Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Panic is spreading, as people wonder whether their money is safe ANYWHERE.

Anxious customers jammed the phone lines and website of Countrywide Bank and crowded its branch offices to pull out their savings because of concerns about the financial problems of the mortgage lender that owns the bank.

The bank's owner is Countrywide Financial Corp., the biggest home-loan company in the nation. Ever since the Bear Stearns debacle began in June, analysts have been expressing concern that Countrywide and other home-loan companies are going to be in financial trouble. Indeed, as of today, the Implode-o-Meter web site indicates that 128 mortgage lenders have "imploded" since December.

Thursday's panic was triggered by fears that Countrywide would declare bankruptcy and by a Thursday announcement by Countrywide that it was borrowing its entire $11.5 billion lines of credit from 40 banks. It's interesting to read Countrywide's press release:

"As we have previously discussed, secondary market demand for non-agency mortgage-backed securities has been disrupted in recent weeks," said David Sambol, President and Chief Operating Officer. "Along with reduced liquidity in the secondary market, funding liquidity for the mortgage industry has also become constrained.

"For many years, Countrywide's liquidity management framework has focused on maintaining a diverse, multi-layered assortment of financing alternatives," said Sambol. "A primary component of this framework is a committed, unsecured credit facility of $11.5 billion provided by a syndicate of 40 of the world's largest banks. In response to widely-reported market conditions, Countrywide has elected to draw upon this entire facility to supplement its funding liquidity position. ...

"Countrywide has taken decisive steps which we believe will address the challenges arising in this environment and enable the Company to meet its funding needs and continue growing its franchise. ...

"Our objective is to navigate the difficult conditions in today's market as we complete the transition of our Bank business and funding strategy," Sambol concluded. "With these changes, we believe we are well-positioned to leverage opportunities presented by a consolidating industry."

Understanding deflation: Why there's less money in the world today than a month ago.:

As the markets continue to fall, the Fed is increasingly in a big bind....

(10-Sep-07)

Alan Greenspan predicts the panic and crash of 2007:

He's said this kind of thing before, but this time it's resonating....

(08-Sep-07)

Bernanke's historic experiment takes center stage:

An assessment of where we are and where we're going....

(27-Aug-07)

How to compute the "real value" of the stock market. :

And some additional speculations about stock market crashes.

(20-Aug-2007)

Ben Bernanke's Great Historic Experiment:

Bernanke doesn't believe that bubbles exist. His Fed policy will now test his core beliefs....

(18-Aug-07)

Redemptions of money market funds now fully in doubt:

Wednesday is the deadline for 3Q redemption of many hedge fund shares....

(15-Aug-07)

Alan Greenspan defends his Fed policies, as people blame him for the subprime crisis:

Greenspan never ceases to amaze, and he did so again on Monday....

(8-Aug-07)

Nouriel Roubini says: "Worry about systemic risk." Whoo hoo!:

His arguments show what's wrong with mainstream macroeconomics....

(6-Aug-07)

Robert Shiller compares stock market to 1929:

He says the recent fall was caused by "market psychology," but is puzzled why....

(20-Mar-07)

A conundrum: How increases in 'risk aversion' lead to higher stock prices:

Maybe because the global financial markets are increasingly "accident-prone."...

(12-Mar-07)

Pundits are suddenly talking about (gasp!) "risk aversion":

Fearing full-scale panic in the mortgage loan marketplace,...

(6-Mar-07)

Alan Greenspan blames the housing bubble on the fall of the Berlin Wall:

Meanwhile, the stock market keeps skyrocketing and appears unstoppable to many investors....

(25-Oct-06)

System Dynamics and the Failure of Macroeconomics Theory :

Mainstream macroeconomic theory, invented by Maynard Keynes in the 1930s, has failed to predict or explain anything that's happened since the bubble started, including the bubble itself. We need a new "Dynamic Macroeconomics" theory.

(25-Oct-2006)

Alan Greenspan gives another harsh doom and gloom speech:

Saying that "the consequences for the U.S. economy of doing nothing could be severe,"...

(4-Dec-05)

Ben S. Bernanke: The man without agony :

Bernanke and Greenspan are as different as night and day, despite what the pundits say.

(29-Oct-2005)

Fed Chairman Alan Greenspan says that the deficit is out of control:

France's Finance Minister Thierry Breton quoted Greenspan...

(25-Sep-05)

Fed Governor Ben Bernanke blames America's sky-high public debt on other nations:

I'm normally wary of applying specific generational archetypes to individuals, but Bernanke is acting like a Baby Boomer....

(14-Mar-05)

Greenspan's testimony further repudiates his earlier stock bubble reasoning:

The Fed Chairman has now completely reversed his previous position on the stock market bubble...

(17-Feb-05)

Alan Greenspan warns that global economic dangers are without historical precedent :

In a speech on Friday, Greenspan buried a major change of position in a speech admitting that his assumptions about the economy for the last decade were wrong.

(6-Feb-2005)

| ||

Looking beyond the soothing words of the press release, it's not easy to discern how much trouble Countrywide is in. However, part of the reason, apparently, for Countrywide to have drawn its entire credit line is concern that the credit line will disappear soon, thanks to the ongoing liquidity crisis.

Thus, it's particularly ironic that Countrywide's bank depositors are doing EXACTLY what Countrywide is doing -- they're withdrawing their deposits out of concern that their deposit will disappear soon, thanks to the ongoing liquidity crisis.

So the panic is growing at all levels from individuals to corporations.

According to the news story:

This is interesting for a couple of reasons. One is just the level of panic that it portrays.

The other is the size of the deposit -- $500,000.

People will tell you that the money that you deposit in a bank is perfectly safe, as long as it's insured by the Federal Deposit Insurance Corp. (FDIC). Even if a bank goes completely bankrupt, you'll be told, you'll be able to recover your money in time from the FDIC.

But the rules for FDIC insurance are complicated. Even if Countrywide has FDIC insured accounts, that doesn't mean that ALL its accounts are insured. And even if your account is insured, that doesn't mean that your ENTIRE account is insured. In many cases, insurance is limited to $100,000, so if you have $500,000 in the bank, then you may not be fully insured.

There are a number of resources available on the FDIC web site:

For example, if you type "Countrywide" into the Bank Find form, then click on "Countrywide Bank FSB," then click on "Last Financial Information" available, then click on "Generate Report," then you get a report that tells you that approximately 60% of deposited funds are insured.

|

Losing your money in a bank is a real concern.

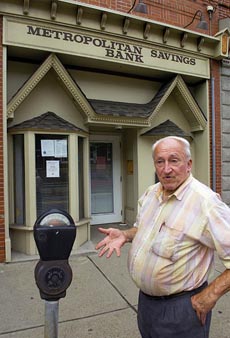

Three weeks ago, a web site reader sent me a reference to a story about a bank collapse, and she commented "Here's the other 'sad story' of the impact."

You have to feel sorry for this guy. He grew up during the horrors of the Great Depression, and he learned his lesson -- he worked hard, saved every penny he could, and put his money -- totalling $521,000 -- into the bank.

According to the article, he transferred his money to the Metropolitan Savings Bank two years ago, when bank officials told him that his money would be insured -- safe and sound.

Now the bank has failed, with regulators citing "unsafe and unsound" operations. And it turns out that he had been misinformed. The FDIC doesn't insure his entire account, and so he loses $321,000 that he had planned to give to his kids.

A few days ago I posted an article entitled "Redemptions of money market funds now fully in doubt." I received some criticism for that, because money market funds are supposed to be completely safe. Well, are they safer than banks?

Every day that passes makes me more astounded about what's happened with CDOs (collateralized debt obligations). The sheer immensity of what's been done is so mind-boggling that it's not surprising that almost everyone is oblivious to it, because it's too incredible to believe. If this were a novel, noone would even find it credible, because so many people have been doing so many stupid and shady and fraudulent things, that you'd never believe that no one caught on.

First you had loosening standards for mortgage loans, to the point where many millions of "subprime" mortgages have been written for homeowners who will never be able to meet the payments, after the initial "teaser rates" expire.

These mortgages were combined into packages of mortgage-backed securities, but since they're so risky, they're rated BBB and BBB- by the ratings agencies.

Now here's the problem: A lot of institutions won't invest in low-rated securities. Some are forbidden by law from doing so, some by charter, and many just don't like it. They'll invest only in the lowest-risk highest-rated AAA securities. Furthermore -- and here's the big point -- once securities receive an AAA rating from the ratings agencies (S&P, Fitch, Moody's), they don't have to ask any more questions. They're considered OK.

So the financiers who were stuck with tens of millions of dollars in BBB and BBB- mortgage-based securities wanted to get rid of them, and looked for a way to increase their ratings. As I recently described, they found a way to slice and dice and repackage these securities into cascading "tranches" of securities, structured in such a way that they could get an AAA rating for most of them. These are the collateralized debt obligations or CDOs. They're restructured securities with AAA ratings, backed indirectly by high-risk subprime mortgages.

However, not all of the tranches of these CDOs are AAA rated. Some of even these are are BBB- CDOs. So the financiers repeated the same trick: They took low-rated CDOs, restructured them into "CDO-squared" securities, and got them an AAA rating as well.

In the process of all this restructuring, the value of these securities was leveraged so that what was formerly tens of millions of dollars of BBB and BBB- rated securities had been magically transformed into tens or hundreds of trillions of dollars of AAA securities.

Please re-read the preceding paragraph and let it sink it, as it has been sinking it with me these last few weeks. It's so incredible that it's almost impossible to grasp.

And since these securities had AAA ratings, every institution in the world could freely invest in them, and almost every one of them did.

Thus, these CDOs are like tens or hundreds of trillions of tiny termites that gnawed there way into the portfolios of every major institution in the world, some more than others, some less than others.

And you have no way of knowing whether your bank, your pension fund, your money market fund or your insurance company has invested heavily in these CDOs.

Because even though these CDOs have a nominal value of tens or hundreds of trillions of dollars, they're based on tens of millions of dollars worth of subprime loans, many of which won't be repaid. The result is that these CDOs aren't worth the paper they're written on.

And so I summarize: Your bank or your pension fund, etc., may have invested millions or billions of dollars in these CDOs, and they are going to suffer an almost total loss of principal on those investments.

Almost all of these institutions are keeping quiet about this, because they're scared to death of what might happen -- and the experience of Countrywide is an example. Countrywide decided to draw down its credit line, and their banks were mobbed by depositors withdrawing their money.

That's why people are panicking. There's no way to know whether you'll have anything left, or whether your bank or your money market fund or your insurance company will survive.

In my article a couple of days ago, "The nightmare is finally beginning," I reached the conclusion that we're beginning a real generational panic by watching how anxiety has increased over the more and more people, with no sign of stopping.

From the point of view of Generational Dynamics, this is the signal that I wait for, when I'm evaluating actions of countries around the world. We saw a panic begin last summer in Israel when two Israeli soldiers were kidnapped near the Lebanon border and and Israel panicked and launched the Lebanon war within four hours, with no plan and no objectives. That's how generational crisis wars begin.

Now we're seeing a similar kind of panic in the financial world, and it's affecting everyone. Here's what a web site reader wrote to me yesterday:

For example, I called my broker Friday morning. The market was back up by then. I asked for a quote on the S&P. Then I will usually make a little small talk. Anyway, this guy started babbling nonsense and was unable to stop.

It didn't make any sense. Something about a guy he knows who is worth $800 million and went to a party with Bernanke and then told him that Bernanke will have to lower interest rates. He must have babbled for 10 minutes without stopping and I listened without saying anything."

This is the kind of anxiety we're seeing everywhere, and it's leading to a full-scale generational panic.

I've posted many quotes from John Kenneth Galbraith's 1954 book, The Great Crash - 1929, but one web site reader has called my attention to one passage that had escaped my notice so far:

Incidentally, note the reference to "investment trusts" in this paragraph. These were the hedge funds, the derivatives, the CDOs of 1929, and they were abused just as much. People today talk about "containing the financial crisis" to the mortgage market. But Galbraith's point was that the 1929 crisis could not be "contained" to the investment trusts.

From the point of view of Generational Dynamics, this is all very familiar. A generational stock market crash is overdue. If you go back through history, there are of course many small or regional recessions. But since the 1600s there have been only five major international financial crises: the 1637 Tulipomania bubble, the South Sea bubble of the 1710s-20s, the bankruptcy of the French monarchy in the 1789, the Panic of 1857, and the 1929 Wall Street crash. We're now overdue for the next one.

The increasing level of anxiety and panic is the measure of where we are on the road to the next crash. It now appears that the levels of anxiety and panic are going to continue to increase. If, by some miracle, they stop and fall again, then we may have a little more time.

But if, as I expect, these levels of anxiety and panic continue to increase, then I would expect to have a major stock market crash within a few weeks, or months at the most.

Thus, Countrywide's move in drawing down its credit line and Countrywide's depositors' moves in withdrawing their deposits are both quite rational moves.

What this means for you, Dear Reader, is the following: If you have

been thinking of doing something to protect yourself or your family,

then right now is the time to do it.

(19-Aug-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004