Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

The country of Iceland is bankrupt (or almost bankrupt) according to Prime Minister Geir Haarde.

With the króna ("krona" or "crown") currency crashing, Iceland apparently went begging from country to country for a bailout, and Russia is looking favorably on a €4 billion loan to Iceland. According to an Iceland official, "We have been calling for aid from neighboring countries and have been turned down. This is looking like the beginning of relations between Russia and Iceland."

There's an irony to that because Russia itself is in a downward spiral.

Or, as the Telegraph's Ambrose Evans-Pritchard says:

The entire complex of commodities and emerging market stocks, bonds, and currencies is now in free-fall as the economic crisis spreads like brushfire, threatening to draw every corner of the globe into the vortex of recession. ...

The euro’s dramatic slide over the past two weeks has for the first time exposed the instability of the twin-pillar system holding up global finance. ...

There are fears that Russia could slip into a downward spiral if oil drops to $50 a barrel, which is now the lower end of Merrill Lynch’s forecast.

Moscow has become addicted to the oil bonanza, ratcheting up spending so quickly that it may now need prices to stay above $90 to fund spending plans. Veteran analysts say they have seen this movie before."

Evans-Pritchard appears to be the only mainstream journalist in the world who appears to have any idea what's going on.

|

Wall Street was convulsed on Tuesday, as the market

However, you'd barely even know there's a problem if you listen to the pundits on tv.

As I'm typing this on Tuesday evening, I'm listening to two clowns on tv listening to questions and delivering carefully scripted responses that say less than nothing. Both of these guys are totally oblivious to what's going on.

But that's OK. Fed Chairman gave a speech on Tuesday afternoon that also said less than nothing.

But that's nothing compared to what I heard this afternoon.

Keep in mind that nobody has any idea what's going on. They either can't or won't face the fact that the market has been in a bubble for many years, and is now going to plummet for many years, by the Law of Mean Reversion. You'd think that Ben Bernanke, at least, would understand that, but I don't get the impression he has any idea what's going on.

So here's what I heard on Bloomberg TV on Tuesday afternoon:

|

And I think that in the longer term, maybe we get a rally off of the bottom here in the order of 25% or so, and then we rethink what the long term looks like.

I would like to see the market have a wholesale panic in the next week or so. We keep having these days when we go down, then we trade up, then we go down, then we trade up. I'd like to see us close down 1000 Dow points, and then set a bottom.

Q: Man, I would not like to see that. John do you want to see a wholesale panic?

John O'Donoghue, Cowen and Company, LLC: No, I've through a lot of these and I don't like those too much. It's worse than going to the dentist. But I will tell you this: The amount of money that has been taken out of this marketplace prior to the third quarter -- now here we are into the second full week of the third quarter -- as opposed to the 25% drop that we had in 1987 -- this is more like Chinese water torture.

I think you'll probably come to the end of this probably in the next week or so. It's just a matter of the selling becoming exhausted, as opposed to - you're going to see this one big swoop-down day. It's becoming quite disconcerting with the false positives that you're seeing.

Q: There's so much cash on the sidelines.

Minerd: And that's why I think you'll get a pretty good lift here - 20-25%. If you're a trader, and even a long-term investor, you've got to start to consider putting your money to work.

There's a really interesting bit of research done -- there's an old saying, "Sell in May, go away, come again on Arbor Day." Well, statistically, it's actually sell on Memorial Day, and buy at the first game of the World Series. So I'm waiting for the World Series.

There's been a lot of bottom-fishing, and I think we've got to get those people discouraged.

Q: If you see us drop to 800 on the S&P in the next couple of weeks, where to you see us at the end of the year?

Minerd: I think maybe at the end of the year we're up to 1000, maybe 1100."

You know, Dear Reader, there are many times when I've expressed astonishment at what was going on. This was true throughout the growth of the bubble, when I always expressed amazement that the investors could possibly be making an enormous bubble even larger.

But I don't know how to express in words what I'm seeing and hearing now. The conversation I quoted above is almost beyond belief in any way possible.

What could these guys possibly be thinking? There is no possible way that they could have the vaguest idea what they're talking about. One is calling for a 1000 point fall in the Dow, after which (he claims) the market will spring back with a 25% rally. The other one says almost the same thing, but with a slower selloff in the next two weeks.

They're just making this stuff up. It's pure fabrication. They have absolutely no idea what's going to happen, so they pass themselves off as experts and say stuff like that. Didn't it even occur to them that on a day when a country like Iceland goes bankrupt, it might mean something on Wall Street?

When I started talking about the Principle of Maximum Ruin several years ago, I knew it was coming by analysis of previous generational crashes, but I didn't know the exact mechanism.

Now that I see it happening, it's more like a cartoon than anything else. These guys literally have no idea what they're talking about, and they're making stuff up.

How can this be? How could we have come to this.

It's one thing for analysts to make these things up and talk about them on a financial channel like Bloomberg TV.

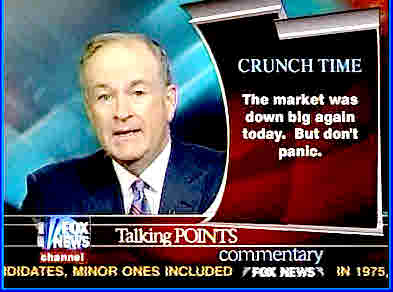

It's another thing for a mainstream commentator to do the same thing:

|

There's a HUGE irony here. Last week, O'Reilly got into a huge shouting match with Massachusetts congressman Barney Frank. The tongue-lashing that Frank got was well-deserved, as he's one of the worst hypocrites around. O'Reilly criticized Frank for saying everything was OK, and allowing ordinary homeowners to be hurt.

But now look at what O'Reilly is doing. He's giving investment advice to millions of viewers. He's telling them not to sell, and he's telling them the market will reach bottom soon.

How could he possibly know that? Does he have a crystal ball? Perhaps he prayed to God, and God gave him the information. (Though I have to wonder if even God can predict chaotic events.)

Or, O'Reilly made it up. Having no idea what's going to happen, he simply made up what he wants to happen.

So now when millions of people listen to him and take his advice, they're going to lose their money. And O'Reilly will be to blame.

O'Reilly keeps saying how furious he is about what's going on. That fury will now be directed at him. I hope he has his bunker picked out.

These are truly incredible days, certainly the most incredible days of my life. It's almost too much to believe what's going on.

(Comments: For reader comments, as well as more frequent

updates on this subject, see the Financial Topics thread of the Generational Dynamics forum. Read

the entire thread for discussions on how to protect your money.)

(8-Oct-2008)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004