURPRISE to everyone, including the administration and Alan Greenspan's Fed. It was not until the END of 1996, when Greenspan gave his "irrational exuberance" speech, that officials became aware that the bubble was on.

So there was a government surplus when the dot-com bubble was on, and there was a deficit when the dot-com bubble burst. This all happened in the Clinton administration. So the Bush administration had absolutely nothing to do with it. That's why Greenspan's remarks are gibberish, although they'll resonate with the usual moronic debates going on in Washington.

Politics has nothing to do with the current financial crisis. As I've written on this web site many times, the current fiscal crisis is caused by the entire Boomer generation and Generation-X, working together to engineer every debauched misuse of credit imaginable. The debauchery is practiced by Republicans and Democrats and independents alike. It has nothing to do with politics. It's because they're in the generations with no personal memory of living through the 1930s Great Depression.

As I've said many times, and discussed at length in "System Dynamics and the Failure of Macroeconomics Theory," mainstream economics has neither explained nor predicted anything since the dot-com bubble began in 1995. In particular, no one has any explanation for why the bubble began in 1995, instead of 1985 or 2005.

The only possible explanation is a generational explanation: The dot-com bubble began when the generations of survivors of the 1930s Great Depression all disappeared in the early 1990s. Their leadership positions were then filled by Boomers and Xers with no personal memory of the 1930s and adopted abusive credit policies that their parents would NEVER have approved.

As I've said before, the survivors of World War II, the GI Generation and the Silent Generation, did great things -- they created the United Nations, World Bank, Green Revolution, World Health Organization, International Monetary Fund, and so forth. They created these organizations and managed them for decades with one purpose in mind: That their children and grandchildren would never have to go through anything so horrible as the Great Depression or World War II.

Throughout their lives, they worked together, even when they were on opposite political sides, to protect America and the world from the excesses that led to the Great Depression and World War II.

In the 1980s, the Republicans and the Democrats cooperated with each other to change the Social Security system to make it a sounder system. After that, they cooperated again to specify new rules to control the budget deficit. And in 1996, as we just discussed, Democratic President Bill Clinton, saying that "the era of big government is over," cooperated with the Republican congress to eliminate the welfare entitlement.

|

For the last few years, especially since 2004 or so, any kind of political agreement has become completely impossible.

In 2006, when the Republicans controlled Congress, I pointed out that the Congressional calendar was just 97 days for all of 2006, because the Congress was so incompetent that they were going to do nothing.

This year, the Democrats took control of Congress, and it's been nothing but a circus. It started out that the new Congress was so incompetent that they couldn't even vote themselves a pay raise.

It's hard to believe, but the Democrats have been even more incompetent than the Republicans (though not because they're Democrats, but because another year of generational change has gone by).

The poster boy is Senator Joe Biden, who is easily the stupidest person in the Senate, as was clear when he went on Meet the Press in April and said one unbelievably stupid thing after another.

He called Bush "incompetent" because he sent too few troops into Iraq in 2003, but then said that he wants to send just 2,500 US troops into Darfur to stop a civil war against 2.5 million Darfurians. Over and over again, he said things like, "All the troops in the world cannot settle a civil war," referring to the Iraq war which is definitely NOT a civil war, but then wants to stop the Darfur genocide, which IS a huge, massive civil war, with just 2500 troops. This guy's a real idiot.

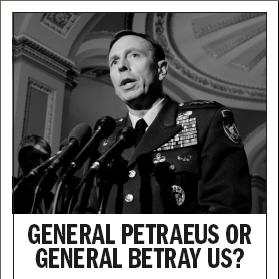

The despicable Moveon.org ad displayed above, implying that Petraeus is a national traitor, is typical of what passes for intelligence in today's Washington.

Lawrence F. Kaplan, senior editor at the liberal, pro-Democratic opinion magazine, The New Republic, pointed out that Congressional leaders: go out of their way to avoid learning anything; make up any "facts" they want, since they don't know anything; and couldn't care less what happens in Iraq, since they just want votes.

But I don't want to make this a Democratic thing, because the Republicans don't know anything either, as we learn from articles in the Congressional Quarterly. Washington journalists, analysts and politicians have no idea what's going on in Iraq. At the time that those surveys were taken, they didn't know the differences between Sunni and Shi'ite, they didn't know that al-Qaeda is operating in Iraq, and they didn't know that al-Qaeda is a Sunni organization.

Now let's return to Greenspan's opinions.

As I said above, Republicans and Democrats were able to accomplish a number of things since 1945, and I gave several examples from the 1980s and 1990s. They did that through compromise.

Since then, they've been unable to compromise on anything except to blame everyone else for everything.

From the point of view of Generational Dynamics, there's a really vicious process going on right now:

The result is that Boomers don't know how to do anything -- how to lead, how to govern, and so forth. All then know how to do is complain about other people who DO know how to do something.

Throughout their lives, the Boomers had everything done for them by their parents. Their parents ran the United Nations, the World Bank, and the other organizations that I mentioned previously, and did a good job. But that generation is gone now, leaving the Boomers in charge. Unfortunately, the Boomers have no idea what to do.

Some of the world's worst dictators are early Nomads (born 16-25 years after the end of the last crisis war), including Adolf Hitler, Josef Stalin, Leon Trotsky, Osama bin Laden, Abu Musab al-Zarqawi, and Shamil Basayev (the guy who masterminded 2004's Beslan school massacre). On the other hand, FDR and other Heroes are also early Nomads.

The people in Generation-X are "doers," unlike the Boomers. The Boomers are content to let other people take care of things, and the Xers want to do things. But the Xers' general disaffection and hatred of the Boomers makes the Xers often very destructive and self-destructive. Nomads often have views and behaviors that Friedrich Nietzsche would have characterized as nihilistic, seeing human existence as devoid of meaning, purpose or essential value.

So now we have these two generational forces coming together.

One example is the "Petraeus / betray us" ad displayed earlier, from Moveon.org. The Democratic and Republican leaders in Congress might well be able to come up with a compromise on many issues, but that's impossible, largely because of the power of Moveon.org. Moveon.org is driving Democrats to a destructive political position where they're essentially supporting al-Qaeda against the Americans. Moveon.org itself is driven by Xers who have no fear of this destructive advocacy.

The second example is current financial crisis.

Here's what PIMCO's Bill Gross, head of the world's largest bond fund, said recently:

Gross's comments show clearly the distinction between Boomers and Xers, and how they created the current mess: Arrogant Boomers are content to let other people take care of things so they can sit back and criticize, and youthful nihilistic Xers show contempt for all caution and have no fear of anything, even their own destruction.

(For those who are even now are planning to write to me, protesting the above, let me say this: The above are generalizations of generational archetypes that are completely true in the aggregate, but are not true of all individuals. If you're an exception, then I congratulate you.)

The remaining question is this: Alan Greenspan was born in 1926, and is a survivor of the 1929 crash and the 1930s Great Depression. Why doesn't he know any better?

The answer is that he does know better, but his own emotions have also gone back and forth. As Fed chairman, he was convinced by the Boomers and Xers that there was nothing to worry about. As I recently described in "Alan Greenspan predicts the panic and crash of 2007," Greenspan has made speeches on both sides. Sometimes he warns of severe danger, and at other times he provides fanciful defenses of his own policies, such as blaming the housing bubble on the 1989 fall of the Berlin Wall. His blaming of the Republicans just advances that pattern.

From the point of view of Generational Dynamics, Alan Greenspan

couldn't have changed much of anything anyway. He was just one man

facing entire generations of Boomers and Xers. If he'd tried to

employ stricter Fed policies to prevent the dot-com or housing

bubbles, he would simply have been fired for "harming" the economy.

I've often described generational trends as similar to a tsunami, and

no one man, not even Alan Greenspan, ever has any hope of stopping a

tsunami.

(16-Sep-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004