|

|

|

Economic Cycles

|

Global technology cycles - Kondratieff cycles |

|

Generational cycles and bubbles |

|

A new "Great Depression" |

|

|

|

|

The 1930s Great Depression

|

|

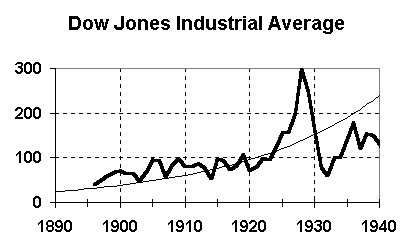

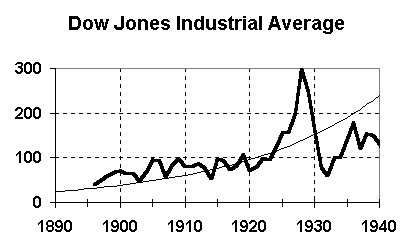

Dow Jones Industrial Average - 1896 to 1940

|

|

Characteristics of 1930s Great Depression |

|

- |

Big credit bubble in 1920s - borrowed money to bid up stock prices |

|

- |

Nobody knew what was going on until a month into stock market crash |

|

- |

1920s stock market bubble CAUSED the 1930s Great Depression |

|

- |

Establishment of SEC and stock market regulations specifically designed to prevent another credit bubble |

|

1929 collapse |

|

- |

Stock market became increasingly volatile |

|

- |

Below a certain level hit a 'tipping point' |

|

- |

People forced to sell to meet margin credit requirements |

|

Previous big credit bubbles |

|

- |

Panic of 1857 (prior to Civil War) |

|

- |

British banking failure in 1772 |

|

|

|

|

The 1990s Credit Bubble

|

|

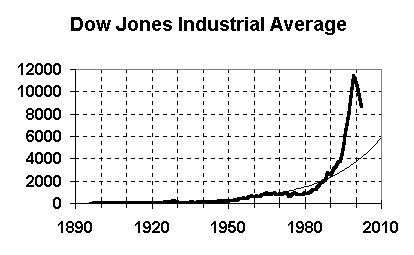

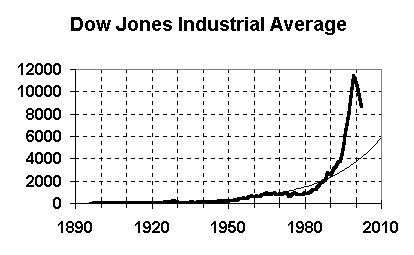

Dow Jones Industrial Average - 1896 to 2002

|

|

New 1990s credit bubble (using stock options) |

|

Complete failure of SEC and stock market regs |

|

Trend line (exponential) |

|

- |

Current (early 2003) value: Above 10000 |

|

- |

Trend value in 2010: 5800 |

|

- |

Predicts fall to around 4000 in next few years |

|

|

|

|

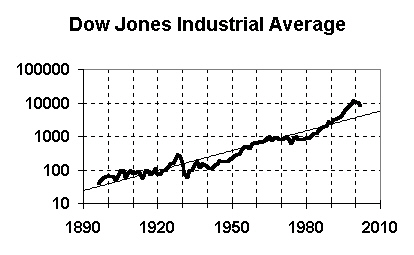

Credit bubbles - logarithmic scale

|

|

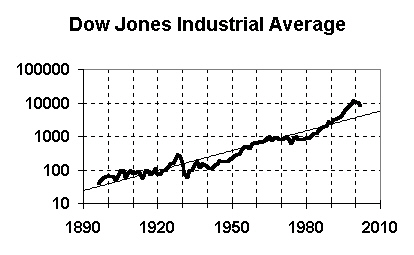

Dow Jones Industrial Average - 1896 to 2002

|

|

Graph now shows both credit bubbles |

|

|

|

|

S&P 500 Index, adjusted for inflation

|

|

S&P 500 Price Index - 1870 to 2002

|

|

For those who consider the DJIA to be too artificial |

|

Trend line (exponential) |

|

- |

Current (early 2003) value: Above 1100 |

|

- |

Trend value in 2010: 589 |

|

- |

Predicts fall to around 400 in next few years |

|

|

|

|

S&P 500 Price/Earnings Ratio

|

|

S&P 500 Price/Earnings Index - 1881 to 2002

|

|

P/E Ratio measures price of stock vs historical earnings |

|

- |

Historical average around 13 |

|

- |

Above 18: Stocks are expensive |

|

- |

Below 10: Stocks are inexpensive |

|

- |

Historically goes below 10 after exceeding 20 |

|

- |

Predicts stock market fall of 50% or more |

|

|

|

|

Generational Economic Cycles

|

Credit bubbles every 70-90 years (generational cycle) during 'unraveling' period |

|

- |

Credit bubble / depression creates a risk-aversive generation |

|

- |

New bubble when previous risk-aversive generation retires |

|

- |

Financial crisis and war crisis reinforce each other |

|

"Crusty Old Bureaucracy" theory |

|

- |

Informal (not rigorous) explanation |

|

- |

Every organization becomes bureaucratic in time - bankruptcy |

|

- |

Same rules applies to entire nation in 70-90 year cycles |

|

|

|

|

Greenspan and the Federal Reserve

|

Greenspan in 1997 |

|

- |

Had referred to "irrational exuberance" |

|

- |

Knew that a stock market bubble was forming |

|

- |

Decided to deal with consequences rather than end bubble |

|

Federal Reserve after 2000 |

|

- |

Prevent 1929 forced selling 'tipping point' |

|

- |

Reduced interest rates (overnight funds rate) to 1% |

|

Consequences of low interest rate |

|

- |

Increased personal borrowing during unemployment |

|

- |

Extension of stock market bubble |

|

Medium range risks |

|

- |

Collapse of Chinese credit bubble |

|

- |

Oil disruption through Mideast war |

|

- |

Loss of confidence after terrorist attack |

|

- |

Cyclic downturn spiraling down |

|

|

|

|

Technology (Kondratieff) versus Generational Cycles

|

|

Technology cycles versus generational bubbles

|

|

|

Identifying technology cycles |

|

- |

Smooth the S&P index, ignoring bubbles |

|

- |

Cycle length 40-50 years |

|

- |

Technology (Kondratieff) cycles have been identified for hundreds of years |

|

Technology versus Generational cycles |

|

- |

Technology cycles are global, generational cycles are local |

|

- |

Entirely independent - can enhance or cancel each other |

|