Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Arizona governor signs tough immigration law called 'misguided' by Obama

As regular readers of the web site are well aware, it's been obvious for at least a couple of months that Greece is headed for bankruptcy, and that the carnival shows that EU officials put on week after week offered only palliatives. In particular, the EU finally offered a non-bailout bailout. This was a promise of money that would be given only if Greece were about to default, and only if then all the EU states agreed to it. The silly hope was that this mere promise of a future consideration of a bailout would alone be enough to restore investor confidence in Greece.

On Friday, Greece finally "pulled the trigger," and formally asked for the non-bailout bailout package of 30 billion euros.

The letter (PDF) was sent by George Papaconstantinou, Greece's Minister of Finance, to Eurogroup officials, and contained only one sentence:

In accordance with the Statement of the Heads of State and Government of 25 March 2010 to provide financial support to Greece, when needed, and the follow up Statement of the Eurogroup, Greece is hereby requesting the activation of the support mechanism.

Sincerely,

George Papaconstantinou"

Greece's financial deterioration had been gathering momentum, as we've been reporting on an almost daily basis for several weeks. And other countries, especially Portugal, were beginning to suffer from Greek "contagion," meaning that they were showing the same symptoms as Greece.

In fact, Europe appears to be approaching full-scale panic, as can be seen from the following graph from FT Alphaville of credit default swap (CDS) prices from debt from Greece and Portugal:

|

Recall that a CDS is a kind of insurance policy, where the insurance will be paid if the underlying debt defaults. If the CDS price increases, it means that insurers are demanding more money to insure the debt, and investors are losing confidence that a default can be avoided. The above graph shows that Greece's CDS prices are going parabolic, and Portugal's are close behind.

Furthermore, Greece is facing a hard deadline. The country has about 2 billion euros in available reserves, but needs to make payments of 11 billion euros on existing debt on May 19.

This is a freight train careening out of control, headed for a smashup. Will Friday's request for aid stop the freight train, or at least slow it down? We'll see on Monday.

The headwinds are enormous. The 30 billion euros of aid would come from other EU countries. Germany would have to contribute the most -- 8.4 billion euros. Bloomberg quotes German chancellor Angela Merkel has already said that any aid package would depend on Athens satisfying "very stringent conditions."

Those conditions would require additional austerity on the part of the Greeks. Thousands of people from Greece's communist-linked public sector unions marched in Athens on Friday, in protest against the request for aid, as reported by Al-Jazeera. And ongoing demonstrations for next week, and the weeks to come.

Even if the aid package is finalized, then Greece's and Europe's troubles are not over. First of all, the 30 billion euro aid package is only a down payment -- Bloomberg quotes Steven Major, global head of fixed-income research at HSBC Holdings Plc in London, as saying that more than 45 billion euros will be needed beyond this year. Germany didn't like paying reparations to France in the 1920s, and I doubt that they'll tolerate paying "reparations" to Greece in the 2010s.

And even if all those problems are solved, it looks like an aid package for Portugal will be required next.

This is actually going to be fascinating to watch.

Yesterday I wrote about interest rate derivatives are a ticking time bomb.

Credit default swaps (CDSs) are insurance policies that protect the buyer against default of the underlying debt. Interest rate swaps are insurance policies that protect the buyer against changes in interest rates. Both of them are in the category of credit derivatives.

The Bank of International Settlements indicates that in June, 2009, there $604 trillion (notional value) of outstanding derivative contracts, and over half of these, $341 trillion, were interest rate swaps.

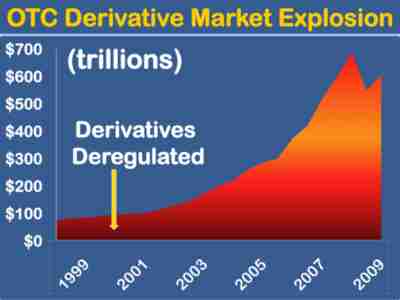

A Washington Post article by Ezra Klein provides a picture of the explosive growth of the derivatives market:

|

This is the major feature of today's global financial system. The size of the American economy is around $14 trillion, which is an anthill compared to the Mount Everest of interest rate swaps. And as yesterday's article indicated, there are the same kinds of fraud for interest rate swaps as there were for the mortgage-backed CDO securities that caused the financial crisis so far.

The big difference is the size. There were only a few trillion dollars of CDOs, and they continue to cause a great deal of trouble.

There are a few HUNDRED trillion dollars of interest rate swaps. These are numbers that are almost unimaginably huge.

CDOs are being written down 50-75%. If interest rate swaps are written down only 5%, that would be a loss of $15 trillion around the world. That would be a huge dislocation. And if that 5% becomes 30%, then the loss would be comparable to the values of all the real estate and businesses in the world.

On Friday, Arizona governor Jan Brewer signed the toughest law against illegal immigration in the country. Church groups, the government of Mexico and civil rights groups opposed the bill, and President Obama called the bill "misguided," according to the LA Times.

Protests against the law have already begun in Arizona, and the law may encounter national opposition.

Several web site readers have written to me objecting to my use of the "xenophobia" to describe the growing public support in Arizona for this law.

In the comments section in the Generational Dynamics forum, one person asked, "A nation protecting itself and its citizens by enforcing Immigration laws (already on the books) against ILLEGAL intruders is 'xenophobia that leads to wars?'" From there, the writer went on to become completely hysterical.

This goes to show how strong the emotions are surrounding this issue.

For one thing, "xenophobia" is one of my favorite words in the English language. (Can anyone guess why?)

But more important than that, the words encapsulates the emotions that are driving this issue. As I've said many times, Generational Dynamics deals with the behaviors and attitudes of large masses of people, entire generations of people. And "xenophobia" describes a fairly common attitude during generational Crisis eras.

In the forum, member "ridgel" responded as follows:

Mexico is in a world of hurt. Their three main export revenue sources, oil, remittances, and tourism are all way off. Because of the decline in their main Cantarell field, they may become oil importers in the next few years. Remittances are way off, I've seen estimates of 20-30% as Mexicans formerly employed in construction and hospitality are layed off. And tourism has been hurt by both the recession and the drug violence. Speaking of drug violence, that's just about the only viable industry left for the common Mexican at this point. And cities like Ciudad Juarez, just south of El Paso, are basically in open warfare at this point."

The "sea change of opinion" is exactly the point. Whether it's good or bad -- and there are plenty of people on both sides of this issue -- there is no doubt that things have changed dramatically in the attitudes of Americans on this subject. The Arizona law is just the beginning of the controversy.

U.S. investors don't think that the Greece problem is any problem at all. The stock market bubble on Wall Street continues to grow, and Friday's session pushed the bubble to new highs since the 2007 credit crunch. Bespoke Investment

Now we know why SEC employees never got around to prosecuting Bernie Madoff. They were spending hours watching porn when they were supposed to be working. CNN

As we've been saying for years, China plans to confront American ships throughout the Pacific and Indian oceans. It's already beginning, and military officials are expressing surprise at how quickly it's happening. NY Times

Free meals in Denmark. All you have to do is ride an exercise bike attached to a generator at the Crowne Plaza Hotel in Copenhagen long enough to produce 10 watt-hours of electricity, and you get a free meal. BBC

(Comments: For reader comments, questions and discussion,

see the 23-Apr-10 News -- Greece, near bankrupcy, makes formal request for aid

thread of the Generational Dynamics forum. Comments may be posted

anonymously.)

(24-Apr-2010)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004