Dynamics

|

Generational Dynamics |

| Forecasting America's Destiny ... and the World's | |

| HOME WEB LOG COUNTRY WIKI COMMENT FORUM DOWNLOADS ABOUT | |

Reacting to news from two major banks about sharp losses from their subprime mortgage businesses, investors began running for cover on both financial stocks and related credit derivatives.

HSBC Holdings plc, an international banking firm headquartered in Europe with over 125 million customers worldwide, issued a press release on Thursday stating that it was now expecting to have $1.75 billion in bad debts that it hadn't previously anticipated.

The culprit was a subsidiary, Household Finance Corp., a venerable old American consumer credit firm that HSBC acquired in 2003. Now known as HSBC Finance Corp., the subsidiary had written a bunch of subprime mortgage loans that are turning out to be bad.

Subprime mortgage loans are those offered to people with poor credit who are willing to pay higher interest rates. As we described earlier this week, these loans have been abused, so much so that loan officers may be held accountable for fraud when the crash occurs.

Here's how HSBC described the situation in their press release:

Don't you just love that kind of language? HSBC's stock fell 2.4% on Thursday.

At almost the same time, another major institution, New Century Financial Corporation, issued its own press release, saying that it was going to have to revise its financial statements from the last two quarters of 2006, and that it now expected to lose money. Here's how they put it:

In addition, the company currently expects to record a fair value adjustment to its residual interests to reflect revised prepayment, loss and discount rate assumptions with respect to the loans underlying these residual interests, based on indicative market data. While the company is still determining the magnitude of these adjustments to its fourth quarter 2006 results, the company expects the combined impact of the foregoing to result in a net loss for that period."

Its stock fell 36% on Thursday.

In fact, shares of mortgage lenders fell across the board Thursday. Countrywide Financial Corp. and IndyMac Bancorp., the two biggest independent U.S. mortgage lenders, each fell more than 2 percent. Novastar Financial Inc. fell 13 percent to a new 52-week low. In fact, the entire financial services sector was hit hard, including firms like Citigroup Inc. and JPMorgan Chase & Co.

Why did the prices of these stocks go down on Thursday? Because investors concluded that they'd earn less money than they'd previously thought, the price that investors are willing to pay for stocks bears some relationship to the amount that the underlying company earns.

So, do you follow this so far, dear reader? Because we're now going to take a turn into a magic world, the world of credit derivatives.

Because the difference between the stocks of those companies and the derivatives we're going to talk about now is that these derivatives have no underlying value whatsoever. Their value is whatever anyone is willing to pay for them.

There's one particular credit derivative we want to describe. It's the ABX-HE credit derivative. It permits the investor to make a bet on whether or not people are going to repay their mortgage loans.

What? A bet? Is this Las Vegas or something? No, it's Wall Street.

The ABX-HE derivative was created in January, 2006. Here's how someone quoted in an article from last April described it:

It's a superlative example of English language speech, isn't it.

But let's just focus on a few words: "It is a new liquidity pool."

What that means is that a bunch of investors throw their money into a pot, and some of them make money and some of them lose money. It might be a bet on a horse race, or it might be a bet on a roulette wheel. But it's none of those; it's a bet that someone else will or will not default.

When you bet your money on this crapshoot ..... errr, I mean credit derivative, you get shares in return. These shares can be bought and sold, with the following intent: If the price of the shares go up, then we believe people are going to be paying off their mortgage loans; if the price goes down, then we believe that people are going to default on their mortgage payments.

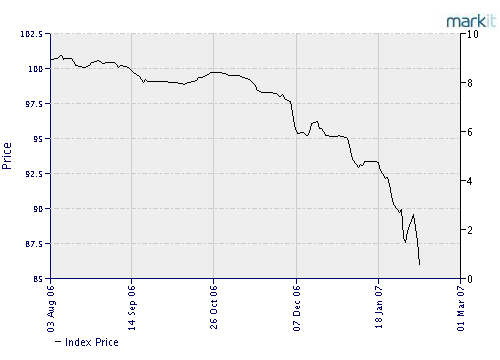

The current price of these derivatives can be found on http://www.markit.com/abx.jsp. We're going to focus on just one of these shares, the ones that were issued for sub-prime mortgages being issued in July, 2006. That index has the name: "ABX-HE-BBB- 06-2". Here's the graph of the index price from August to Thursday:

|

The index price of these shares has been falling since August, and on Thursday took another extremely sharp fall, quite possibly a record fall.

If you're an investor, one way to use these derivatives is to buy insurance that someone else is going to pay off their mortgage loans. Last July, it cost $242,000 to purchase this kind of insurance on $10 million of subprime loans. At the current price, it now costs $686,000 to purchase insurance for the same thing. It was was around $600,000 just a couple of days ago.

Thursday's collapse in the ABX index is being called a "very violent bearish reaction" by one ABX trader.

In fact, Thursday's price fall was actually much greater than was justified by the problems at HSBC and New Century. That means that investors are panicking.

Now, maybe investors will regain their confidence tomorrow, or maybe they'll look at the massively increasing default and foreclosure rate and decide to panic even more. It's hard to predict panic.

Web site readers often ask me to provide them with the exact date that I expect a crash to occur, and after much experimenting with different wordings, I finally came up with the words that I use very often on this web site: It might be tomorrow, next week, next month, next year, or thereafter, but probably sooner rather than later. It's a phrasing that allows me to convey a sense of urgency without specifying an exact date.

But lately several readers have asked a different question: What exactly is going to happen? Is there a specific stock market index we should look for, or what?

There will, of course, be a sharp fall in stock prices, but that's the point. What's going to happen is something that we haven't seen in this country since 1929: A "generational crash."

The first one that historians have documented is known as "Tulipomania." The high-tech item of the early 1600s were tulips. Dutch botanists succeeded in using breeding techniques to create tulips with spectaculars colors that were sought by the wealthy. Investors all over Europe soon purchased a kind of "tulip future," a certificate purchased in the fall which can be traded for a specific actual tulip to be grown the following spring. Sounds like an ABX certificate, doesn't it?

In 1636, speculation in tulip futures went through the roof, and on February 3, 1637, the tulip market suddenly crashed, causing the loss of enormous sums of money, even by ordinary people.

Everyone who lived through that horror never forgot it, but by the 1710s decade, all those people were gone. There was a similar generational crash of the South Sea Bubble in 1721. Then there was the bankruptcy of the French Monarchy in 1789, leading to the French Revolution and the Reign of Terror. Then there was the Hamburg Crisis of 1857, called the Panic of 1857 in America. And then there was the Wall Street crash of 1929.

There have been, of course, many small or regional economic recessions, but there have been only five major international financial crises, the generational crashes. Each one occurred roughly 70-80 years after the previous one, just when there's no one left who remembers the last one.

What's a generational crash like?

We saw a little bit of it a year ago, when a high-flying Japanese internet portal firm, LiveDoor, came under suspicion for financial irregularities. Investors panicked, causing a bloodbath in both Japan and New York, with stock markets around the world suffering similar shocks. However, the loss of confidence didn't continue, and the markets worked there way back.

With a generational crash, what I'm talking about is a massive loss

of confidence throughout the country and the world, total destruction

of self-confidence, replaced by a corrosively growing fear, leading

to panic, massive homelessness and bankruptcies. We're actually

overdue for that, just as we're overdue for a flu pandemic. When

that happens, you'll know it. And yes, it might happen tomorrow,

next week or next year, but probably sooner rather than later.

(9-Feb-07)

Permanent Link

Receive daily World View columns by e-mail

Donate to Generational Dynamics via PayPal

Web Log Summary - 2016

Web Log Summary - 2015

Web Log Summary - 2014

Web Log Summary - 2013

Web Log Summary - 2012

Web Log Summary - 2011

Web Log Summary - 2010

Web Log Summary - 2009

Web Log Summary - 2008

Web Log Summary - 2007

Web Log Summary - 2006

Web Log Summary - 2005

Web Log Summary - 2004

Web Log - December, 2016

Web Log - November, 2016

Web Log - October, 2016

Web Log - September, 2016

Web Log - August, 2016

Web Log - July, 2016

Web Log - June, 2016

Web Log - May, 2016

Web Log - April, 2016

Web Log - March, 2016

Web Log - February, 2016

Web Log - January, 2016

Web Log - December, 2015

Web Log - November, 2015

Web Log - October, 2015

Web Log - September, 2015

Web Log - August, 2015

Web Log - July, 2015

Web Log - June, 2015

Web Log - May, 2015

Web Log - April, 2015

Web Log - March, 2015

Web Log - February, 2015

Web Log - January, 2015

Web Log - December, 2014

Web Log - November, 2014

Web Log - October, 2014

Web Log - September, 2014

Web Log - August, 2014

Web Log - July, 2014

Web Log - June, 2014

Web Log - May, 2014

Web Log - April, 2014

Web Log - March, 2014

Web Log - February, 2014

Web Log - January, 2014

Web Log - December, 2013

Web Log - November, 2013

Web Log - October, 2013

Web Log - September, 2013

Web Log - August, 2013

Web Log - July, 2013

Web Log - June, 2013

Web Log - May, 2013

Web Log - April, 2013

Web Log - March, 2013

Web Log - February, 2013

Web Log - January, 2013

Web Log - December, 2012

Web Log - November, 2012

Web Log - October, 2012

Web Log - September, 2012

Web Log - August, 2012

Web Log - July, 2012

Web Log - June, 2012

Web Log - May, 2012

Web Log - April, 2012

Web Log - March, 2012

Web Log - February, 2012

Web Log - January, 2012

Web Log - December, 2011

Web Log - November, 2011

Web Log - October, 2011

Web Log - September, 2011

Web Log - August, 2011

Web Log - July, 2011

Web Log - June, 2011

Web Log - May, 2011

Web Log - April, 2011

Web Log - March, 2011

Web Log - February, 2011

Web Log - January, 2011

Web Log - December, 2010

Web Log - November, 2010

Web Log - October, 2010

Web Log - September, 2010

Web Log - August, 2010

Web Log - July, 2010

Web Log - June, 2010

Web Log - May, 2010

Web Log - April, 2010

Web Log - March, 2010

Web Log - February, 2010

Web Log - January, 2010

Web Log - December, 2009

Web Log - November, 2009

Web Log - October, 2009

Web Log - September, 2009

Web Log - August, 2009

Web Log - July, 2009

Web Log - June, 2009

Web Log - May, 2009

Web Log - April, 2009

Web Log - March, 2009

Web Log - February, 2009

Web Log - January, 2009

Web Log - December, 2008

Web Log - November, 2008

Web Log - October, 2008

Web Log - September, 2008

Web Log - August, 2008

Web Log - July, 2008

Web Log - June, 2008

Web Log - May, 2008

Web Log - April, 2008

Web Log - March, 2008

Web Log - February, 2008

Web Log - January, 2008

Web Log - December, 2007

Web Log - November, 2007

Web Log - October, 2007

Web Log - September, 2007

Web Log - August, 2007

Web Log - July, 2007

Web Log - June, 2007

Web Log - May, 2007

Web Log - April, 2007

Web Log - March, 2007

Web Log - February, 2007

Web Log - January, 2007

Web Log - December, 2006

Web Log - November, 2006

Web Log - October, 2006

Web Log - September, 2006

Web Log - August, 2006

Web Log - July, 2006

Web Log - June, 2006

Web Log - May, 2006

Web Log - April, 2006

Web Log - March, 2006

Web Log - February, 2006

Web Log - January, 2006

Web Log - December, 2005

Web Log - November, 2005

Web Log - October, 2005

Web Log - September, 2005

Web Log - August, 2005

Web Log - July, 2005

Web Log - June, 2005

Web Log - May, 2005

Web Log - April, 2005

Web Log - March, 2005

Web Log - February, 2005

Web Log - January, 2005

Web Log - December, 2004

Web Log - November, 2004

Web Log - October, 2004

Web Log - September, 2004

Web Log - August, 2004

Web Log - July, 2004

Web Log - June, 2004