Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

A warning about gold

The culture of fraud and extortion is now consuming both sides of the Atlantic.

As I've written many times in the past, there is no solution to the Greece debt problem. It's not a matter of left- or right- wing ideology, or Sarkozy versus Merkel, or Socialism versus Capitalism, or Keynes versus von Mises versus Friedman. It's a matter of simple math, combined with the Generational Dynamics prediction that the hopes and prayers of a "V-shaped recovery" powered by a return to the credit bubble of the mid 2000s decade will not occur. A default is mathematically certain, and contagion to other countries is certain.

|

Thus, every few months, the Europeans have announced a new final solution to the Greek debt problem, always based on some level of fraud and extortion, only to see the solution crash and burn in the weeks that followed.

The solution announced at last week's Euro Summit isn't even taking a few weeks. Less than a week later, it's clear not only that Greece is still going to default (sooner or later), but that Italy and Spain are still in the same vicious cycle, with surging bond yields (interest rates).

Here's how Euro Intelligence described the current situation:

"There is always a point towards the end of July when the eurozone news flow drops off sharply due to the summer holidays. We may have reached that point today. Even though the situation remains hopeless, it is no longer deemed to be serious.As bond yields rise back to the pre-summit levels, the congratulatory mood among officials has given way to more recriminations for who is to blame for the poor communication. FT Deutschland echoes the criticism of a diplomat who said that EU leaders created confusion after the summit by citing wildly different figures about the scale of the implied debt reduction. He gave as an example the statement by Mark Rutte, the Dutch PM, who suggested in his final press conference that the private sector component was part of the €109bn package. (There was also confusion about the extent to which the agreement would reduce the net debt of Greece.) There was also a lack of clarity as to how the IMF will participate in the programme. Christine Lagarde said the negative market reaction was due to the complexity of the agreement, and the fact that a lot of work has yet to be done to implement the decision. The newspaper noted that there is not even a scheduled meeting for the eurogroup, which is supposed to implement the agreement."

The fact is that the eurogroup's latest announcement is based on fraud and extortion. The fraud comes from misstating the figures (see "24-Jul-11 World View -- Mauldin: Greece's bond 'haircuts' are at 75-80%"), and the extortion comes from forcing major investors (mostly banks) to take "voluntary" haircuts on Greek bonds.

And let's recall that European politicians have lied over and over again, and Eurogroup chairman Jean-Claude Juncker was quoted as saying, "When it becomes serious, you have to lie," as we reported in May.

Blaming the renewed euro crisis on "poor communication" is absurd beyond belief (except that nothing is beyond belief these days). We've now extended to the limit the 2000s concept that fundamentals are irrelevant, and nothing matters except what you say and what you can extort.

I first became aware of this insanity in 2004, when I commented, with incredulity, how "[Ben] Bernanke apparently believes that the Fed can use verbal statements, even misleading verbal statements, to affect the economy -- stock prices, interest rates (bond prices), and so forth -- in the long run!" ( "Bernanke / The Fed congratulates itself - again - on its jawboning policy")

As this policy of defrauding investors and the public has increasingly failed to work, we've seen extortion applied to try to make it work. One of the worst offenders has been New York Insurance Superintendent Eric Dinallo who spent several months in 2008 helping the banks and "monoline" bond insurance companies to collude to commit fraud. And we've seen widespread fraud and extortion related to the "ObamaCare" health care bill, which I've said was a proposal of economic insanity, because it was just like President Nixon's wage-price controls.

And journalists on CNBC and Bloomberg TV have been defrauding viewers and investors consistently by quoting price/earnings ratios (also call valuations) based on fraudulent "operating earnings" (which exclude many expenses), rather than real earnings.

I had completely forgotten about an interview that I posted in February 2009 in the Generational Dynamics Forum, but never posted in the web log. Better late than never, here's the Bloomberg TV interview with Charles Minter, Director & Co-Portfolio Manager, Comstock Partners:

"We think it's just insane what Wall Street are looking at, and looking at operating earnings.It just makes no sense. Operating earnings exclude writeoffs.

The only way you get people coming on the air and talking about the market being fairly valued, or undervalued, or really cheap, is to look at operating earnings, which only came into existence in the late 1980s, and became more and more popular as everybody on Wall Street needed to use them, especially during the financial mania of the late 1990s, in order to justify the prices they were paying for the S&P 500.

They should have been using reported earnings, which are GAAP earnings, and we have a history of reported earnings going back for 90 years. We have no history of operating earnings."

The interview was conducted by Bloomberg TV anchor Matt Miller, and after that, he would question people about operating earnings versus real earnings. He stopped doing that after a few days, I assume because some advertiser threatened his job.

|

At that time, someone pointed out to me that the Wall Street Journal was reporting P/E ratios in terms of operating earnings. I wrote a series of really nasty, mocking comments, and after two or three months, WSJ reversed itself. I don't know whether it was because of me or because of someone else, but WSJ's Price/Earnings page is publishing the S&P 500 P/E ratio based on "Trailing 12 months," which refers to real earnings during the last year, and which is the correct value to use. By the way, the current value, as of July 22, is 16.55, not the nonsense figures of 12 or 13 that you hear on CNBC or Bloomberg TV.

Analysts and journalists on CNBC and Bloomberg tv ALWAYS lie when they talk about price/earnings ratios (also called valuations), as I've discussed in "5-Oct-10 News -- Goldman Sachs's Cohen gives price/earnings fantasy" and "24-Aug-10 News -- Ariel's Bobrinskoy gives price/earnings fantasy."

Just as no solution exists for Europe's debt problems, it's also true that no solution exists for America's debt problems. America is in a continuing deflationary spiral, there will be no V-shaped recovery, and a default is 100% certain, now or later.

Politicians on both sides are committing fraud on a continuing basis, making claims that change on an hourly basis. Extortion takes the form of, "Do it my way, or we'll have a new Great Depression." Democrats blame the problems on the Tea Party "terrorists," while Republicans blame the Obama administration "socialists."

In fact, we're headed for a new Great Depression, no matter what happens in Washington. I suspect that many of the politicians already realize this, and all they're doing now is posturing so that someone else will be blamed -- which is exactly what the Europeans have been doing for well over a year.

As for the current deficit ceiling battle, my expectation is that they'll do exactly what the Europeans have been doing. They'll come to some stopgap agreement that "kicks the can down the road," and they congratulate themselves for being so clever, while they blame the other side. When things start unraveling again, then the whole process will be repeated.

There's a very interesting war being conducted by Washington politicians on Moody's, S&P and Fitch, the three major bond ratings services.

Let's first recall that the Europeans have been conducting a war on the same ratings agencies ever since they began downgrading the debt of Greece, Ireland and Portugal, over a year ago. American politicians really didn't care about the ratings agencies then, until they started talking about downgrading U.S. debt.

Ratings agency officials were grilled on Wednesday for the House Financial Services committee, according to CNN.

The argument being used against ratings agencies is: "The ratings agencies gave AAA ratings to securities that turned out to be toxic. They were completely wrong in retrospect. So why should anyone believe them now?"

As I've said many times, the circumstantial evidence is that ratings agencies purposely accepted fat fees from Citibank and other banks to give AAA ratings to mortgage-backed synthetic securities that they new to be defective, because they were making so much money doing so.

Nonetheless, it's hypocritical to blame the messenger now.

|

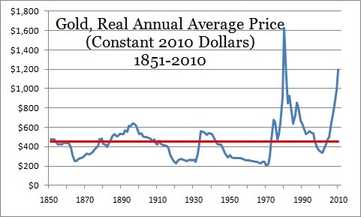

I've warned web site readers about investing in gold a number of times in the past, and now is a good time to repeat those warnings. The adjoining chart appears in a Motley Fool article from last year. As it shows, the long-term trend price of gold is about $500 per ounce. Gold is currently around $1600 per ounce, and applying the Law of Mean Reversion to the current bubble, its price is going to fall well below $500. This means that anyone investing in gold right now is expected to lose a great deal of money.

The Fed and a number of economists are saying that the economy is slowing down right now. The same is happening in Europe and China. This will result in a fall in all commodities prices, forcing commodities dealers to sell their gold to pay for their losses in other commodities. This could happen next month or next year, but it's coming, and it will mean a collapse of the gold bubble.

Moody's Investors Service has announced that if the U.S. government debt loses its AAA rating, then there are five states that will also lose their AAA ratings: Maryland, New Mexico, South Carolina, Tennessee and Virginia. Moody's placed the group of five under watch because of their relatively large exposure to federal funding – from Medicaid payments to government contracts and the like. And any deal to raise the debt ceiling will likely include spending cuts. Fortune

Standard & Poor's on Wednesday cut Greece's sovereign credit rating further into junk territory, saying the European Union's proposed debt restructuring would put the country into "selective default". Reuters

(Comments: For reader comments, questions and discussion,

see the 28-Jul-11 News -- Washington follows Brussels in fraud and extortion

thread of the Generational Dynamics forum. Comments may be

posted anonymously.)

(28-Jul-2011)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004